The Indian tax landscape changed forever on January 15, 2026. On that day, the Supreme Court delivered a monumental verdict regarding the GAAR doctrine Tiger Global Flipkart case. This ruling specifically targets how multinational corporations use offshore structures to avoid local taxes. For example, it addresses the high-profile exit of Tiger Global from Flipkart in 2018.

Understanding the Landmark Decision

In this case, the Supreme Court overturned a previous Delhi High Court decision. Specifically, the Court held that the transaction was designed primarily for tax avoidance. Consequently, the tax authorities can now look beyond legal forms to find the economic reality. Therefore, this decision emphasizes “substance over form” in all international tax planning.

The Core Conflict in International Tax

Tiger Global claimed benefits under the India-Mauritius Tax Treaty capital gains provisions. However, the Revenue Department argued the Mauritius entities were mere conduits. They claimed these entities lacked any real commercial substance. As a result, the dispute centered on whether treaty benefits apply to artificial structures.

Background of the Dispute: Tiger Global vs. Income Tax Department

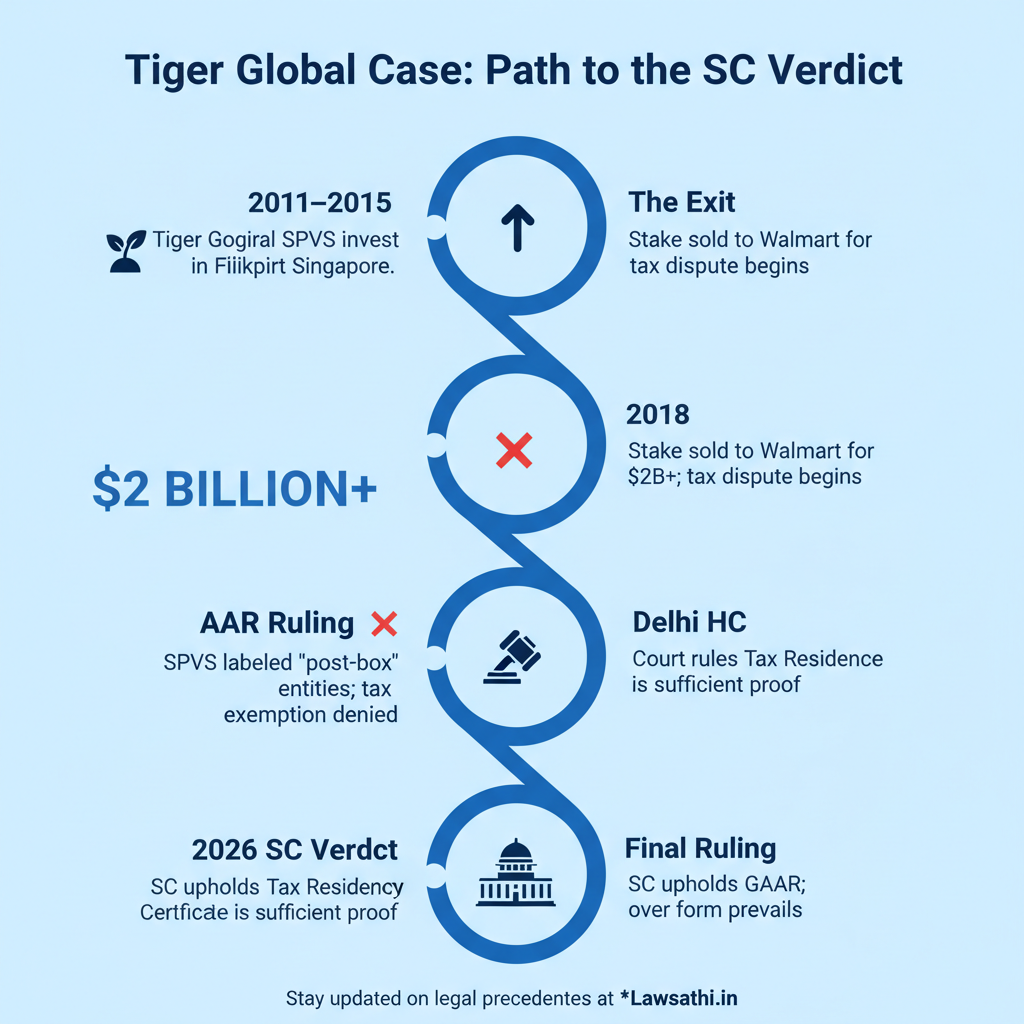

The story began when Tiger Global’s Mauritius-based SPVs invested in Flipkart Singapore. These investments occurred between 2011 and 2015. Moreover, Flipkart’s value came from Indian assets. Therefore, the 2018 sale to Walmart triggered tax concerns regarding the indirect transfer of assets located in India.

The 2018 Exit and Initial Rulings

In 2018, Tiger Global sold its stake for over $2 billion. Initially, they sought a nil-withholding certificate from tax authorities. However, the Authority for Advance Rulings (AAR) rejected their plea. They labeled the Mauritius companies as “post-box” entities. For instance, they found that real control stayed with US-based managers.

Reversing the Delhi High Court

Later, the Delhi High Court quashed the AAR’s order. The High Court stated that a Tax Residency Certificate (TRC) was sufficient proof of residency. Furthermore, it ruled that the 2016 Protocol grandfathered these old investments.

The Supreme Court eventually set aside this High Court ruling. Above all, this reversal restored the tax department’s power to penalize tax avoidance.

Defining the GAAR Doctrine in the Indian Context

The GAAR doctrine Tiger Global Flipkart case relies on Chapter X-A of the Income Tax Act. These General Anti-Avoidance Rules (GAAR) allow the government to declare an arrangement “impermissible.” Consequently, if a deal lacks commercial substance, the tax benefits are denied.

Power under Section 90 of the IT Act

Section 90 generally allows taxpayers to choose between the Act or a Treaty. However, GAAR acts as an exception to this rule. Therefore, treaty benefits are no longer “automatic” or “sacrosanct.” In fact, tax authorities can now ignore treaties if the main purpose of a deal is a tax benefit.

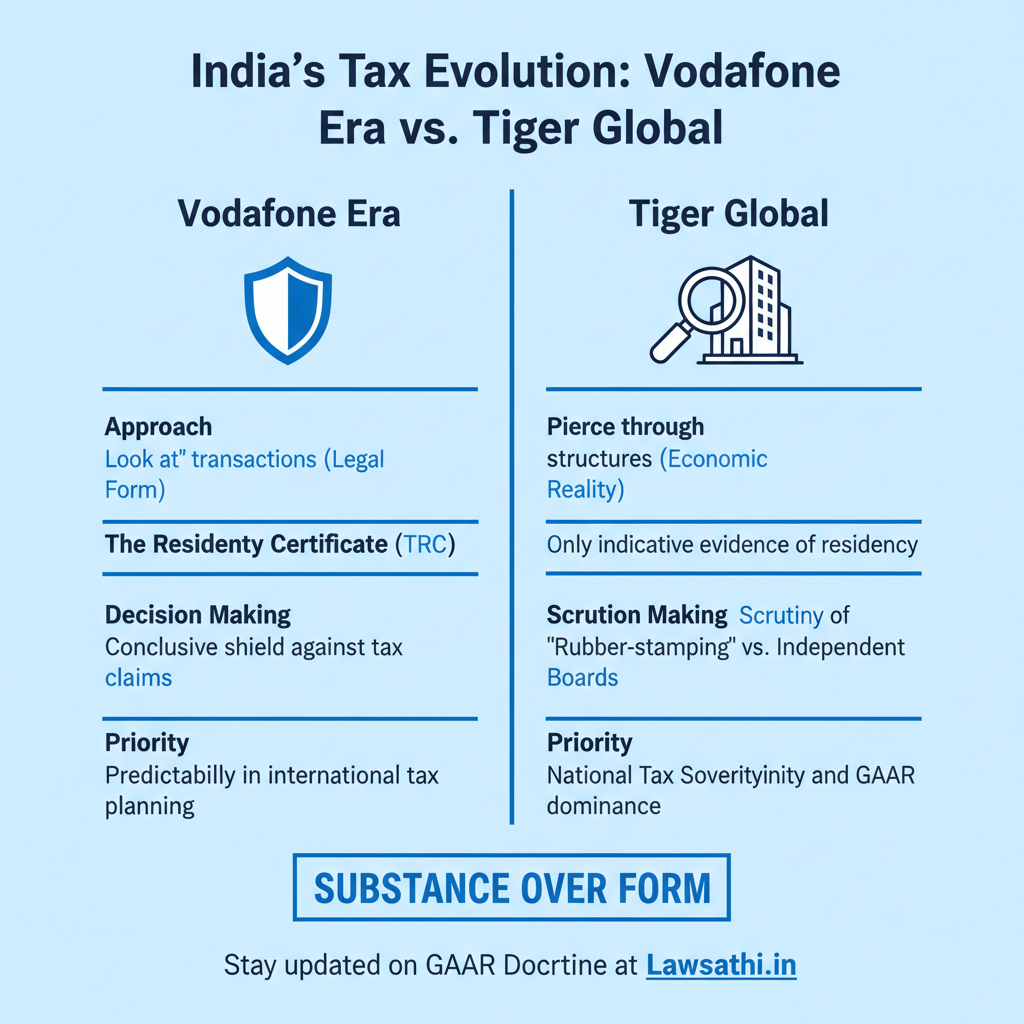

Shifting Away from the Vodafone Precedent

In the past, the 2012 Vodafone case protected many offshore structures. That case told authorities to “look at” the transaction rather than “pierce through” it. In contrast, this new ruling signals a stricter regime. The Court stated that tax sovereignty must not be compromised by complex international tax treaties.

The Supreme Court’s Ratio Decidendi: Why Treaty Benefits Were Denied

The Court found that the Mauritius entities lacked “commercial substance.” For instance, their Board of Directors simply “rubber-stamped” decisions. These decisions were actually made by the Investment Manager in the US. Consequently, the Court applied the “lifting of the corporate veil” to find the real owners.

TRC is Not an Absolute Shield

One major takeaway involves the Tax Residency Certificate (TRC). Formerly, many believed a TRC stopped all tax inquiries. However, the Court ruled that a TRC is only indicative evidence. Therefore, it does not provide conclusive proof of “beneficial ownership.”

Specifically, authorities can still investigate a tax treaty abuse Supreme Court case. This ensures that companies do not use paperwork to hide tax evasion.

Identifying Impermissible Arrangements

The Court noted that the transaction was a “sham” designed for tax evasion. Furthermore, the Share Purchase Agreement (SPA) with Walmart had already accounted for tax risks. This suggested that the parties anticipated a legal challenge. As a result, the Court denied the exemption under the India-Mauritius DTAA.

Impact on the India-Mauritius DTAA and Foreign Portfolio Investors (FPIs)

This ruling changes how we view General Anti-Avoidance Rules India. Specifically, it impacts the 2016 amendment of the India-Mauritius treaty. Even if investments were made before 2017, they are not necessarily safe. If the exit happens now, GAAR can still be applied to the deal.

Higher Scrutiny for Offshore Funds

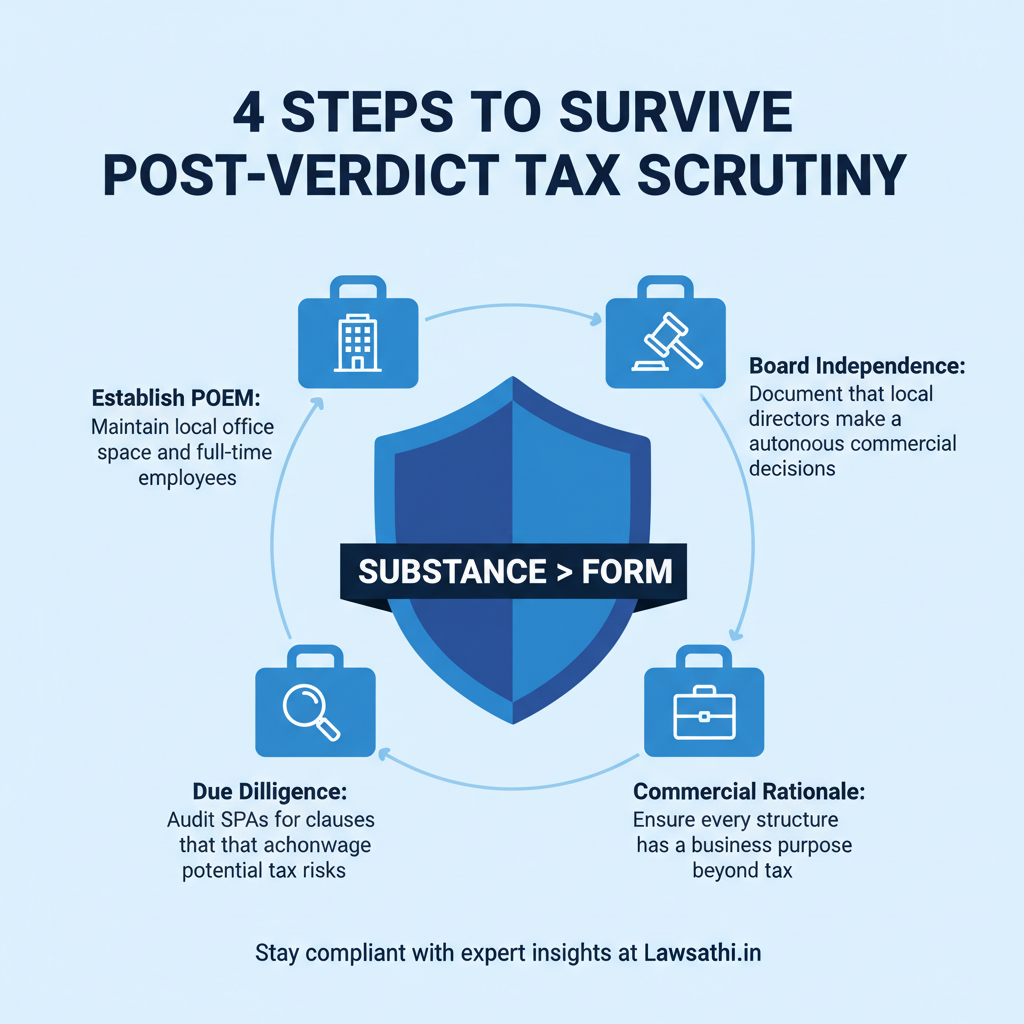

Private Equity (PE) firms must now prove their “Place of Effective Management” (POEM). They need to show actual operations in the treaty country. For example, they should have local employees and independent directors. Without these, their tax structures could be labeled as impermissible avoidance arrangements.

Consequences for Singapore and Mauritius Routes

Mauritius and Singapore have been popular for Indian investments. However, this ruling makes those “routes” much riskier. Foreign Portfolio Investors (FPIs) must expect deeper questions about their beneficial owners. Additionally, the Revenue will likely target other indirect transfer of assets cases currently in litigation.

Key Takeaways for Indian Tax Lawyers and Law Firms

Indian lawyers must now update their due diligence checklists. It is no longer enough to have a TRC. Instead, you must ensure your clients have “substance” in their offshore jurisdictions. For example, documentation should prove that the local Board makes independent choices.

Advising on “Main Purpose” Tests

Lawyers should warn clients about the “main purpose” test under GAAR. If the primary goal of a structure is saving tax, it will fail. Therefore, transactions must have a clear commercial rationale. In other words, you should review existing SPAs for clauses that might suggest tax evasion.

Redefining Substance for Clients

Firms should help clients establish a physical presence in treaty countries. This includes maintaining office space and conducting regular board meetings. In fact, tax treaties should not become instruments to erode national security or sovereignty. Proper documentation is now the only way to defend against GAAR.

Conclusion: A Paradigm Shift in Indian International Taxation

The GAAR doctrine Tiger Global Flipkart case marks a new era. It draws a clear line between “tax planning” and “tax evasion.” While planning is legal, creating artificial structures is not. This ruling protects India’s tax revenue from complex global schemes.

The Future of Tax Litigation

We expect more litigation regarding beneficial ownership in the coming years. Furthermore, the use of AI will help the Revenue Department find these patterns. Tax lawyers must adapt to this high-scrutiny environment. Above all, the focus has shifted from legal titles to economic reality.

Stay ahead of complex tax litigation developments with LawSathi’s AI-powered research and case management. Streamline your firm’s workflows today—Book a demo at LawSathi.in.