Filing a cheque bounce case under Section 138 is now a specialized task for Indian litigators. In 2026, the judiciary has shifted toward rapid disposals and mandatory digital compliance.

Consequently, lawyers must adapt to these evolving standards. This ensures successful recovery for their clients.

Introduction: The Evolving Landscape of Negotiable Instruments Litigation

The cheque bounce case under Section 138 of the Negotiable Instruments Act remains a cornerstone of Indian commercial law. However, the legal landscape has changed significantly over the last two years.

Historically, these cases faced massive backlogs in Magisterial courts. This often delayed justice for several years.

Judicial Trends in 2026

Fortunately, the Supreme Court has issued revolutionary guidelines to address these delays. For example, recent rulings emphasize that the primary goal is payment. It is no longer just about retribution.

In the case of Sanjabij Tari v. Kishore S. Borcar (2025), the court introduced rigorous compounding structures. Therefore, timely filing and precise documentation are more critical than ever before.

Why Speed Matters

Moreover, practitioners must understand that Section 138 is criminal in nature. However, it is recovery-oriented in practice.

If you miss a statutory deadline, your client loses their criminal remedy. As a result, maintaining a strict calendar for notices and filings is the mark of a professional advocate in 2026.

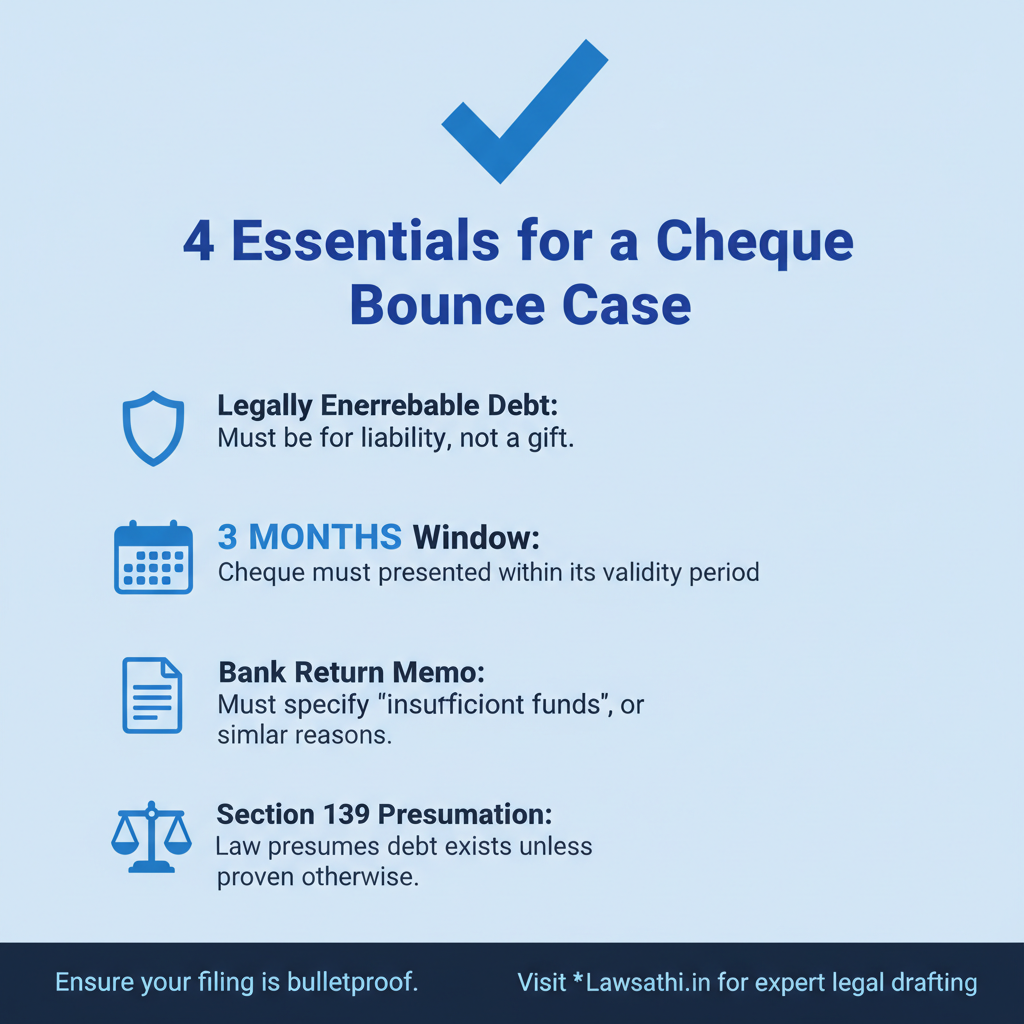

Essential Ingredients of an Offense Under Section 138

Winning a cheque bounce case under Section 138 requires proving specific statutory elements. First, the cheque must be issued for a legally enforceable debt or liability.

If the cheque was a gift, the case will likely fail. Similarly, it will fail if it was for an illegal transaction.

The Role of Statutory Presumptions

Additionally, the court presumes the debt exists under Section 139 of the NI Act. This means the burden of proof lies on the accused. They must rebut the claim with evidence.

Specifically, the Supreme Court held in December 2025 that High Courts cannot quash cases early. They cannot conduct pre-trial enquiries into the debt’s validity.

Technical Requirements for Validity

Furthermore, the payee must present the cheque within its validity period. Usually, this is three months from the date of issue.

Second, the bank must return the cheque with a “memo.” This memo must cite insufficient funds or similar reasons. Finally, you must send a demand notice within 30 days of receiving that memo.

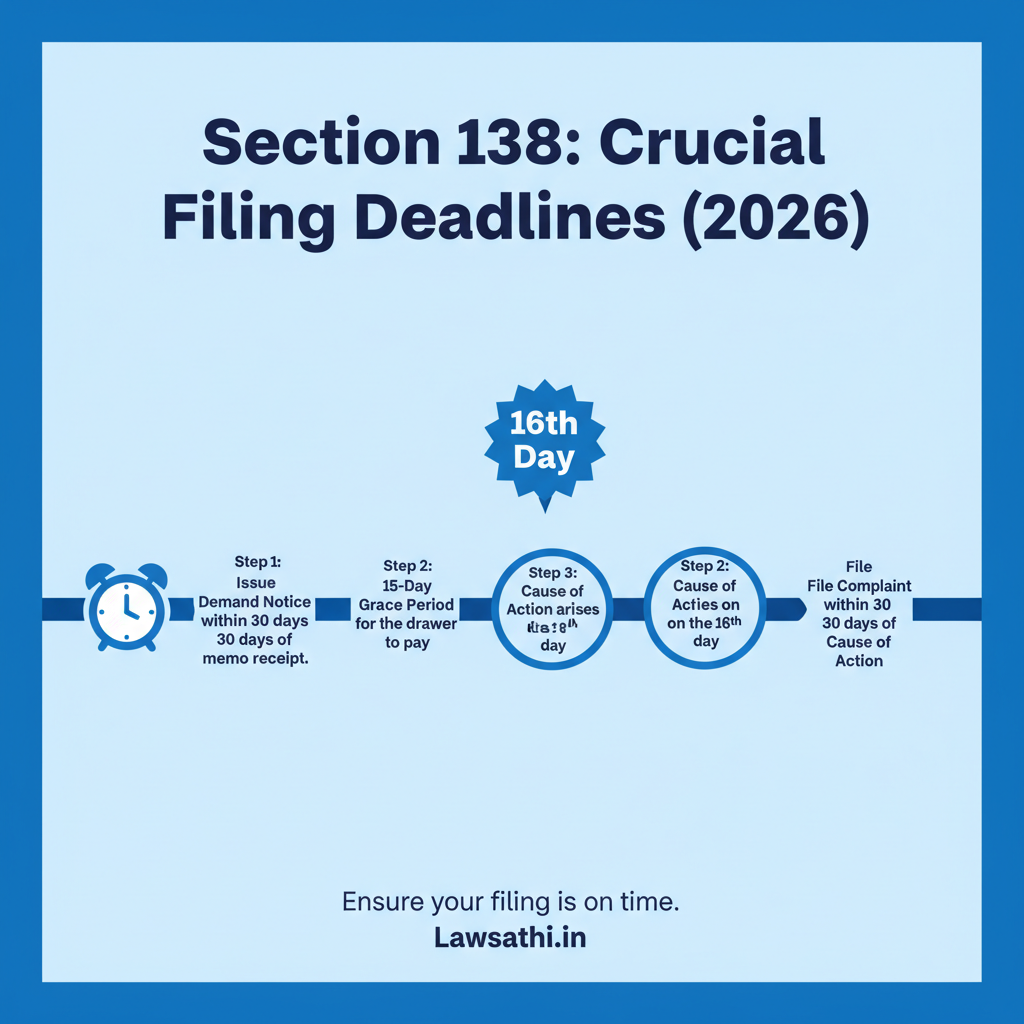

Step-by-Step Procedure for Filing a Cheque Bounce Case

Navigating the NI Act Section 138 procedure requires surgical precision regarding timelines. A single day’s delay can result in the dismissal of your complaint. Therefore, following a standardized workflow is essential for every law office.

Step 1: Issuing the Statutory Demand Notice

First, you must send the cheque bounce legal notice format to the drawer. This must happen within 30 days of the cheque’s return.

The notice must clearly demand the cheque amount. Furthermore, the Supreme Court’s 2025 guidelines now suggest that ignoring this notice is risky. Specifically, failure to reply can lead to an adverse inference against the accused.

Step 2: The Grace Period and Filing

Second, you must give the accused 15 days to pay. This time starts from the date they receive the notice.

If they fail to pay, the cause of action arises on the 16th day. Consequently, you have exactly 30 days to file the formal complaint in court. Additionally, modern courts now require a specific synopsis at the top of every filing.

Step 3: Pre-summoning Evidence

Third, the Magistrate will examine the complaint and the accompanying documents. Usually, the complainant provides evidence through an affidavit.

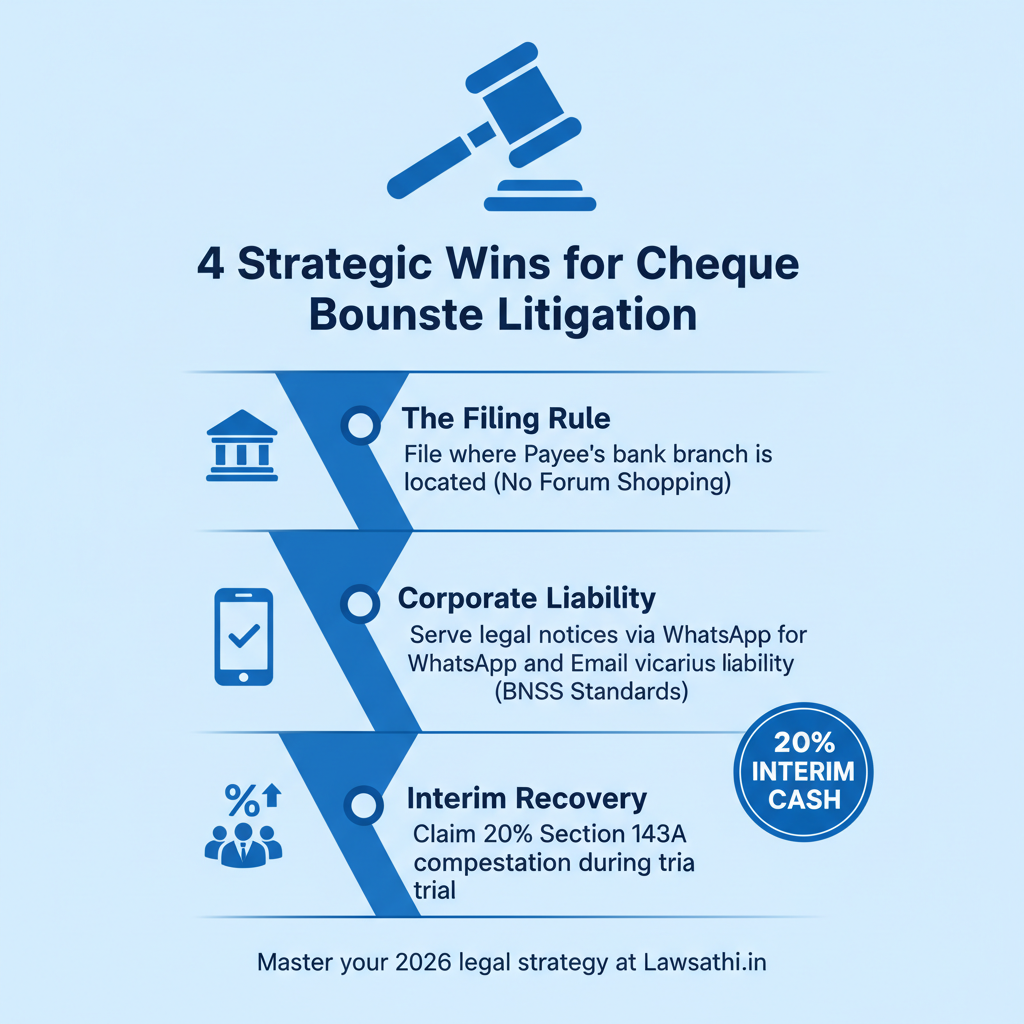

In 2026, courts often use “Dasti” service or electronic summons to speed up the process. For instance, notice via WhatsApp or Email is now standard practice under the Bhartiya Nagarik Suraksha Sanhita (BNSS).

Jurisdiction Trends: Where to File the Complaint?

Determining the jurisdiction for cheque bounce cases used to be a point of constant litigation. However, the Negotiable Instruments Act 1881 latest amendments have simplified this.

The Home Branch Rule

Specifically, Section 142(2) dictates where you must file account payee cheque suits. You must file where the Payee’s bank branch is located.

In Jai Balaji Industries Ltd. v. HEG Ltd. (2025), the Supreme Court clarified this “Home Branch” rule. Most importantly, it prevents “forum shopping” by the complainant.

Impact of CTS Clearing

Moreover, the legal delivery happens at your home branch. This remains true even if you present a cheque at a different branch for convenience.

This rule provides clarity for corporate clients with multiple accounts. Therefore, always verify the exact branch address where your client maintains their account. Do this before drafting the memo of parties.

Leveraging Section 143A: Claiming Interim Compensation

One of the most powerful tools in a cheque bounce case under Section 138 is interim compensation under Section 143A. This provision allows the court to order a temporary payment.

Specifically, the accused may have to pay up to 20% of the cheque amount during the trial. This helps the complainant maintain liquidity during the legal battle.

Is 20% Mandatory?

However, recent jurisprudence has clarified the court’s discretion. In the landmark case Rakesh Ranjan Shrivastava v. State of Jharkhand (2024), the Supreme Court provided clarity.

The court ruled that this payment is “directory.” In other words, it is not mandatory for every case.

Criteria for Success

As a result, the court must consider certain factors before passing such an order. For example, the complainant must establish a strong prima facie case.

Additionally, the court may look at the financial distress of the accused. Therefore, your application under Section 143A must contain reasoned arguments. Avoid making a mechanical request.

Mandatory Documentation Checklist for Lawyers

To succeed in a cheque bounce case under Section 138, your paperwork must be flawless. Even a minor error in a Board Resolution can stall the proceedings. Similarly, a wrong postal receipt can cause months of delays.

Essential Files for Every Complaint

First, ensure you have the original cheque and the bank return memo. These are the cornerstones of your evidence.

Second, keep the copy of the statutory demand notice. You must also include the original postal receipts. In 2026, you must also provide an affidavit of service if you served the notice via digital means.

Corporate and Trust-Related Cases

Furthermore, if the complainant is a company, a proper Board Resolution is mandatory. This proves the representative has the authority to file.

For cases involving Trusts, the Supreme Court in 2025 provided a specific rule. It emphasized that the Trust itself must be named as an accused. Without this, you cannot hold the Trustees vicariously liable.

Common Pitfalls and How to Avoid Them

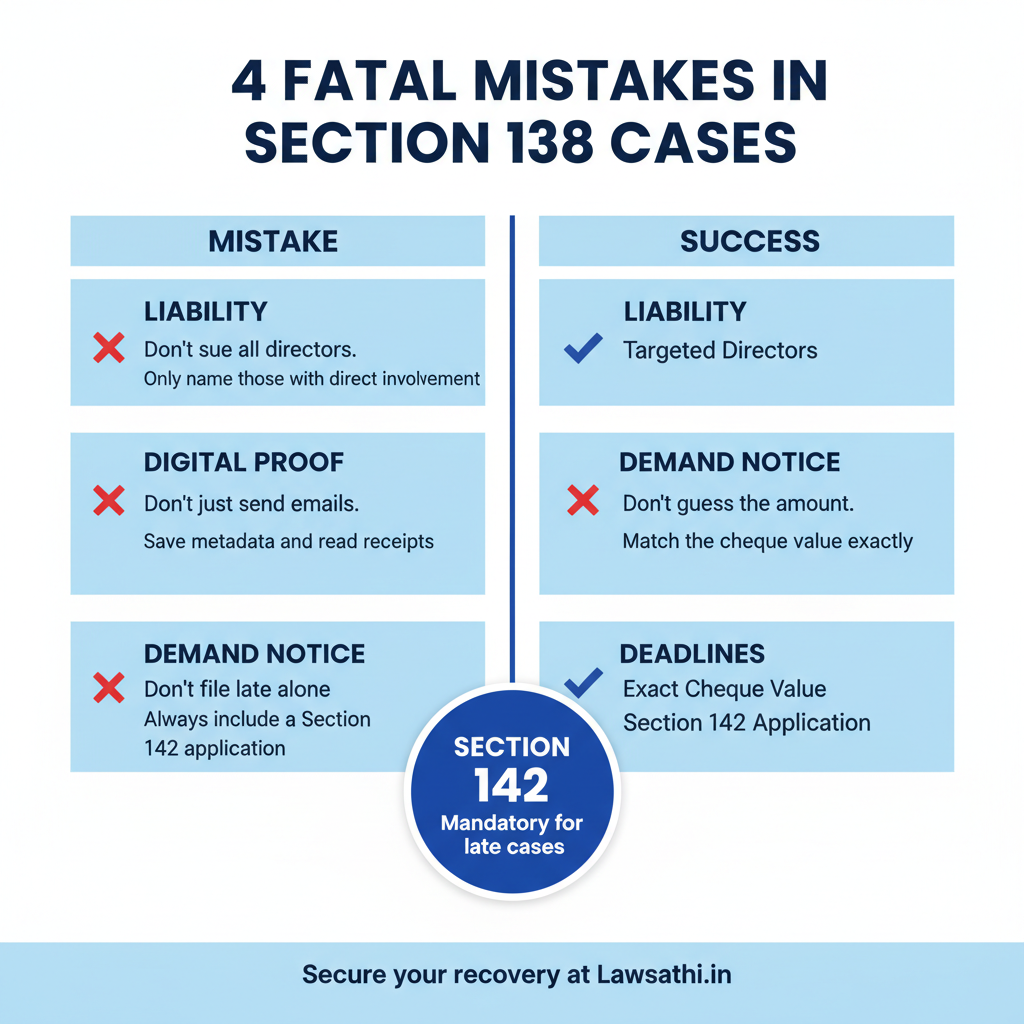

Many lawyers face hurdles due to Section 141. This section deals with vicarious liability. Specifically, you cannot simply name every director of a company as an accused.

Naming the Right Directors

In KS Mehta v. Morgan Securities (2025), the Supreme Court protected certain individuals. It protected independent and non-executive directors.

Consequently, you must prove their direct involvement in the transaction. Identifying the “person in charge” accurately at the start is vital. This saves your case from future quashing petitions.

Managing Limitation Delays

Additionally, many cases fail due to service issues. If a notice is returned as “refused,” it is usually deemed served. However, you must still present the tracking report.

You must also include an affidavit to satisfy the Magistrate. If you are filing late, you must take action immediately. Specifically, move an application for condonation of delay under Section 142.

Technology in Litigation: Managing NI Act Cases Digitally

The year 2026 has brought technology to the forefront of the Indian legal system. Most Magisterial courts now support e-filing for criminal complaints.

Furthermore, technology helps lawyers manage high volumes of cases. This is especially helpful for multiple debt recovery matters.

AI and Automation

For example, AI-powered tools can now automate notice templates. They can also track limitation periods automatically.

This reduces the risk of human error significantly. Moreover, some District Courts have introduced QR codes for instant payments. This allows an accused to settle the matter immediately. As a result, this facilitates instant compounding and case closure.

Digital Evidence and Service

Finally, the transition to the BNSS has formalized electronic evidence. Lawyers should now maintain digital logs of all communications.

This includes WhatsApp read receipts and email delivery logs. These digital footprints are now very valuable. In fact, they are as important as traditional AD cards in the eyes of the court.

Conclusion

Filing a cheque bounce case under Section 138 today requires a blend of skills. You need traditional legal knowledge and modern technical expertise.

By following the corrected jurisdictional rules, you can secure faster results. Additionally, utilizing Section 143A effectively helps your clients. Always remember that the 2026 judiciary favors settlement. Therefore, stay prepared for compounding at every stage.

Streamline your Section 138 filings and never miss a limitation deadline again. Discover how LawSathi’s AI-powered dashboard tracks your cheque bounce cases from notice to judgment. Book a Demo Today.