# SC Upholds Rejection of Advance Ruling on Tax Avoidance: A Deep Dive for Indian Practitioners

Managing tax uncertainty is a constant struggle for Indian legal practitioners. Many lawyers previously recommended the Authority for Advance Rulings (AAR) to secure clarity for their clients. However, a landmark Supreme Court judgment on January 15, 2026, has fundamentally changed this landscape.

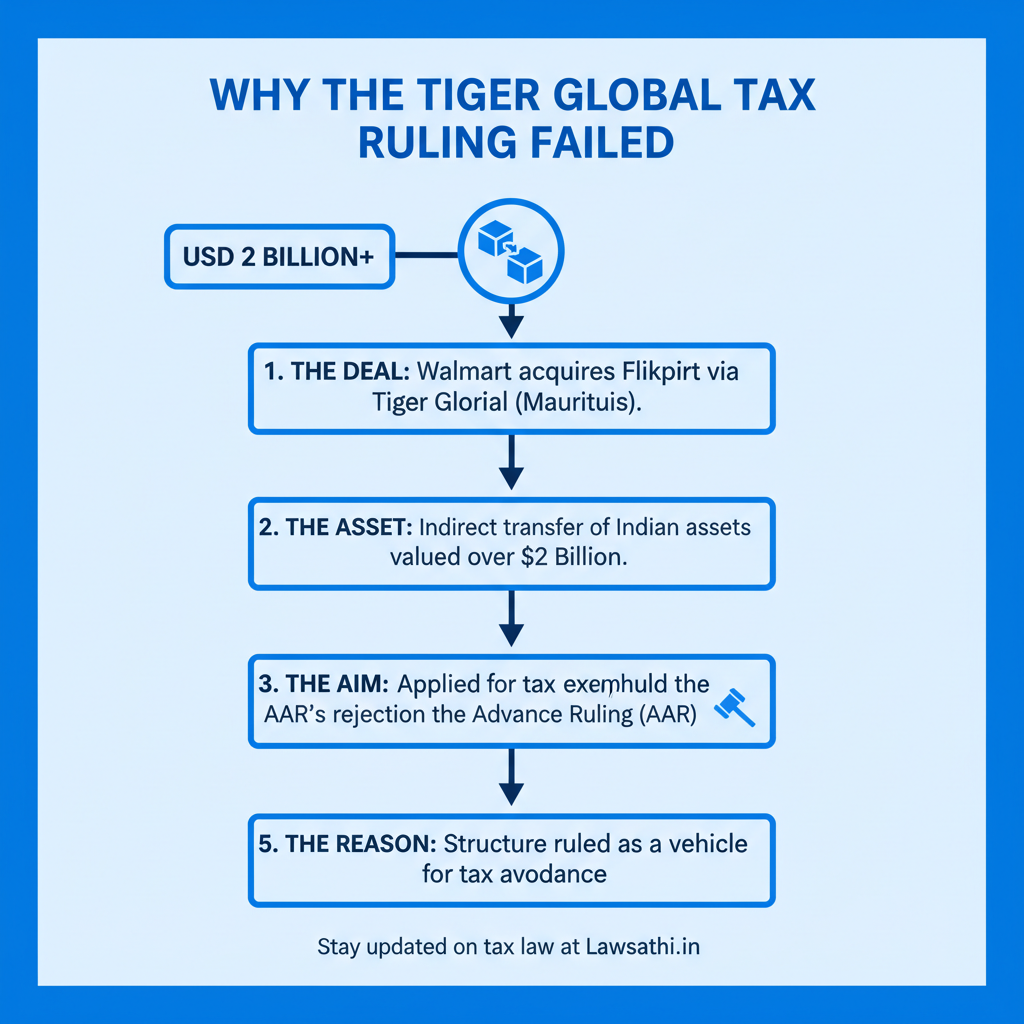

The Court recently addressed the limits of seeking an advance ruling on tax avoidance. In the case of AAR v. Tiger Global International II Holdings, the SC upheld the rejection of an application at the very first stage. Consequently, practitioners must now rethink how they advise clients on complex property and share transactions.

Evolution from AAR to the Board for Advance Rulings

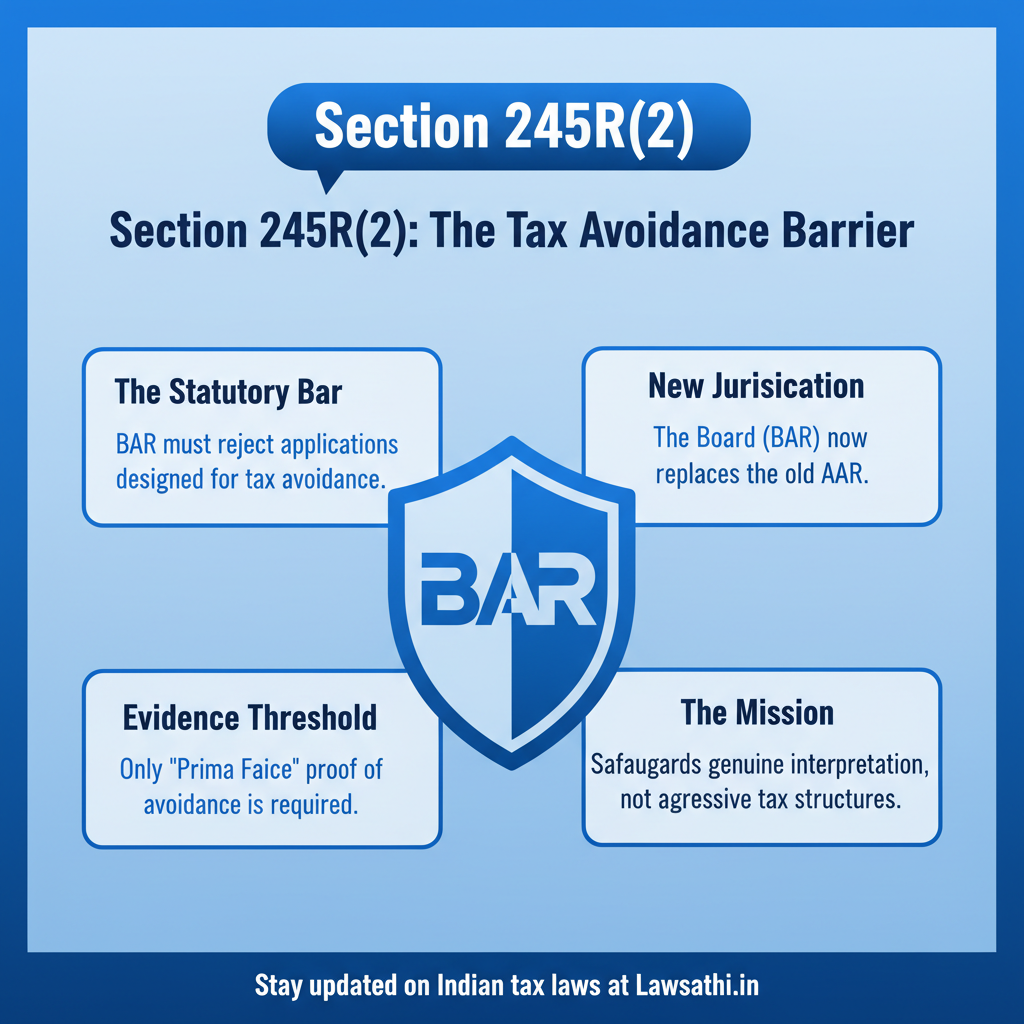

Historically, the AAR provided a non-adversarial venue for non-residents to determine their tax liabilities. This mechanism aimed to provide certainty and prevent long-drawn litigation. In recent years, the government replaced the AAR with the Board for Advance Rulings (BAR).

Therefore, understanding the jurisdictional limits of these bodies is critical for tax consultants. The Supreme Court has clarified that these forums are not for validating aggressive tax structures. Instead, they serve as a shield for bona fide taxpayers seeking genuine legal interpretation.

Factual Matrix: The Property Transaction in Question

The case centered on a massive deal involving the 2018 Walmart acquisition of Flipkart. Tiger Global, through Mauritius-based entities, sold shares of Flipkart Private Limited (Singapore). The total consideration for this transaction exceeded USD 2 Billion.

Most importantly, Flipkart Singapore derived its primary value from underlying Indian assets. Therefore, the Indian Revenue Department sought to tax the capital gains as an “indirect transfer” under Section 9(1)(i).

Procedural History leading to the Apex Court

The applicants initially approached the AAR to confirm they were exempt from tax. They cited the India-Mauritius Double Taxation Avoidance Agreement (DTAA). However, the AAR rejected the application in March 2020.

In contrast, the Delhi High Court later quashed this rejection in 2024. The High Court ruled that the transaction was bona fide and protected by grandfathering clauses. Eventually, the Revenue Department appealed this decision to the Supreme Court.

Why the Supreme Court Overturned the High Court

The Supreme Court set aside the High Court’s judgment on January 15, 2026. Specifically, the Court restored the AAR’s original order of rejection. It held that the structure was designed primarily to bypass Indian tax laws. As a result, the application for an advance ruling on tax avoidance was legally barred at the threshold.

Understanding Section 245R(2): The Statutory Bar

The core of this ruling lies in Section 245R(2) of the Income Tax Act. This provision acts as a gatekeeper for all advance ruling applications. It clearly states that the Authority shall not allow an application if the question involves tax avoidance. Specifically, the transaction must not be “prima facie for the avoidance of tax.”

Limits of BAR Jurisdiction

For example, a lawyer cannot use the BAR to “bless” a sham transaction. If the revenue shows evidence of tax avoidance, the BAR loses its jurisdiction to hear the merits. This creates a high hurdle for applicants involved in complex offshore structures.

Defining Tax Planning vs. Tax Avoidance

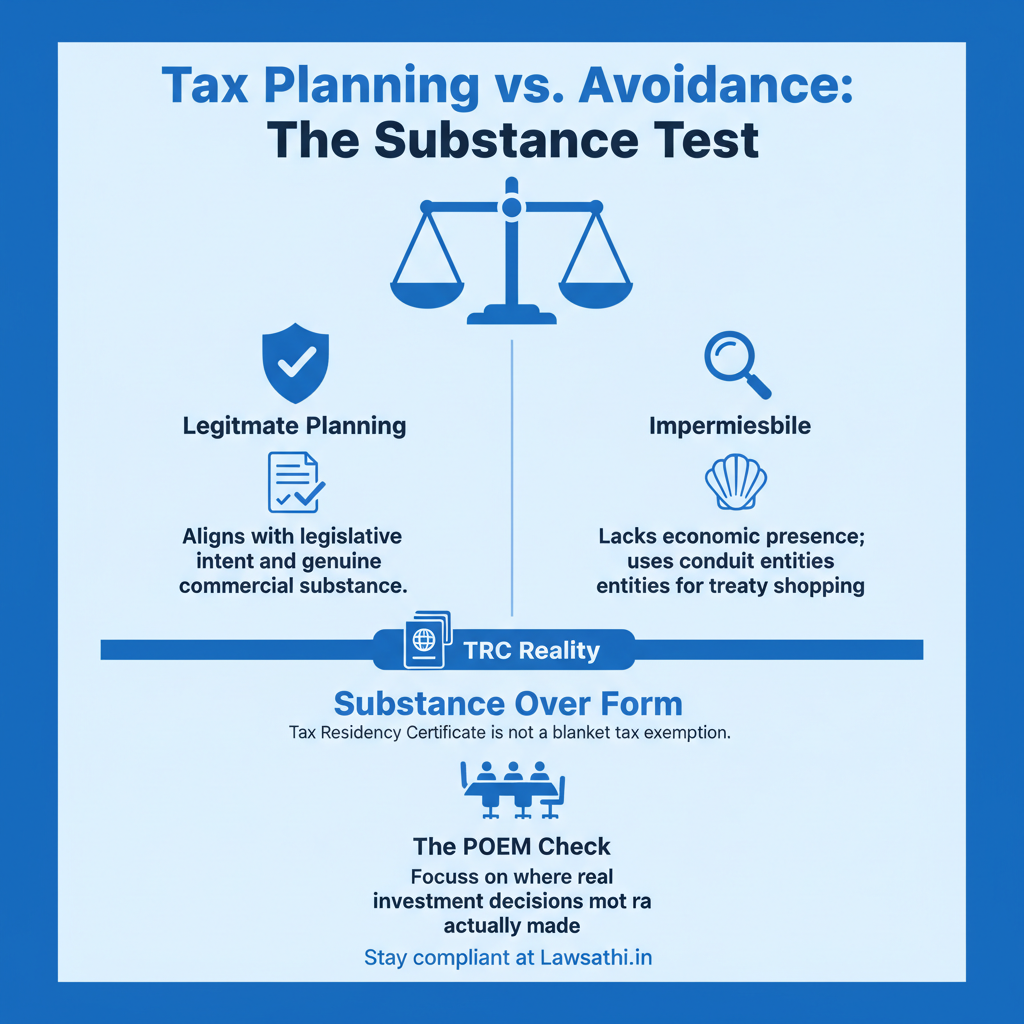

The Supreme Court drew a sharp distinction between legitimate tax planning and illegal evasion. Legitimate planning must conform to the legislative intent. In contrast, tax avoidance involves using artificial methods to circumvent tax liability.

Furthermore, the Court emphasized that once a structure lacks commercial substance, it becomes “impermissible avoidance.” Taxpayers can no longer rely on mere “form” to claim treaty benefits.

The Problem of the Burden of Proof

Who must prove that a transaction is a sham? Under the General Anti-Avoidance Rules (GAAR), the onus often falls on the taxpayer. However, for a rejection under Section 245R(2), the revenue only needs to show “prima facie” evidence.

Consequently, practitioners must ensure that every aspect of a property deal has a commercial justification. If the primary purpose of the structure is a tax benefit, the application will likely be rejected.

The Supreme Court’s Rationalization

The Apex Court focused heavily on the doctrine of “substance over form.” It scrutinized the Mauritius entities and found them to be “conduit entities.” These companies lacked independent management or significant economic presence in Mauritius.

Specifically, the Court noted that investment decisions were made by advisors in the US. Moreover, the entities had no real “skin in the game” beyond holding shares. Therefore, they were seen as tools for “treaty shopping.”

GAAR vs Advance Ruling Interface

The interplay between GAAR and advance rulings is now tighter than ever. Although the initial investments happened before 2017, the sale happened in 2018. The Court ruled that GAAR is attracted if the arrangement results in a tax benefit after the GAAR effective date.

Additionally, holding a Tax Residency Certificate (TRC) is not a “blanket exemption.” The Court clarified that Article 13 of the India-Mauritius DTAA requires a genuine economic presence. Without “substance,” the TRC alone cannot prevent a rejection of an advance ruling on tax avoidance.

Impact of Sovereign Power to Tax

The SC reiterated that the power to levy tax is a sovereign function under Article 265. While DTAAs prevent double taxation, they should not facilitate “non-taxation.” Consequently, any structure that creates a “tax vacuum” will face intense judicial scrutiny.

Critical Implications for Legal Practitioners

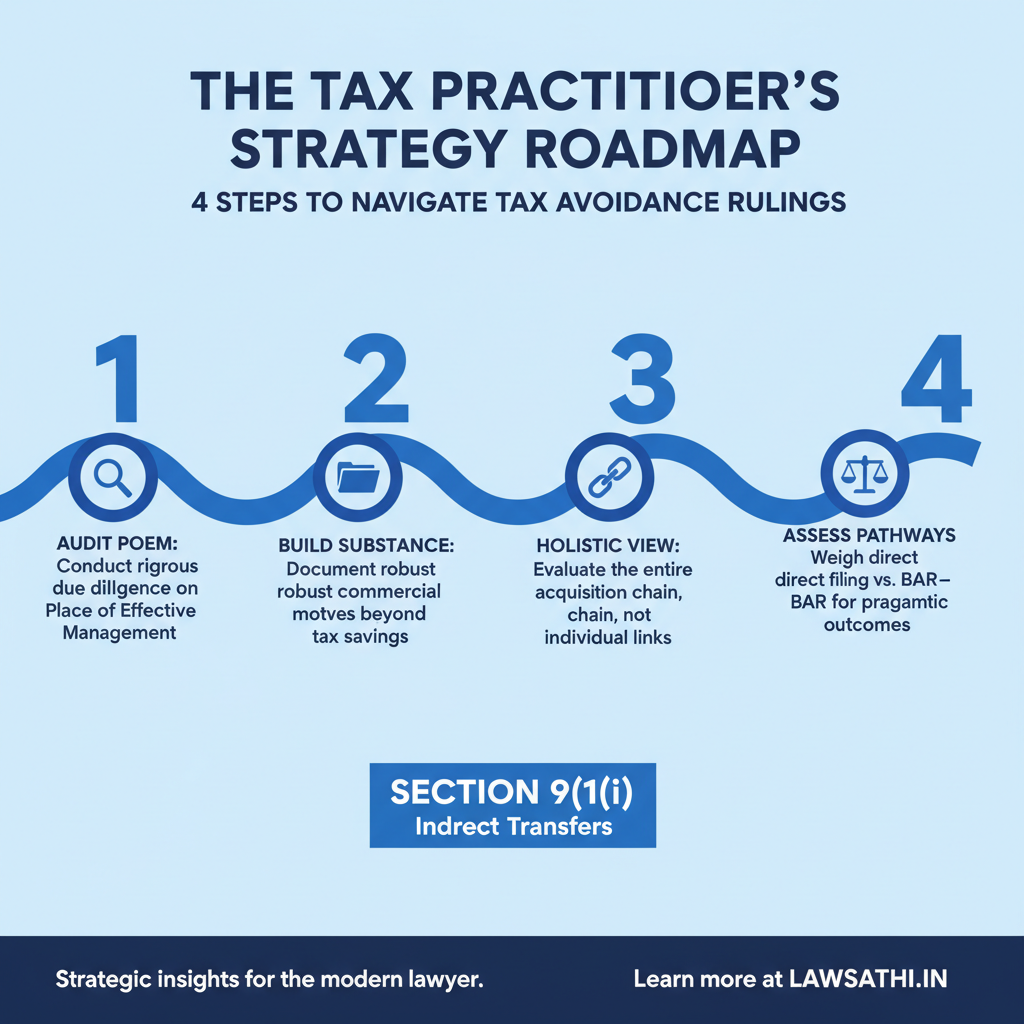

This judgment significantly narrows the scope for high-value domestic and cross-border deals. Lawyers must now perform rigorous due diligence before filing for an advance ruling. You must examine the “Place of Effective Management” (POEM) with extreme care.

Identifying Management and Control

For instance, identify where the board meetings occur and who truly makes decisions. If the control lies outside the treaty country, the BAR may reject your application. As a result, your client could face years of litigation in the ITAT and High Courts.

Risk Assessment for Complex Divestments

Practitioners should avoid a “dissecting” approach to transactions. Authorities will instead look at the entire chain of acquisition and sale. If any link in the chain is deemed a “sham,” the whole structure may fail.

Furthermore, explain to your clients that the BAR is no longer a “safe harbor” for clever tax engineering. Instead, it is a narrow gateway for legitimate legal queries. Therefore, always prepare a robust “commercial substance” file for every transaction.

Strategic Planning After the SC Ruling

First, reassess all pending applications that might involve “prima facie” avoidance elements. Second, consider if a direct filing with the Assessing Officer is more pragmatic. Finally, ensure that all “grandfathering” claims are backed by solid evidence of bona fide intent.

The Future of Dispute Resolution in Indian Tax Law

The transition from AAR to the Board for Advance Rulings (BAR) is now complete. However, this recent SC ruling suggests that the BAR will act as a strict gatekeeper. Consequently, we may see a decline in the number of successful advance rulings for multinational corporations.

Moreover, the new Income-tax Act, 2025 (notified in August 2025) will further tighten these rules. Tax certainty in India is evolving into a “substance-first” model.

Will Litigation Increase in Higher Courts?

As the BAR rejects more applications, litigation will naturally shift to the ITAT and High Courts. This means practitioners must be ready for longer battle lines. Most importantly, the Supreme Court has cleared the path for the Revenue to challenge aggressive tax planning at the earliest stages.

Conclusion: Navigating the New Tax Reality

The Supreme Court’s stance on an advance ruling on tax avoidance sends a clear message. Taxpayers cannot use specialized forums to validate “treaty shopping” or artificial property structures. For Indian lawyers, this means providing advice that balances tax efficiency with commercial reality.

Always prioritize “substance” over “form” to protect your clients. Above all, stay updated on the shifting interpretations of Section 245R(2) to provide the best legal defense.

Stay ahead of landmark judgments and manage your tax litigation files effortlessly with LawSathi’s AI-powered practice management tools. Book a free demo today!