The landscape of property ownership in Gujarat is undergoing a massive transformation this year. Specifically, the state government recently introduced the Gujarat Land Revenue Amendment 2025. This law aims to resolve thousands of pending disputes.

As a result, this new policy offers a rare window for landowners. They can now regularize violations before strict enforcement begins. Therefore, lawyers across the state are seeing a surge in inquiries.

Understanding the New Legal Framework

Most inquiries regard land titles and conversion penalties. Furthermore, understanding these updates is critical for any legal professional. You must stay informed if you handle revenue matters in 2026.

This guide breaks down the settlement scheme in detail. Consequently, you will understand what it means for your legal practice. We will focus on compliance and the new regularization standards.

Transitioning from Punishment to Regularization

In January 2025, the Gujarat government shifted its focus. It moved from punitive actions toward revenue generation. Moreover, this shift aims to unlock “stuck” real estate projects.

The government achieves this by offering a compounding model for technical violations. Primarily, the goal is to protect property rights while increasing state revenue. Specifically, the Gujarat Stamp (Amendment) Act, 2025 now targets responsible parties.

As a result, authorities ensure duty is paid before loan disbursements. This creates a more transparent financial environment for the real estate sector.

Why the Grace Period Matters in 2026

Most importantly, this amendment provides a safe harbor. It helps those who missed previous deadlines. Consequently, the state is offering a limited-time grace period for regularization.

If owners fail to act now, they may face harsh provisions. For example, they could be prosecuted under the Gujarat Land Grabbing (Prohibition) Act. Therefore, immediate action is necessary to secure property rights.

Key Highlights of the New Amendment: What Has Changed?

The Gujarat Land Revenue Amendment 2025 brings significant changes. Specifically, it alters the “Non-Agricultural” (NA) conversion process. For example, the government has liberalized Section 65 to reduce bureaucratic delays.

If the Collector does not decide on an NA application within three months, the status is strictly deemed as granted. In fact, this deemed NA status is a major relief. It helps industrial and residential developers who previously waited years for approvals.

Section 65B Compliance and Urban Expansion

Moreover, the amendment simplifies Section 65B compliance. This applies to unauthorized developments on agricultural land. Such changes are particularly relevant for industrial hubs near Ahmedabad and Surat.

Additionally, new notifications under the Gujarat Land Revenue Code allow for easier regularization. This includes industrial sheds. However, developers must ensure their current land use aligns with the specialized 2025 guidelines.

New vs. Old Tenure Land Rules

Another vital change involves “New Tenure” land regulations. Under the 2024-2025 reforms, certain tenants can convert land. This applies to those who have farmed the land for over 15 years.

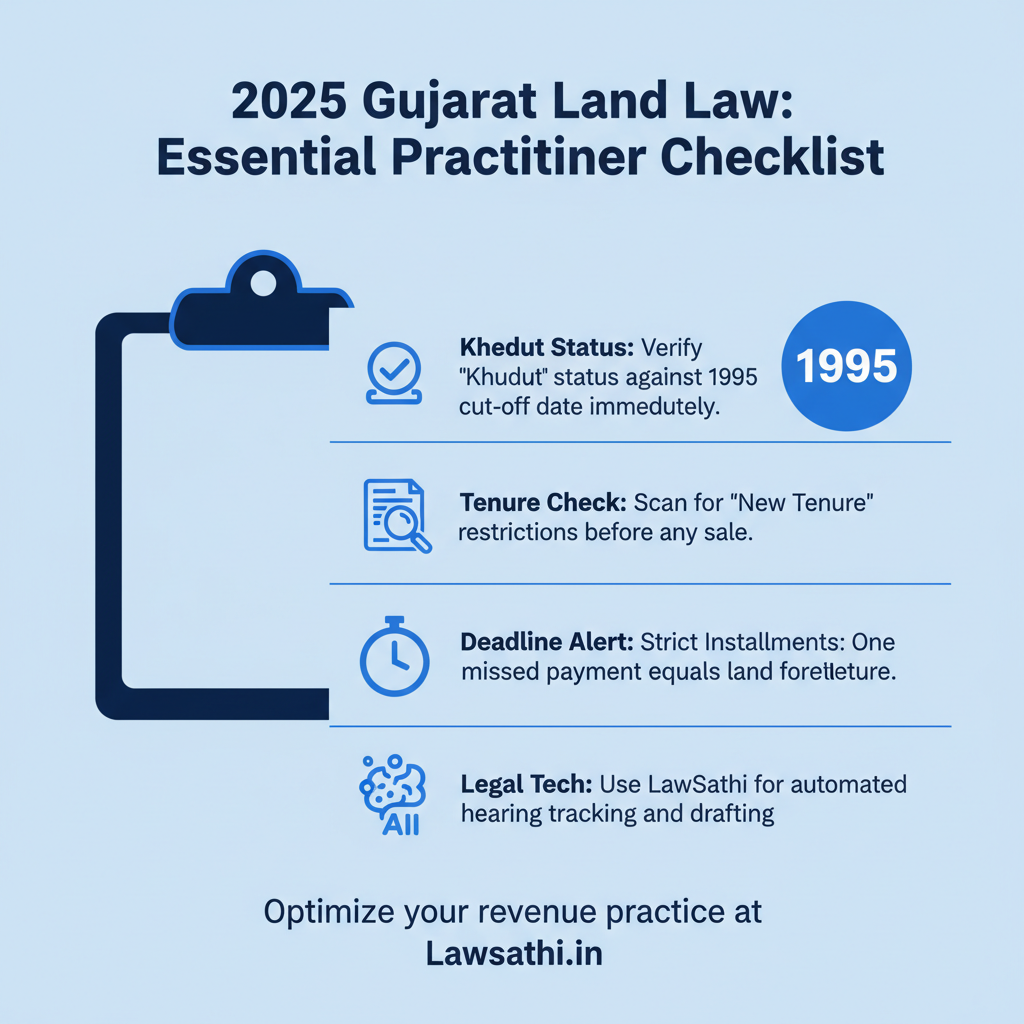

They can move from New Tenure to Old Tenure. While this conversion is often fee-free, converting to NA still requires a premium payment. Consequently, lawyers must carefully verify the history of tenure. You must do this before advising clients on sale transactions.

The Regularization Window: Opportunities for Landowners

The 2025 window is open for both residential and commercial encroachments. However, this only applies to encroachments on agricultural land. Nevertheless, not every violation is eligible for settlement.

For instance, certain frameworks exclude lands reserved for public purposes. Specifically, the Gujarat Regularisation of Unauthorised Development (GRUDA) sets these limits. Therefore, you must check local development plans first.

Calculating Impact Fees and Premiums

The fee structure is now based on scientific Circle Rates. These are commonly known as Jantri. Following the Supreme Court’s guidance in March 2025, the government must fix fair rates.

These rates must reflect real market value. Therefore, if the Jantri rates are over-inflated, landowners may have grounds for a legal challenge. In other words, the premium calculation is no longer arbitrary. It must follow strict market-linked data.

Meeting the Settlement Deadlines

Furthermore, the government has set strict deadlines for these premium payments. Missing a single installment could lead to serious trouble. Specifically, it may cause the immediate forfeiture of the land.

As a result, lawyers must emphasize to their clients that this is a final opportunity. Once the window closes, the enforcement surge will begin. This will likely involve reclaiming land without further notice.

Navigating the Legal Hurdles: Tips for Revenue Lawyers

Filing for regularization requires meticulous documentation. First, lawyers must secure Village Forms 7/12, 6, and 8A. These forms are essential to establish the status of the applicant.

Specifically, they prove the “Khedut” (farmer) status. Fortunately, a recent circular has streamlined this process. Authorities are now instructed not to investigate old mutation entries. They will not look at entries prior to the April 6, 1995, cut-off date.

Dealing with ‘Sharat-Bhang’ (Breach of Conditions)

“Sharat-Bhang” cases remain a common pitfall in revenue litigation. To resolve these, you must typically pay the “difference of premium.” Additionally, you must pay a compounding penalty.

For example, a client might have sold New Tenure land without permission. In this case, you must file for retrospective approval. Most importantly, ensure that the application references the Gujarat Land Revenue Amendment 2025. This allows your client to benefit from the new lower penalty slabs.

Expediting Applications via iORA

In contrast to the old manual system, all applications now move through the iORA portal. This is the Integrated Online Revenue Applications system. Therefore, lawyers must be tech-savvy to track cases.

You must monitor cases at the Taluka and District Collector levels effectively. Using digital portals reduces “under-the-table” delays. However, it also means that the timeline for responding to queries is much shorter. You must respond quickly to stay compliant.

Modernizing Revenue Practice with LawSathi

The 2025 settlement window has created a high volume of work. For revenue practitioners, this is a busy time. Managing hundreds of cases manually is no longer sustainable.

This is where LawSathi becomes an indispensable tool for your firm. Specifically, LawSathi’s AI can help you draft “Sharat-Bhang” petitions in minutes. It uses standardized templates based on the latest 2025 notifications.

Automating Case Tracking

Furthermore, you can track hearing dates across various courts. This includes the Collectors’ courts and the Special Secretary Revenue Department (SSRD). LawSathi ensures you never miss a deadline.

As a result, your firm can handle a higher case load. You can do this while maintaining high accuracy. For instance, you can set automated reminders for clients. They will know exactly when to submit their 7/12 extracts.

Enhancing Client Communication

In addition to internal management, LawSathi improves communication. You can send automated SMS or WhatsApp updates to landowners. This process keeps them informed about their regularization status.

Clearly, this builds trust and transparency. In fact, many successful firms in Gujarat are already using AI. This helps them stay ahead of the enforcement crackdown.

Conclusion: Preparing Your Clients for the 2025 Enforcement

The Gujarat Land Revenue Amendment 2025 is a double-edged sword. While it offers a pathway to legal titles, it also signals the end of leniency. Therefore, legal professionals must act as a bridge.

First, verify the “Khedut” status against the 1995 cut-off. Second, check for any New Tenure restrictions. Finally, ensure all fees are paid within the stipulated window.

By following this checklist, you protect your clients from land forfeiture. You also prevent future litigation. The role of the revenue lawyer is now more critical than ever.

Don’t let the 2025 Revenue Crackdown overwhelm your firm. Use LawSathi’s AI-powered practice management to streamline your Gujarat land cases. Start your free trial today!

when

re to find the GR