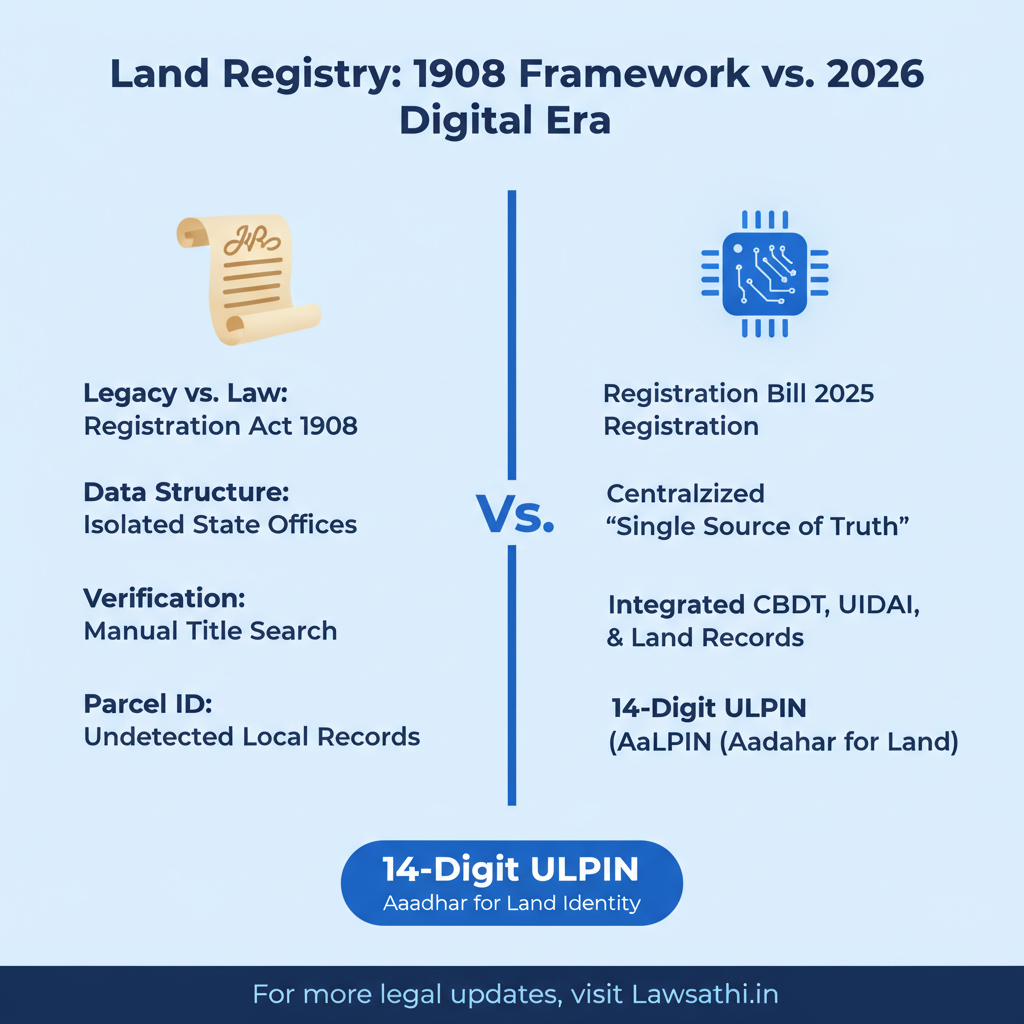

The landscape of Indian real estate changed forever this month. Specifically, the government introduced the New Land Registry Rules 2026. This marks a historic departure from the century-old Registration Act of 1908.

For lawyers, this change is not just a digital update. Instead, it is a complete overhaul of property transactions and client advisory. Consequently, everyone in the industry must adapt to these new digital demands immediately.

A Unified Shift in Property Governance

Starting January 2026, the Registration Bill, 2025 replaced the outdated 1908 framework. Therefore, property registration has moved from isolated state offices to a central digital lattice.

The Department of Land Resources (DoLR) now chairs this “single source of truth.” Furthermore, the mandate integrates land records with the CBDT and UIDAI databases. As a result, the registry now acts as a verified ledger for ownership and tax liabilities. Legal professionals must therefore pivot their roles to become compliance gatekeepers.

The Role of Lawyers in 2026

Lawyers can no longer treat registration as a mere title transfer. Instead, you must now verify Statement of Financial Transactions (SFT) compliance. This ensures that the registry value matches the actual consideration paid.

In other words, your due diligence must include tax history and biometric eligibility. Failure to do so could result in transaction delays or legal penalties. Most importantly, you must guide clients through this high-tech verification process.

Deciphering the 2026 Rules: Key Regulatory Changes

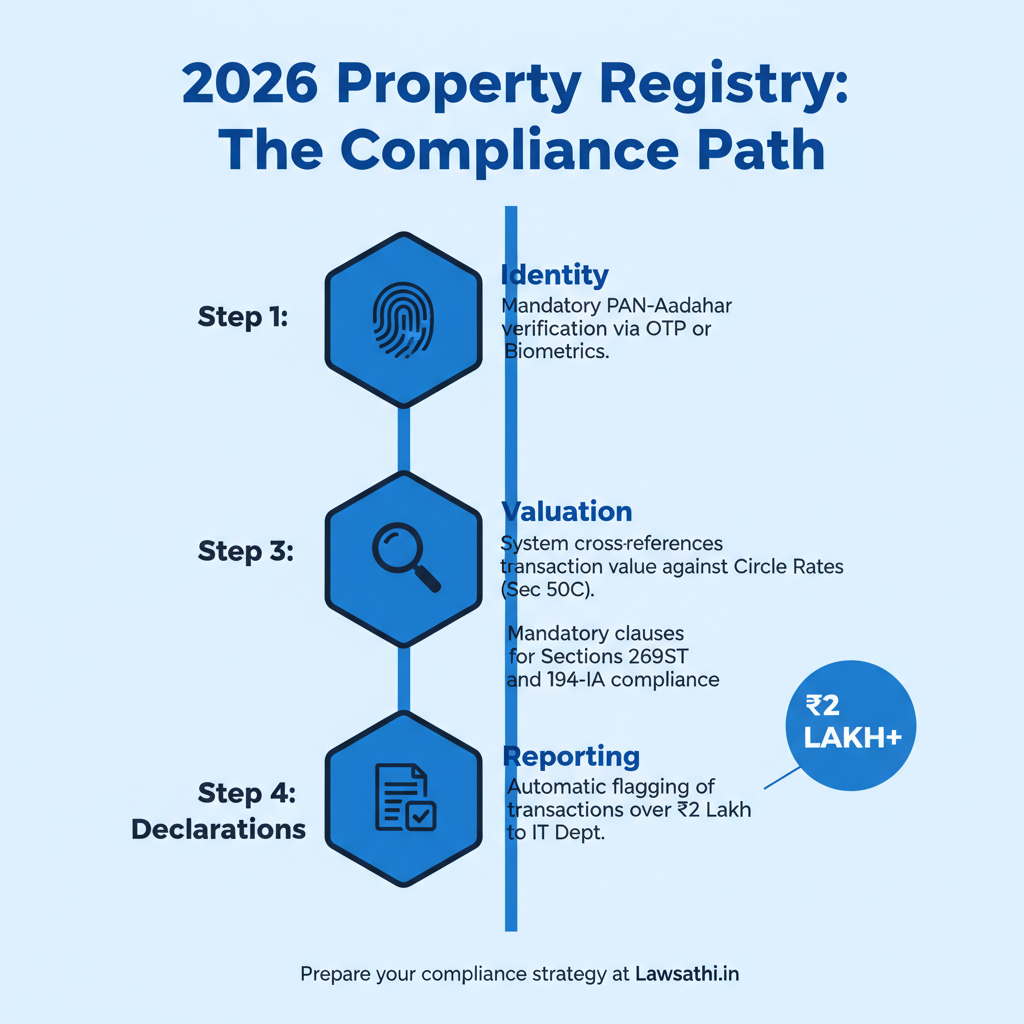

The New Land Registry Rules 2026 introduce mandatory PAN and Aadhaar authentication for all deeds. Under Sections 18 and 29 of the new Bill, every party must undergo verification. This usually involves biometric data or OTP checks.

Without this digital handshake, the Sub-Registrar Office (SRO) will not accept the documents. Therefore, physical presence and digital identity are now inextricably linked at the point of sale.

Automatic Income Tax Flagging

The new system includes an automatic flagging mechanism for “High-Value Transactions.” This follows the landmark ruling in RBANMS Educational Institution v. B. Gunashekar.

As a result, SROs have new statutory duties. They are now legally obligated to report any cash transactions of ₹2 Lakh or above. This report goes directly to the Income Tax Department for immediate scrutiny.

Implementation of the ULPIN System

Additionally, every land parcel now carries a 14-digit Unique Land Parcel Identification Number (ULPIN). Many experts refer to this as the “Aadhaar for Land.”

Specifically, it serves as the primary key for all future tax assessments. For example, the system uses GIS data to calculate capital gains with surgical accuracy. Therefore, any attempt to undervalue property will trigger an immediate red flag in the system.

The Buyer’s Perspective: A Big Win for Transparency?

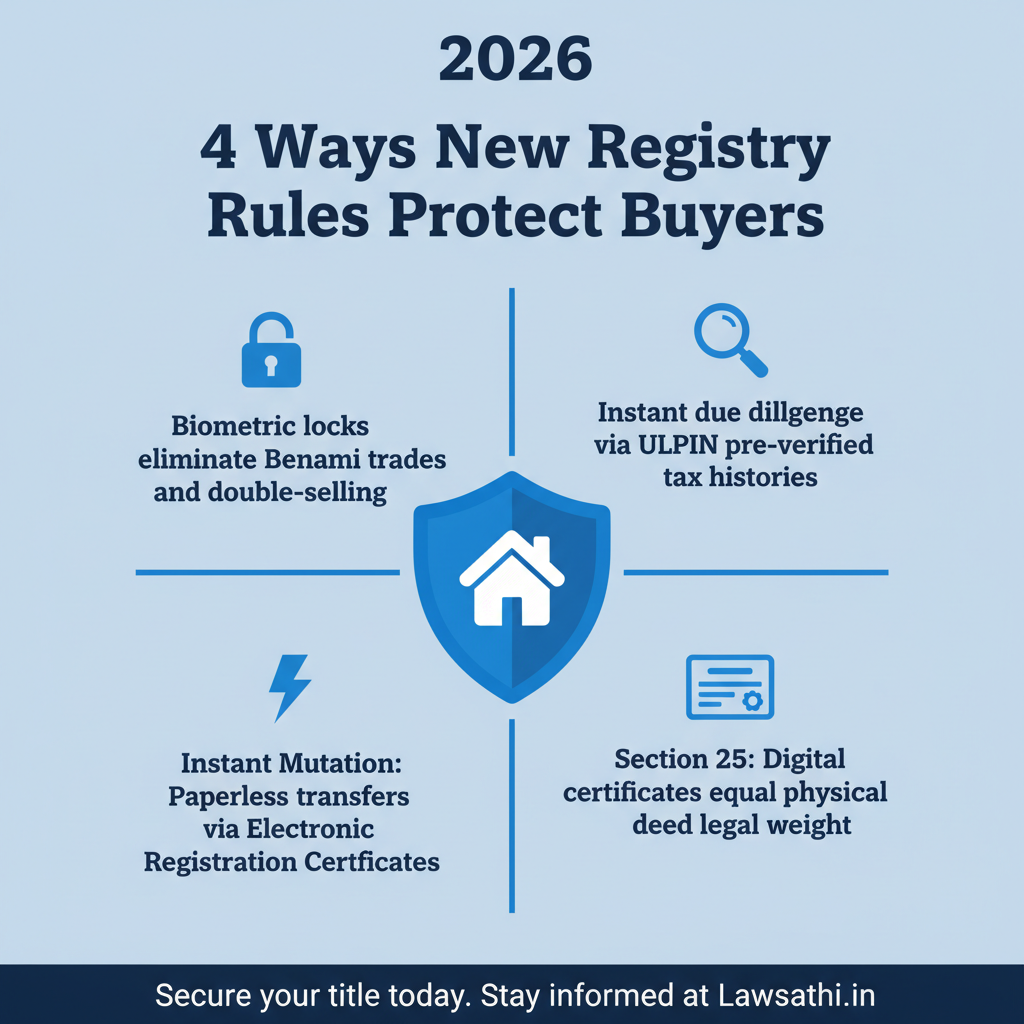

For property buyers, the New Land Registry Rules 2026 offer a significant layer of security. For instance, biometric verification has drastically reduced “Benami” transactions. It also blocks the practice of “double-selling” the same plot to different parties.

Because the records are linked, the system prevents a second sale once a deed is uploaded. Consequently, the risk of title fraud has reached an all-time low in India.

Simplified Title Verification

Buyers can now enjoy a simplified due diligence process. Through the ULPIN-linked portal, they can access pre-verified tax histories easily. For instance, a buyer can see if the seller has unpaid property taxes.

Moreover, they can check for existing income tax liens on the property. This transparency builds confidence in the market. As a result, it reduces long-term litigation risks for all parties involved.

Electronic Registration Certificates

Additionally, Section 25 of the Bill authorizes Electronic Registration Certificates. These digital documents are legally identical to physical deeds. Therefore, they allow for paperless transfers and instant updates.

Consequently, the time taken for “mutation” of property has been slashed. What used to take months now happens in mere hours. This massive speed increase benefits both residential and commercial developers.

The Privacy Debate: Data Security or State Surveillance?

While transparency is beneficial, the centralization of land data raises serious privacy concerns. The Digital Personal Data Protection (DPDP) Rules, 2025 are now in full effect.

Specifically, SROs are now classified as “Data Fiduciaries.” This means they must protect the biometrics and personal details of every citizen. Therefore, legal teams must ensure their clients’ information remains secure during the filing process.

Risks of Automated Scrutiny

However, some critics label this integration as “Tax Terrorism.” Automated scripts now cross-reference a buyer’s declared income with the property value. If a mismatch occurs, the system sends an automated notice.

In fact, even honest taxpayers may face increased scrutiny. This happens if their financial records are not perfectly aligned with the registry data. As a result, pre-transaction tax planning has become vital.

Cybersecurity and Identity Theft

Moreover, centralized databases are high-value targets for hackers. A breach in the land registry could lead to widespread identity theft. To mitigate this, the DPDP Rules mandate a 72-hour reporting window for any leaks.

Lawyers must advise clients on these risks. Furthermore, they must ensure their digital signatures are securely managed. Maintaining digital hygiene is now a core part of property law.

Impact on Legal Practice: New Compliance Burdens

The New Land Registry Rules 2026 have transformed how we draft legal documents. Sale deeds must now include specific “Tax Compliance Clauses.” These clauses declare that the transaction adheres to Sections 269ST and 194-IA.

For example, if a lawyer fails to include these, the portal might reject the deed. Therefore, drafting precision is more important than ever before.

Capital Gains and Valuation Parity

Lawyers must also educate clients on Section 50C implications. The “Stamp Duty Value” is now automatically compared to the “Transaction Value.”

This happens via the CBDT link in the registry software. If the sale price is lower than the circle rate, the seller faces a tax demand. Consequently, precise valuation is now a core part of legal advisory services.

Managing NRI Client Hurdles

Furthermore, Non-Resident Indian (NRI) clients face new digital hurdles. The digital norms require e-KYC through Indian Consulates.

Alternatively, they may use specific Digital Signature Certificates (DSC). Physical Power of Attorney (PoA) holders are also subject to stricter scrutiny. Therefore, lawyers must start the verification process weeks before the registration date.

Conclusion: Navigating the Future of Indian Real Estate Law

The New Land Registry Rules 2026 represent an inevitable shift toward a digital ecosystem. While the transition is complex, it offers a more efficient landscape for the legal profession.

We are moving away from dusty record rooms toward a streamlined future. Most importantly, staying updated on these changes is now a requirement for survival. Lawyers who master these tools will find themselves at a distinct advantage.

Streamline your property due diligence and manage complex revenue law documentation with LawSathi’s AI-enabled practice management. Start your free trial today to access updated 2026 deed templates.