Understanding the nuance of Legal Heir Certificate vs Succession Certificate is vital for any probate practitioner in India. Many clients approach lawyers confused about which document they need to settle a deceased relative’s estate. In India, inheritance laws are complex. Specifically, they are dictated by various personal laws and statutes. Therefore, selecting the wrong document can lead to significant delays and financial loss for your clients.

The Jurisprudential Distinction in Inheritance Documentation

A Legal Heir Certificate (LHC) serves primarily as an administrative tool. Revenue officials issue it to identify the living heirs of a deceased person. Most importantly, it helps families claim internal benefits like pensions or insurance. Furthermore, it facilitates electricity connection transfers. However, it does not prove the legal right of inheritance in a court of law for high-value assets.

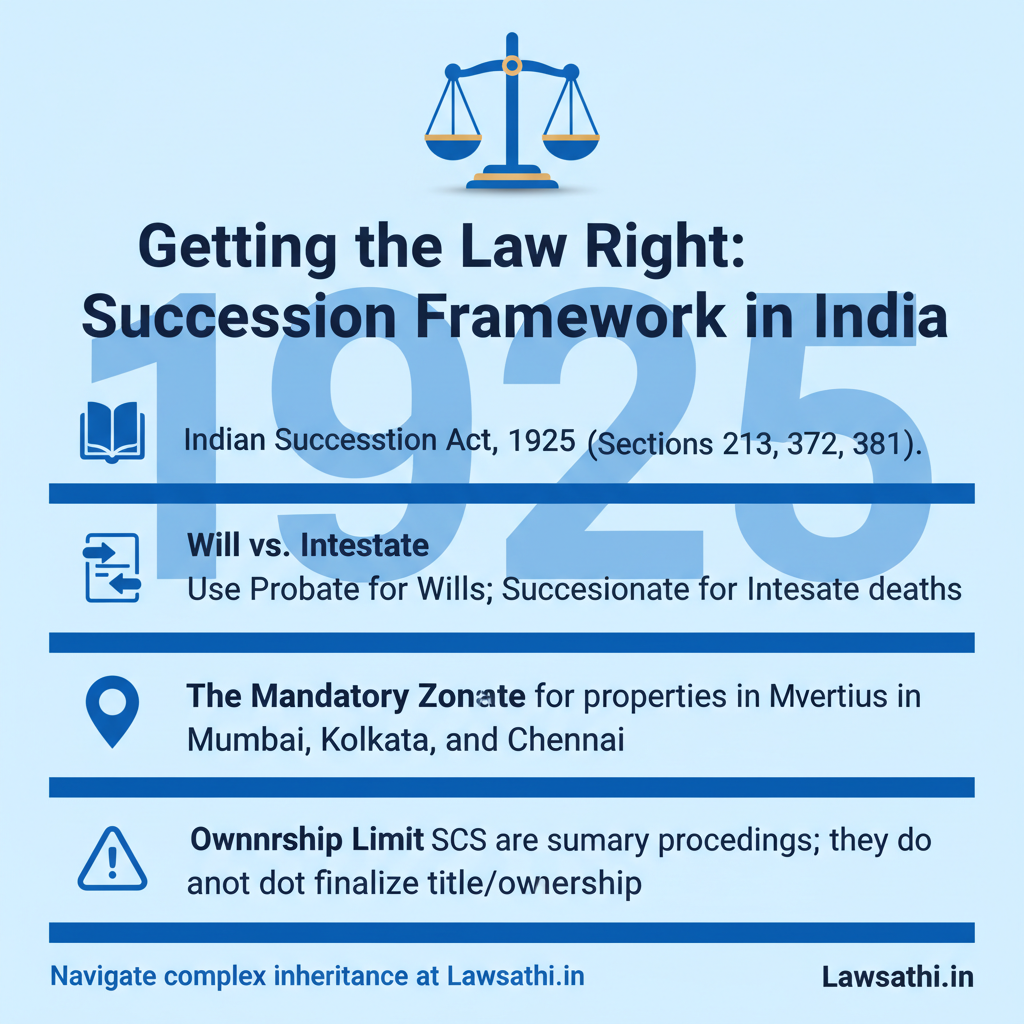

In contrast, a Succession Certificate (SC) is a judicial document. It is governed strictly by the Indian Succession Act, 1925. Courts issue this certificate to authorize heirs to realize debts and securities. Therefore, if a bank refuses to release a fixed deposit, the SC becomes the mandatory remedy.

Why Practitioners Must Distinguish These Tools

Lawyers must clarify these differences during the initial client intake. For example, the Madhya Pradesh High Court recently observed an important rule. Specifically, only legally recognized heirs using a succession certificate can stake claims to certain employment dues.

Therefore, a Legal Heir Certificate might suffice for a government job on compassionate grounds. However, it will fail when dealing with complex financial portfolios. As a practitioner, your advice must align with the specific nature of the assets involved. Consequently, you must evaluate the asset type before filing any application.

Detailed Comparison: Legal Heir Certificate vs Succession Certificate

The primary difference lies in the issuing authority and the scope of the document. A Tahsildar or Revenue Officer issues the Legal Heir Certificate. In contrast, a Civil Court judge grants the Succession Certificate. Consequently, the legal weight of an SC is much higher than that of an LHC.

Comparing Legal Weight and Scope

Under Section 381 of the Indian Succession Act, an SC provides full indemnity to parties paying debts. It acts as conclusive evidence of the heir’s authority. On the other hand, an LHC is merely prima facie evidence of a relationship. While it confirms who the relatives are, it does not settle ownership disputes.

Furthermore, the scope of these certificates differs significantly. An LHC helps in claiming “service benefits” of deceased government employees. This includes gratuity, salary arrears, and family pensions. Conversely, the SC is restricted to movable properties. Specifically, these include bank balances, stocks, and shares.

Fee Structures and Financial Implications

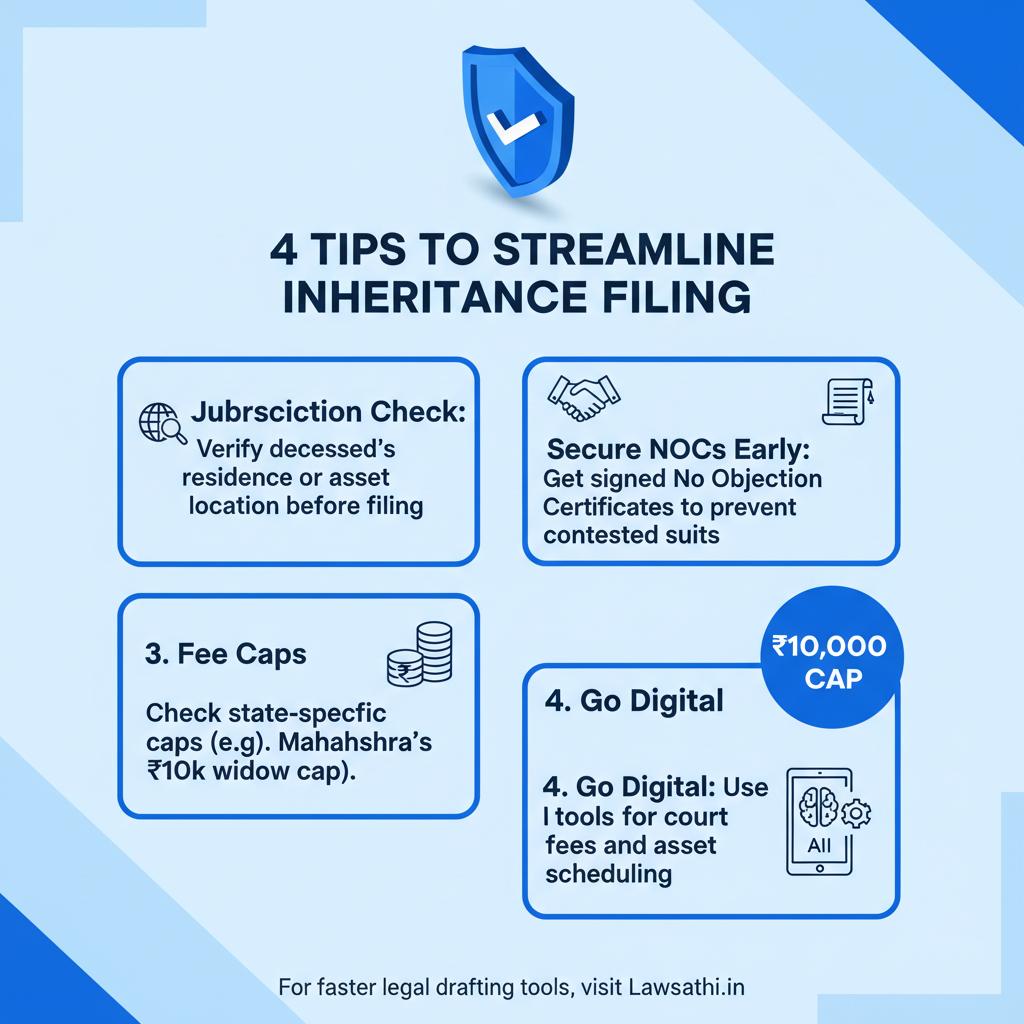

Fees represent another major point of comparison in the Legal Heir Certificate vs Succession Certificate debate. Obtaining an LHC is relatively inexpensive. Specifically, you only need to pay nominal stamp duties or administrative fees. This makes it an attractive first step for many grieving families.

However, the cost of a Succession Certificate is much higher. Courts charge an ad-valorem fee based on the total value of the assets. For example, the Kerala High Court recently upheld fee hikes for court services. Additionally, Maharashtra has capped fees at ₹10,000 for widows. Always check your state’s latest court fee amendments before filing.

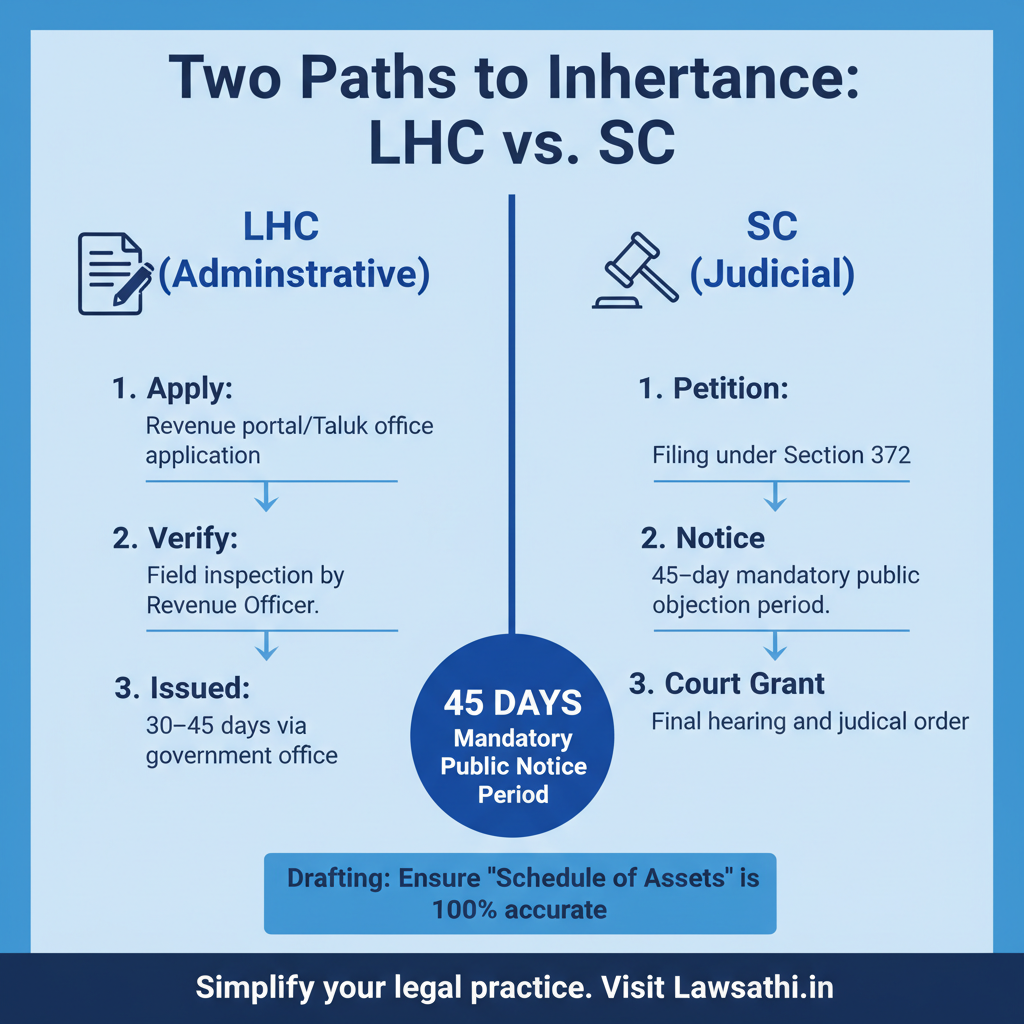

Procedural Steps for Applying for a Legal Heir Certificate

The legal heir certificate application process usually begins at the local Taluk or Tehsil office. First, the applicant must identify all surviving direct heirs. This typically includes the spouse, children, and parents of the deceased. In most states, you can now apply through digital e-governance portals.

Documentation and Field Verification

The applicant must submit several key documents. These include the original death certificate and proof of residence. Additionally, heirs must provide their ID proofs and a self-undertaking affidavit. In some jurisdictions like Madras, the court has made specific allowances. For instance, the High Court has allowed affidavits from neighbors as valid evidence.

Following the submission, a Revenue Inspector conducts a field inquiry. They visit the residence to verify all claims. Finally, after the verification report is submitted, the Tahsildar issues the certificate. Generally, this process takes 30 to 45 days.

The Judicial Process for Obtaining a Succession Certificate

The procedure for succession certificate is entirely judicial and begins with a petition. You must file this under Section 372 of the Indian Succession Act. Specifically, this happens in a District Court. The petition must include the time of death and the residence of the deceased. Most importantly, it must contain a detailed “Schedule of Assets.”

Public Notice and Hearing Requirements

Once the court admits the petition, it issues a public notice in local newspapers. This allows any interested person to raise objections. In most cases, the objection period lasts 45 days. If no one objects, the court proceeds to a hearing. The judge then examines the evidence and hears the petitioners.

Subsequently, the court grants the certificate if it finds no grounds for rejection. However, the Supreme Court has noted in Joginder Pal v. Indian Red Cross Society a key limitation. Specifically, these proceedings are summary in nature. They do not permanently decide title or ownership. Therefore, a full civil suit might still be necessary if complex disputes arise.

When is a Probate Necessary? Intersection with Succession Certificates

Practitioners must understand when a Will overrides the need for a Succession Certificate. A probate is a court-certified copy of a Will. It proves that the Will is the valid testament of the deceased. In some regions, probate remains mandatory for properties in Mumbai, Kolkata, and Chennai.

Specific Applications of Section 213

Section 213 of the Indian Succession Act governs the necessity of probate. However, recent rulings have clarified its limits. For example, probate is not always required for Hindu Wills for certain properties. This applies to assets outside specific metropolitan limits.

If a valid Will exists, heirs should apply for Probate or Letters of Administration. You should not seek an SC in these cases. If the deceased died intestate, then an SC is the correct path. Consequently, advising your client on this distinction prevents the annulment of proceedings.

Practical Challenges for Probate Practitioners

One common challenge involves managing multiple heirs spread across the globe. You must often secure ‘No Objection Certificates’ (NOCs) from all siblings. This helps to streamline the legal process. However, if one heir refuses to sign, the case can turn into a lengthy suit.

Drafting the Schedule of Assets

Furthermore, drafting the Schedule of Assets requires meticulous detail. If you omit a bank account, you must file a fresh petition to add it. This mistake doubles the workload and the court fees. Therefore, practitioners should use comprehensive checklists from local courts to ensure every security is listed.

Additionally, properties in different jurisdictions can complicate filings. While an SC is valid throughout India, the initial filing has specific rules. Specifically, it must happen where the deceased lived. If the deceased had no permanent residence, you file where the bulk of the property is situated.

Leveraging Technology to Streamline Estate Management

Modern legal practice demands speed and accuracy. Manually tracking the 45-day waiting period is prone to error. Fortunately, digital tools now help lawyers manage these inheritance timelines effortlessly. For instance, AI-powered platforms can suggest correct court fees based on current state laws.

Automating Client Intake and Documentation

Moreover, automating the drafting of client intake forms saves hours of manual work. You can create templates for asset schedules instantly. Furthermore, these tools ensure you meet requirements from the Income Tax department for legal heir registration.

Finally, cloud-based practice management allows you to store death certificates securely. You can access these files during court hearings or while communicating with officials. In fact, this digital transition is no longer optional for competitive Indian law firms today.

Conclusion: Mastering the Client Advisory

Navigating the choice of Legal Heir Certificate vs Succession Certificate requires deep expertise. Always remember that an LHC is best for administrative and employment benefits. In contrast, an SC is essential for accessing financial securities and debt recovery. By identifying the client’s specific assets early, you provide faster, cost-effective relief.

Streamline your probate filings and manage client documents effortlessly with LawSathi’s AI-powered practice management. Start your free trial Today!