Delayed payments pose a systemic threat to the survival of Indian small businesses. In fact, recent data shows that liquidity crunches remain a top concern for the sector in 2026. Therefore, the MSME Samadhaan scheme recovery procedure has emerged as a vital tool for legal practitioners.

The Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, serves as a protective umbrella. Specifically, it provides a specialized mechanism to bypass the delays of traditional civil courts. Consequently, litigators must understand how to navigate this statutory framework to secure their clients’ finances.

Statutory Framework: Understanding Sections 15–18 of the MSMED Act

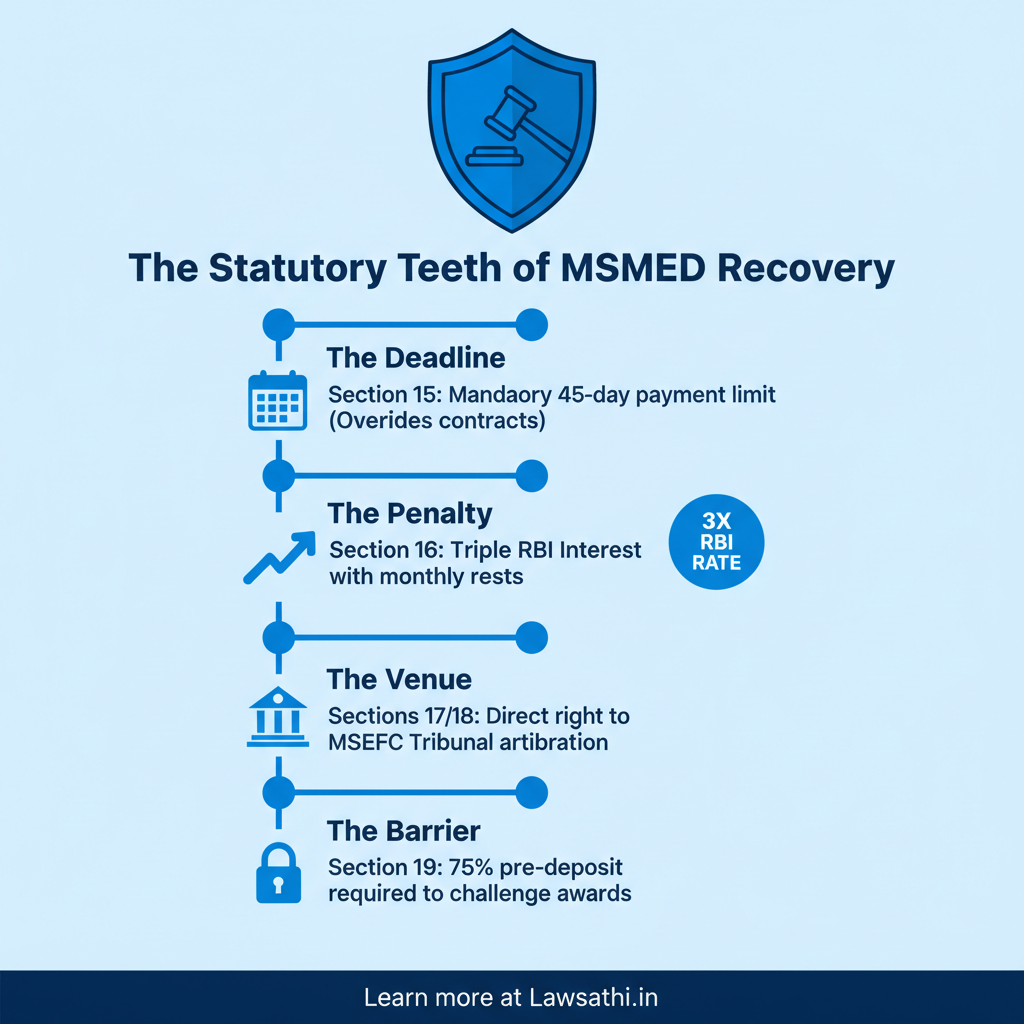

The MSMED Act creates a strict liability for buyers. According to Section 15, the buyer must pay the supplier within 45 days. This timeline applies even if the contract suggests a longer period.

Furthermore, the “appointed day” is usually 15 days from the date of acceptance if no agreement exists. In other words, the law prioritizes prompt payment over private contractual delays.

The Mandatory Interest Hammer under Section 16

Section 16 provides the most powerful deterrent against delayed payments. For instance, it mandates compound interest at three times the RBI bank rate. As of February 2026, the RBI bank rate remains a critical benchmark for these calculations.

Additionally, this interest is calculated with monthly rests. Therefore, the final amount often exceeds the principal debt. Most importantly, courts have held that Section 16 is mandatory and overrides any private contracts attempting to waive interest.

The Right to Reference under Sections 17 and 18

Section 17 grants the supplier the right to receive both principal and interest. If the buyer fails to pay, Section 18 allows a reference to the Micro and Small Enterprise Facilitation Council (MSEFC). This Council acts as a specialized tribunal for debt recovery.

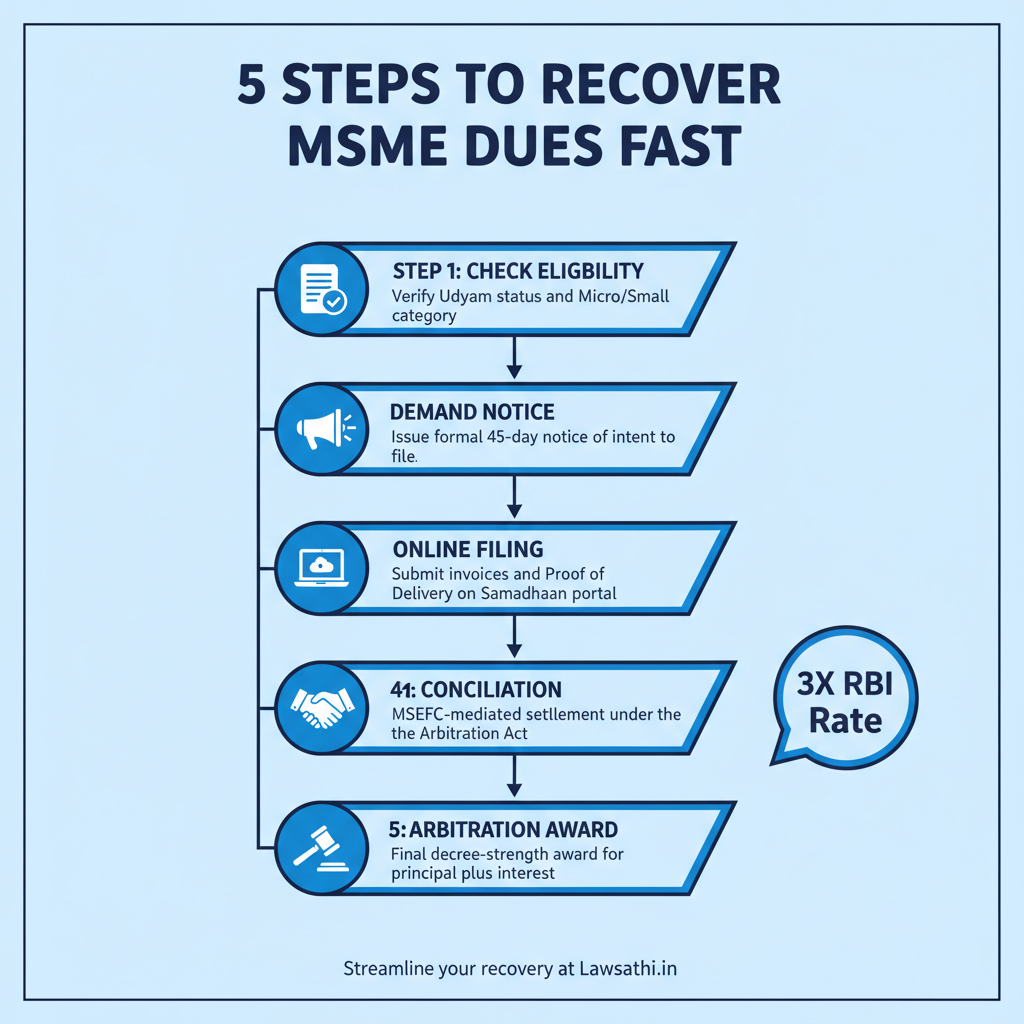

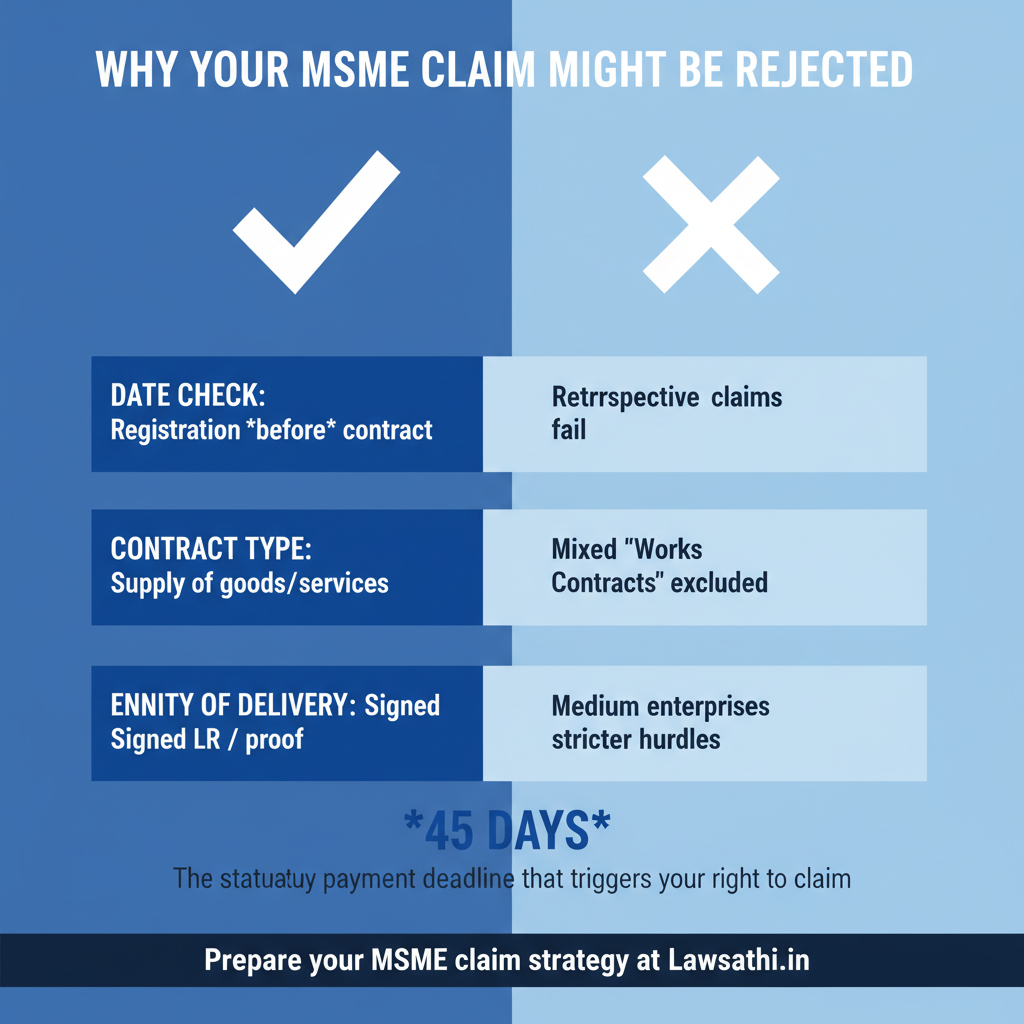

Step 1: Pre-Filing Compliance and Eligibility Check

Before initiating the MSME Samadhaan scheme recovery procedure, you must verify your client’s eligibility. Primarily, the benefits of the Samadhaan portal are reserved for Micro and Small enterprises. However, medium enterprises are currently excluded from the MSEFC recovery mechanism.

Retrospective Udyam Registration and the Supplier Definition

A common question involves whether a supplier can claim dues for work done before registration. In the landmark case of NBCC (India) Ltd. v. State of West Bengal-ltd.-v.-the-state-of-west-bengal-(2025-insc-54)/view), the Supreme Court provided clarity.

The Court held that prior registration is not a mandatory prerequisite to invoke Section 18. However, benefits like penal interest typically accrue from the date the Udyam registration was actually obtained. Therefore, lawyers should advise clients to register immediately to protect future transactions.

Drafting the Mandatory Demand Notice

First, you should issue a formal demand notice to the buyer. This notice should highlight the 45-day statutory limit. Additionally, it must clearly state the intention to move the MSEFC. As a result, this often prompts settlement before the formal filing begins.

Step 2: Filing the Online Application on MSME Samadhaan Portal

The filing process is entirely digital through the MSME Samadhaan portal. Moreover, this system requires specific documentation to pass the initial scrutiny phase. For example, you must upload the valid Udyam Registration Certificate.

Documentation and Digital Workflow

Subsequently, you must provide proof of the transaction. This includes invoices, purchase orders, and delivery challans. In fact, many applications face rejection due to missing “Proof of Delivery.” Therefore, you must ensure your client has signed Lorry Receipts or Labeled Delivery Challans.

Avoiding Common Rejection Pitfalls

Furthermore, certain types of contracts are ineligible for this scheme. For instance, “Works Contracts” involving integrated projects are often excluded. Specifically, the courts have recently reiterated that MSME procurement preferences do not always extend to complex service-cum-supply contracts. Always check the nature of the transaction before filing.

Step 3: Conciliation Proceedings under MSEFC

Once the Council accepts the application, it initiates conciliation under Section 18(2). In this phase, the Council acts as a mediator. It seeks to resolve the dispute amicably without formal litigation.

Application of the Arbitration and Conciliation Act

During this stage, the provisions of the Arbitration and Conciliation Act, 1996, apply. For example, the Council facilitates discussions between the buyer and the supplier.

However, the limitation period is a key concern. In Sonali Power Equipments v. Maharashtra SEB, it was noted that while conciliation is flexible, the subsequent arbitration must respect legal timelines.

Outcomes of the Conciliation Phase

If the parties reach a settlement, the Council records it as a settled case. However, if the buyer remains non-compliant, the conciliation is declared a failure. Consequently, the matter automatically moves to the next legal stage.

Step 4: The Arbitration Phase and Final Award

If conciliation fails, Section 18(3) mandates that the Council shall take up the dispute for arbitration. Alternatively, the Council may refer the case to an institution like the Delhi International Arbitration Centre (DIAC).

The Dual Role Controversy

Currently, a Constitution Bench is reviewing whether Council members can legally act as both conciliators and arbitrators. Despite this, the arbitration process remains the primary route for securing a recovery award.

Adhering to the 90-Day Statutory Goal

The MSMED Act expresses a goal to decide cases within 90 days. However, reality often differs due to heavy case volumes. Therefore, litigators should use statutory directions to push for timely disposals. The resulting award has the same force as a decree from a Civil Court.

Step 5: Challenging and Enforcing the Award

Securing an award is only half the battle. Buyers often try to challenge the award in higher courts. However, Section 19 of the Act provides a massive advantage to the MSME supplier.

The Mandatory 75% Pre-Deposit Rule

No court can entertain a challenge against an MSEFC award unless the buyer deposits 75% of the amount. This is a mandatory pre-condition. In fact, the Supreme Court has discouraged “writ detours” intended to bypass this deposit. As a result, this rule ensures that buyers cannot use litigation as a stalling tactic.

Overriding Effect on Other Laws

Additionally, the MSMED Act often takes precedence over other statutes. For example, in disputes involving the Insolvency and Bankruptcy Code (IBC), the MSMED Act’s interest provisions remain highly relevant.

Furthermore, banks cannot levy foreclosure charges on floating-rate MSME loans. Consequently, this provides further financial protection to the business.

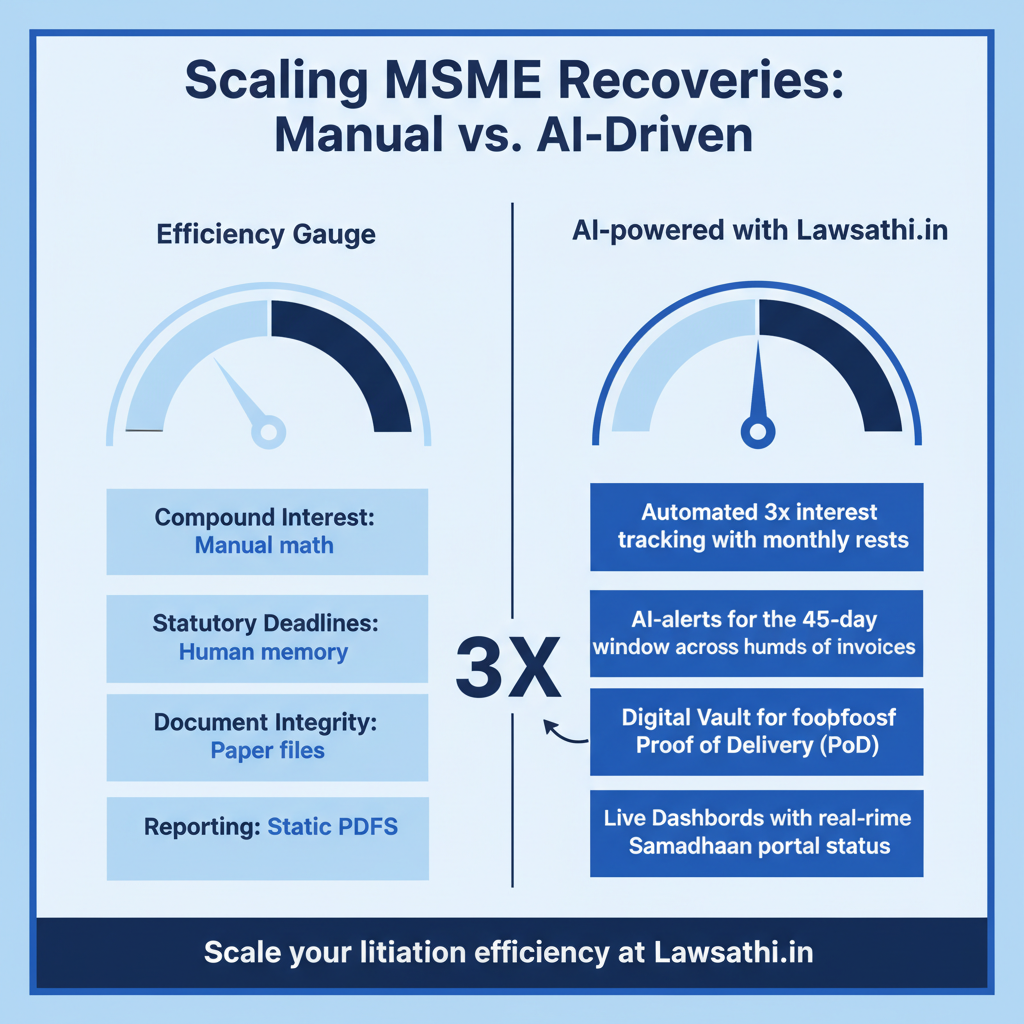

Tech for Litigators: Managing High-Volume MSME Claims

Managing dozens of MSME claims manually is nearly impossible. For instance, calculating 3x compound interest across multiple invoices requires precision. Therefore, modern commercial litigators are turning to AI-driven legal tech.

Automation and Dashboard Tracking

Specifically, automation tools can track the 45-day window for hundreds of invoices. They can also monitor the status of applications on the Samadhaan portal. Moreover, maintaining a digital repository of delivery proof ensures that filings are never rejected for technical errors.

Strengthening Your Practice with AI

Finally, using a centralized dashboard allows you to provide real-time updates to your clients. This transparency builds trust and improves the efficiency of your recovery practice. In a competitive legal market, these technological edges are essential.

Conclusion

The MSME Samadhaan scheme recovery procedure is a robust mechanism for debt collection. By leveraging the mandatory interest rates of Section 16 and the 75% pre-deposit rule of Section 19, lawyers can ensure swift justice for small businesses.

Success depends on careful pre-filing compliance and efficient digital management of claims. Therefore, practitioners should adopt tools that simplify these workflows.

Streamline your MSME recovery practice with LawSathi. From automated interest calculators to seamless case tracking, empower your firm with India’s leading AI legal platform. Book a demo today!