Introduction: Landmark Relief for Infrastructure Project Affected Families

India’s massive infrastructure expansion has displaced thousands of families along highway and metro corridors. However, a significant legal relief exists that many practitioners overlook. Tax exemption on land compensation under the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (RFCTLARR Act) provides complete income tax exemption for affected landowners.

Furthermore, recent judicial pronouncements have strengthened this position considerably. For instance, the Chhattisgarh High Court in September 2025 categorically held that compensation received from NHAI for land acquisition is not taxable under Section 96 of the RFCTLARR Act. Compensation Received From NHAI Not Taxable: Chhattisgarh High Court.

Why This Matters for Legal Practitioners

Lawyers advising landowners must understand these provisions thoroughly. The stakes are substantial—compensation amounts often run into lakhs or crores. Therefore, incorrect tax treatment can result in clients paying taxes they never owed. Additionally, failure to claim exemptions properly may lead to unnecessary litigation and appeals.

This guide examines the statutory framework, judicial precedents, and compliance procedures. Consequently, it equips you to advise clients confidently on land acquisition compensation India matters.

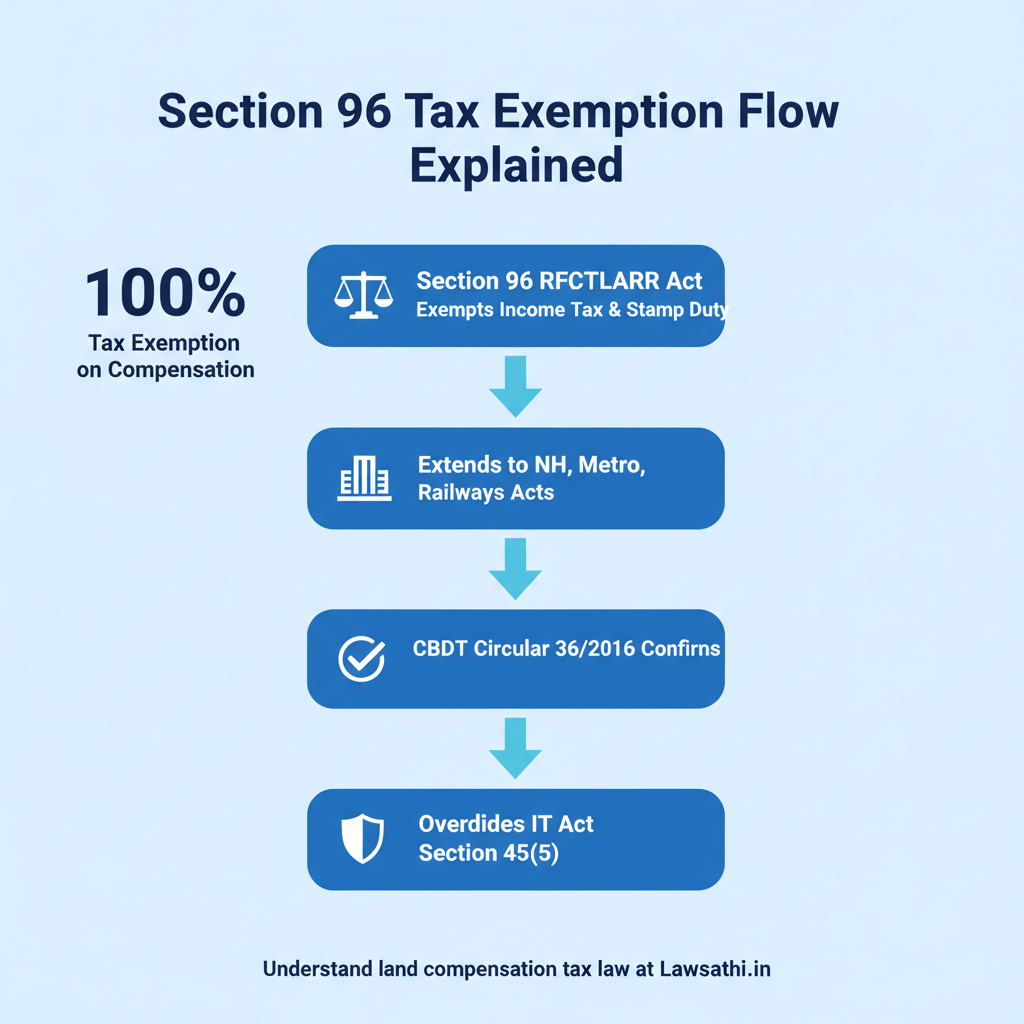

Legal Framework: Section 96 of RFCTLARR Act, 2013 Explained

The primary statutory basis for tax exemption lies in Section 96 of the RFCTLARR Act. Specifically, this provision explicitly states that no income tax shall be levied on any award or agreement made under the Act.

Statutory Text and Scope

Section 96 reads:

“No income tax or stamp duty shall be levied on any award or agreement made under this Act, except under Section 46, and no person claiming under any such award or agreement shall be liable to pay any fee for a copy of the same.”

The exemption is comprehensive in nature. It covers the entire compensation package determined under the Act’s provisions. Additionally, CBDT Circular No. 36 of 2016 clarified that this exemption applies even without specific provisions in the Income Tax Act.

Applicability to Highway and Metro Projects

A critical question arises: does this exemption apply to acquisitions under other enactments like the National Highways Act? The Removal of Difficulties Order, 2015 modified Section 105(3) of the RFCTLARR Act. Consequently, compensation determination provisions now apply to all Fourth Schedule enactments.

These include the National Highways Act, 1956, the Metro Rail Acts, and the Railways Act, 1989. Therefore, highway land compensation tax exemption extends to NHAI acquisitions as well.

Interplay with Income Tax Act Provisions

Section 45(5) of the Income Tax Act governs capital gains on compulsory acquisition. Generally, such gains are taxable when compensation is received. However, the RFCTLARR Act’s Section 96 creates an overriding exemption.

The Income Tax Department’s own tutorial on compulsory acquisition acknowledges this position. Moreover, the exemption covers both agricultural and non-agricultural land. This scope is broader than Section 10(37) of the Income Tax Act.

Eligibility Criteria for Full Tax Exemption

Understanding who qualifies for exemption is essential for proper client advisory. The eligibility framework encompasses both project categories and recipient classifications.

Categories of Projects Covered

The income tax exemption land acquisition covers acquisitions under the RFCTLARR Act itself. Additionally, it extends to Fourth Schedule enactments including:

– National Highways Authority of India Act projects – Metro rail project compensation under various Metro Rail Acts – Railway infrastructure under the Railways Act, 1989 – Power sector projects under the Electricity Act, 2003

The key requirement is that the acquisition must be for public purpose. Furthermore, the project notification should clearly identify this purpose.

Qualifying Recipients Under the Act

Several categories of persons can claim the exemption. First, original landowners with valid title documents qualify automatically. Second, interested parties with legally recognized interests in the land are eligible. Third, protected tenants under relevant tenancy laws can claim benefits.

Moreover, legal heirs of deceased landowners can also claim exemptions. However, they must establish their succession rights through proper documentation.

Essential Documentation Requirements

Claiming exemption requires maintaining proper records. The award letter from the Land Acquisition Officer is paramount. Additionally, project notifications identifying the public purpose must be preserved.

Payment receipts showing compensation amounts and dates are crucial. The Income Tax Department guidelines emphasize documentation importance. Therefore, lawyers should advise clients to obtain certified copies of all acquisition proceedings.

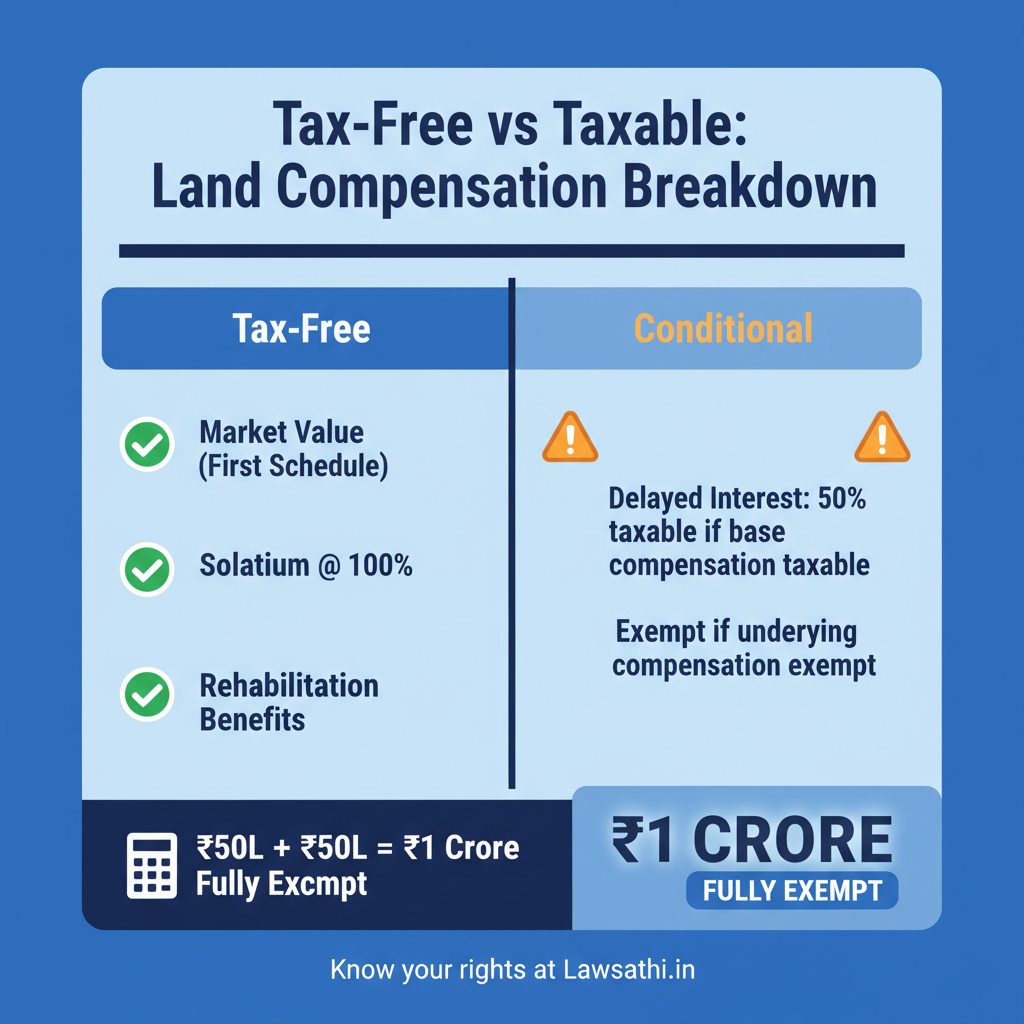

Components of Compensation: What’s Tax-Free and What’s Not

Not all compensation components receive identical tax treatment. Understanding this distinction prevents filing errors and potential litigation.

Fully Exempt Components

Market value compensation determined under the First Schedule is completely exempt. This forms the primary compensation amount based on prevailing market rates. Similarly, solatium payment at 100% of market value enjoys full exemption status.

The Supreme Court has consistently held that solatium forms part of the compensation package. Consequently, it inherits the same exemption under Section 96. Furthermore, rehabilitation and resettlement benefits under the Second and Third Schedules are also exempt.

Treatment of Interest on Delayed Payment

Interest on compensation requires careful analysis. Section 56(2)(viii) of the Income Tax Act taxes interest as “Income from Other Sources.” However, a 50% deduction is available under Section 57.

Important: If the underlying compensation itself is exempt, the interest is also exempt. This principle emerged from various judicial interpretations.

Practical Calculation Example

Consider a landowner receiving ₹50 lakhs as market value compensation. The solatium component adds another ₹50 lakhs at 100%. Therefore, both amounts totaling ₹1 crore are fully exempt from tax.

However, if ₹5 lakhs interest was paid for delayed compensation, different rules apply. For exempt compensation cases, this interest is also exempt. In contrast, for taxable scenarios, 50% of the interest becomes taxable.

Key Judicial Precedents Every Lawyer Should Know

Judicial interpretations have significantly shaped the exemption landscape. Several landmark decisions provide binding guidance for practitioners.

Supreme Court Rulings on Compensation

In Union of India v. Tarsem Singh (2019) 9 SCC 304, the Supreme Court delivered a crucial ruling. The Court held that denying solatium and interest under the National Highways Act violates Article 14. Specifically, the acquiring statute cannot determine compensation fairness for affected landowners.

The Court reasoned that landowners suffer equally regardless of which law acquires their land. Therefore, this principle strengthens arguments for uniform treatment across acquisition statutes. The full judgment provides detailed reasoning.

Chhattisgarh High Court’s Definitive Ruling

The September 2025 Chhattisgarh High Court decision provides the most recent authoritative pronouncement. In Sanjay Kumar Baid v. ITO, the Division Bench examined taxability of NHAI compensation. The Court held unequivocally that compensation from NHAI acquisitions is not taxable.

The judgment analyzed Section 105(3) amendments and the Removal of Difficulties Order. Consequently, it concluded that denying Section 96 benefits to Fourth Schedule acquisitions would be discriminatory.

High Court and Tribunal Decisions

The Kerala High Court in Madaparambil Varkey Varghese v. CIT affirmed tax exemption under Section 96. Similarly, ITAT Chandigarh in Baljit Kaur v. CIT reached similar conclusions for NHAI acquisitions.

However, some tribunal decisions initially took contrary views. For example, the ITAT Raipur in Heritage Buildcon Pvt. Ltd. v. PCIT adopted a narrower interpretation. Subsequently, the Chhattisgarh High Court overruled this approach.

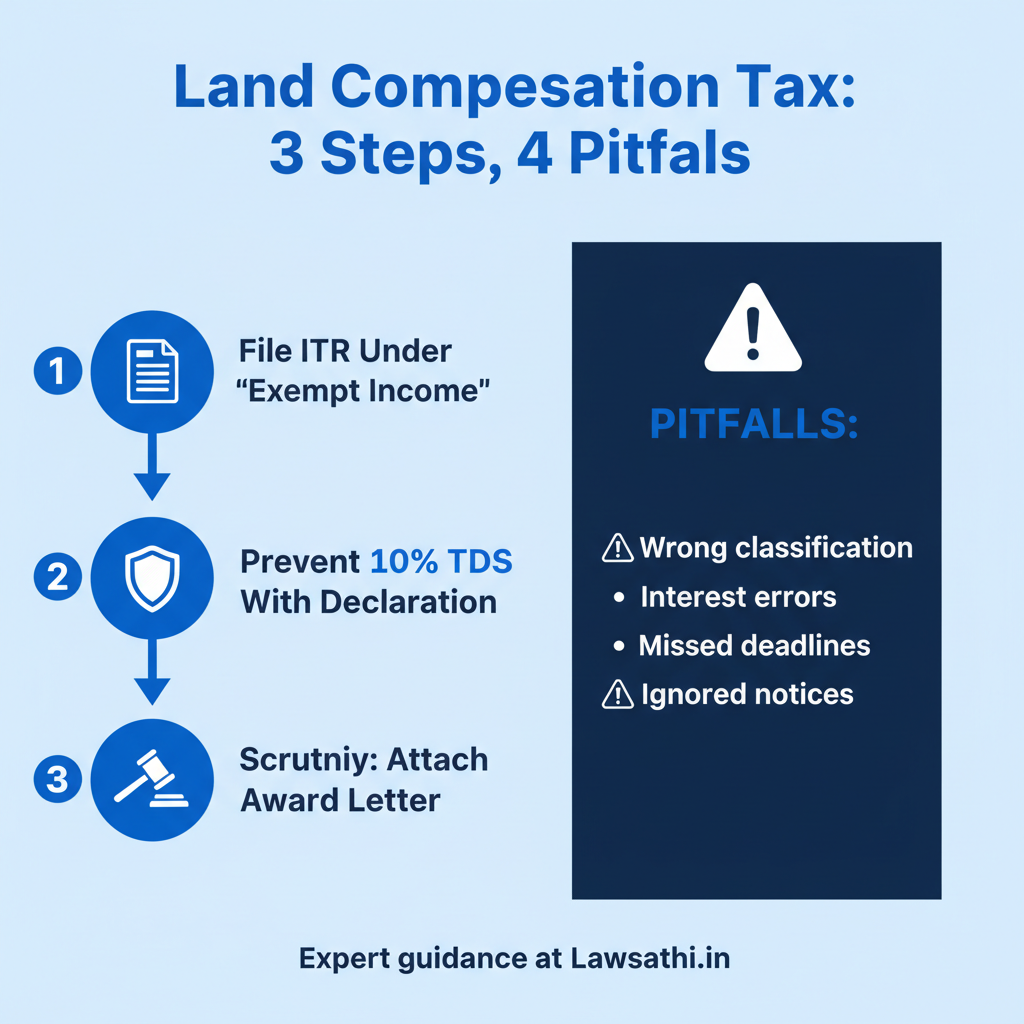

Compliance Procedure: Filing Returns and Claiming Exemption

Proper compliance ensures clients receive their entitled exemptions without complications. Therefore, practitioners must follow established procedures carefully.

Reporting in Income Tax Returns

The compensation amount should appear under the “Exempt Income” schedule in ITR forms. Specifically, the nature of exemption must be stated as “Exempt u/s 96 of RFCTLARR Act, 2013.” This clear identification helps processing and prevents scrutiny issues.

Even if TDS was deducted under Section 194LA, assessees can claim refunds. They must show the compensation as exempt income and claim the TDS refund accordingly.

TDS Provisions and Thresholds

Section 194LA mandates 10% TDS on compensation payments exceeding ₹5 lakhs. This threshold increased from ₹2.5 lakhs effective April 1, 2025. However, no TDS should be deducted if the compensation is exempt under Section 96.

Therefore, deductees should provide declarations to acquiring authorities about their exemption eligibility. This prevents unnecessary TDS deduction and subsequent refund claims.

Handling Scrutiny Notices

If notices under Section 143(2) are received, prompt response is essential. Practitioners should submit the award letter and project notification. Additionally, citing CBDT Circular No. 36 of 2016 and relevant judicial precedents strengthens the response.

The tax treatment guidelines from the Income Tax Department support exemption claims. Consequently, presenting these authorities systematically usually resolves scrutiny issues favorably.

Common Pitfalls and How to Avoid Them

Several common errors can undermine exemption claims and cause client difficulties. Therefore, practitioners must remain vigilant about these potential mistakes.

Misreporting as Capital Gains

Many practitioners incorrectly report compensation under the “Capital Gains” head. As a result, this leads to computing gains and paying taxes on exempt income. The solution is verifying the acquisition statute and claiming Section 96 exemption properly.

Ignoring the Interest Component Distinction

Treating interest on compensation as fully exempt when it’s partially taxable creates problems. Conversely, not recognizing that interest on exempt compensation is also exempt causes overpayment. Therefore, careful analysis of the underlying compensation’s tax status determines interest treatment.

Missing Critical Deadlines

Appeal deadlines are strictly enforced. Rectification applications should be filed promptly. For instance, CIT(A) appeals require filing within 30 days of adverse orders. Similarly, ITAT appeals have a 60-day limit. Missing these deadlines often proves fatal to client cases.

Inadequate Response to Notices

Ignoring scrutiny notices leads to best judgment assessments under Section 144. These often deny exemptions and levy penalties. Therefore, timely, comprehensive responses with proper documentation prevent adverse outcomes.

Practical Checklist for Legal Practitioners

Systematic approaches ensure comprehensive client service for compensation cases. The following checklists streamline case management.

Client Intake Information

First, gather complete details including land location, survey numbers, and classification. Second, document the acquiring authority and acquisition dates. Third, record all compensation components received and TDS deducted. Finally, note any pending enhancement proceedings.

Document Verification Checklist

Verify title documents, revenue records, and acquisition notifications. Additionally, examine the award letter carefully for all components. Preserve payment receipts and TDS certificates systematically. Moreover, maintain copies of project notifications showing public purpose.

Advisory Opinion Structure

Begin with case facts and applicable legal provisions. Then, analyze the acquisition statute’s coverage under RFCTLARR Act provisions. Address each compensation component’s tax treatment separately. Finally, conclude with compliance recommendations and risk assessment.

Conclusion: Helping Clients Navigate Compensation Claims Effectively

Tax exemption on land compensation under Section 96 of the RFCTLARR Act provides significant relief to affected families. The exemption covers highway, metro, and railway acquisitions under Fourth Schedule enactments. Furthermore, recent judicial pronouncements have clarified and strengthened this position.

Practitioners must distinguish between fully exempt compensation components and partially taxable interest. Additionally, proper ITR reporting and documentation are essential for successful claims. Constitutional arguments under Article 14 provide additional support when departments resist exemptions.

The infrastructure sector’s continued growth means land acquisition will remain common. Therefore, lawyers who master these provisions deliver substantial value to affected clients. Above all, staying updated with judicial developments and departmental circulars ensures accurate, timely advice.

Stay ahead of revenue law updates with LawSathi’s AI-powered legal research and case management tools. Track compensation cases, manage client documents, and access real-time legal updates—all in one platform. Start your free trial today!