Introduction: A Paradigm Shift in Indian Revenue Law

India’s regulatory landscape is undergoing its most significant transformation in decades. The government has announced 28 major deregulation moves under the Task Force on Compliance Reduction and Deregulation. Among these reforms, the scrapping of land conversion permit deregulation stands out as particularly impactful for legal practitioners. This shift fundamentally alters how lawyers will approach real estate transactions and revenue matters.

The land conversion permit deregulation represents more than mere administrative simplification. Rather, it marks a decisive break from the traditional “permit raj” that has governed Indian property law for generations. According to the Economic Survey 2025-26, this initiative aligns with the “Minimum Government, Maximum Governance” philosophy. Furthermore, this philosophy has driven reforms since 2014.

The Scale of Regulatory Transformation

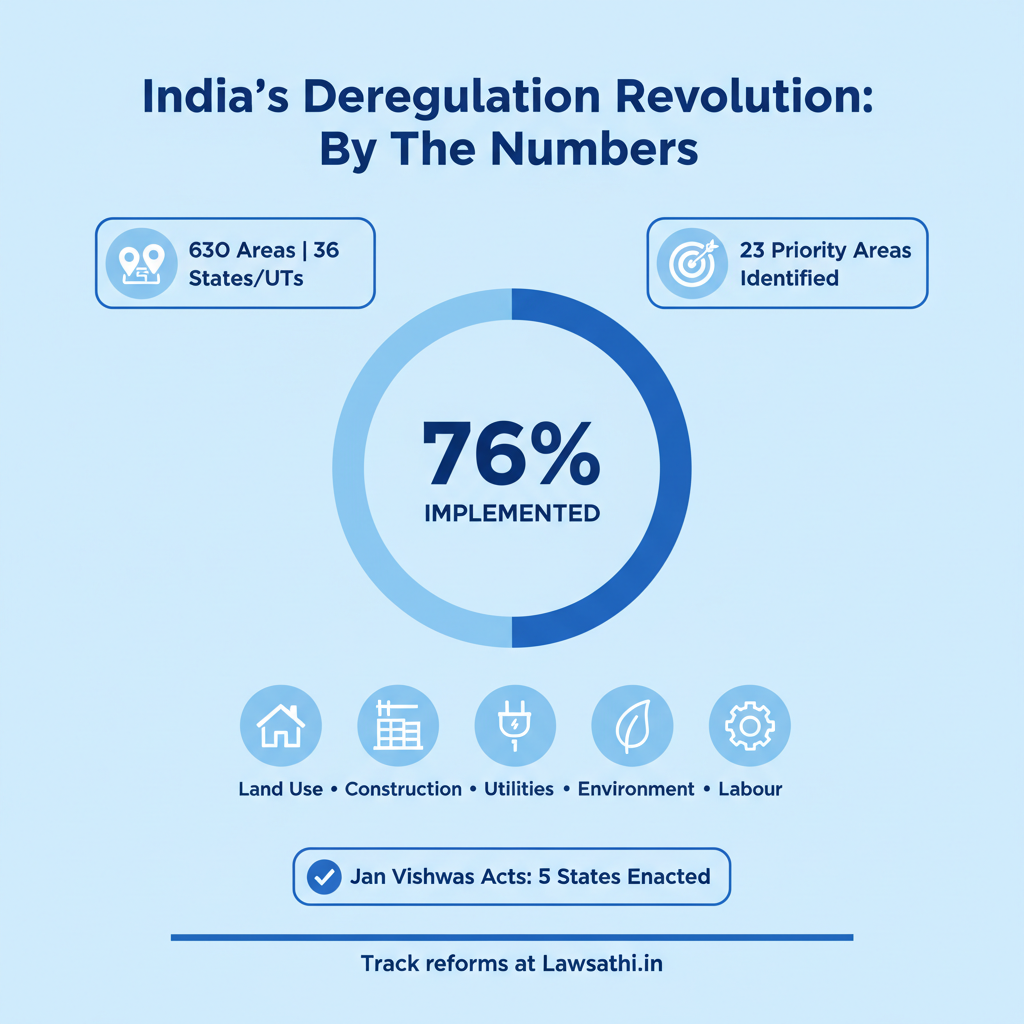

The numbers reveal the magnitude of this undertaking. As of January 23, 2026, 630 priority areas (76%) have been implemented. These reforms span 828 total actionable areas across 36 States and Union Territories. Additionally, the Task Force was constituted in January 2025 under the Cabinet Secretary’s chairmanship. It has systematically identified 23 priority areas across five broad sectors.

For legal professionals, this transformation demands immediate attention. The PIB Press Release confirms that Phase II was rolled out in January 2026. Specifically, this phase covers land, building construction, utilities, environment, education, health, and labour.

Decoding the End of Land Conversion Permits

Understanding Traditional Land Conversion

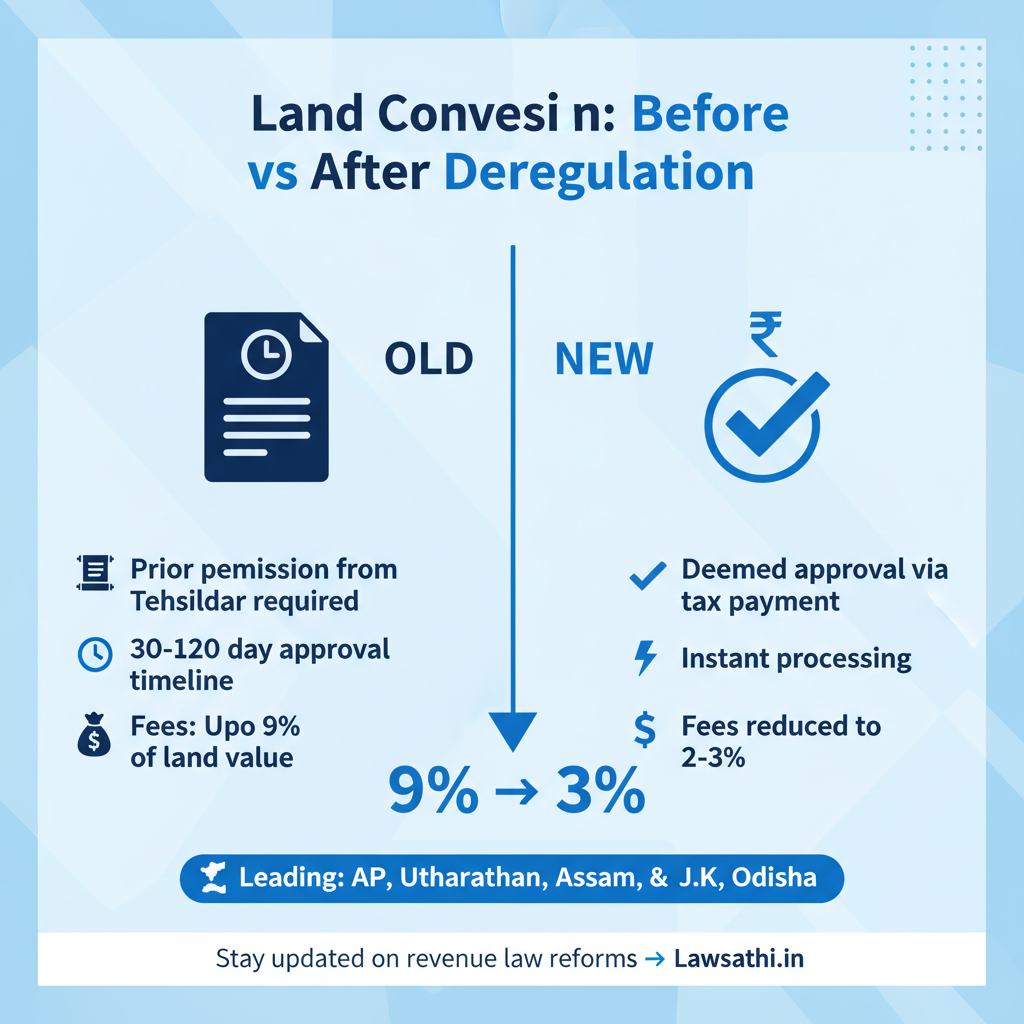

Land conversion refers to changing the use of agricultural land for non-agricultural purposes. Previously, this required prior permission from competent authorities like the Tehsildar or Revenue Divisional Officer. The process involved field verification, payment of conversion fees, and updating revenue records.

Typical timelines ranged from 30 to 120 days depending on the state. Conversion fees also varied significantly across jurisdictions. For instance, Andhra Pradesh previously charged 3-9% of basic land value.

The New Deregulated Framework

The land conversion permit deregulation operates through two primary mechanisms. First, several states have eliminated conversion requirements for specific categories entirely. Second, others have introduced negative lists for mixed land use.

According to the Economic Survey 2025-26, several states have taken decisive action. Andhra Pradesh and Uttarakhand have completely eliminated land conversion requirements for specified categories. Meanwhile, Assam, Jammu & Kashmir, Odisha, Puducherry, and Tripura have introduced negative lists.

The Deemed Approval Model

Under the new framework, payment of conversion tax now serves as deemed permission in many states. Andhra Pradesh exemplifies this approach effectively. The Andhra Pradesh Agricultural Land Conversion Act was amended in 2018. This amendment substituted “obtaining permission” with “payment of conversion tax.”

Consequently, land is deemed converted upon payment of tax. The conversion tax has also been reduced from 9% to 3% in most areas. In municipal corporation areas, it dropped from 5% to 2%.

Key Highlights from the 28 Deregulation Moves

Sector-Wise Distribution of Reforms

The 23 priority areas span five critical sectors affecting legal practice. Land Use reforms include eliminating change of land use requirements for specific categories. They also cover digitizing CLU processes and rationalizing road width requirements for industries.

Building and Construction reforms increase third-party roles in approvals. Additionally, they simplify occupation and completion certification processes. Labour sector reforms remove prohibitions on women working in certain industries. Furthermore, these reforms revise working hours limits.

Environmental Clearance Reforms

The January 28, 2026 amendments to uniform consent guidelines represent another significant change. Consent to Operate (CTO) is now valid until cancelled. Therefore, this eliminates renewal requirements entirely.

Additionally, processing time for Red Category industries has been reduced from 120 to 90 days. Self-certification for MSEs in notified industrial estates has also been introduced.

State-Level Jan Vishwas Acts

Several states have enacted legislation similar to the central Jan Vishwas Act. Specifically, Chhattisgarh, Gujarat, Haryana, Karnataka, and Uttar Pradesh have introduced state-level Acts. These reforms decriminalize minor offences and convert penalties into fees for technical defaults.

For lawyers, this creates a patchwork of state-specific regulations. Consequently, continuous monitoring of state gazette notifications becomes essential.

Legal Implications for Real Estate Transactions

Transforming Due Diligence Processes

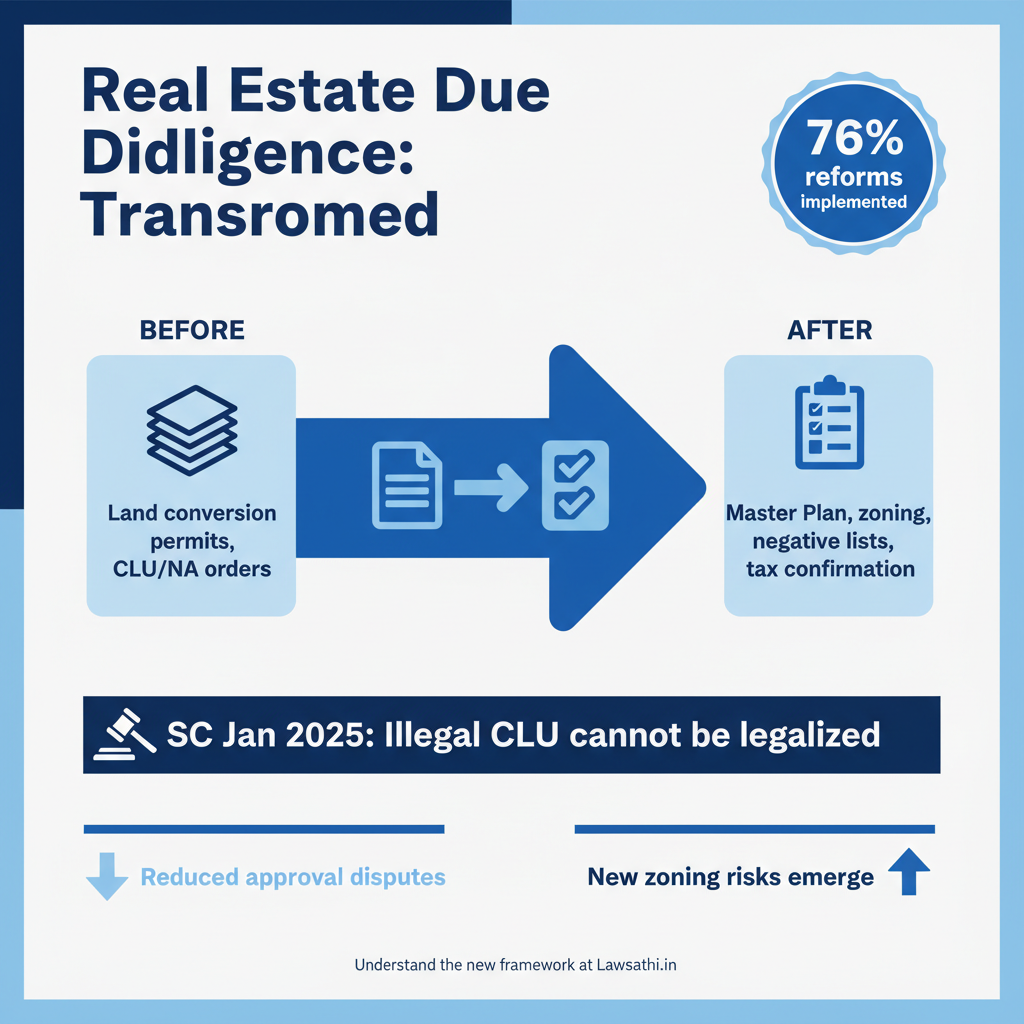

Land conversion permit deregulation fundamentally changes title verification procedures. Previously, lawyers verified land conversion permits, CLU orders, and NA orders extensively. However, the focus now shifts to verifying land use under Master Plan and zoning regulations.

Lawyers must also check negative lists where applicable. Confirming payment of conversion tax becomes necessary in states where the fee-based model operates. Ensuring compliance with zoning laws without prior permit requirements presents new challenges.

The Supreme Court’s Guidance

A January 2025 Supreme Court ruling provides important guidance. In the Punjab Regional Town Planning Act case, the Court held that illegal CLU permission cannot be post-facto legalized. This applies unless the statute expressly provides for such legalization.

The Court observed that “a permission invalid from inception remains a nullity regardless of subsequent approval.” Therefore, this precedent reminds lawyers to verify that any existing CLU was granted according to statutory procedure.

Potential Reduction in Litigation

Several types of disputes will likely decrease following these reforms. For example, delay in land conversion approvals has historically generated significant litigation. Arbitrary rejection of conversion applications has burdened courts for decades.

Disputes over conversion fee calculations may also decline. However, new categories of disputes may emerge around zoning compliance and misrepresentation.

From ‘Permit Raj’ to ‘Post-Compliance’: The New Framework

Self-Certification Becomes Central

The shift from pre-approval to self-certification represents a fundamental governance transformation. Multiple states have implemented self-certification frameworks across different areas.

Andaman & Nicobar has introduced self-certification for environmental clearances. Similarly, Andhra Pradesh, Goa, Tamil Nadu, and Uttarakhand have implemented it for Consent to Operate. Punjab’s Draft Unified Building Rules 2025 allow empanelled architects to self-certify building plans. Specifically, this applies to low-rise buildings.

Changing Role of Revenue Officials

The Sub-Registrar and Revenue Department’s responsibilities are evolving significantly. Previously, they verified conversion permits before registration. Now they must verify land use conformity with revenue records. Additionally, they must confirm conversion tax payments where applicable.

The Economic Survey notes that administrative energy is being redirected. Specifically, it moves “from routine policing towards coordination, monitoring, and problem-solving.” This shift results from lowering friction at the interface between firms and the State.

Penalties for Misrepresentation

The relaxed framework comes with stringent penalties for violations. For instance, Andhra Pradesh imposes a 50% penalty over the conversion fee for unauthorized conversion. Recovery proceeds under the Revenue Recovery Act, 1864.

States implementing Jan Vishwas-type Acts have introduced graded penalties based on offence severity. Moreover, environmental non-compliance can result in consent cancellation without immunity from prosecution.

How Lawyers Can Prepare for These Revenue Law Updates

Updating Client Advisories

Legal practitioners must revise their client communication strategies immediately. Clients need to understand that project timelines will accelerate. This occurs through elimination of conversion permit wait periods. Additionally, lower costs from reduced conversion fees represent tangible benefits.

However, new compliance requirements around self-certification require careful attention. Lawyers should develop advisory templates that check applicable state reforms. Furthermore, they should verify land use under current zoning. Finally, they must ensure proper documentation of all self-certifications.

Monitoring State Gazette Notifications

India land law reforms 2026 require continuous monitoring of official publications. Lawyers must track state-level amendments to Revenue Codes. Additionally, they should monitor changes to building bye-laws. Environmental consent modifications also demand attention.

The Economic Survey’s Chart XVI.8 provides state-wise implementation status. Moreover, digital MIS platforms enable real-time monitoring. Monthly reviews by the Cabinet Secretariat ensure accountability.

New Practice Opportunities

The real estate regulatory changes create fresh opportunities for law firms. Traditional permit application work declines. However, compliance consulting grows significantly.

Third-party inspection coordination represents an emerging service area. Self-certification documentation also requires legal expertise. Additionally, zoning compliance certificates for pre-transaction verification add value. Regulatory risk assessment becomes increasingly important for clients navigating the new framework.

Conclusion: Streamlining the Future of Property Law

Tangible Benefits Emerge

The land conversion permit deregulation delivers measurable improvements for legal practice. Transactions proceed faster without bureaucratic hurdles. Furthermore, lower costs benefit clients across the board. Greater predictability enables better legal planning.

The statistics support these observations. Active registered companies increased from 1.55 lakh (2020-21) to 1.98 lakh (2025-26). This represents 27% growth. Additionally, GST registered taxpayers grew from 60 lakhs (2017) to 1.5 crore (November 2025).

Balancing Development and Protection

The reforms maintain safeguards for agricultural land. Negative list approaches explicitly prohibit certain activities in agricultural zones. Moreover, conversion tax continues as a deterrent to arbitrary conversion.

Environmental assessments remain mandatory for sensitive areas. Master Plan provisions also continue governing land use decisions.

The Evolving Legal Profession

Lawyers transform from permission chasers to compliance partners. Strategic advisory becomes more valuable than application filing. Furthermore, risk assessment and mitigation take precedence over routine paperwork.

The Economic Survey captures this evolution perfectly. It states that “Entrepreneurial governance emerges when experimentation is disciplined, incentives are aligned to learning, and institutional design explicitly distinguishes good-faith error from malfeasance.”

For Indian lawyers, land conversion rules India now demand different expertise. The professionals who adapt fastest will capture the emerging opportunities in this deregulated landscape.

Stay ahead of regulatory changes. Automate your case tracking and client updates with LawSathi. Start your free trial today.