The Union Budget 2026 has introduced a transformative Budget 2026 tax exemption land acquisition policy for Indian farmers. Consequently, this landmark decision is being hailed as the end of “tax nightmares” for the farming community. For years, legal practitioners and landowners struggled with the taxability of compensation received from government land grabs.

Ending the Tax Nightmare for Farmers

The Finance Minister’s recent announcement shifts the focus toward a blanket exemption for both rural and urban agricultural land. Previously, initial compensation was often exempt. However, the tax department frequently targeted enhanced compensation and interest.

Specifically, the Union Budget Speech 2026-27 clarifies that these gains will now be tax-free. As a result, farmers can breathe a sigh of relief.

A Landmark Move for Ease of Living

This reform aims to reduce agricultural distress across the nation. Therefore, lawyers must understand how these changes simplify the settlement process for their clients. In fact, many practitioners expect a significant reduction in protracted tax litigation.

Most importantly, the government has prioritized the socio-economic welfare of those losing their land for national development. Consequently, this policy aligns with broader goals of social justice.

The Legal Pivot: Amendments to Section 10(37) of the Income Tax Act

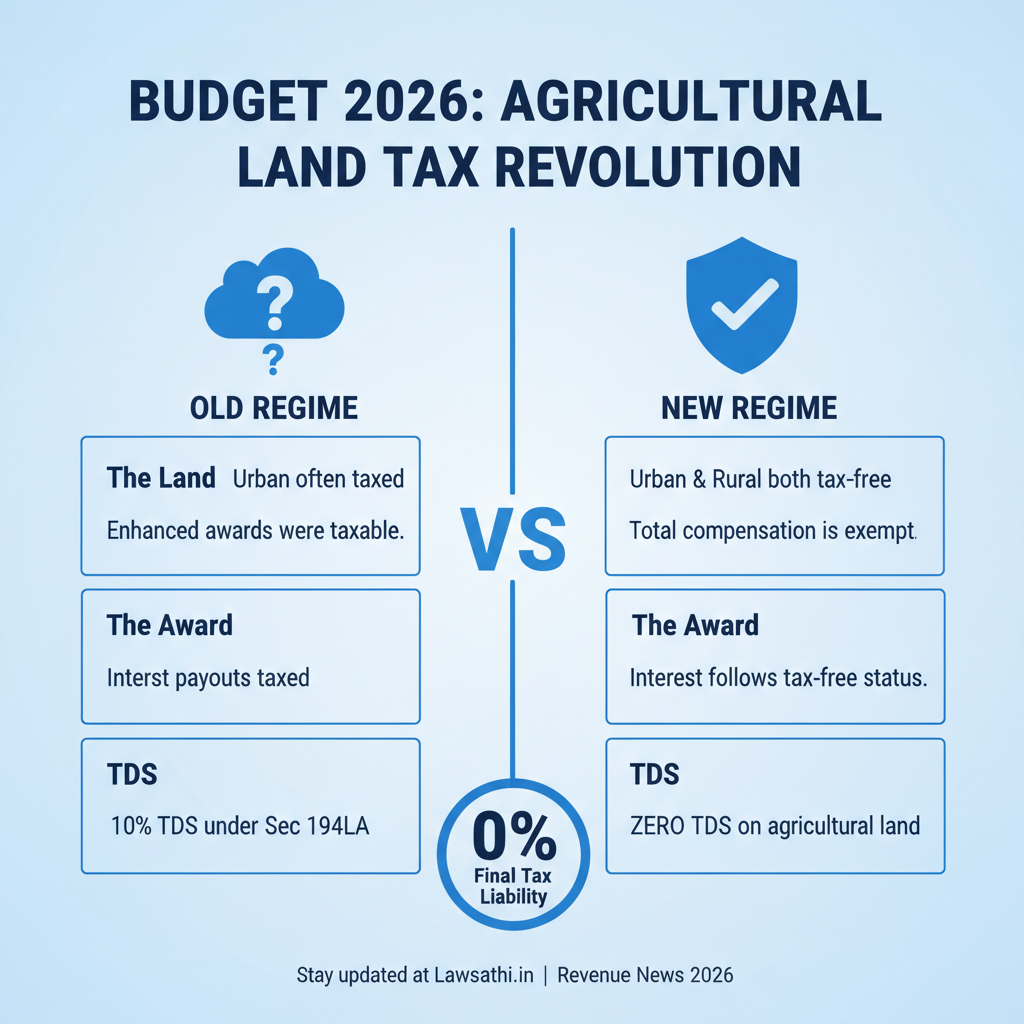

The Finance Bill 2026 introduces specific legislative changes to Section 10(37) of the Income Tax Act. Under the old regime, the distinction between rural and urban land caused immense confusion. Specifically, urban agricultural land often fell into the tax net during compulsory acquisitions.

Expanding the Definition of Agricultural Land

The revised statute now mandates a blanket exemption regardless of the land’s geographical location. To qualify, the land must be used for agricultural purposes for at least two years. Furthermore, Clause 27-30 of the Finance Bill overrides the previous “receipt basis” taxation for enhanced compensation.

Why Enhanced Compensation is Now Exempt

In the past, Courts or Tribunals often awarded additional sums years after the initial acquisition. Consequently, the tax department would tax these amounts as capital gains in the year of receipt.

However, the 2026 mandate ensures that any additional award follows the primary asset’s tax-free status. As a result, farmers can now retain the full value of the judicial awards they win in court.

RFCTLARR Act vs. Income Tax Act: Harmonizing the Two Regimes

For a long time, Section 96 of the RFCTLARR Act 2013 clashed with the Income Tax Act. While the RFCTLARR Act prohibited taxing awards, the IT Department often disagreed. Specifically, disputes frequently arose regarding interest paid on delayed compensation under Section 28 of the Land Acquisition Act.

Aligning Section 96 with the Finance Act

The Budget 2026 tax exemption land acquisition updates finally resolve this long-standing conflict. According to the Memorandum Explaining the Finance Bill, the IT Act is now explicitly aligned with Section 96. Therefore, all awards and agreements made under the RFCTLARR Act are fully immune from income tax.

TDS Immunity and Section 194LA

Additionally, Section 194LA has undergone significant changes to support this harmonization. Previously, authorities deducted tax at source (TDS) on various compensation payments.

According to the Income Tax Department FAQs, all agricultural land payments are now exempt from TDS. This change ensures that farmers receive their full compensation without administrative hurdles.

Key Benefits for Landowners: Beyond the Headlines

One of the most critical aspects for lawyers is the application of these new rules. Specifically, practitioners need to know if the relief is retroactive. While most changes apply to Assessment Year 2027-28, there is an important caveat.

Consequently, the government has introduced immunity for “technical defaults.” This immunity has retrospective effect from October 2024.

Urban and Rural Parity Explained

Furthermore, the removal of the “Urban Agricultural Land” distinction is a massive win. Historically, farmers on city outskirts faced heavy taxes when the NHAI acquired their land for highways.

Now, the Budget 2026 tax exemption land acquisition ensures parity for all agricultural landowners. As a result, the location of the farm no longer dictates the tax liability of the owner.

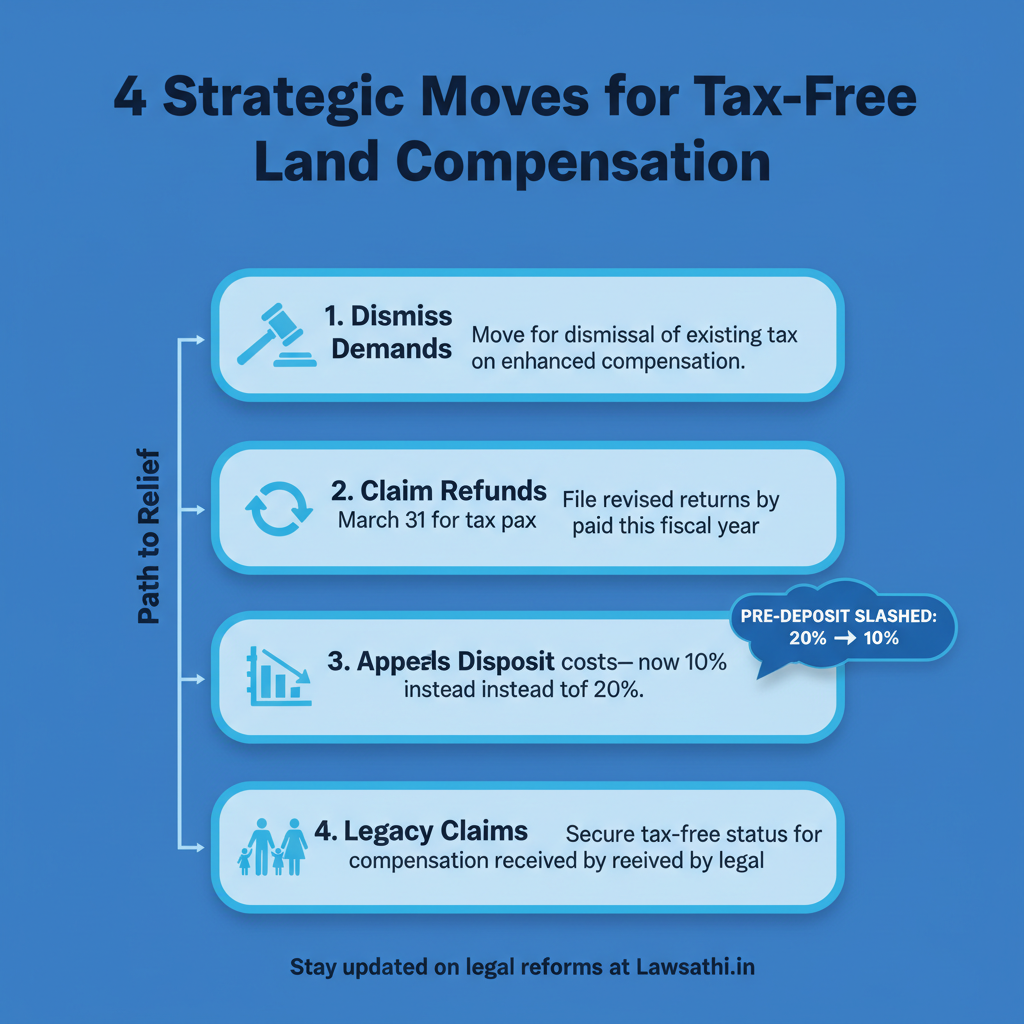

Provisions for Legal Heirs

Similarly, the exemption now explicitly extends to legal heirs. In many cases, the original landowner passes away during the long legal battle for compensation.

In fact, recent Supreme Court directives have emphasized protecting inherited claims. Therefore, heirs receiving compensation post-death can also enjoy the tax-free status of the award.

Strategic Implications for Revenue Lawyers and Litigators

If you are currently handling compensation disputes, your strategy must change immediately. First, you should review all pending tax demands on enhanced compensation. Given the new updates, you can now move for the dismissal of these demands.

Filing for Refunds and Revised Returns

Moreover, the government has extended the return revision deadline to March 31. Therefore, farmers who paid tax on compensation earlier this fiscal year can take action.

Specifically, they can file revised returns to claim refunds under the Section 10(37) updates. As a result, lawyers can provide immediate financial relief to their clients.

Lower Pre-deposits for Appeals

Another major change involves the mandatory pre-payment for filing appeals. In fact, the Budget has slashed this requirement from 20% to just 10%.

This reduction eases the cash-flow burden on land-owning clients. Consequently, it allows more farmers to seek justice without the fear of upfront financial exhaustion.

Common Pitfalls: When the Exemption Might Not Apply

Despite the broad benefits, some exceptions still exist that lawyers must navigate. First, the exemption applies specifically to “Compulsory Acquisition.” Therefore, a voluntary sale to a private developer might not qualify for the same relief.

Furthermore, you must ensure the acquisition notification was issued under a specific statute. This includes laws like the National Highways Act.

Dealing with Commercial Structures

Similarly, the status of structures on the land is important. For example, the government might acquire a plot with a commercial godown. In this case, that portion might remain taxable.

The Income Tax Tutorial on Land Acquisition notes that only agricultural assets are generally exempt. Consequently, lawyers must carefully bifurcate the compensation amounts for their clients.

Proving Agricultural Status

Finally, documentation remains the key to success. To claim the Budget 2026 tax exemption land acquisition benefits, the taxpayer must prove agricultural use.

For instance, the Assessment Officer will require 7/12 extracts or crop insurance records. Specifically, these documents must prove the land was used for farming for the two years preceding the grab.

Conclusion: A New Era for Land Rights Advocacy

The Union Budget 2026 has successfully simplified the revenue landscape for millions. By harmonizing the IT Act with the RFCTLARR Act, it ends years of unnecessary litigation. Above all, it ensures the promised market value is not eroded by the taxman.

As a litigator, your role is now to ensure these benefits reach the grassroots. These tax-free windfalls will undoubtedly have a positive socio-economic impact on rural India. Furthermore, the use of technology will be vital in managing new refund claims.

Stay ahead of the curve with these changes. Use LawSathi’s AI-driven research tools to cite the latest land acquisition precedents effortlessly. Experience the future of legal practice and Try LawSathi Today!