# Filing a Claim Under the Motor Vehicles (Amendment) Act 2019: Limitation Periods & Documentation Guide

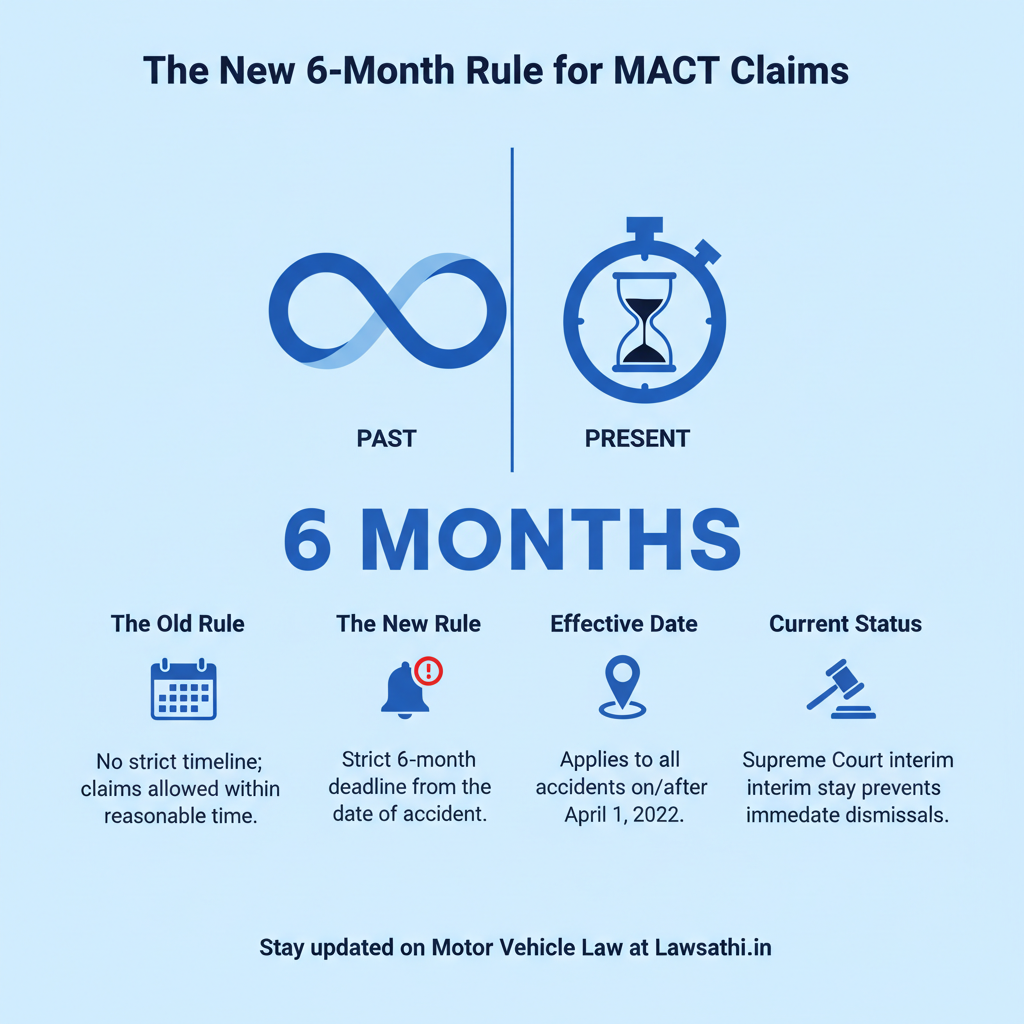

The legal landscape for motor accident claims in India changed significantly recently. Specifically, the Motor Vehicles (Amendment) Act 2019 introduced rigorous procedural shifts. For years, lawyers operated under a “no limitation” regime.

However, the new rules notified on April 1, 2022, changed everything. Now, practitioners must master a new Motor Vehicles Amendment Act 2019 claim procedure to protect their clients.

The Shift in Motor Accident Claims Landscape Post-2019

The primary objective of the 2019 Amendment was to streamline compensation. Additionally, the government focused on reducing litigation time. Therefore, the government introduced a more investigative system rather than a purely adversarial one. This shift aims to help victims receive relief faster.

Why Lawyers Must Adapt Now

First, the move from “no limitation” to strict statutory timelines is the biggest hurdle. Previously, lawyers could file claims years after an incident. Now, the law demands immediate action. Consequently, staying updated on these procedural shifts is no longer optional for motor accident practitioners.

New Rules Effective from 2022

The pivotal rules relating to claims and insurance took effect from April 1, 2022. These rules introduced a new report ecosystem involving the police and insurance companies. Above all, these changes aim to transform how the Motor Accident Claims Tribunal (MACT) functions daily.

The Crucial Change: Limitation Periods for MACT Claims

The most controversial update is the MACT limitation period 2019 amendment found in Section 166(3). According to this section, no claim petition shall be entertained unless filed within six months. This period begins from the date of the accident occurrence.

Moving Away from “Reasonable Time”

For decades, “reasonable time” was a valid defense for delayed filings. However, the 2019 Act removed this flexibility entirely. In fact, the statute does not explicitly allow Tribunals to condone delays. As a result, a delay of even one day could potentially jeopardize a victim’s right to compensation.

Judicial Stance on Prospective Effect

Fortunately, the judiciary has provided some temporary relief for older cases. The Kerala High Court clarified in Athira Prasad vs. State of Kerala that the six-month limit applies only prospectively. This means it only affects accidents occurring on or after April 1, 2022.

Supreme Court Interim Protection 2025

Most importantly, the Supreme Court issued a vital interim order on November 7, 2025. The Court directed that no claim should be dismissed as time-barred while a constitutional challenge is pending. Nevertheless, lawyers should still strive to meet the six-month deadline. Doing so helps avoid future legal complications.

Step-by-Step Procedure for Filing a Claim Under Section 166

Navigating the Motor Vehicles Amendment Act 2019 claim procedure requires understanding jurisdiction first. Under Section 166(2), you can file at the location of the accident. Alternatively, you may file where the claimant resides or where the defendant lives.

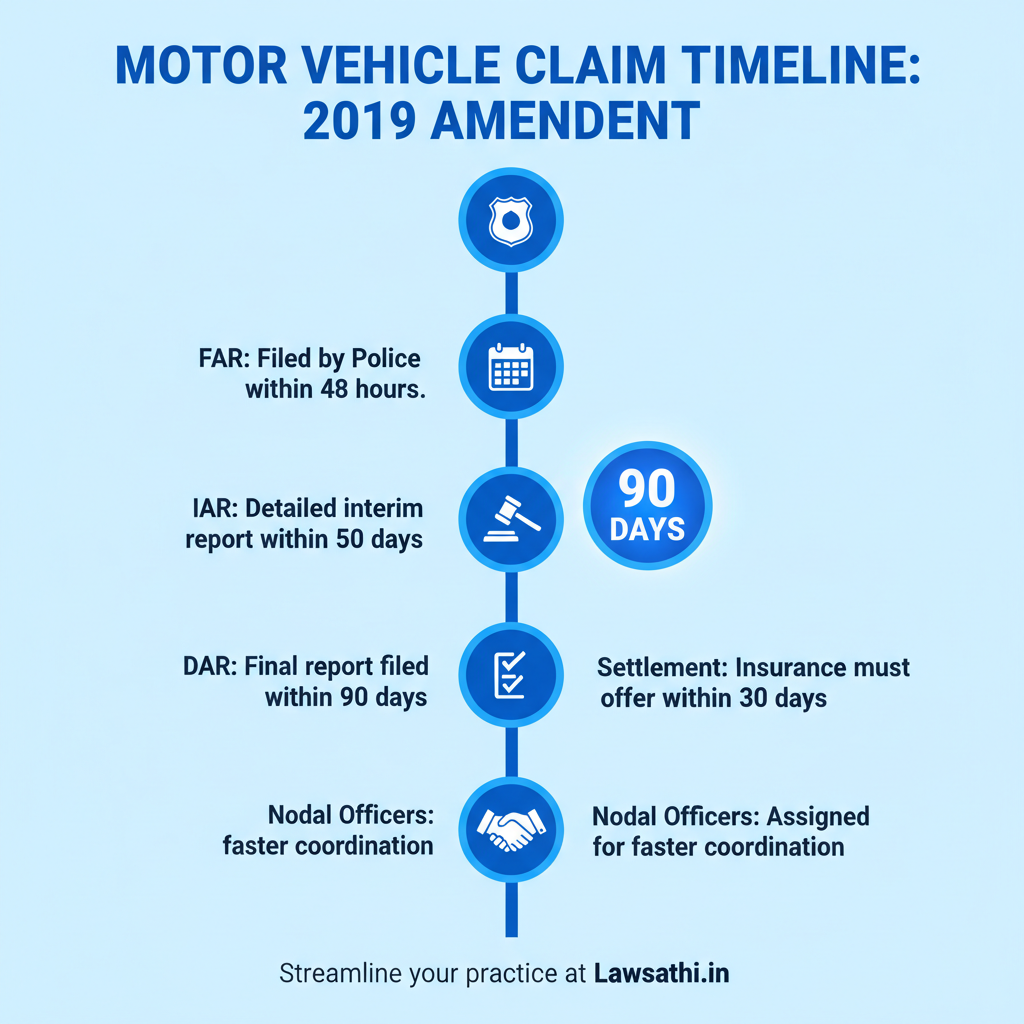

The New Report Ecosystem

The police now play a proactive role in the claims process. First, they must submit a First Accident Report (FAR) within 48 hours. Second, they file an Interim Accident Report (IAR) within 50 days. Finally, the Investigating Officer must submit a Detailed Accident Report (DAR) within 90 days.

Converting DAR into a Claim

In many cases, the DAR is automatically treated as a claim petition. If the insurance company offers a fair settlement based on the DAR, the matter concludes quickly. This process avoids a lengthy trial. Therefore, lawyers must ensure the police record accurate data in the DAR early on.

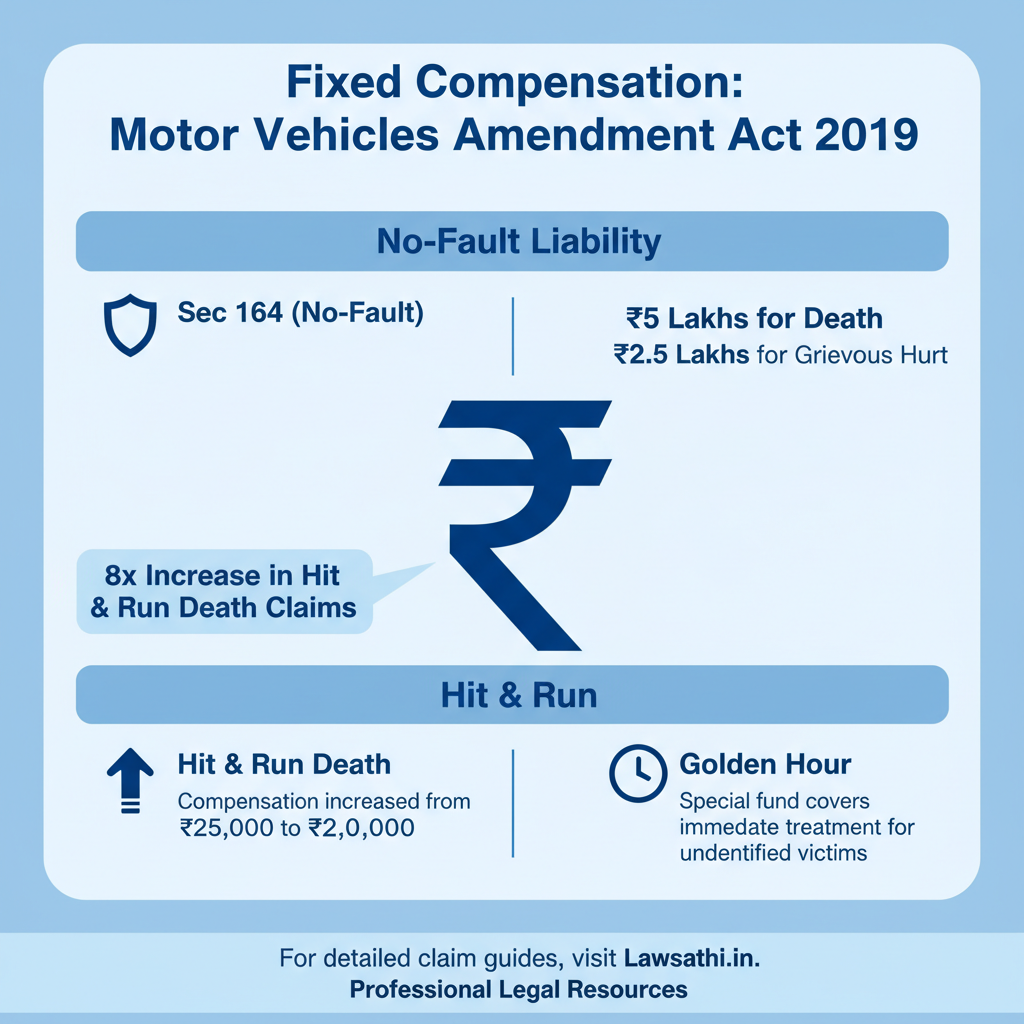

Section 164 No-Fault Liability

Alternatively, you can seek “No-Fault Liability” under the new Section 164. This replaces the old Section 140. It provides fixed compensation of ₹5 Lakhs for death and ₹2.5 Lakhs for grievous hurt.

If you choose this path, you do not need to prove negligence. However, your petition under Section 166 will lapse if you accept this. Specifically, you must decide which route offers the best outcome for your client.

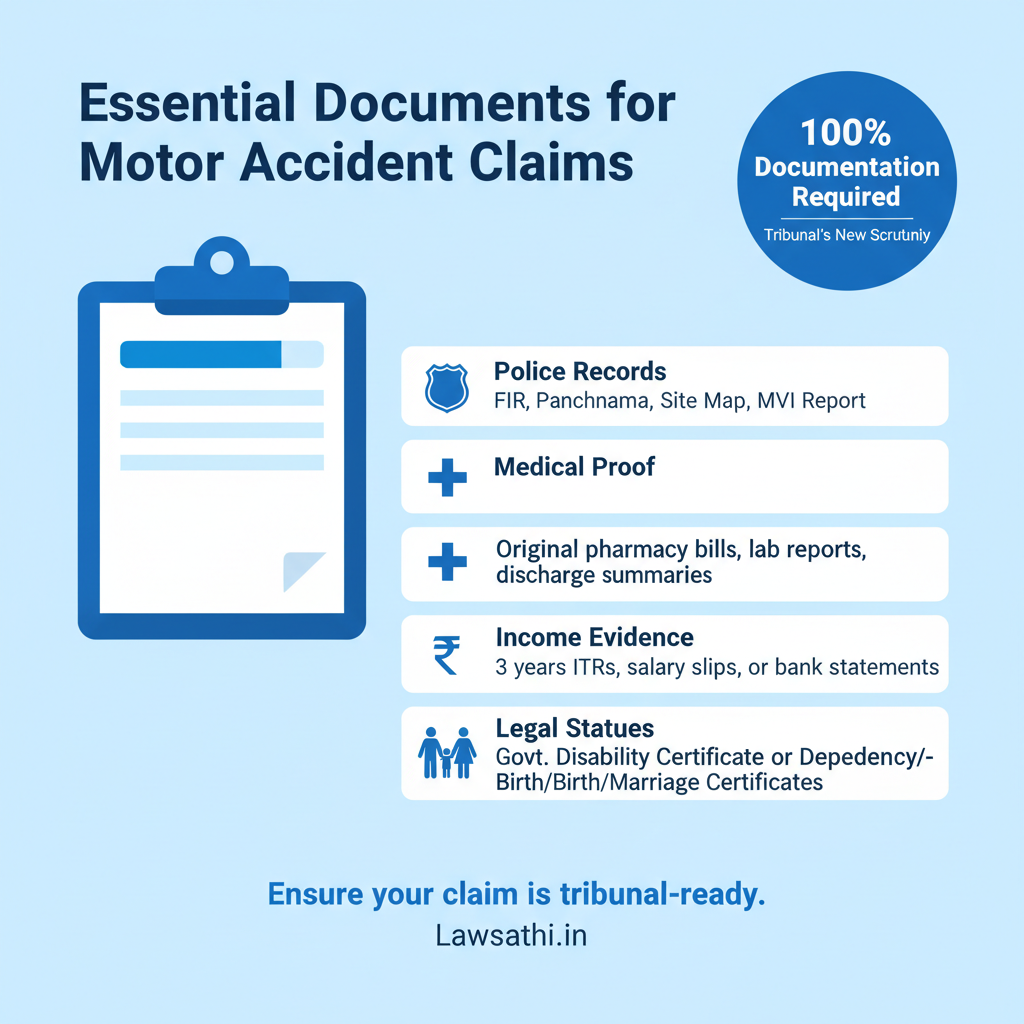

Mandatory Documentation Checklist for Legal Professionals

Success in MACT cases relies heavily on documentation for MACT claims. You must gather police, medical, and financial records systematically. For example, local Tribunals now scrutinize the “Golden Hour” treatment records more frequently.

Essential Police and Identity Records

First, collect the FIR, Panchnama, Site Map, and Mechanic Inspection Report (MVI). These documents establish the facts of the accident. Additionally, you need the claimant’s Aadhaar card and Voter ID. For fatal cases, birth or marriage certificates are necessary to prove dependency.

Proving Income and Disability

For income proof, provide Salary Slips or Income Tax Returns for the last three years. If the victim is self-employed, bank statements become crucial evidence. Furthermore, you must obtain a disability certificate from a duly constituted Medical Board. Private hospital certificates are often insufficient in court.

Medical Evidence for Treatment

Gather all original pharmacy bills and lab reports from the start. A detailed discharge summary is vital for calculating pain and suffering. Most importantly, ensure the medical history matches the version of events in the FIR. Discrepancies here can destroy your case during cross-examination.

Hit and Run Cases: Compensation and Procedures

The 2019 Amendment significantly increased compensation for hit and run cases India. Specifically, Section 161 now provides much higher amounts for victims. For instance, compensation for death rose from ₹25,000 to ₹2,00,000. For grievous hurt, it increased to ₹50,000.

The Solatium Scheme Application

Families can apply for these funds through the Compensation to Victims of Hit and Run Motor Accidents Scheme, 2022. A District Level Committee manages these claims in every district. This committee verifies the identity of the victim and the details of the incident.

The Role of Enquiry Officers

Usually, a Claims Enquiry Officer at the Taluka level conducts the initial verification. They then submit a report to the District Collector. Finally, the funds are released from the Motor Vehicle Accident Fund.

In fact, the Supreme Court recently urged the police to inform victims directly about this scheme. This ensures that families do not miss out on mandatory state support.

The Role of Insurance Companies and Third-Party Liability

Insurance providers now face strict timelines under Rule 23 of the 2022 Rules. Once a DAR is filed, the company must offer a settlement within 30 days. This rule forces insurance companies to act fast. As a result, lawyers can often bypass years of litigation.

Consequences of Non-Compliance

Moreover, insurance companies must appoint designated Nodal Officers. These officers coordinate directly with the Tribunals. If an insurance company fails to comply, the Tribunal can pass an award based on the available DAR. Consequently, the burden of speed has shifted to the insurers.

The Special Accident Fund

Section 164B introduced the Motor Vehicle Accident Fund. This fund covers treatment during the “Golden Hour”. It also provides compulsory insurance for all road users. For example, it helps pay for immediate medical care for unidentified victims. Most importantly, it ensures that lack of funds does not lead to loss of life.

Leveraging Technology: How LawSathi Simplifies MACT Practice

Managing dozen of MACT cases manually is nearly impossible under the new regime. The strict 6-month deadline requires a robust tracking system. Therefore, digital integration is no longer a luxury for Indian law firms.

Managing Deadlines and Reports

LawSathi’s AI-powered platform helps you track the MACT limitation period 2019 amendment for every case. You can set automated reminders for FAR, IAR, and DAR filings. Additionally, our system centralizes document storage for FIRs and medical bills. This ensures you are always ready for the next hearing.

AI-Driven Case Tracking

Furthermore, LawSathi integrates with court databases to provide real-time updates. You can track multiple filings across different Tribunals from a single dashboard. Specifically, this helps in cases where the DAR is converted into a claim petition unexpectedly. Use these tools to stay ahead of the curve.

Conclusion: Mastering the New MACT Era To summarize, the Motor Vehicles (Amendment) Act 2019 has made speed and accuracy mandatory. You must navigate the six-month limitation and handle complex DAR reports skillfully. By following the documentation checklist and understanding the new procedural rules, you can ensure justice for accident victims.

Stop worrying about missing strict 6-month limitation periods. Manage your MACT cases, track deadlines, and organize accident reports seamlessly with LawSathi’s AI-powered dashboard. Book a demo today!