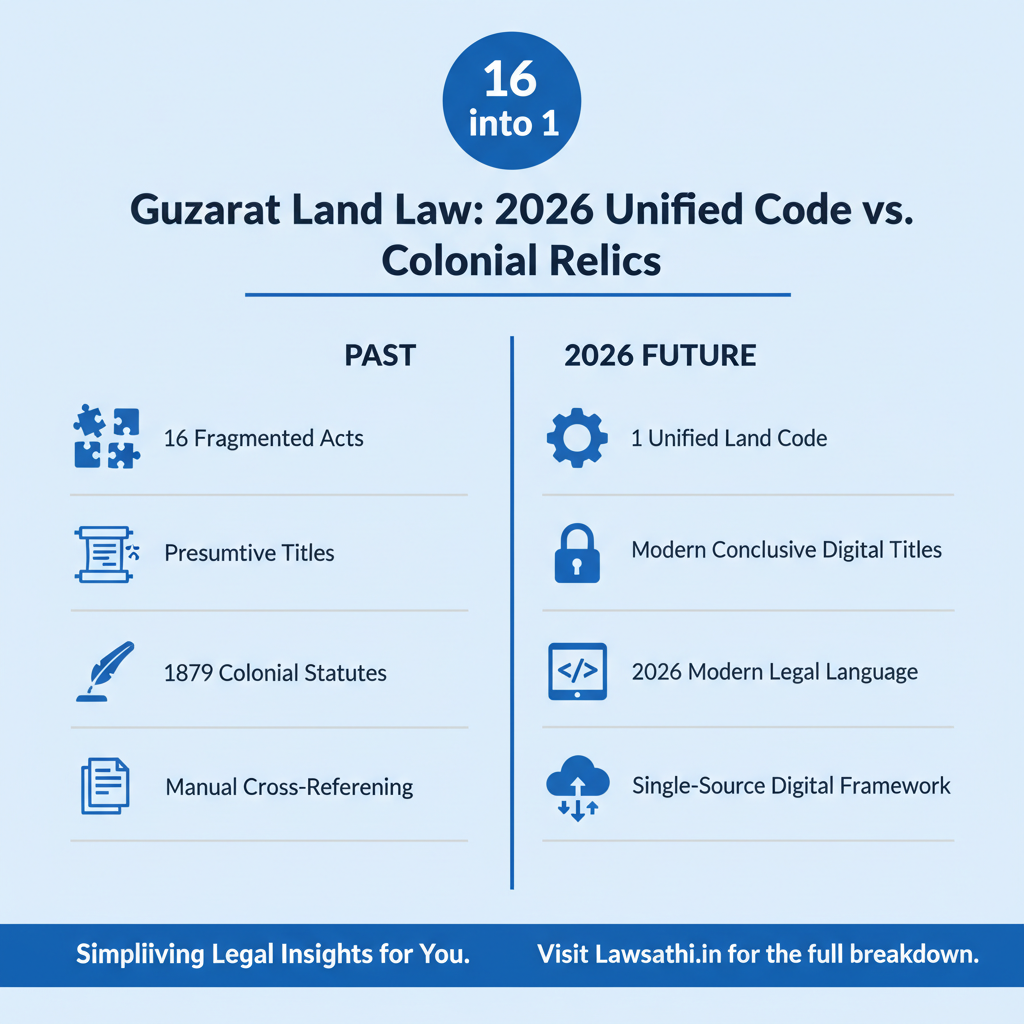

The landscape of property law in Gujarat is undergoing a massive transformation. As of January 2026, the state has officially implemented the Gujarat Land Law Overhaul 2026. This historic move merges 16 fragmented revenue acts into a single, cohesive framework.

Consequently, lawyers and property owners must adapt to the new Gujarat Unified Land Revenue Code. This legislative shift aims to modernize colonial-era rules. Furthermore, it simplifies complex procedures that have hindered industrial and residential growth for decades.

Introduction: The Dawn of a New Era in Gujarat’s Revenue Landscape

Gujarat has finally moved to repeal statutes dating back to 1879. The primary objective is to enhance the Ease of Doing Business. Specifically, the government wants to reduce the “Tarikh culture” prevalent in revenue courts.

Therefore, the state is transitioning from a presumptive title system to a digitised, conclusive administration. This “One State, One Law” vision ensures that land administration is transparent. Most importantly, it minimizes the discretionary powers of local revenue officials.

Ending the Era of Colonial Statutes

For over a century, the Bombay Land Revenue Code governed Gujarat’s soil. However, these laws were often contradictory and outdated. The new 2026 overhaul replaces these relics with modern legal language.

As a result, practitioners no longer need to cross-reference multiple overlapping statutes. Instead, they can find all relevant provisions within the Unified Code. This clarity is a significant win for the legal fraternity.

Promoting Ease of Doing Business

The overhaul focuses on speed and efficiency. For example, the state aims to settle land disputes within fixed timelines. This move encourages global investors to view Gujarat as a stable market. Furthermore, it reduces the backlog of cases in the Mamlatdar and Collector offices.

The 16 Acts Merged: What Has Changed?

The consolidation integrates historically fragmented laws into one powerhouse statute. Notable repeals include the Prevention of Fragmentation and Consolidation of Holdings Act. Additionally, the foundational Bombay Land Revenue Code 1879 is now part of legal history.

Integration of Tenancy Laws

Perhaps the most significant change involves the Gujarat Tenancy and Agricultural Lands Act. Previously, transitioning from “New Tenure” to “Old Tenure” was a bureaucratic nightmare.

Now, land held for over 15 years can transition with minimal friction. This change follows recent 2024-2025 amendments designed to liberate agricultural land. Consequently, farmers can now unlock the true market value of their holdings more easily.

Streamlining Specialized Acts

The overhaul also tightens the rules for specialized legislation. For instance, the Gujarat Land Grabbing (Prohibition) Act remains active but more regulated.

The High Court recently issued guidelines to prevent its misuse against lawful tenants. Above all, the Unified Code ensures these specialized laws do not clash with general land rights.

Simplifying Non-Agricultural (NA) Permissions

Historically, Section 65 of the old code was a major bottleneck. It required property owners to seek arduous Collector approvals for land use changes. However, the Gujarat Land Law Overhaul 2026 introduces “Deemed NA” status for many zones.

Abolishing the Section 65 Barrier

The new framework emphasizes self-certification for property owners. Specifically, owners can pay a premium online and receive immediate conversion certificates. This shift reduces approval timelines from months to just a few days.

Moreover, the Gujarat High Court has ruled that once land is NA, its agricultural character is gone forever. Therefore, changing the type of industry on that land no longer requires a fresh NA permission.

Impact on Real Estate Development

Real estate developers will benefit immensely from these predictable rules. For example, industrial land acquisition is now significantly faster. Developers can now forecast project timelines with higher accuracy. Consequently, this leads to lower carrying costs for large-scale infrastructure projects.

Digitization and the Role of Blockchain Land Records

Technology is the backbone of the new Unified Code. The state has upgraded the “AnyROR” portal to version 2.0. This system now offers real-time mutation updates for every land parcel in Gujarat.

Blockchain-Backed Security

To prevent title fraud, Gujarat has implemented blockchain-backed ledgers. Every change in the 7/12 or 8A extracts is now immutable and timestamped. Therefore, hackers or corrupt officials cannot alter records retrospectively.

This move aligns with the National Registration Bill 2025. It focuses on end-to-end digital property registration. As a result, title disputes caused by manual entry errors will drastically vanish.

Minimizing Boundary and Title Fraud

Blockchain technology ensures that every transaction is transparent. For instance, if a mutation application is filed, all stakeholders receive automated alerts. This feature is particularly helpful for preventing “Benami” transactions. Furthermore, it provides a “single source of truth” for all revenue officials.

Impact on Legal Practice: Challenges and Opportunities

For lawyers, the Gujarat Land Law Overhaul 2026 is a double-edged sword. On one hand, it simplifies the law. On the other hand, it requires a total re-learning of procedural rules.

The Shift to e-Courts and IRCMS

Revenue litigation has moved to the Integrated Revenue Case Management System (IRCMS). Lawyers must now file all cases and applications online. Thus, the need for physical presence at the Collector’s office is diminishing.

New Litigation Trends for Lawyers

Litigation trends are shifting away from traditional title disputes. Instead, lawyers are seeing more cases involving premium calculation disputes. Additionally, challenges against “administrative digitization errors” are becoming common.

First, practitioners must master the new section numbers. Second, they must understand the automated premium calculators. Above all, staying tech-savvy is no longer optional for a successful revenue practice.

Key Benefits for Property Owners and Investors

The overhaul brings significant financial relief through stamp duty reforms. For example, the Gujarat Stamp (Amendment) Act 2025 capped mortgage duty at ₹5,000. This move makes borrowing against property much cheaper.

Enhanced Security for NRI Property Owners

Non-Resident Indians (NRIs) often fear land grabbing while they are abroad. However, the new digital system allows them to set “alerts.” If anyone tries to sell their land, they get a notification. Furthermore, Aadhaar-linked authentication prevents forged signatures on sale deeds.

Transparency in Premium Payments

Previously, premium payments for tenure conversion were often opaque. Now, the revenue portal features an automated calculator. Therefore, investors know the exact cost of conversion before they buy. This transparency eliminates the need for “negotiations” with local authorities.

Conclusion: Preparing for the Future of Revenue Law

The Gujarat Land Law Overhaul 2026 marks a significant milestone in India’s legal history. By merging 16 acts, the state has cleared a century of legal clutter. As a result, property transactions are now faster, safer, and more transparent.

For legal professionals, this is the time to embrace technology. The shift to digital records and e-filing is irreversible. Consequently, those who adapt quickly will thrive in this new regulatory environment. In summary, Gujarat has set a gold standard for land reform that other states may soon follow.

Streamline your revenue practice amidst Gujarat’s legal reforms. Use LawSathi’s AI-powered case management to track land records and manage filings seamlessly. Book a demo today!