Receiving a Show Cause Notice (SCN) is a critical moment for any taxpayer. In the Indian legal landscape, this document serves as the foundation for tax adjudication. Consequently, knowing how to respond to a Show Cause Notice from the GST department is an essential skill for every tax practitioner.

Introduction: The Gravity of a GST Show Cause Notice (SCN)

An SCN is the first formal step in the adjudication process under the CGST Act, 2017. Specifically, it satisfies the Principles of Natural Justice by informing the taxpayer of specific charges. Furthermore, it allows the taxpayer to present their side before a final order is passed.

Risks of Common Notice Triggers

Most notices arise from mismatches between GSTR-3B and GSTR-2A. For example, others stem from ineligible Input Tax Credit (ITC) claims or non-payment of taxes. Therefore, practitioners must treat every notice with high priority to avoid heavy penalties.

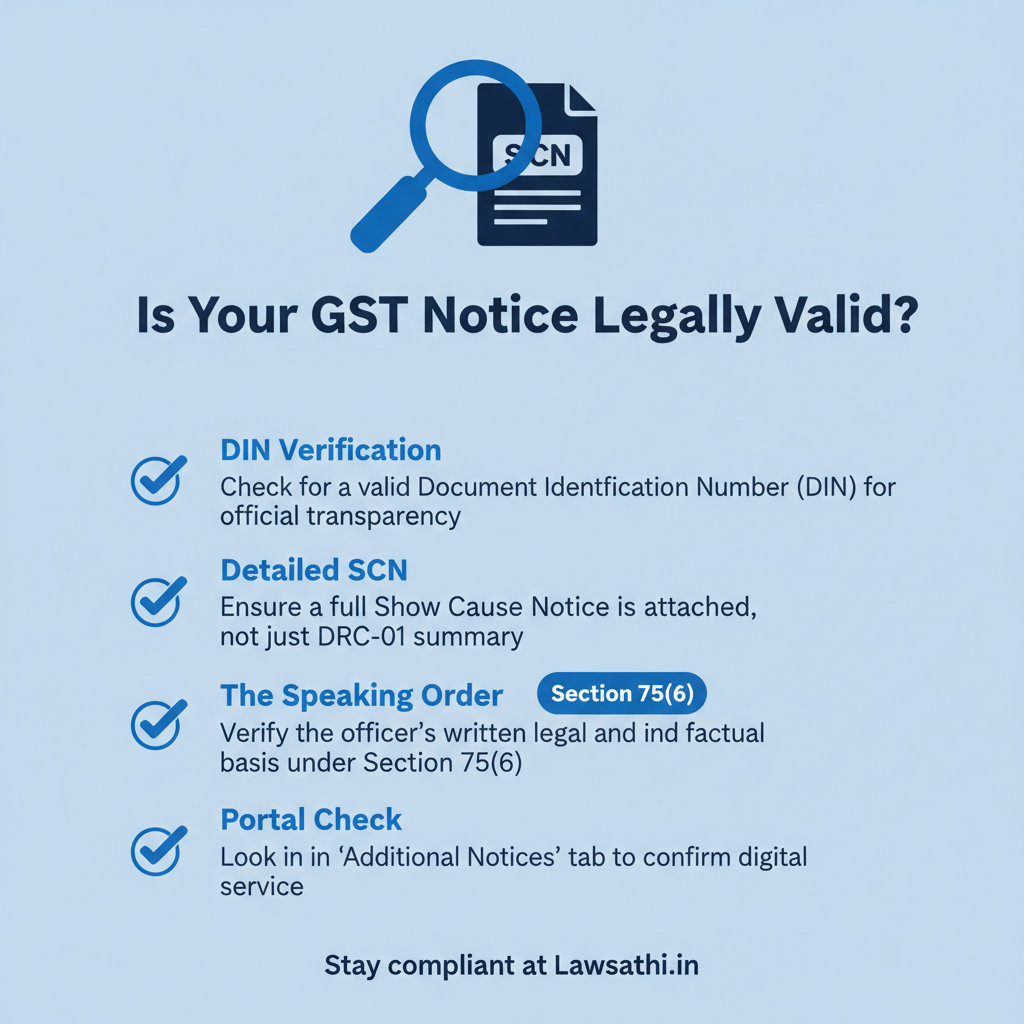

The Necessity of a Speaking Order

The law requires the department to issue a “speaking order” under Section 75(6). Specifically, this means the officer must explain the factual and legal basis for their decision. For instance, the Gauhati High Court in Udit Tibrewal v. State of Assam ruled that a mere summary is insufficient. As a result, a detailed SCN must accompany the summary in Form DRC-01.

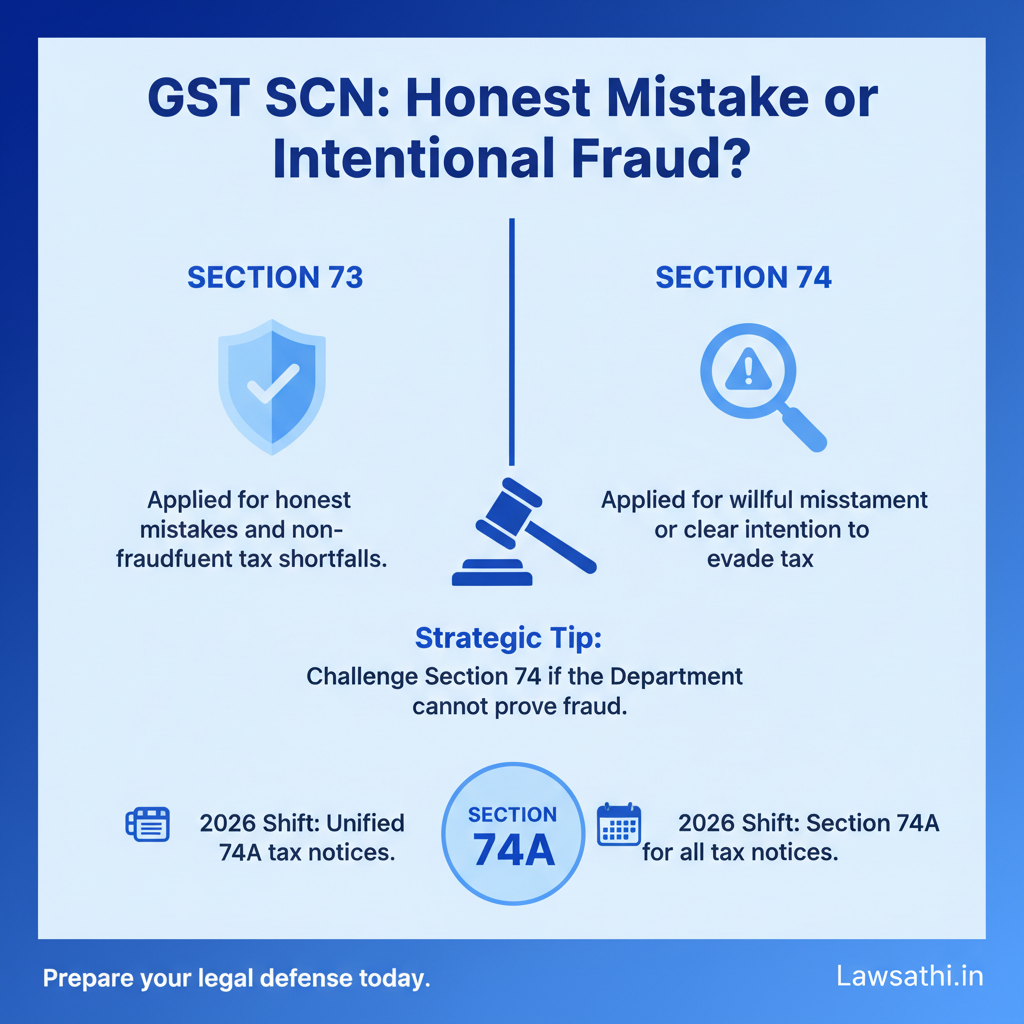

Analyzing the Type of Notice: Section 73 vs. Section 74

The first step in drafting a reply involves identifying the legal provision invoked. Most notices fall under Section 73 or Section 74 of the CGST Act. However, recent amendments have introduced a unified approach.

Distinguishing Between Fraud and Error

Section 73 handles cases where tax was not paid due to honest mistakes. In contrast, Section 74 applies to cases involving fraud or willful misstatement. Specifically, the “intention to evade tax” is the cornerstone of Section 74 litigation. Hence, practitioners must vigorously challenge the invocation of Section 74 if no fraud exists.

The Shift to Section 74A in 2026

Notably, the 53rd GST Council Meeting recommended a significant change. From the financial year 2024-25 onwards, a new Section 74A provides a common time limit. Moreover, this unified deadline simplifies the process for both taxpayers and officers. Additionally, it reduces the complexity of tracking different limitation periods for fraud versus non-fraud cases.

Initial Steps: Verifying Validity and Jurisdiction

Before addressing the merits, you must check the technical validity of the notice. For example, verify if the document contains a valid Document Identification Number (DIN). Specifically, the CBIC mandates a DIN for all official communications to ensure transparency.

Challenging Based on Procedural Lapses

An SCN may be invalid if it lacks specific charges. Furthermore, the Andhra Pradesh High Court recently clarified that orders without a DIN are technically invalid. Moreover, ensure that the issuing officer has the correct jurisdiction. If the notice is too vague to understand, it can be challenged as a violation of natural justice.

Digital Service of Notice

Taxpayers often miss notices uploaded to the “Additional Notices” tab. However, the Delhi High Court ruled on this matter. It stated that improper digital service can be grounds for setting aside an order. Therefore, practitioners should check all sections of the GST portal frequently.

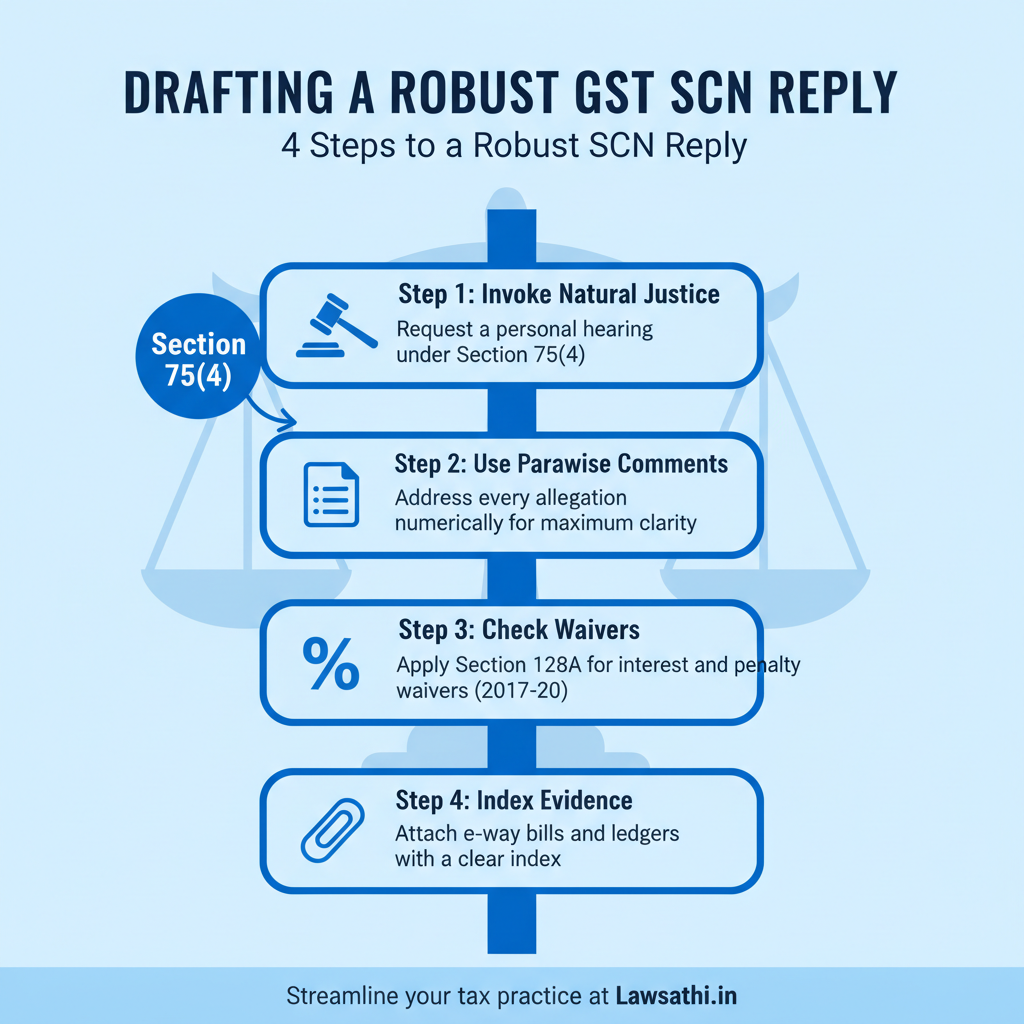

Legal Strategies for Drafting a Robust Reply

Drafting a reply requires a structured approach. First, always invoke the Principles of Natural Justice. Specifically, request an opportunity for a personal hearing under Section 75(4). This is a mandatory requirement whenever an adverse decision is contemplated.

The Parawise Comments Approach

When learning how to respond to a Show Cause Notice from the GST department, the “parawise comments” format is best. This involves addressing every allegation in a numbered table. As a result, the adjudicating officer cannot claim that any point went unrefuted.

Utilizing Statutory Waivers

Furthermore, practitioners should leverage Section 128A. This provision allows for a waiver of interest and penalties for the years 2017-18 to 2019-20. Consequently, the taxpayer must pay the full tax amount by the notified deadline to qualify. Such strategic moves can save clients substantial amounts of money.

Essential Documentation and Evidence Checklist

A strong legal argument needs solid evidence. Therefore, you must compile a comprehensive “Index of Documents.” This simplifies the officer’s review process and builds credibility.

Proving Genuine ITC Claims

For ITC disputes, gather e-way bills, invoices, and bank statements. Specifically, prove that the goods were actually received and paid for. In recent years, courts have protected “bona fide” buyers. For example, the Supreme Court held that ITC benefits cannot be reduced without clear statutory sanction.

Reconciling Digital Ledgers

Additionally, reconcile the Electronic Credit Ledger with the Cash Ledger. Use GSTR-2A/2B data to justify every rupee claimed. Moreover, if a supplier defaulted, argue that the buyer should not be penalized. This strategy is highly effective in 2026 litigation.

The Personal Hearing: Preparation and Conduct

The personal hearing is your final chance to influence the officer. Under Section 75(5) of the CGST Act, a taxpayer may request up to three adjournments. However, you must provide sufficient cause for each delay.

Preparing Written Submissions

During the hearing, submit a “Synopsis of Arguments.” This document should summarize your technical defenses clearly. Most importantly, ensure the “Record of Personal Hearing” accurately reflects your statements. If the officer misses a point, ask them to include it in the minutes.

Conduct and Etiquette during Hearings

Treat the hearing as a formal court proceeding. For instance, remain respectful but firm on legal points. If the officer suggests a quick settlement, evaluate the long-term impact carefully. Above all, never leave a hearing without a signed copy of the attendance record.

Common Technical Defenses and Case Law References

Smart practitioners use established precedents to win cases. One powerful defense is “Revenue Neutrality.” Specifically, this applies when tax paid by one branch is available as ITC to another. In such cases, there is usually no intention to evade tax.

Defenses for Immovable Property

A major breakthrough occurred in the Safari Retreats case. For instance, the Supreme Court held that ITC may be allowed on buildings necessary for providing services. Therefore, if a building acts like a “plant,” Section 17(5)(d) may not apply.

Fighting Retrospective Cancellations

Moreover, the Delhi High Court has ruled against arbitrary retrospective cancellations. Such cancellations often deny ITC to genuine customers unfairly. Consequently, practitioners can use this precedent to protect their clients from supplier-related issues.

Streamlining GST Litigation with Technology

In 2026, manual tracking of notices is no longer efficient. Modern GST practice management for lawyers requires digital tools. This is where LawSathi provides a competitive edge to tax professionals.

Automating Limitation Dates

LawSathi’s AI helps in tracking critical limitation dates for SCN replies. Missing a deadline can lead to an ex-parte order. Consequently, automated reminders ensure you always stay ahead of the department’s clock.

Centralized Document Management

Additionally, the platform offers centralized document management. You can store historical filings and case laws in one place. By using technology, you can master how to respond to a Show Cause Notice from the GST department with speed and accuracy.

Conclusion

Responding to a GST notice is both a science and an art. First, verify the technical validity of the SCN. Second, determine if the case falls under Section 73 or Section 74. Then, draft a parawise reply supported by the latest judgments. Finally, represent the client effectively at the personal hearing. By following this guide, practitioners can navigate GST litigation with confidence.

Tired of missing GST notice deadlines? Streamline your tax practice, manage documents, and never miss a hearing with LawSathi’s AI-powered platform. Book a free demo today!