The legal landscape for insolvency in India has undergone a massive digital transformation this year. As of January 2026, the National Company Law Tribunal (NCLT) has moved to a “digital-mandatory” framework. Consequently, practitioners must adapt to these rigorous standards to avoid technical dismissals. This guide explores the critical NCLT procedure changes 2026 and how they impact your practice.

Introduction: The 2026 Digital Shift in NCLT Proceedings

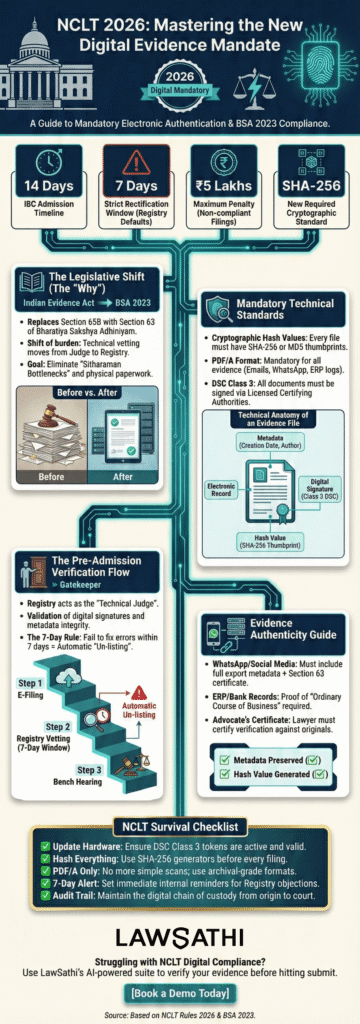

The Ministry of Corporate Affairs (MCA) recently enforced major updates to the NCLT Rules. These changes align the tribunal with the Bharatiya Sakshya Adhiniyam (BSA), 2023. Effectively, this new law replaced the Indian Evidence Act.

Furthermore, the primary goal is to eliminate delays. These delays often stem from voluminous physical filings. Therefore, digital compliance is now the highest priority for legal professionals.

Why the MCA Pushed for Change

For years, the “Sitharaman bottleneck” slowed down the admission of cases. Manual vetting of documents led to frequent breaches of the strict 14-day IBC timeline. Therefore, the MCA introduced mandatory e-filing pre-requisites to streamline the process.

Most importantly, these updates shift the burden of technical verification. Specifically, the responsibility moves from the judge to the Registry. This allows the bench to focus solely on legal merits.

Impact on Case Disposal Speed

Under the new rules, the Registry vets all submissions before they reach a bench. This ensures that judicial time is spent only on the merits of a case. As a result, the “pre-admission” lag has decreased significantly for compliant petitioners. In fact, well-prepared filings now move through the system much faster than under previous rules.

Mandatory Electronic Evidence Authentication: The New Standard

The NCLT procedure changes 2026 have ended the era of simple Section 65B affidavits. Practitioners must now follow Section 63 of the BSA for all electronic records. Specifically, electronic evidence must include a two-part certificate for admissibility.

Technical Requirements for Hash Values

Every digital file must now include a “Hash Value” such as SHA-256 or MD5. This cryptographic thumbprint acts as a digital seal. It proves that the data has not been altered since the default occurred. For example, experts suggest using specific tools to extract these values before filing.

The Role of Certifying Authorities

Furthermore, metadata preservation is now a core requirement for IBC filings. You must submit ERP logs, email headers, and database exports in PDF/A format. All documents must be signed using a Licensed Certifying Authority (DSC Class 3).

In contrast to old practices, simple scans of digital documents are no longer acceptable. Consequently, practitioners must ensure their digital signatures are active and valid.

Understanding the New ‘Pre-Admission’ Verification Process

The NCLT Registry now functions as a “technical judge” for every application. Before a hearing is scheduled, the Registry performs strict pre-admission verification of all digital signatures. This stage is crucial for both financial and operational creditors.

The Strict 7-Day Rectification Window

If the Registry finds a technical default, you have a very short time to act. Specifically, the petitioner receives a strict 7-day window to fix authentication errors.

Consequently, failure to meet this deadline leads to the application being automatically “un-listed.” Therefore, precision in the initial filing is more vital than ever. You must double-check all technical metadata before submission.

Impact on Creditors

Operational Creditors (OCs) must now provide authenticated invoices with digital proof of service. Similarly, Financial Creditors must ensure that Information Utility (IU) records comply with BSA standards. Although IU data remains primary evidence, it must still pass the Registry’s technical vetting process. In addition, all certificates must remain current during the entire litigation period.

Step-by-Step Guide to Filing Under the 2026 NCLT Rules

Filing under the NCLT procedure changes 2026 requires a methodical approach to digital data. First, you must convert all evidence into PDF/A format. This includes WhatsApp chats and email threads. Additionally, you must preserve the original metadata to ensure the hash value remains consistent.

Authenticating Social Media and ERP Logs

Screenshots are no longer sufficient evidence in the NCLT. For example, WhatsApp records must be exported with full metadata and a Section 63 certificate.

This certificate confirms the integrity of the source device. Moreover, ERP logs must show a clear chain of custody to be admissible. Specifically, the petitioner must demonstrate that the records were generated in the ordinary course of business.

The Advocate’s Compliance Certificate

Every new filing must include a signed certificate from the Petitioner’s Advocate. In this document, the lawyer states they have verified digital records against original sources.

However, many practitioners fail at this stage by using expired DSCs. Consequently, these “gatekeeping” errors lead to immediate rejection by the NCLT Registry. Therefore, lawyers should perform a pre-check of their hardware tokens.

Consequences of Non-Compliance: Costs and Dismissals

The NCLT has adopted a “No-Cure, No-Hearing” policy for electronic records. If the digital chain of custody is broken, the evidence becomes inadmissible. Therefore, Section 7 or 9 petitions are often dismissed immediately for non-compliance with e-filing rules.

Heavy Costs and Penalties

The Tribunal now uses its inherent powers under Rule 11 to penalize negligence. For instance, filing unauthenticated or distorted digital records can lead to costs up to ₹5 Lakhs.

Additionally, improper filings prevent the 14-day IBC clock from starting. This protects debtors from frivolous litigation based on weak digital proof. As a result, the NCLT ensures only verified claims occupy its docket.

Speed vs. Accuracy in 2026

The new system prioritizes accuracy over mere speed. While the 14-day admission goal remains, NCLAT rulings emphasize that technical compliance is a prerequisite. Practically, this means a “fast” filing is useless if it is technically flawed. Therefore, spend more time on the technical audit of your evidence.

Technological Tools for the Modern NCLT Practitioner

To thrive in this paperless era, law firms must embrace legal technology. Automated SHA-256 hash generators are now a necessity for high-volume IBC practices. Furthermore, automated indexing tools can help you bypass common Registry objections.

Future-Proofing Your Practice

Transitioning to a “Paperless NCLT” requires secure digital archives. Firms must maintain local copies of “original” electronic records in case the court demands verification.

Moreover, using specialized software reduces the human error involved in serving notices via email. In modern practice, automation is no longer a luxury. Instead, it is a requirement for survival in the insolvency space.

Conclusion

The NCLT procedure changes 2026 represent a significant shift toward a faster, more transparent legal system. By mandating electronic evidence authentication, India is setting a global standard.

Although the new rules are strict, they provide a clearer path for creditors. Specifically, they allow for justice without procedural delays. Don’t let Registry objections slow down your IBC filings. Use LawSathi’s AI-powered document compliance suite to verify your electronic evidence before you hit submit. Book a demo today.