# New GST Rules 2026: Comprehensive Guide to Compliance, ITC Blocking, and Return Deadlines

The Indian tax landscape is undergoing a massive digital transformation. Specifically, as of January 1, 2026, the government has introduced significant changes to the tax regime. These New GST Rules January 2026 represent a shift toward real-time monitoring. For legal professionals, this means manual reconciliation is no longer enough to stay safe.

The Shift Toward Real-Time GST Compliance in 2026

The latest reforms follow the landmark 56th GST Council meeting held in late 2025. You can find more details in the official PIB release. Consequently, the department now focuses on automated enforcement rather than manual audits. This change aims to reduce tax evasion through better data integration.

Furthermore, the GST Appellate Tribunal (GSTAT) is now fully operational. This provides a structured path for dispute resolution. However, preventing disputes is always better than fighting them. Therefore, law firms must pivot their tax planning strategies immediately to avoid technical defaults.

Why Lawyers Must Adapt Now

Legal services often involve complex billing. For example, firms deal with disbursements and long-term retainers. This complexity makes law firms more vulnerable to the New GST Rules January 2026. Similarly, your ability to claim tax credits now depends on your vendor’s filing speed. As a result, your clients also depend on your timely filing to claim their own credits.

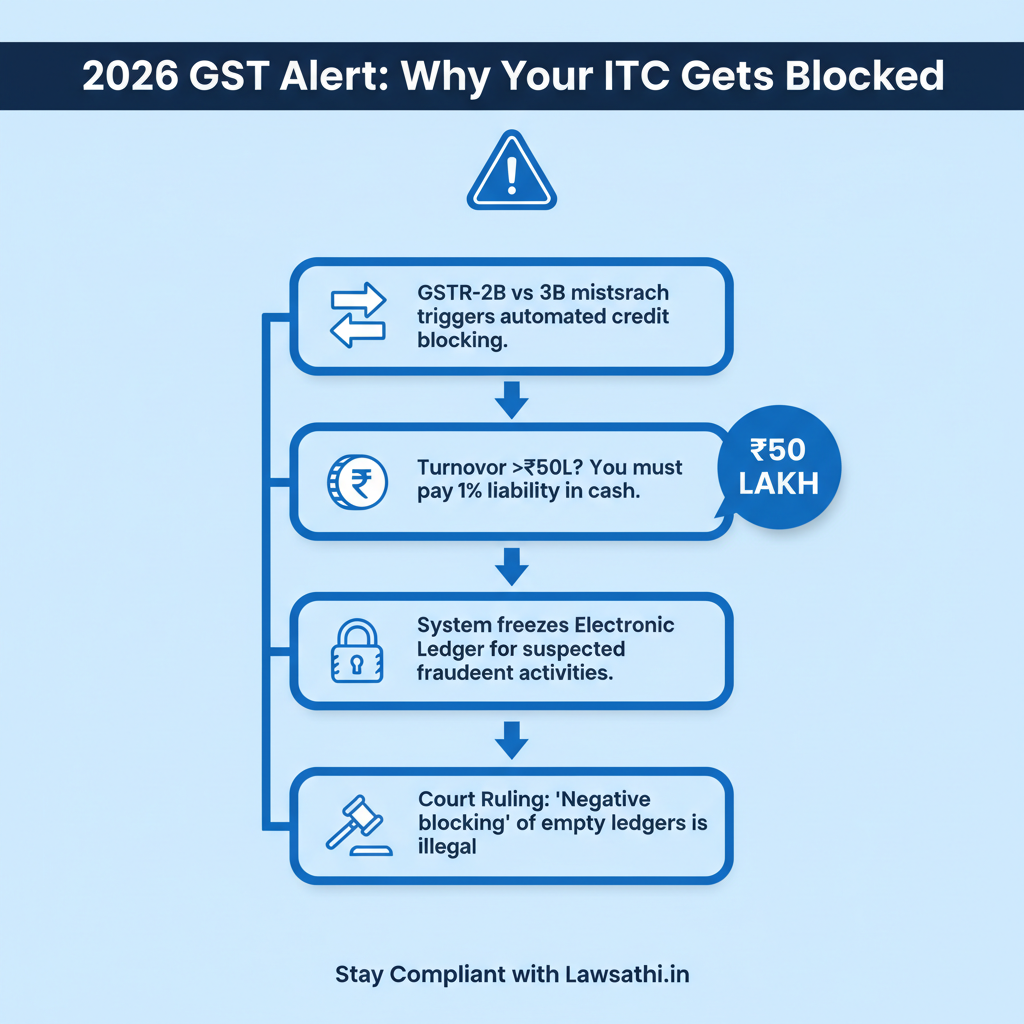

Stricter ITC Blocking: Understanding Targeted Restrictions

Input Tax Credit (ITC) is the backbone of GST efficiency. Nevertheless, the 2026 rules introduce stricter automated triggers for blocking this credit under Rule 86A and 86B. Specifically, the system now automatically flags significant mismatches between GSTR-2B and GSTR-3B.

Automated Triggers and Rule 86B

The department can now proactively block the Electronic Credit Ledger. They do this if they have a “reason to believe” that credit was availed fraudulently. Moreover, the updated Rule 86B limits the use of the credit ledger. This specifically affects high-turnover firms.

Compliance for High-Turnover Firms

Firms with a monthly turnover exceeding ₹50 lakh must pay at least 1% of their liability in cash. This is a mandatory requirement under the new rules. Therefore, you must plan your cash flow accordingly. Above all, failure to comply can lead to immediate digital blocks on your account.

Judicial Limits on Blocking

However, there is relief from the judiciary regarding these powers. The Punjab & Haryana High Court recently ruled that “negative blocking” is illegal. This means the department cannot block more credit than what is actually available in your ledger. As a result, lawyers have a stronger ground to challenge arbitrary ledger freezes.

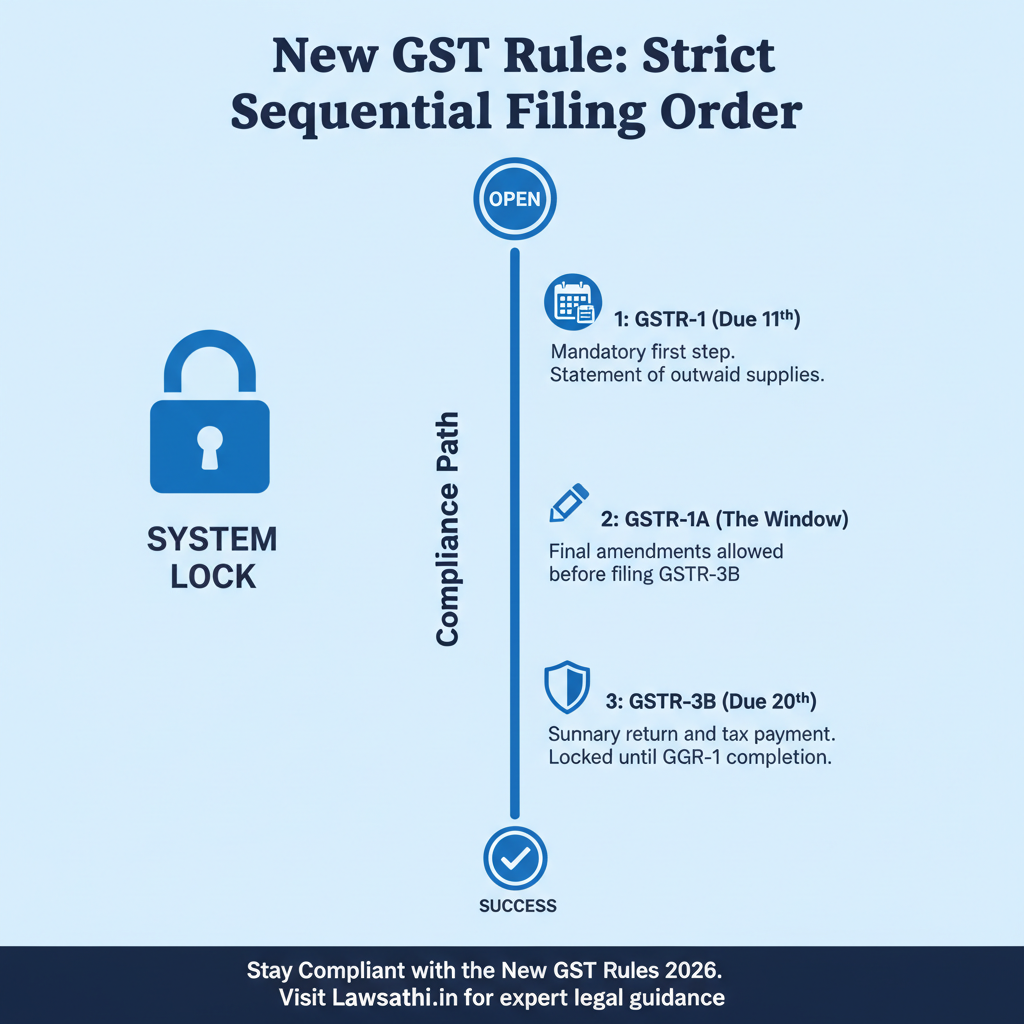

Revised Return Filing Deadlines: No More Grace Periods

The New GST Rules January 2026 have introduced a strict “lock-in” mechanism for filings. Currently, taxpayers cannot file GSTR-3B without first filing GSTR-1 for that period. In other words, this sequential filing is mandatory to ensure data consistency across the portal.

The Sequential Filing Mandate

If you miss the GSTR-1 deadline on the 11th, you cannot file GSTR-3B on the 20th. Consequently, your business will face a total block on subsequent filings. In fact, the 53rd GST Council Meeting minutes highlight that this prevents taxpayers from delaying liability payments. This ensures that everyone claims credits fairly.

New Form GSTR-1A for Corrections

To assist taxpayers, the government introduced Form GSTR-1A. You can use this form to amend details after filing GSTR-1. However, you must do this before filing GSTR-3B. For instance, if you forgot to include a legal consultation bill, you can add it here. Therefore, your tax liability in GSTR-3B will accurately reflect your real-world transactions.

Invoice Reporting and E-Invoicing Threshold Changes

Compliance for professional services is now more digital than ever. Specifically, the threshold for mandatory e-invoicing has expanded significantly over the last two years. As a result, many mid-sized law firms now fall under these requirements.

Lowered Thresholds for Law Firms

Previously, many firms ignored e-invoicing due to high turnover limits. However, current regulations mandate e-invoicing for firms with an AATO above ₹5 Crore. Failure to generate an Invoice Reference Number (IRN) makes your invoice legally invalid. Consequently, your corporate clients will be unable to claim ITC on your professional fees.

Reporting B2C Supplies

Furthermore, the reporting rules for inter-state B2C supplies have changed. You must now report invoice-wise details for all inter-state B2C transactions over ₹1 Lakh. To illustrate, if you provide a legal opinion to an out-of-state individual for ₹1.2 Lakh, you must list it separately. This is a sharp drop from the previous ₹2.5 Lakh limit.

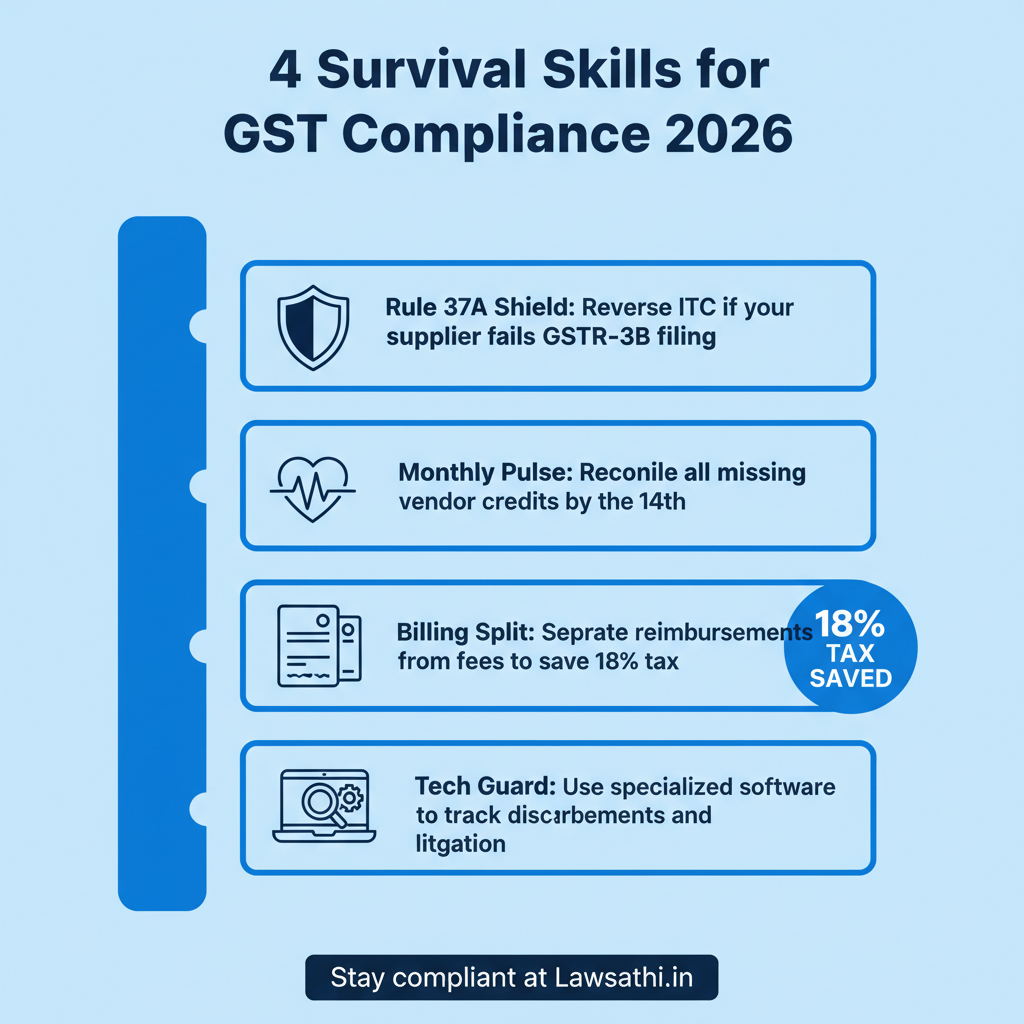

Rule 37A and Reversal of ITC: Risks for Law Firms

Rule 37A is perhaps the most critical update for law firm administrators. It mandates that you must reverse ITC if your supplier fails to file GSTR-3B. This applies even if you have already paid the supplier the full amount.

Tracking Vendor Compliance

You must now audit your service providers regularly. If your office rent provider skips their tax payment, you pay the price. For example, if they don’t file GSTR-3B by September 30th, you must reverse the credit. If you fail to reverse it, you will face interest penalties.

Procedural Hurdles in Reclaiming Credit

Fortunately, you can reclaim this credit later. Nevertheless, you can only do so after the supplier finally pays their taxes. This creates a procedural hurdle and a cash flow strain for law firms. Therefore, performing monthly reconciliation is no longer optional. It is now a survival skill.

Best Practices for Indian Lawyers to Avoid GST Litigation

To stay safe under the New GST Rules January 2026, law firms should adopt automated internal audits. You should reconcile your purchase register with GSTR-2B by the 14th of every month. This ensures you catch missing credits before the filing deadline.

Correct Service Classification

Classification remains a major area of litigation. Pure legal services usually fall under the Reverse Charge Mechanism (RCM). However, general consultancy may attract an 18% Forward Charge. Most importantly, you must separate “Pure Agent” reimbursements. These include court fees and stamp duties.

Handling Administrative Fees

If you charge a lump-sum “administrative fee,” the entire amount could become taxable. Therefore, you must be very careful with how you structure your bills. Moreover, you should keep detailed records of every expense incurred on behalf of the client. As a result, you will avoid unnecessary tax liabilities.

The Role of Technology

Finally, managing high-volume litigation expenses manually is nearly impossible today. Many firms now use specialized software to track every disbursement. By doing so, they ensure that tax-exempt court fees do not get mixed with taxable legal fees. In other words, transparency in billing is your best defense against tax notices.

Conclusion: Preparing for a Tech-Driven GST Environment

The New GST Rules January 2026 clearly show that the era of “filing whenever” is over. The “lock-in” filing system and Rule 37A reversals demand absolute precision. Law firms must treat tax compliance as a core part of their practice management. By staying updated with CBIC notifications, you can protect your firm from penalties.

Above all, remember that transparency in your billing and vendor management is key. Automated tools can help you track these changes without increasing your workload. As the GST portal becomes more automated, your office must follow suit.

Don’t let GST compliance slow down your practice. Use LawSathi’s automated financial management tools to track your expenses. Additionally, manage invoices and ensure your law firm stays compliant with the latest 2026 regulations. Book a demo today!