The Indian legal landscape is currently witnessing a massive shift. Courts are changing how they view white-collar investigations. Most recently, the ADAG Bank Fraud Case has taken center stage in the Supreme Court.

In February 2026, the bench expressed deep dissatisfaction. They questioned the slow pace of central agencies. Specifically, they asked why investigations into Anil Ambani’s group have lingered for years. For legal practitioners, this case serves as a vital case study. It highlights investigative delays and personal liberty.

Introduction: The Supreme Court’s Intervention in the ADAG Case

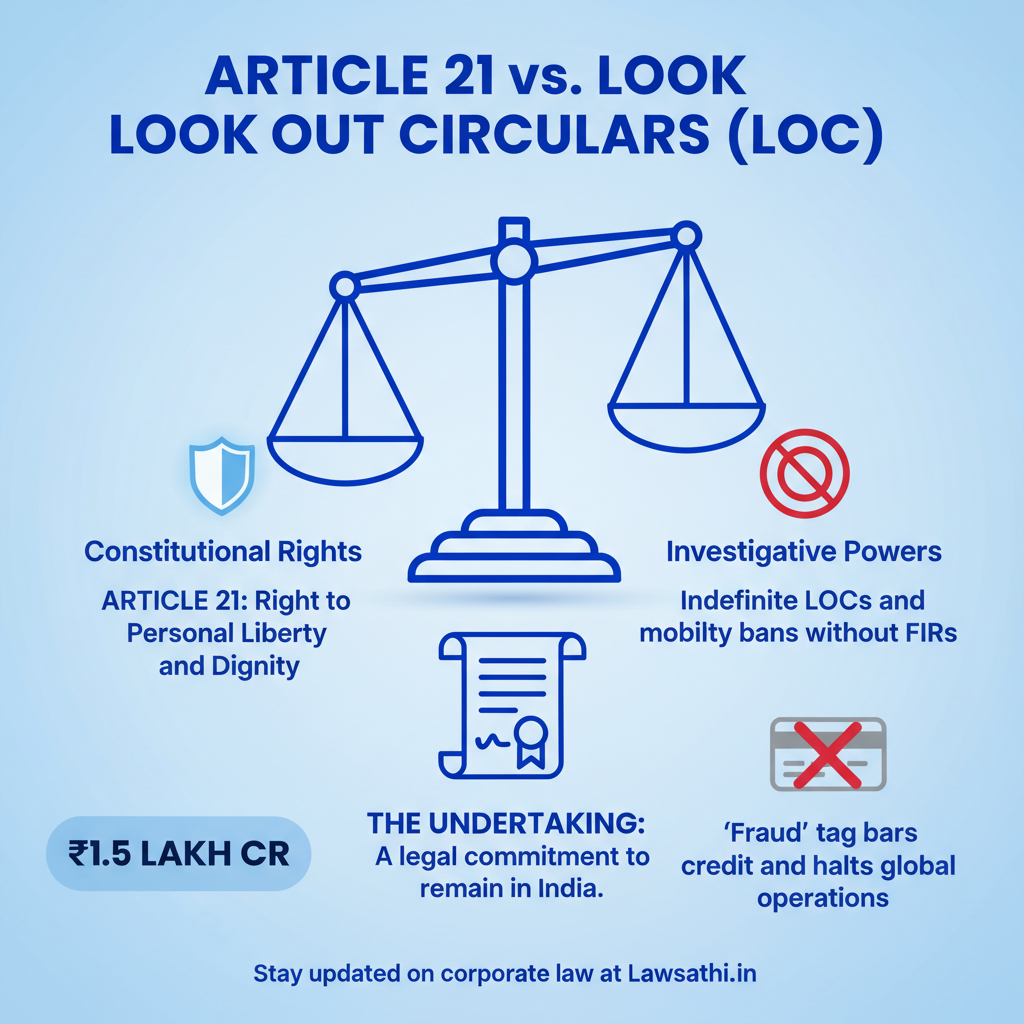

The Supreme Court recently intensified its oversight of the Reliance ADAG group. Chief Justice Surya Kant and Justice Joymalya Bagchi led the proceedings. During the session, the Supreme Court sought status reports from the CBI and ED. This intervention follows a PIL highlighting debts reaching ₹1.5 lakh crore.

The Legal Significance of the Undertaking

During the hearings, Anil Ambani’s legal team provided a crucial undertaking. They confirmed the promoter would not leave the country without permission. Therefore, this undertaking acts as a substitute for harsher restrictive measures. However, the court remained focused on why formal FIRs took so long to materialize.

Why Corporate Lawyers Should Watch This Case

This case highlights how high-profile individuals manage “flight risk” accusations. Moreover, it tests the limits of the Preventive Look Out Circular (LOC) system. Lawyers must understand these travel protocols. Such knowledge helps to protect clients from indefinite mobility bans. Consequently, this matter sets a new standard for corporate litigation strategy in India.

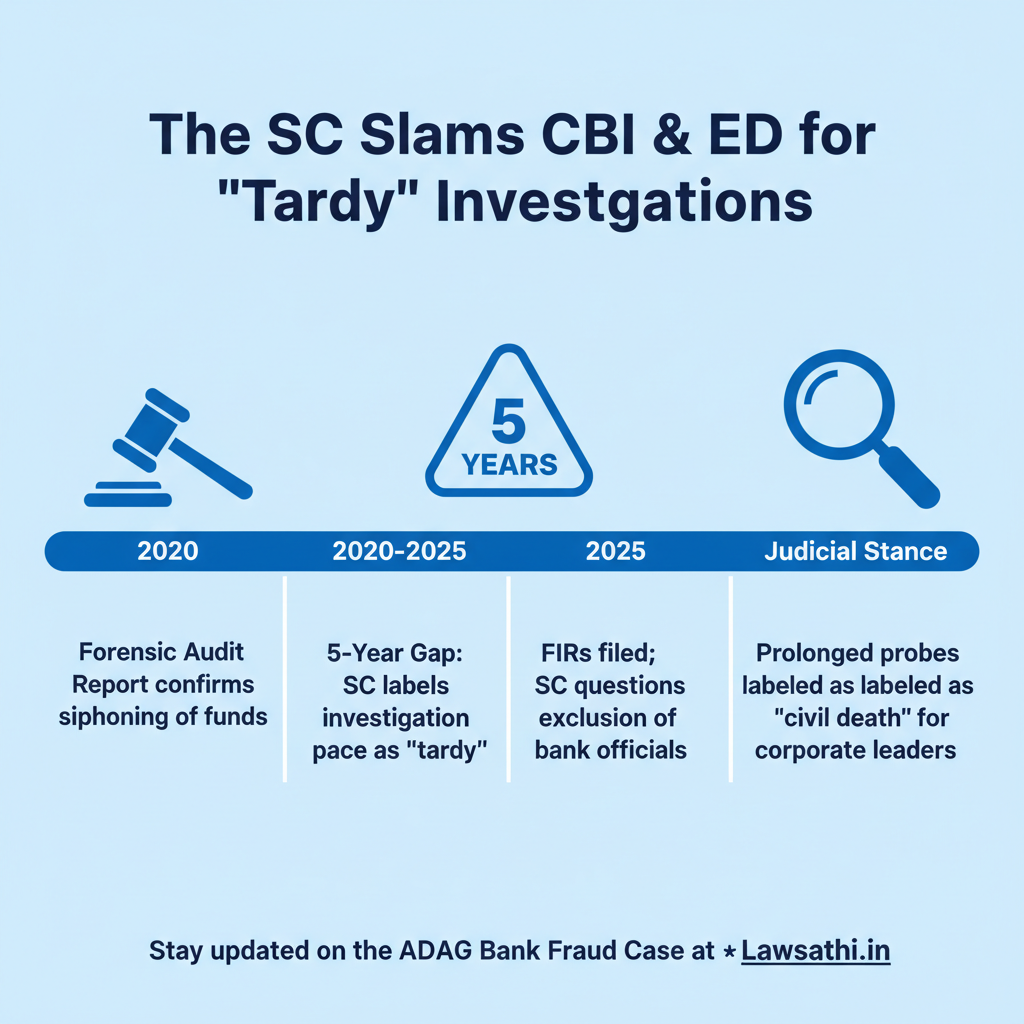

The Court’s Critique: Why the SC Pulled Up the ED and CBI

The Supreme Court bench did not hold back in its criticism. They labeled the investigation pace as “tardy.” For example, a Forensic Audit Report (FAR) existed as early as 2020. Yet, the SBI only filed formal complaints in August 2025. Consequently, the CBI and ED must now justify this five-year gap to the court.

Questioning the Lack of Definitive Evidence

The bench questioned the agencies about the lack of concrete evidence. Furthermore, they noted that excluding bank officials from FIRs seemed suspicious. If funds were siphoned, bank insiders likely played a role. By focusing only on promoters, the agencies might be conducting an incomplete probe.

Article 21 and Personal Liberty in Financial Crimes

Most importantly, the Court emphasized the “Right to Personal Liberty” under Article 21. It observed that indefinite investigations act as a “civil death” for leaders. In other words, the state cannot restrict rights forever without a trial. This judicial shift protects individuals from a perpetual state of suspicion.

Legal Analysis: Anil Ambani’s Undertaking and Travel Protocols

In the ADAG Bank Fraud Case, travel restrictions are a primary battleground. Anil Ambani’s undertaking not to leave India is a strategic move. By doing so, his team hopes to avoid a formal Look Out Circular. Typically, an LOC can completely paralyze a businessman’s global operations.

The Impact of the “Fraud” Tag

Ambani’s counsel argued that the “fraud” classification caused significant harm. In fact, they described it as a “civil death” for his career. Such a tag bars access to credit. It also triggers immediate travel bans. Therefore, challenging the “fraud” label is now a priority for defense lawyers.

Comparing High-Profile Flight Risks

The Court is comparing this situation to historical “flight risk” cases. Unlike some who fled, Ambani has remained to join the legal process. Thus, the court must balance security with the promoter’s right to dignity. For practitioners, this highlights that travel bans should not be pre-trial punishments.

Key Allegations in the ADAG Bank Fraud Case

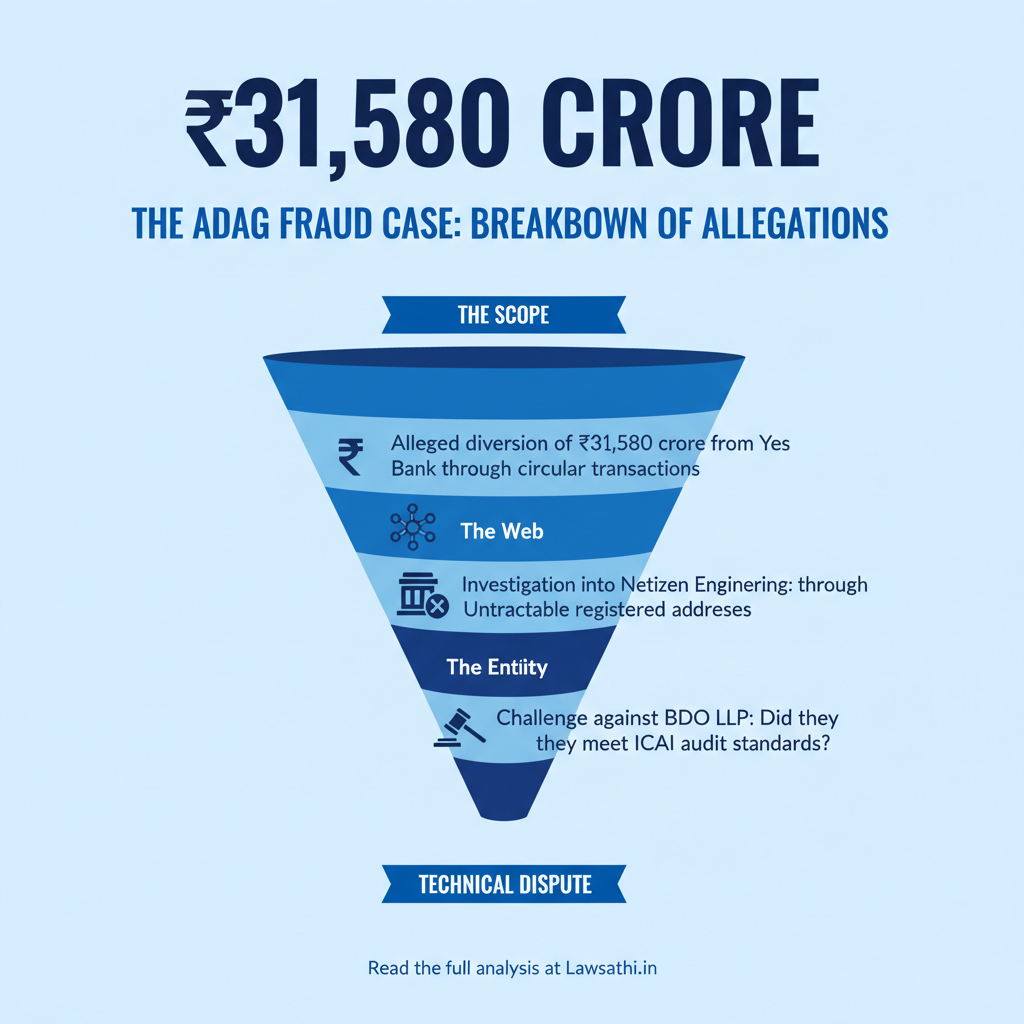

The core of the ADAG Bank Fraud Case involves massive loan diversions. Agencies allege that funds moved through over 500 shell companies. Specifically, they point to circular transactions totaling thousands of crores. These allegations focus on loans obtained from Yes Bank and SBI.

Breakdown of Primary Charges

According to reports, loans worth ₹31,580 crore are under scrutiny. Investigators claim that entities like Netizen Engineering siphoned funds. However, these companies were often untraceable at their registered addresses. As a result, the agencies are demanding a deep dive into financial history.

The BDO LLP Audit Controversy

A major legal hurdle is the validity of the forensic auditor. Ambani’s team argues that BDO LLP did not meet ICAI requirements. If the audit is flawed, the “fraud” classification might collapse. Therefore, lawyers must always verify the credentials of auditors.

The Judicial Shift: Scrutinizing Investigative Agencies in 2026

The judicial climate in 2026 shows a trend toward agency accountability. In the past, the ED held vast powers with little pushback. Now, the Supreme Court demands the “timely completion of trial” as a right. For instance, recent rulings in the Arvind Dham case support this timeline.

PMLA Scrutiny and Corporate Rights

The Court no longer accepts “ongoing investigation” as a reason for long detentions. Specifically, they are scrutinizing Section 45 of the PMLA more strictly. If the prosecution lacks a path to trial, courts may grant relief. Consequently, this shift benefits corporate clients facing legal uncertainty.

Implications for Legal Practitioners

Lawyers must now adapt their strategies to this new environment. First, use investigation delays as a ground for quashing orders. Second, demand transparency in how banks classify accounts. Finally, always insist on natural justice before a client is blacklisted.

Conclusion: What Lies Ahead for the ADAG Group

The ADAG Bank Fraud Case is far from over. The Supreme Court directed the CBI and ED to submit status reports. These reports will determine if the court monitors the investigation. For Anil Ambani, the undertaking remains his primary tool for liberty.

In summary, the 2026 judicial trend favors speed and fairness. Legal professionals should watch technical challenges against forensic audits closely. Moreover, this case will set a precedent for handling “flight risk” in India. Above all, the balance between state power and individual rights remains the focus.

Stay ahead of high-profile litigation updates. Manage your corporate case files and research with LawSathi’s AI-powered platform. Book a demo today!