On January 15, 2026, the Indian Supreme Court reshaped the world of international taxation. This court delivered a landmark judgment in the Tiger Global indirect transfer case Supreme Court matter. Consequently, this ruling settles a long-standing dispute regarding tax treaty benefits versus domestic anti-avoidance laws.

Why This Judgment Matters to Tax Lawyers

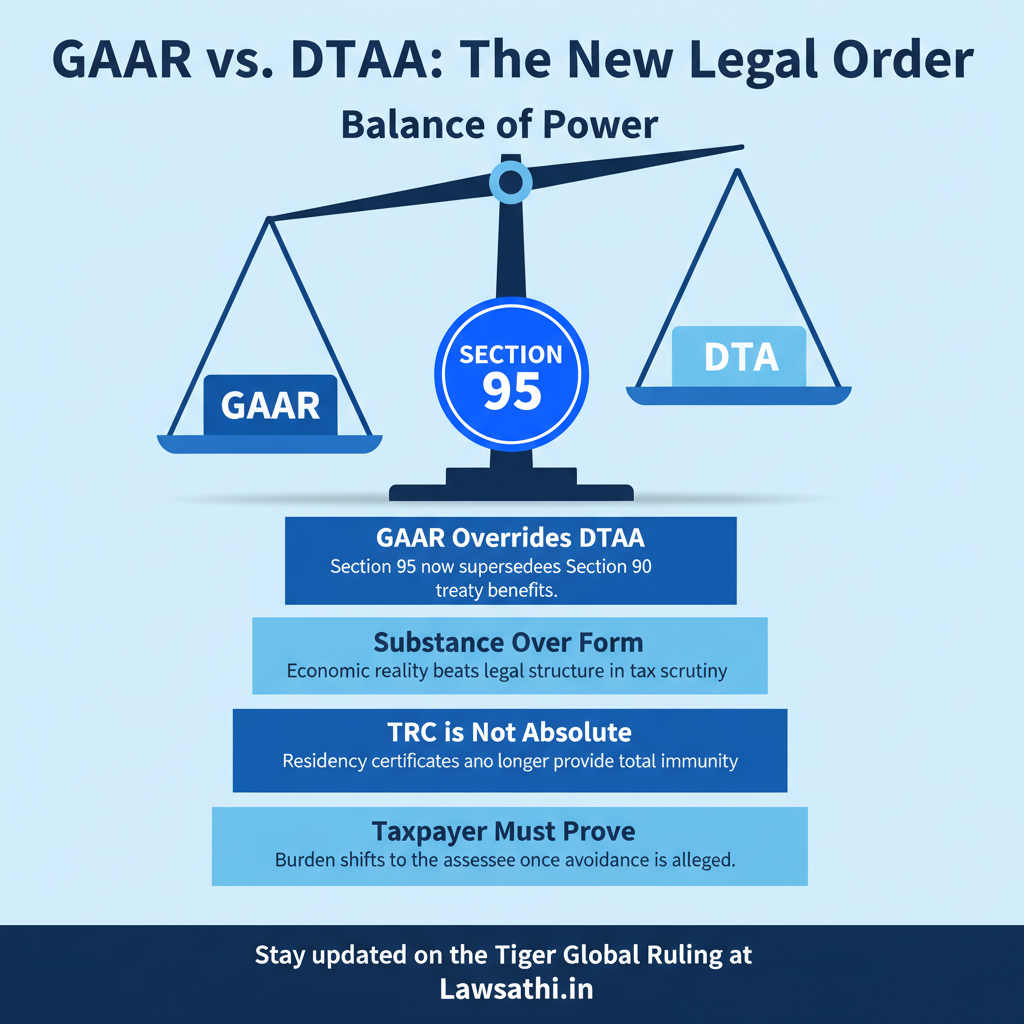

In the case of Authority for Advance Rulings v. Tiger Global International II Holdings, the court upheld a 2020 AAR decision. Specifically, the Bench led by Justice J.B. Pardiwala ruled that the General Anti-Avoidance Rule (GAAR) can override Double Taxation Avoidance Agreements (DTAA).

As a result, international tax planning for Indian assets now faces unprecedented scrutiny. Furthermore, this decision serves as a stern warning against “treaty shopping.” The court emphasized that tax sovereignty remains paramount. Therefore, lawyers must reassess how they structure cross-border investments. They should aim to avoid being labeled as “sham” arrangements.

Background: The Tiger Global-Flipkart Deal and AAR’s Initial Stance

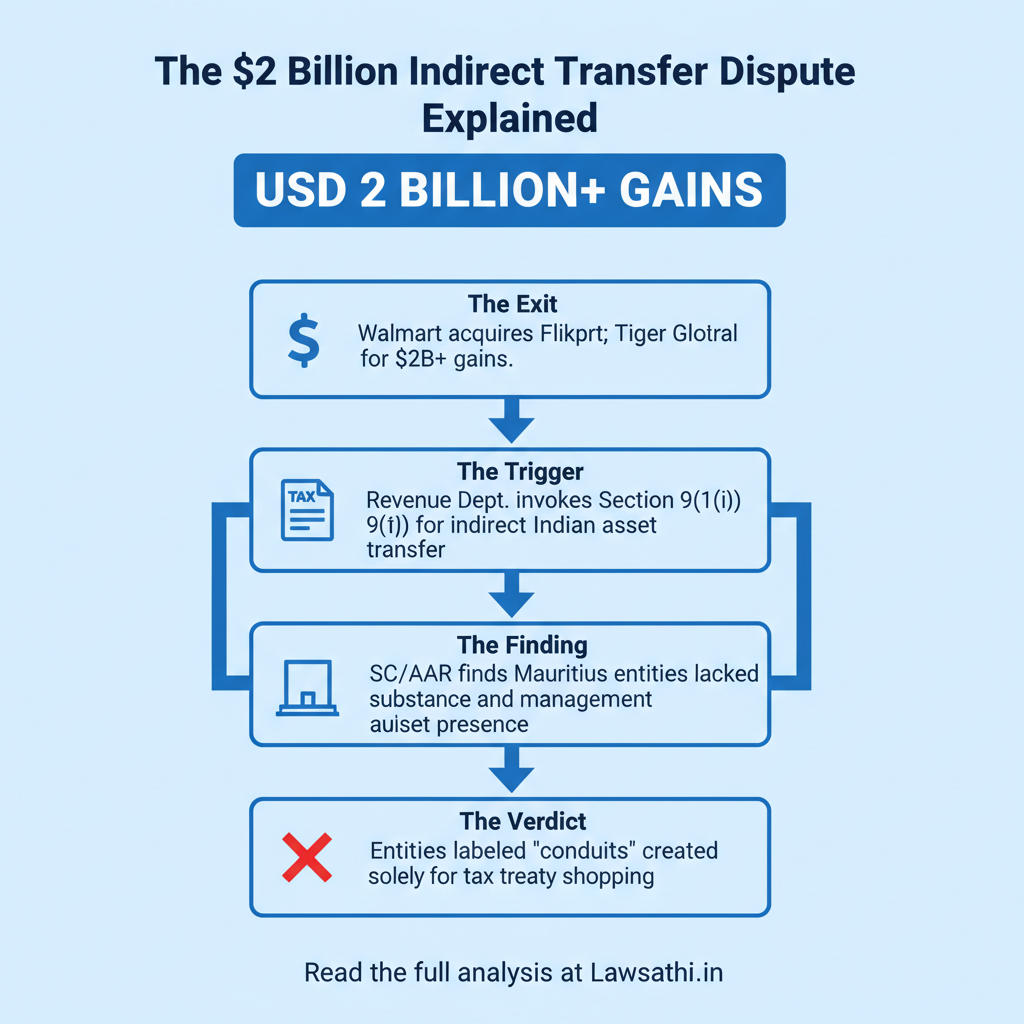

The dispute began with the massive 2018 Flipkart-Walmart deal. During this transaction, Walmart acquired a majority stake in Flipkart Singapore. Tiger Global’s Mauritius-based entities sold their shares in the Singapore entity. Consequently, they realized gains exceeding USD 2 billion.

The Trigger for Section 9(1)(i)

The Revenue Department invoked the Tiger Global indirect transfer case Supreme Court precedent. Specifically, they applied Section 9(1)(i) of the Income Tax Act. Although the shares belonged to a Singapore company, that company derived its “substantial value” from Indian operations. Thus, the transaction was an indirect transfer of Indian assets.

Originally, Tiger Global sought a “Nil withholding” certificate. However, the Authority for Advance Rulings (AAR) rejected this application in 2020. They found the Mauritius entities lacked commercial substance. Additionally, the AAR noted that US-based management effectively controlled these offshore units.

Why the AAR Denied Relief

The AAR concluded that the Mauritius companies were mere “conduit entities.” For example, these entities had no real management presence in Mauritius. Moreover, they were created solely to benefit from the India-Mauritius DTAA.

In fact, the Supreme Court eventually affirmed this stance. They ruled that these arrangements were designed for tax avoidance. Above all, they were not genuine business structures.

Crux of the Matter: GAAR Overriding DTAA Provisions

The central legal question involved the interaction between Section 90 and Section 95 of the Income Tax Act. Section 95 introduced GAAR to empower the Revenue to look past legal forms. Specifically, it allows authorities to identify the “substance” of a transaction.

Substance Over Form Doctrine

The court applied the “Substance over Form” doctrine with full force. It ruled that the commercial motive reveals the true nature of any deal. In this case, the Mauritius entities failed to demonstrate any independent business purpose. Therefore, their existence was deemed an “impermissible avoidance arrangement.”

The Limitation of Tax Residency Certificates (TRC)

Previously, a Tax Residency Certificate (TRC) was often seen as a “statutory shield.” However, the Supreme Court clarified that a TRC is not absolute. In fact, the Revenue can look behind the TRC “curtain.” This helps them find the “beneficial owner.”

Furthermore, treaty benefits will be denied if the entity is a conduit. Most importantly, Section 96(2) creates a statutory presumption. Once the Revenue establishes a prima facie case of avoidance, the burden shifts. Specifically, the taxpayer must prove that tax benefit was not the main objective. Tiger Global failed to meet this high evidentiary threshold.

Analyzing the ‘Grandfathering’ Clause Argument

Tiger Global relied heavily on the “grandfathering” clause in the 2016 India-Mauritius Protocol. They argued that their investments were made between 2011 and 2015. Consequently, they claimed these should be protected from GAAR under Rule 10U of the Income Tax Rules.

Why Grandfathering Failed

The court rejected this defense for two primary reasons. First, the specific arrangement for the sale to Walmart happened in 2018. This occurred well after the 2017 GAAR implementation date. Second, the court held that grandfathering does not protect “shams.”

Understanding Rule 10U Limits

In other words, Rule 10U protects legitimate investments but not illegal structures. If an arrangement is “impermissible” from the start, no clause can save it. Therefore, the timing of the exit structure became the deciding factor for the court.

Distinguishing Tax Planning from Evasion

The judgment clarifies the thin line between tax planning and evasion. Specifically, legitimate planning involves using legal provisions to reduce liability. In contrast, evasion involves creating artificial structures with no economic reality. The court noted that Tiger Global’s structure fell into the latter category.

Impact on International Tax Practice for Indian Lawyers

This ruling forces a massive shift in how lawyers advise corporate clients. We can no longer rely on simple offshore holding structures. Instead, clients must establish “Commercial Substance.” This must occur in jurisdictions like Mauritius or Singapore.

Necessary Steps for Establishing Substance

First, offshore SPVs must have a real operational footprint. This includes hiring local employees and maintaining physical offices. Second, local directors must make key management decisions. If all decisions come from the US or India, the Revenue will likely invoke GAAR.

Upholding Tax Sovereignty

Additionally, tax sovereignty must be respected as a core principle. Indian courts now prioritize taxing income where the economic activity actually occurs. As a result, we expect a significant spike in litigation regarding Special Purpose Vehicles (SPVs).

Revisiting Existing Structures

Lawyers should urgently review existing multi-layered structures. For example, check if your client’s offshore entity has its own bank accounts. Ensure the entity incurs significant local operational expenses. Most importantly, document the commercial reasons for holding assets through that specific jurisdiction.

Conclusion: A Modern Era of Tax Transparency

The Tiger Global indirect transfer case Supreme Court ruling marks the end of “treaty shopping” in India. By aligning with global OECD BEPS standards, the court has prioritized transparency. This decision ensures that India can tax gains derived from its own soil.

Tax practitioners must now adopt a “substance-first” approach. Documentation must reflect real business operations. Ultimately, the era of using shell companies as tax shields is over.

Stay ahead of landmark tax rulings and manage complex litigation flawlessly. Use LawSathi’s AI-powered research and case management tools to streamline your practice. Book a demo today.