The Indian insolvency landscape has faced significant shifts over the last few years. Recent judicial pronouncements have finally settled the debate regarding the Adjudicating Authority’s power. Consequently, we have seen a transition back to a rigid, creditor-friendly regime.

The Supreme Court has now solidified the concept of Mandatory Admission in CIRP. This applies specifically under the Insolvency and Bankruptcy Code (IBC). Therefore, the legal path for creditors is now clearer than ever before.

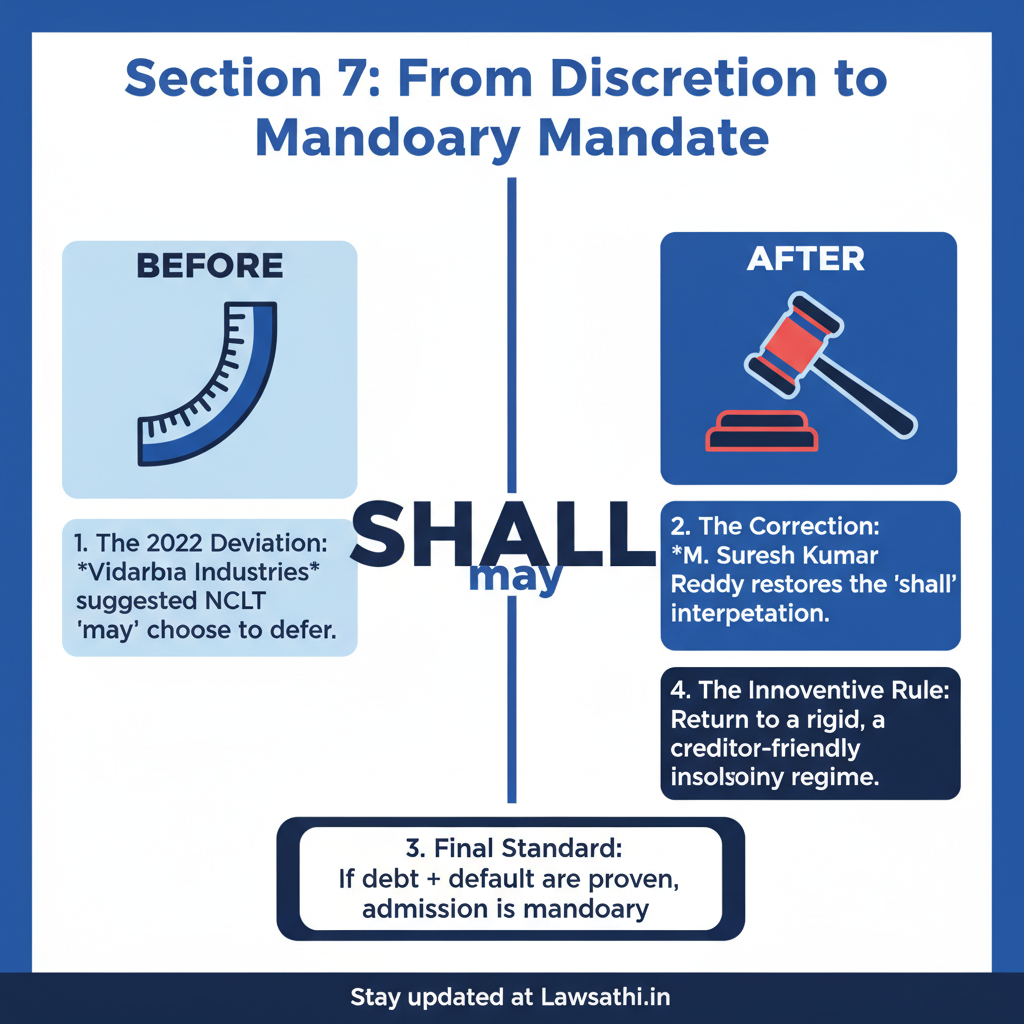

The Evolution of Section 7 Jurisprudence

Historically, the IBC operated as a discovery mechanism for default. However, the 2022 ruling in Vidarbha Industries vs. Axis Bank introduced unexpected friction. In that case, the Court suggested that NCLTs possessed discretionary power to defer applications. Specifically, this was based on the word “may” appearing in Section 7(5).

Defining the Current Legal Mandate

By 2024 and 2025, the judiciary corrected this trajectory. The landmark judgment in M. Suresh Kumar Reddy vs. Canara Bank re-established the original intent of the Code.

Therefore, the Mandatory Admission in CIRP is now the rule rather than the exception. If a debt exists and a default is proven, the NCLT must act. In other words, the court has little room for delay.

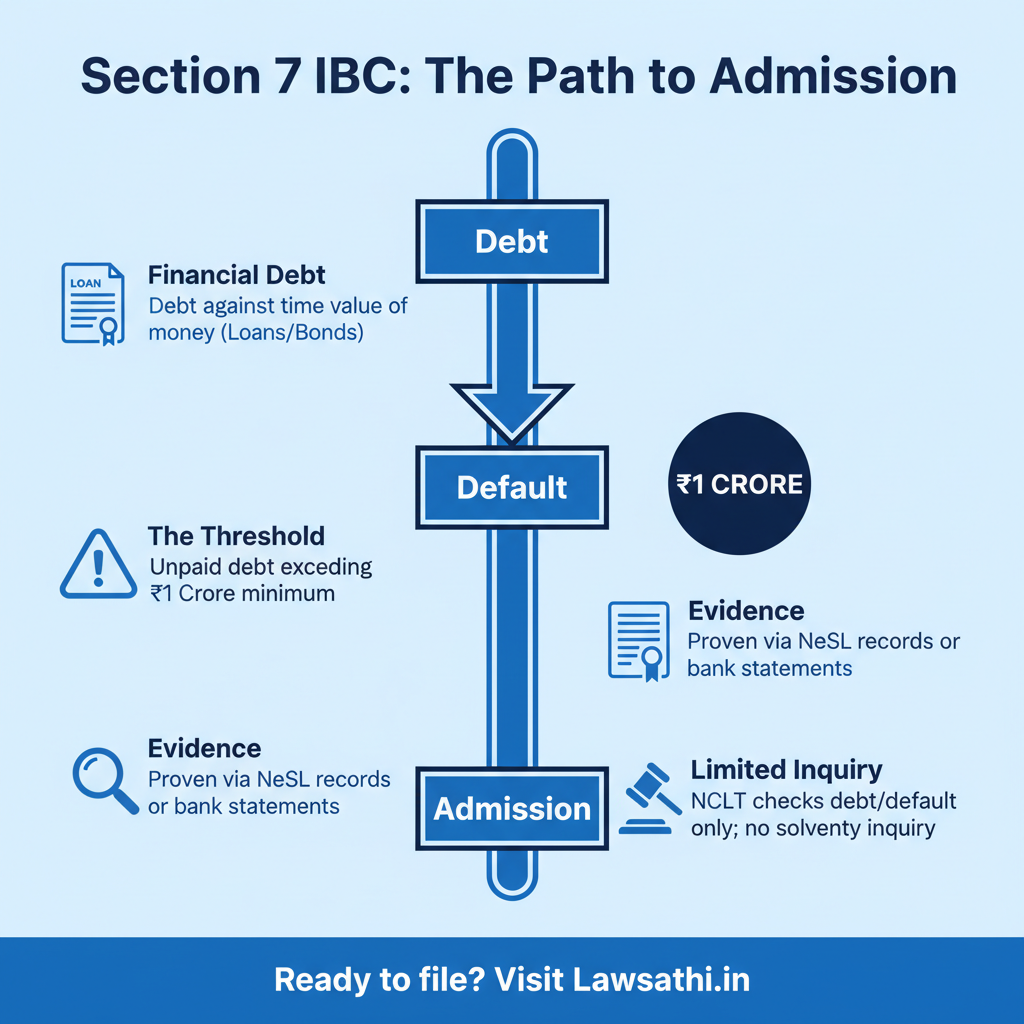

The Anatomy of Section 7: Financial Debt and Default

Section 7 of the IBC allows financial creditors to initiate the Corporate Insolvency Resolution Process (CIRP). To succeed, the creditor must demonstrate two primary elements. First, they must prove the existence of a “Financial Debt.” Second, they must provide evidence of a “Default.”

Understanding Financial Debt

Under Section 5(8), financial debt refers to money borrowed against the consideration for the time value of money. For example, this includes term loans, bonds, and credit facilities. Furthermore, the core of the relationship must be a purely financial transaction. This distinction is vital for a successful filing.

Identifying the Moment of Default

Default occurs when a debt becomes due and payable but remains unpaid. Currently, the threshold for initiating insolvency remains at ₹1 Crore.

Most importantly, even a partial default above this limit triggers the right to file. The NCLT’s role is strictly limited to verifying these facts. As a result, the process remains highly focused.

The Limited Scope of NCLT Inquiry

Furthermore, the Adjudicating Authority cannot act as a court of equity. They should not investigate the corporate debtor’s overall financial health. For instance, if the debt and default are established, the NCLT loses its discretionary power. Specifically, it cannot stay the proceedings simply because the debtor claims to be “solvent.”

Vidarbha Industries vs. Suresh Kumar Reddy: Resolving the Conflict

The legal community faced confusion for nearly two years following the Vidarbha verdict. Many practitioners argued that NCLTs could reject petitions if the debtor had pending receivables. However, recent clarifications have categorized Vidarbha as a fact-specific exception rather than a general rule.

How Suresh Kumar Reddy Changed the Game

The Supreme Court in M. Suresh Kumar Reddy clarified that Vidarbha did not dilute the mandate of Section 7. Instead, the “may” in the statute functions effectively as “shall” for financial creditors. Consequently, this prevents debtors from using litigation as a stalling tactic.

Why Precedents Now Point to Admission

As a result of these rulings, the “Innoventive Standard” has returned to the forefront. This standard dictates that the NCLT only needs to see a “complete application” and “proven default.” In fact, recent 2025 appellate rulings confirm that IBC is a complete code.

Moreover, High Courts are increasingly discouraged from interfering with these mandatory admissions. This ensures a faster judicial process for all parties.

Impact on Judicial Discretion

Additionally, this shift ensures that the NCLT does not become a forum for prolonged trials. The priority is the “time-bound” resolution of the stressed asset. Therefore, Mandatory Admission in CIRP provides the necessary legal certainty that investors and banks require.

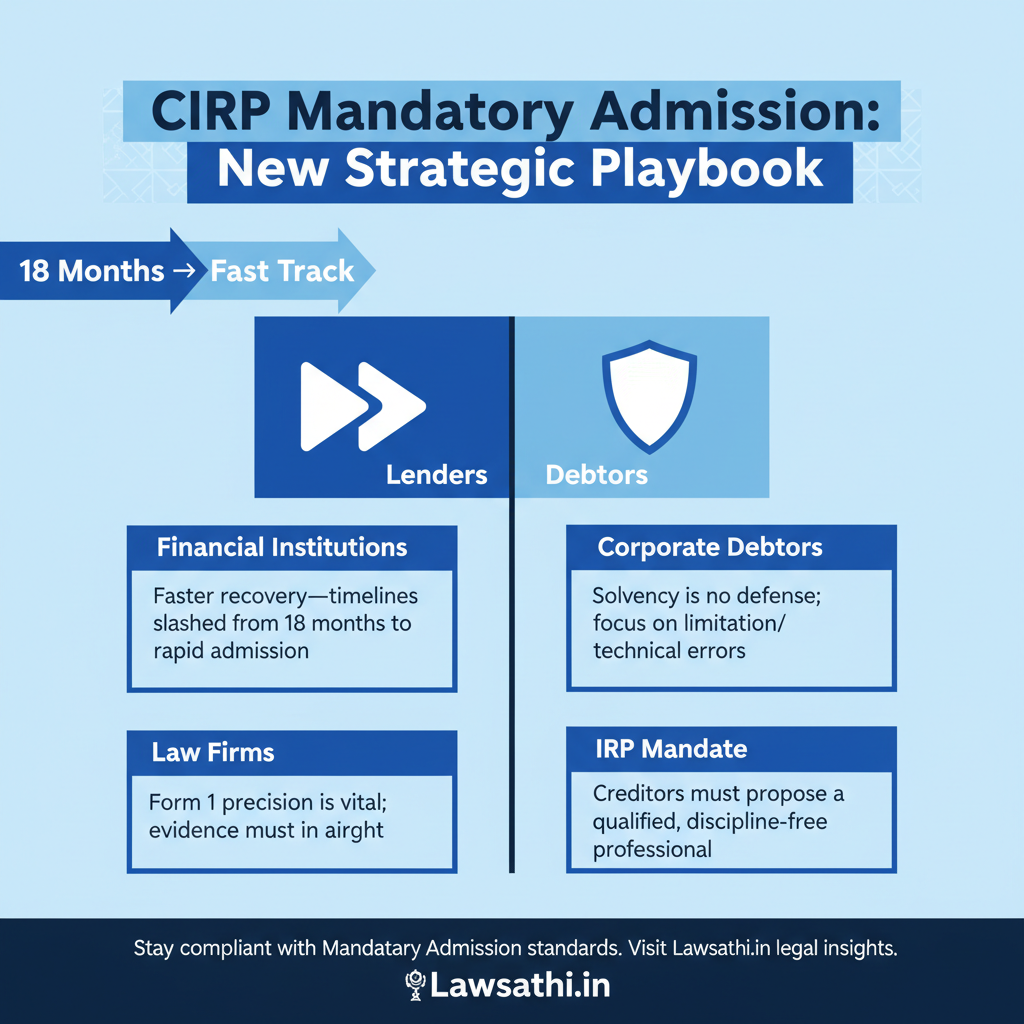

Impact on Financial Institutions and Law Firms

For Indian banks and NBFCs, this mandatory standard is a game-changer. It significantly streamlines the recovery process for high-value bad loans. Consequently, the “pre-admission” phase of litigation has seen a drastic reduction in timelines.

Strategic Shifts for Financial Creditors

Previously, litigation at the admission stage could drag on for 18 months. Now, with the revived focus on mandatory admission, cases are being admitted much faster. Therefore, financial institutions can move straight to the resolution or liquidation phase. Most importantly, this change preserves the value of the corporate debtor’s assets.

New Defense Strategies for Corporate Debtors

On the other hand, corporate debtors are shifting their defense strategies. Since “solvency” is no longer a valid shield, they often focus on technical non-compliance. For example, they may challenge the authorization of the bank’s signatory. Additionally, they often argue that the debt is barred by the Limitation Act.

Streamlining Legal Workflows

Furthermore, law firms must adapt to these faster timelines. Lawyers now need to ensure that evidence of default is airtight before filing. For example, bank statements and recall notices must precisely match the amounts claimed in Form 1. Consequently, this precision prevents unnecessary technical dismissals.

Procedural Nuances: What Adjudicating Authorities Must Check

While the admission is mandatory, the procedural requirements remain strict. The NCLT must ensure that the application is complete. Additionally, they must verify the existence of the default through authorized records.

The Role of Information Utilities (IU)

Information Utilities like NeSL play a vital role in providing a record of default. However, recent decisions, such as Assets Care & Reconstruction vs. Rajesh Buildspace, offer some flexibility. For example, the NCLT Mumbai held that IU certificates are not the only way to prove default.

Alternative Evidence for Default

Specifically, other reliable documents like loan agreements and audited balance sheets remain valid. Moreover, bank certificates under the Bankers’ Book Evidence Act are often sufficient. This ensures that creditors are not penalized for technical glitches in the IU system.

The Interim Resolution Professional (IRP) Mandate

Additionally, the creditor must propose a qualified IRP in their application. The NCLT checks if there are any disciplinary proceedings against the proposed professional. Once these boxes are checked, the Mandatory Admission in CIRP follows immediately.

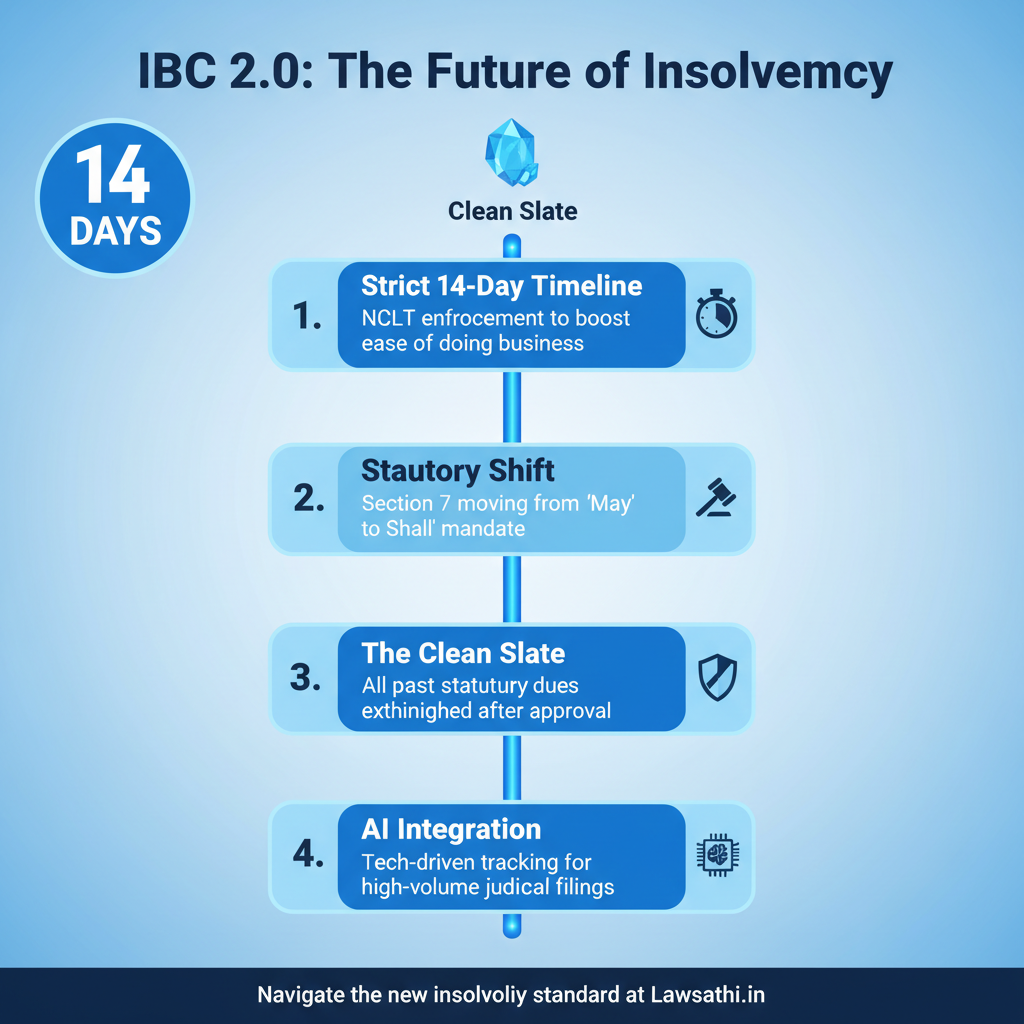

Future Outlook: Predictability in Indian Insolvency Jurisprudence

The move toward mandatory admission strengthens the “time-bound” objective of the IBC. By 2026, we expect the NCLTs to enforce the 14-day admission rule more strictly. Consequently, this will enhance India’s global ease of doing business rankings.

Anticipated Legislative Amendments

In fact, many experts anticipate future amendments to Section 7. The government may replace “may” with “shall.” Specifically, this would permanently align the statute with Supreme Court precedents. As a result, it would eliminate any remaining ambiguity in the law.

The Power of the Clean Slate Doctrine

Furthermore, once the CIRP is successfully admitted and a plan is approved, the “Clean Slate” doctrine applies. As affirmed in Vaibhav Goel vs. CIT (2025), all past statutory dues are extinguished. Therefore, this provides a fresh start for the company and its new resolution applicant.

Integration of Legal Technology

Finally, the role of AI and practice management software is becoming essential. These tools help lawyers manage high-volume IBC filings efficiently. They allow teams to track these rapid judicial developments in real-time.

Managing complex insolvency cases requires precision and speed. Use LawSathi’s AI-powered practice management to streamline your IBC filings and keep track of evolving precedents. Simplify your legal workflow today.