Introduction: A Watershed Moment for International Tax Law in India

On January 15, 2026, the Supreme Court of India delivered a landmark judgment. This decision fundamentally reshapes cross-border taxation. The Supreme Court Tiger Global GAAR ruling dismissed appeals by Tiger Global entities. They had sought capital gains tax exemption under the India-Mauritius tax treaty. This decision marks the first major application of the General Anti-Avoidance Rule (GAAR) by the apex court.

The transaction involved shares worth over USD 2 billion in the Flipkart-Walmart deal. The Court held that the arrangement was “designed with the sole intent of evading tax” [^1]. Consequently, this judgment establishes a decisive precedent against treaty shopping through Mauritius entities.

Significance for Legal Practitioners

For Indian lawyers advising foreign investors, this ruling carries profound implications. The Court unequivocally held that Tax Residency Certificates (TRCs) alone cannot guarantee treaty benefits. Therefore, tax authorities can now examine the underlying commercial substance of any investment structure.

Furthermore, the judgment clarifies the boundaries between legitimate tax planning and impermissible tax avoidance. This distinction will guide future cross-border transactions and litigation strategies.

Case Background: The Tiger Global Structure and Tax Assessment

The Investment Structure

Three Mauritius-registered entities formed the core of Tiger Global’s investment structure. Specifically, these were Tiger Global International II Holdings, III Holdings, and IV Holdings. Each entity held a Category I Global Business Licence under Mauritius law [^2].

The entities possessed valid Tax Residency Certificates from the Mauritius Revenue Authority. Their boards comprised Mauritian resident directors along with one non-resident director. Additionally, they maintained office premises, bank accounts, and accounting records in Mauritius.

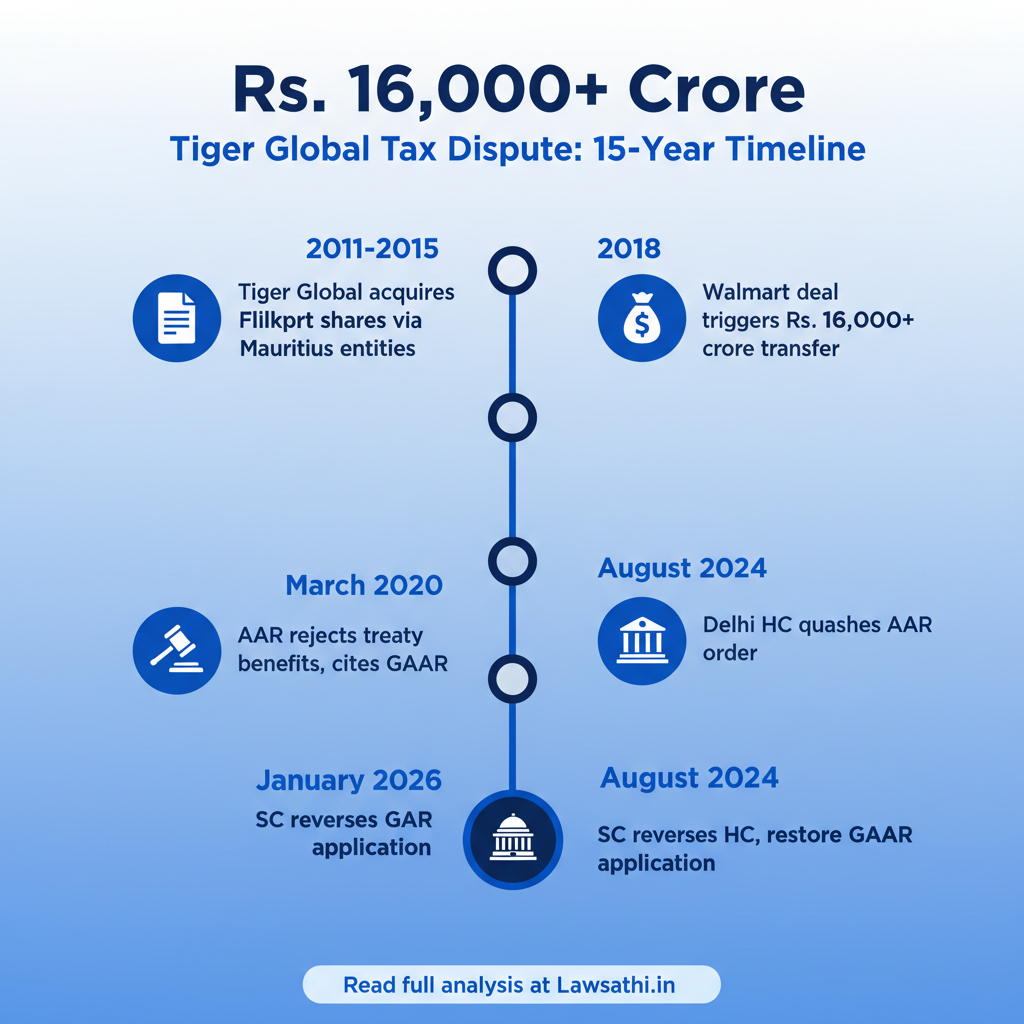

Timeline of the Dispute

Between 2011 and 2015, these entities acquired shares in Flipkart Private Limited, Singapore. In 2018, they transferred these shares to Fit Holdings S.A.R.L. (Luxembourg). This transfer occurred as part of Walmart’s acquisition of Flipkart.

Before the transaction, Tiger Global applied under Section 197 for nil withholding certificates. However, the Revenue Department rejected these applications. Subsequently, Tiger Global approached the Authority for Advance Rulings (AAR) under Section 245-Q(1) [^3].

The AAR and High Court Proceedings

On March 26, 2020, the AAR rejected Tiger Global’s applications citing GAAR. It found that the entities lacked commercial substance. Therefore, the AAR held that the structure was designed primarily to obtain treaty benefits.

However, on August 28, 2024, the Delhi High Court quashed the AAR’s order. It allowed Tiger Global’s writ petitions. The High Court took a more favourable view of the commercial substance present in the structure.

Supreme Court’s Final Decision

On January 15, 2026, the Supreme Court reversed the High Court’s decision. It restored the AAR’s ruling. The Court found that Tiger Global entities were “conduit entities” functioning as mere pass-through vehicles [^4].

The transaction value exceeded Rs. 16,000 crores. Therefore, the tax implications were substantial. The Court’s reasoning provides crucial guidance for similar structures.

The Legal Framework: Understanding GAAR and the DTAA

GAAR Provisions Under the Income Tax Act

The General Anti-Avoidance Rule came into effect on April 1, 2017. Chapter X-A of the Income Tax Act, 1961 contains these provisions. Section 95 empowers tax authorities to declare an arrangement as an “impermissible avoidance arrangement” [^5].

Section 96(1) defines such arrangements comprehensively. An arrangement becomes impermissible if its main purpose is obtaining a tax benefit. Additionally, it must meet certain conditions. These include creating rights not at arm’s length, misusing the Act, lacking commercial substance, or lacking bona fide purpose.

The Rebuttable Presumption

Section 96(2) creates a critical rebuttable presumption. If any step in an arrangement has tax benefit as its main purpose, the entire arrangement is presumed to have that purpose. Consequently, the burden shifts to the taxpayer to prove otherwise [^6].

This reversal of burden significantly strengthens the Revenue’s position. Therefore, taxpayers must now affirmatively demonstrate commercial substance.

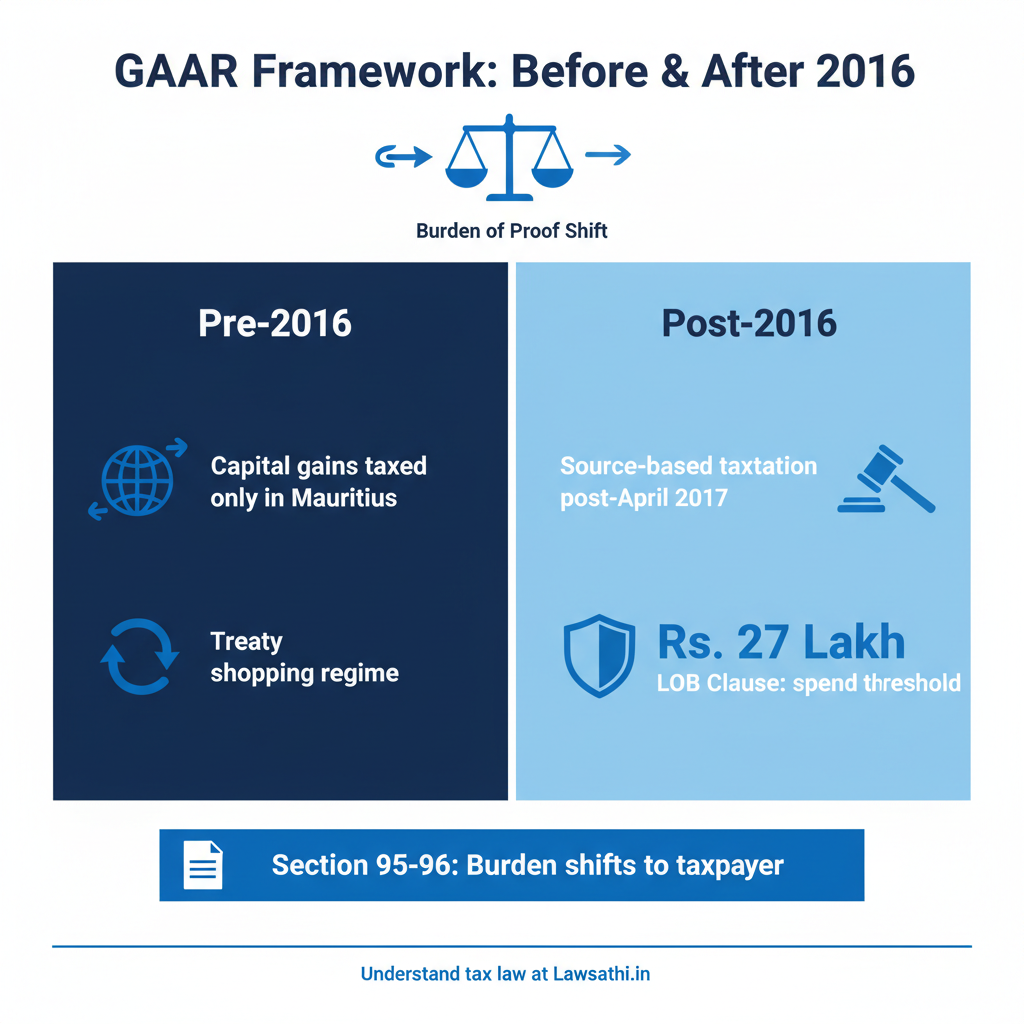

India-Mauritius DTAA Framework

Before the 2016 Protocol, Article 13(4) of the DTAA provided significant tax advantages. Capital gains were taxable only in the residence state—Mauritius. As a result, this created the famous “Mauritius Route” for tax-neutral investments into India [^7].

The 2016 Protocol fundamentally changed this landscape. For shares acquired on or after April 1, 2017, India gained source-based taxation rights. A transition period with 50% tax rate reduction applied until March 31, 2019.

Limitation of Benefits Clause

Article 27A introduced the Limitation of Benefits (LOB) clause. This clause targets shell or conduit companies. Specifically, an entity is deemed a shell company if its operational expenditure falls below certain thresholds [^8].

The expenditure threshold is Mauritian Rs. 1,500,000 or Indian Rs. 2,700,000. Companies failing this test cannot claim treaty benefits. However, an exception exists if they are listed on a recognized stock exchange.

Supreme Court’s Rationale: “Substance Over Form”

Commercial Substance Analysis

The Court affirmed that Tiger Global entities were “see-through entities” acting as conduits. Despite having Mauritian directors and physical offices, the actual control lay elsewhere. Investment advisory and portfolio management services came from Tiger Global Management LLC in the USA [^9].

The Court observed that Mauritian boards merely provided “final approval.” The real decision-making occurred outside Mauritius. Therefore, the ‘head and brain’ of the companies was not in Mauritius.

TRC Is Not Conclusive Proof

This represents a significant departure from earlier jurisprudence. The Court held that “TRC alone is not sufficient to avail the benefits under the tax treaty.” In effect, this overruled the Azadi Bachao Andolan (2003) precedent [^10].

The Court cited Section 90(4) of the Income Tax Act. This provision empowers tax authorities to examine beneficial ownership beyond the TRC. Consequently, foreign investors can no longer rely solely on TRCs as shields.

The Double Non-Taxation Problem

The Court noted a striking feature of Tiger Global’s position. The entities sought exemption from Indian tax under the DTAA. Simultaneously, they contended the transaction was also exempt under Mauritian law.

The Court found this problematic. It observed that this “is contrary to the spirit of the DTAA” [^11]. Furthermore, it presents a strong case for the Revenue to deny the benefit. Tax treaties aim to prevent double taxation, not facilitate double non-taxation.

Tax Planning Versus Tax Evasion

Justice Pardiwala articulated a critical distinction in the judgment. Tax planning is permissible when it uses legal mechanisms in conformity with statutory parameters. However, once the mechanism is found to be illegal or sham, it ceases to be permissible avoidance.

Instead, it becomes impermissible avoidance or outright evasion. The Court relied on the McDowell & Company Ltd v. Commercial Tax Officer (1985) Constitution Bench ruling [^12]. That judgment held that colorable devices cannot form part of legitimate tax planning.

Holistic Examination Principle

The Court emphasized that transactions must be examined holistically. The entire sequence—from acquisition to sale—must be considered together. In other words, a dissecting approach that examines only the sale portion is impermissible.

Since the transfer proposal arose in May 2018, the post-April 2017 regime applied squarely. Therefore, the timing of the original investment (2011-2015) was irrelevant.

Implications for FPIs and Foreign Investors

End of the Treaty Shopping Era

The Supreme Court Tiger Global GAAR ruling effectively ends the Mauritius Route as a tax-neutral pathway. Foreign investors can no longer rely on formal compliance alone. Instead, tax authorities will examine the underlying reality of investment structures [^13].

TRCs do not provide immunity from scrutiny. Entities must demonstrate genuine economic presence in the treaty jurisdiction. Moreover, GAAR can override treaty benefits if arrangements lack commercial substance.

Enhanced Compliance Requirements

Foreign investors must now ensure robust compliance frameworks. The following table summarizes key requirements:

| Requirement | What It Means | |————-|—————| | Commercial substance | Genuine business operations in treaty jurisdiction | | Place of Effective Management | Key decisions must occur in the claiming jurisdiction | | Beneficial ownership | Real and continuous business activities required | | Documentation | Board meetings, decision trails, employee records essential |

LOB Compliance Obligations

Under the amended India-Mauritius DTAA, investors must meet specific expenditure thresholds. The minimum operational expenditure is Rs. 2,700,000 (Indian) or Mauritian Rs. 1,500,000 [^14].

Additionally, entities must pass the main purpose test. The arrangement should not have obtaining treaty benefits as its primary objective. Shell company presumptions can be rebutted only with evidence of genuine operations.

Impact on Investment Flows

Expert commentary suggests short-term uncertainty for existing structures. Many Foreign Portfolio Investors (FPIs) may need to restructure their investment vehicles [^15].

Some investors might shift towards direct investment routes. Others may establish structures with genuine commercial presence. Furthermore, the ruling may also influence India’s treaty negotiations with other jurisdictions.

Retroactive Application Concerns

The Court’s approach to timing raises important questions. It applied the post-April 2017 regime based on when the transfer occurred. Therefore, the original investment date was not determinative [^16].

This principle may affect other pending disputes. Investors who acquired shares before 2017 but sold afterward face similar scrutiny.

Practical Advice for Legal Practitioners and Tax Advisors

Auditing Existing Structures

Legal practitioners should immediately audit clients’ existing investment structures. The audit must examine commercial substance compliance comprehensively. Key areas include board composition, decision-making processes, and employee presence [^17].

Furthermore, advisors should assess POEM risk carefully. Where are key management and commercial decisions actually made? Documentation must support the claimed jurisdiction of residence.

Restructuring Considerations

For structures lacking adequate substance, restructuring may be necessary. However, restructuring itself requires careful planning. The following factors deserve attention:

Board composition should include majority independent directors resident in the jurisdiction. Board meetings must occur in the jurisdiction with documented genuine deliberations. Additionally, a meaningful workforce with decision-making authority should be based locally.

Moreover, operational expenditure must meet LOB thresholds. Investment analysis and approval processes should demonstrably occur within the jurisdiction.

POEM Compliance Framework

The Place of Effective Management (POEM) test requires careful navigation. CBDT Circular 6/2017 and Circular 25/2017 provide guiding principles [^18].

For companies engaged in active business outside India, a presumption operates. If majority board meetings occur outside India, POEM is presumed to be outside India. However, the Active Business Outside India (ABOI) test has specific criteria.

Passive income must not exceed 50% of total income. Less than 50% of assets should be situated in India. Similarly, the same threshold applies to employees and payroll expenses.

Litigation Strategy for Pending Disputes

For clients with pending disputes involving treaty shopping allegations, comprehensive documentation is essential. First, compile evidence of commercial operations, employees, and expenditure. Second, document the decision-making trail through board minutes and deliberations.

Third, demonstrate beneficial ownership through real economic activity, not just legal form. Finally, carefully analyze timelines—when investments were made versus when transfers occurred [^19].

Documenting Commercial Substance: A Checklist

Legal practitioners should ensure clients maintain the following documentation:

– Physical office premises with meaningful operations – Employees with decision-making authority based in jurisdiction – Board meetings held in jurisdiction with documented deliberations – Operational expenditure meeting LOB thresholds – Active bank accounts with genuine transactions – Engagement of local professional advisors – Documented investment analysis with commercial rationale

Conclusion: Navigating the New Normal in Cross-Border Taxation

The Supreme Court Tiger Global GAAR ruling delivers an unambiguous message. Tax benefits must follow commercial substance. Form cannot override reality in determining tax liability [^20].

Core Principles Established

The judgment establishes several fundamental principles for Indian taxation. First, tax treaties exist to prevent double taxation, not facilitate non-taxation. Second, GAAR operates as a potent tool to pierce artificial structures. Third, TRCs are not conclusive—authorities can examine underlying substance.

India’s Maturing Tax Framework

This ruling represents India’s maturing international tax framework. It aligns with OECD’s Base Erosion and Profit Shifting (BEPS) principles. Consequently, both legislative and judicial approaches now demonstrate intolerance for tax avoidance schemes.

Looking Ahead

The CBDT may issue clarificatory circulars following this judgment. SEBI has already enhanced FPI beneficial ownership disclosure requirements [^21]. Additionally, India may seek stronger LOB provisions in other tax treaties. Lower courts will apply these principles to pending cases.

For legal practitioners, the focus must fundamentally shift. Form-based structuring is no longer sufficient. Instead, substance-based compliance is the new imperative. Foreign investors must demonstrate genuine economic presence to claim treaty benefits.

Stay ahead of critical legal developments. Use LawSathi’s AI-powered case law research tools to analyze the impact of GAAR judgments on your clients. Start your free trial today.