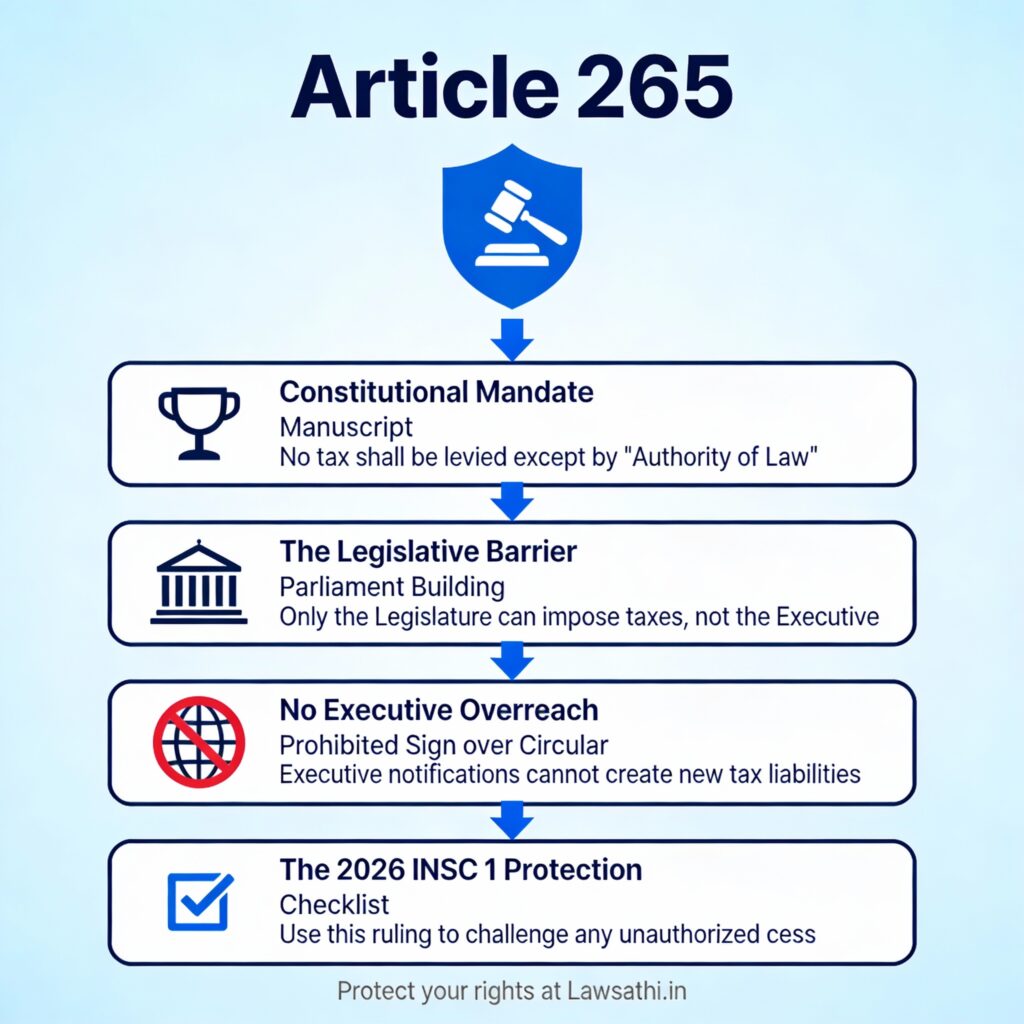

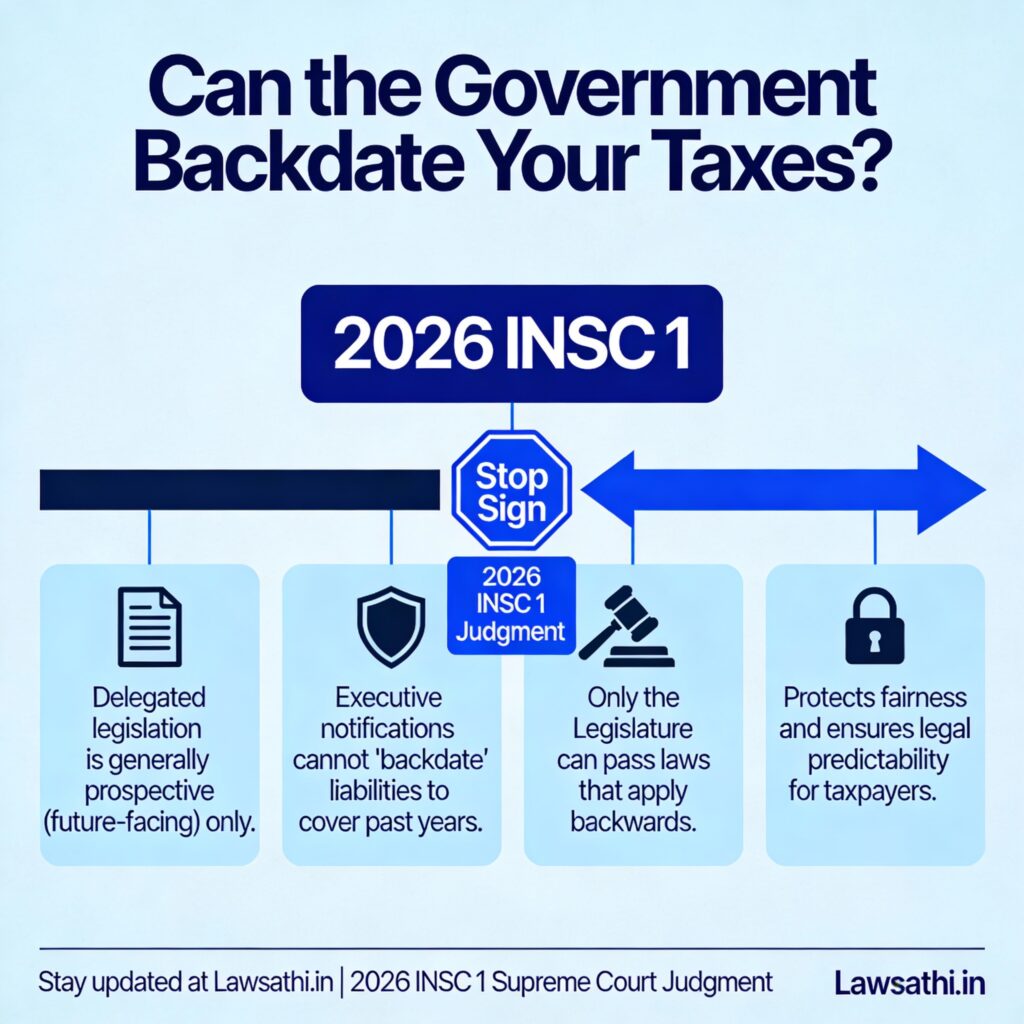

Does the executive branch have the power to create new tax liabilities through simple notifications? The Supreme Court recently answered this critical question with a resounding “No.” In the landmark 2026 INSC 1 Supreme Court Judgment, the bench clarified the boundaries of fiscal authority. This decision reinforces the constitutional mandate that only Parliament or State Legislatures can impose financial burdens on citizens.

Therefore, this ruling serves as a vital shield against executive overreach. It ensures that taxpayers remain protected from sudden, retroactive demands that lack a statutory basis. In this blog, we will analyze why this judgment is a cornerstone for Indian tax jurisprudence in 2026.

Introduction: The Landmark Ruling in 2026 INSC 1

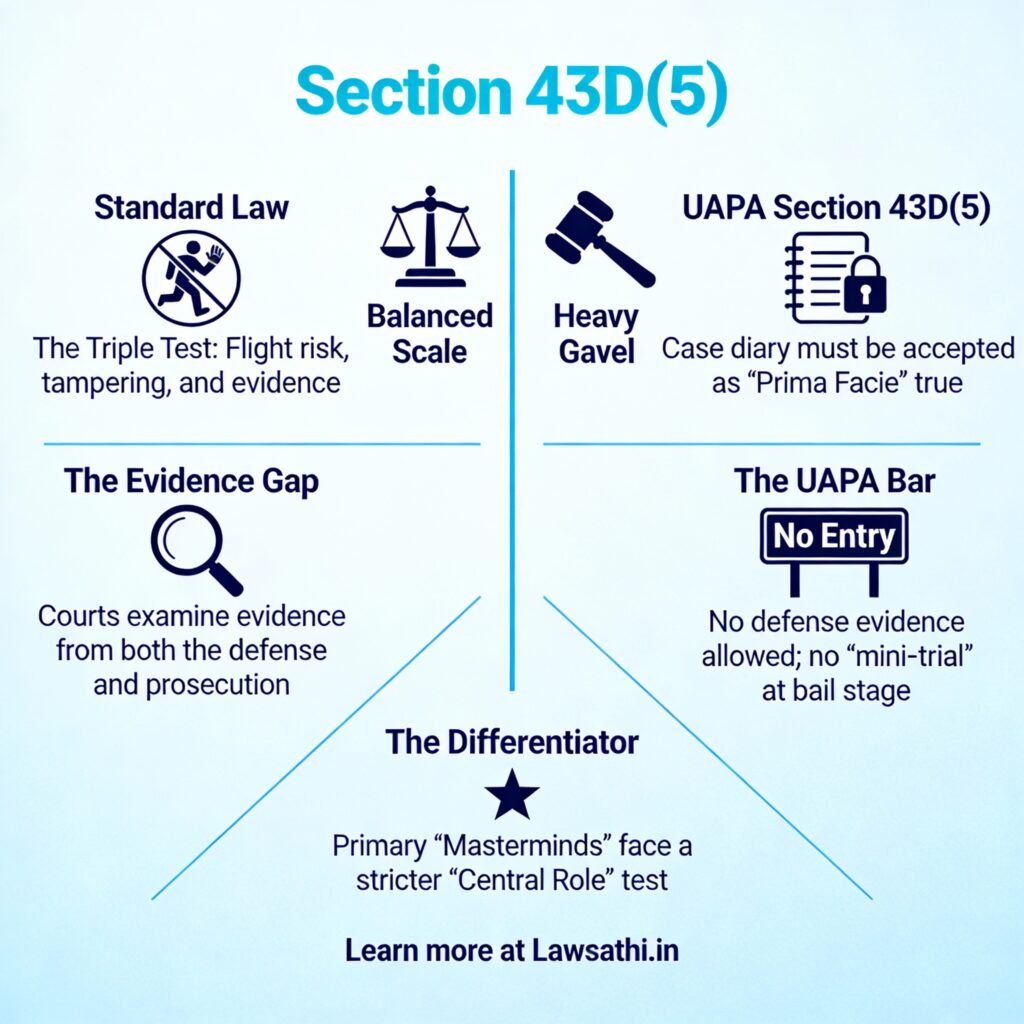

The 2026 INSC 1 Supreme Court Judgment has set a powerful precedent regarding the “authority of law.” Specifically, the Court addressed whether an executive body can retain a levy that was never formally sanctioned by the legislature. The core principle stems from Article 265 of the Constitution of India.

Protecting the Rule of Law

In fact, the Court emphasized that “no tax shall be levied or collected except by authority of law.” This means that even a well-intentioned administrative fee can be struck down if it acts like a tax in disguise. Furthermore, the 2026 INSC 1 citation is now the primary reference point for challenging unauthorized cess.

Curbing Executive Overreach

Additionally, the judgment highlights the rising tension between delegated legislation and legislative mandates. Many regulatory bodies often issue “clarificatory” notifications. However, these notifications sometimes cross the line into creating new fiscal obligations. Consequently, the Supreme Court has now strictly limited such practices.

Factual Matrix: The Dispute Leading to the SC Intervention

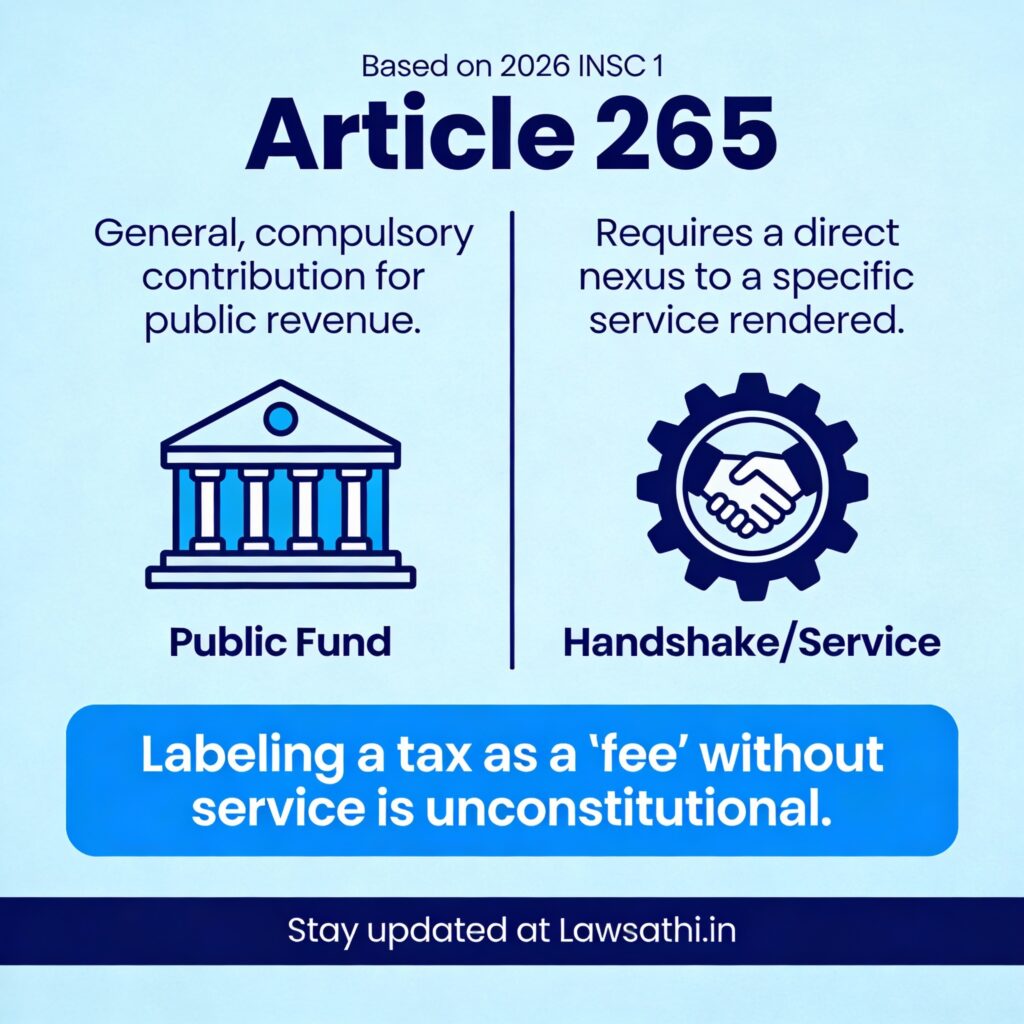

The dispute began when a regulatory body issued a notification to impose a “service cess” on specific transactions. Initially, the executive justified this levy as a means to cover “administrative costs.” However, the notification was not backed by any specific amendment to the parent Tax Act.

Challenges in the Lower Courts

Initially, the High Court viewed this collection as a permissible regulatory “fee.” For example, the State argued that the funds were necessary for public infrastructure. Nevertheless, aggrieved taxpayers challenged this. They argued that the levy was a compulsory exaction.

Why the Supreme Court Intervened

Eventually, the case reached the apex court as a matter of constitutional importance. The Supreme Court observed that the executive could not justify the retention of these funds. Most importantly, the State tried to claim “unjust enrichment” by the taxpayers.

As a result, the Court rejected this claim. Instead, it focused on the lack of legislative sanction for the collection. Therefore, the absence of a formal law rendered the collection invalid.

Article 265 and the Doctrine of Constitutional Legality

Article 265 is the bedrock of Indian tax law. It prohibits any tax collection that does not have a clear legislative “law” behind it. In the 2026 INSC 1 Supreme Court Judgment, the bench interpreted “law” strictly. It excludes mere executive orders or departmental circulars.

Legislative Authority vs. Executive Orders

First, the Court noted that taxation is an inherent function of the legislature. Second, the executive branch only has the power to implement what the legislature has passed. Therefore, bypassing the Parliament to create fiscal liabilities violates the Separation of Powers.

The Distinction Between Tax and Fee

To illustrate, a “fee” requires a specific service to be rendered to the payer. In contrast, a “tax” is a general contribution to public revenue. Because the disputed levy had no direct nexus to a service, the Court declared it a tax. Since no statute authorized this specific tax, it was declared unconstitutional.

The Prohibition of Retrospective Taxation by Executive Fiat

One of the most significant aspects of the 2026 INSC 1 Supreme Court Judgment is its stance on retroactivity. Taxpayers often arrange their business affairs based on current laws. Consequently, sudden retrospective taxes can cause immense financial distress.

Vested Rights and Legal Certainty

Specifically, the Court ruled that only a “Sovereign Legislature” can pass laws that apply backwards in time. Even then, the intent must be expressed clearly in the statute itself. In this case, the executive tried to “backdate” a notification to cover past years.

Limits of Delegated Legislation

However, delegated legislation is generally prospective in nature. As a result, rules or notifications cannot create tax liabilities for periods before they were issued. This aligns with earlier principles seen in CIT v. Vatika Township.

It ensures that “Vested Rights” of taxpayers are not taken away arbitrarily. Furthermore, any retrospective application must pass the test of “Fairness.” In 2026 INSC 1, the Court found the executive action both arbitrary and burdensome.

Most importantly, it protected taxpayers who had already completed their fiscal cycles under old rules. Consequently, the judgment reinforces the need for legal predictability in a modern economy.

Key Takeaways for Indian Lawyers and Tax Practitioners

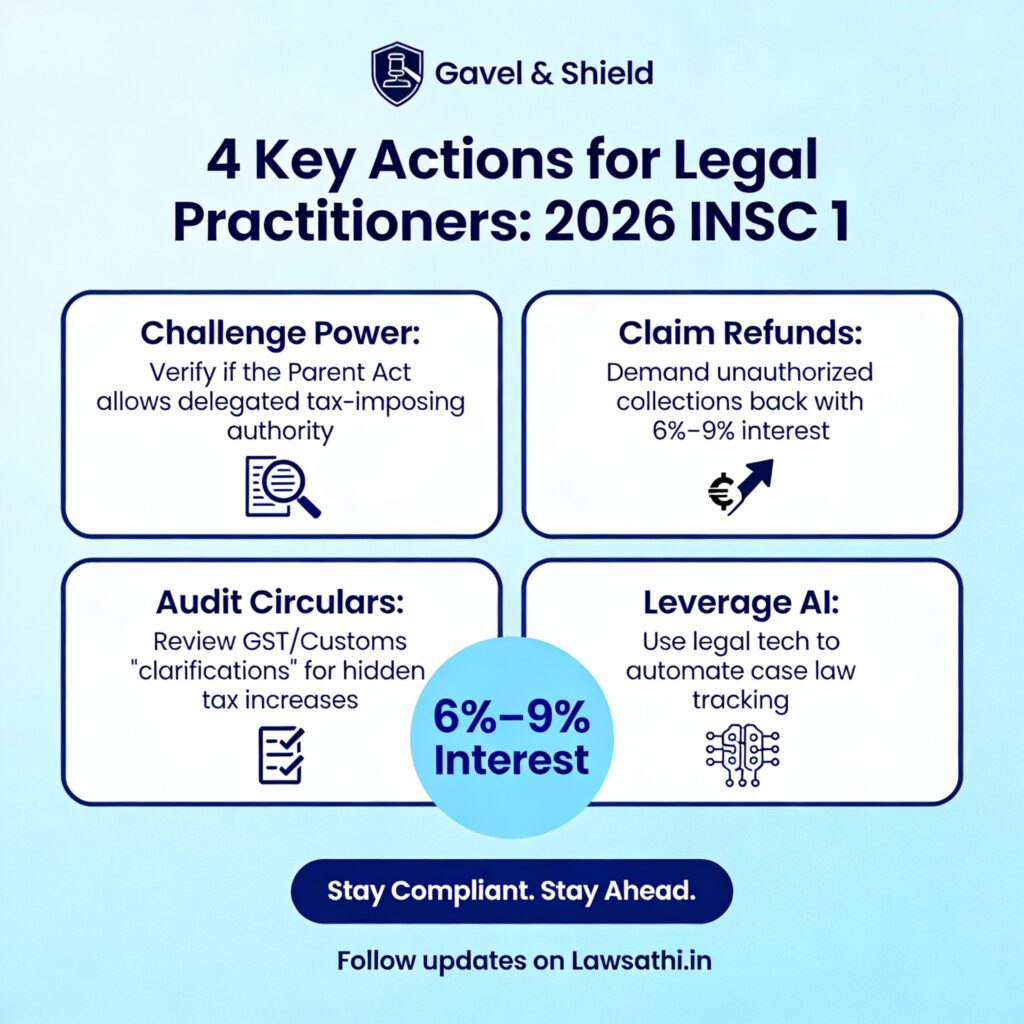

For legal practitioners, this judgment is an essential tool for pending tax litigation. It provides strong grounds to challenge any unauthorized cess or surcharge. If a notification lacks primary legislative backing, it is now highly vulnerable to a writ petition.

Grounds for Challenging Notifications

First, identify if a circular creates a new liability. Second, check if the parent Act allows such a power to be delegated. If not, the notification can be challenged based on the 2026 INSC 1 ruling.

Directives on Refunds and Interest

Additionally, the Court gave a clear mandate on refunds. It ordered that any unauthorizedly collected amount must be returned with interest. This interest typically ranges between 6% and 9%. As a result, the State can no longer hide behind technicalities to keep illegal levies.

Impact on Indirect Tax Practice

Furthermore, this judgment affects GST and Customs practitioners. Many departmental circulars often attempt to “clarify” tax rates in a way that increases the burden. Following this judgment, attorneys can argue that such “clarifications” must only be prospective. Specifically, practitioners should review all recent notifications for potential overreach.

The Role of AI Legal Tech in Tracking Complex Tax Precedents

Staying updated with the 2026 INSC 1 Supreme Court Judgment is just the beginning. The Supreme Court releases thousands of orders every year. Consequently, searching for “Neutral Citations” like 2026 INSC 1 manually can be exhausting for busy lawyers.

Simplifying Case Law Research

Modern tools like LawSathi use AI to simplify this process. For example, our AI research engine can instantly link 2026 INSC 1 to older foundational cases. This includes links to Article 265 interpretations and past retrospective tax rulings.

Automating Legal Updates

Additionally, firms specializing in tax law can set automated alerts. This ensures you never miss a departmental appeal or a new clarification from the apex court. Specifically, LawSathi’s platform helps you summarize 100-page judgments into actionable points for your clients.

Enhancing Firm Efficiency

Finally, using AI-powered tech allows you to focus on strategy rather than transcript searching. Whether you are handling a reopening of assessment or a dispute over a “fee,” quick access to 2026 INSC 1 is vital. Therefore, adopting technology is no longer optional for successful firms.

Conclusion: A Victory for Constitutional Governance

The 2026 INSC 1 Supreme Court Judgment reasserts that the Constitution is the supreme law of the land. By striking down an unauthorized levy, the Court has highlighted that executive convenience cannot override taxpayer rights. This decision brings much-needed legal certainty to the Indian fiscal landscape.

In summary, the judgment ensures that Article 265 remains a living safeguard. It prevents the state from collecting money without a clear, legislative mandate. For lawyers, this is a powerful reminder that every tax demand must be measured against the strict yardstick of constitutional legality.

Stay ahead of landmark judgments like 2026 INSC 1. Modernize your firm’s research and case management with LawSathi’s AI-powered platform. Book a demo today.