Drafting a Gift Deed of immovable property in India requires more than just templates. Specifically, it demands a deep understanding of the Transfer of Property Act and the Registration Act. Consequently, even a minor clerical error can trigger decades of litigation for your clients.

In this guide, we provide a practitioner’s checklist. This list ensures your drafts remain legally airtight. We will analyze mandatory registration, tax implications, and recent judicial trends. Therefore, you can protect your client’s interests while streamlining your firm’s output.

Introduction: The Nuances of Gratuitous Transfers in Indian Law

A gift is a unique legal instrument. According to Section 122 of the Transfer of Property Act, 1882, it is a voluntary transfer. Furthermore, the donor must provide the property without any monetary consideration.

Understanding Gratuitous Intent

First, the transfer must be entirely “gratuitous” to qualify as a gift. If you include any form of payment, the court may reclassify it as a sale. Second, the intention of the donor is paramount. For example, recent judgments like N.P. Saseendran v. N.P. Ponnamma emphasize distinguishing between gifts and Wills.

Why Drafting Precision Matters

A poorly drafted deed often leads to disputes among legal heirs. Therefore, you must clarify that the transfer happens “in praesenti” or at present. If the deed suggests the title transfers only after death, it may be treated as a Will. Above all, this distinction is critical for compliance. Specifically, Wills do not require registration, but gifts do.

The 5 Essential Elements of a Valid Gift Deed

To create a valid Gift Deed of immovable property in India, you must fulfill five specific criteria. First, the parties must have legal capacity. The donor must be of sound mind. Moreover, they must be competent to contract. While a minor cannot be a donor, they can be a donee through a guardian.

Subject Matter and Lack of Consideration

Additionally, the gift must involve “existing” property. Under Section 124 of the TPA, a gift of future property is void. Therefore, ensure the property description matches the current title deeds perfectly. Most importantly, the recital should explicitly mention “love and affection.” This identifies the primary motivation for the transfer.

The Necessity of Acceptance

Acceptance is a non-negotiable requirement for a valid gift. Specifically, the donee must accept the gift during the donor’s lifetime. If the donee dies before acceptance, the gift becomes void. According to the Supreme Court in Daulat Singh v. State of Rajasthan, acceptance can be implied. For example, the donee taking possession of the original title deed often proves acceptance.

Mandatory Registration and Documentation Checklist

In India, an oral gift of land is not legally valid. According to Section 17 of the Registration Act, 1908, all gifts of immovable property must be registered. This rule applies regardless of the property’s value.

The Role of Attesting Witnesses

Furthermore, the instrument requires proper attestation. At least two witnesses must sign the deed. They must observe the donor signing the document in person. Without this, the sub-registrar will reject the registration. Consequently, you should keep digital records of witness IDs to avoid future verification hurdles.

Essential Documentation for the Sub-Registrar

Practitioners should gather a complete document set before visiting the registrar. This includes original title deeds and a fresh Encumbrance Certificate (EC). Moreover, you need PAN cards and Aadhaar details for all parties. Finally, obtain a Property Valuation Report. This report helps in calculating the correct stamp duty and registration fees.

Stamp Duty and Tax Implications for Legal Practitioners

Stamp duty varies significantly across Indian states. For instance, Maharashtra offers nominal rates for gifts to close relatives. This applies specifically to spouses or children. Similarly, Jammu & Kashmir recently exempted stamp duty for transfers between blood relatives. These changes help simplify wealth transitions.

Navigating Income Tax Act Section 56(2)(x)

Lawyers must also advise clients on the Income Tax Act, Section 56(2)(x). Generally, gifts from defined “relatives” are tax-exempt for the receiver. However, a non-relative may receive property worth over ₹50,000. In this case, it is taxed as “Income from Other Sources.”

Valuation and Capital Assets

For example, the ITAT Mumbai recently ruled on these rules. Specifically, they apply mainly to capital assets. If the property is held as stock-in-trade, different rules may apply. Therefore, always check the client’s financial standing before finalizing the deed. This prevents unexpected tax liabilities from ruining a family settlement.

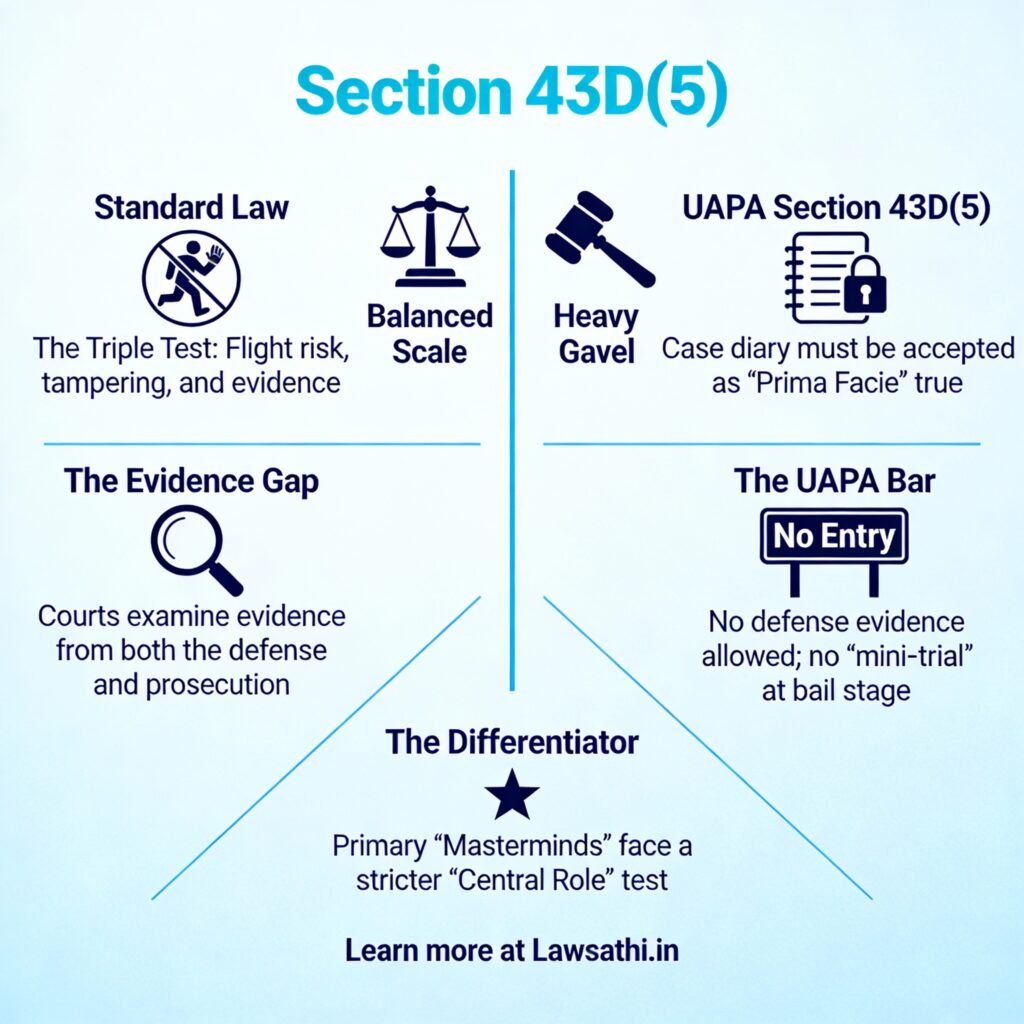

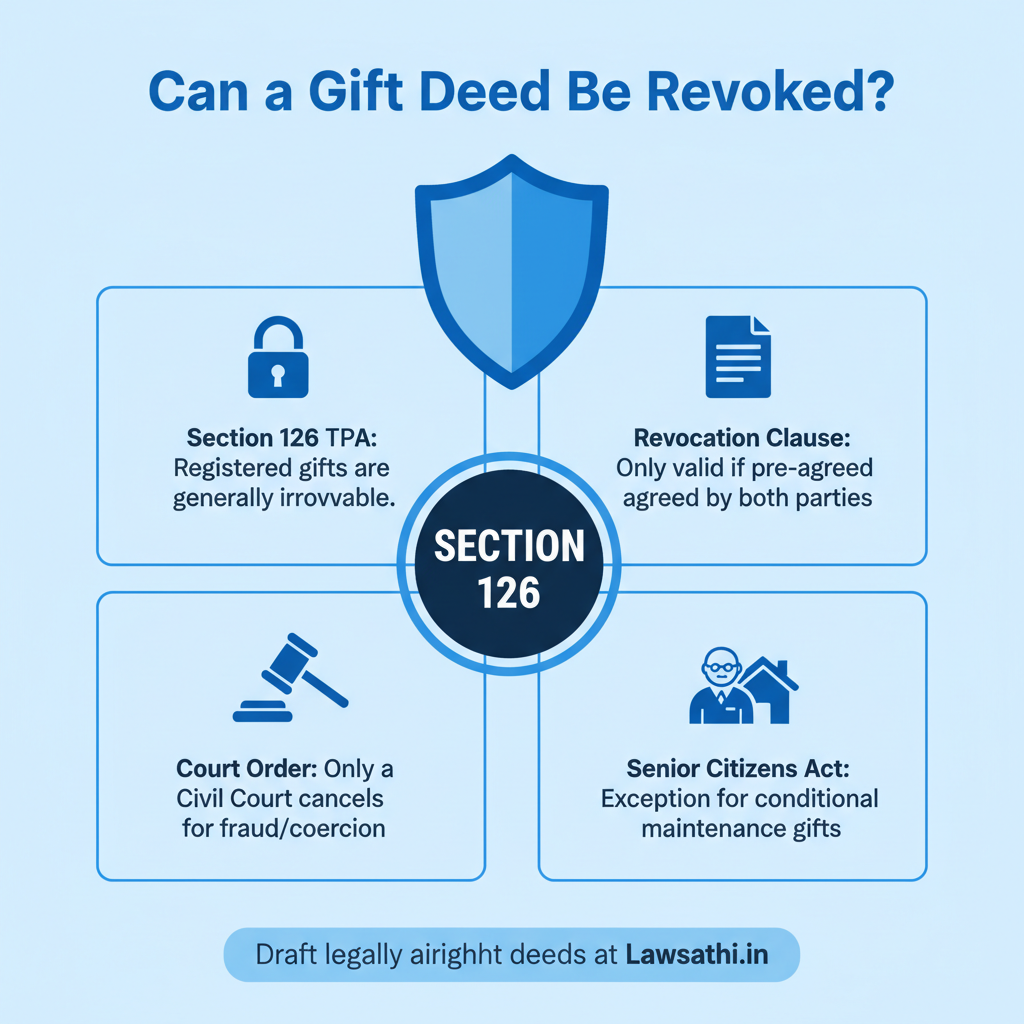

Revocation and Suspension of Gift Deeds

Can a donor take back a gift? Generally, the answer is no. Under Section 126 of the Transfer of Property Act, a gift cannot be revoked at a whim. However, revocation is possible if both parties agreed to a specific suspension clause.

The Senior Citizens Act Provision

A major exception exists under the Maintenance and Welfare of Parents and Senior Citizens Act, 2007. Suppose a senior citizen gifts property on the condition of maintenance. They can revoke it if the donee fails them. In fact, many High Courts now treat maintenance as an implied condition of the gift.

Judicial Stance on Unilateral Cancellation

Nevertheless, a donor cannot unilaterally cancel a registered deed. A “Cancellation Deed” is usually insufficient. The Supreme Court has clarified that the donor loses all rights once a gift is complete. Only a civil court can set aside a registered deed. Usually, they require grounds of fraud or coercion. Thus, your drafting should be final and decisive.

Common Pitfalls and Drafting Best Practices for Lawyers

Many practitioners confuse Gift Deeds with Relinquishment Deeds. For example, sisters might give up shares to a brother. The Delhi High Court held that this is not a gift. Instead, it is a release of rights. Using a Relinquishment Deed is often more tax-efficient in co-ownership scenarios.

Possession and Life Interest Clauses

Is physical possession mandatory? Registration is the primary requirement. However, mentioning the transfer of possession in the recitals adds legal weight. Additionally, donors often wish to stay in the property. In such cases, draft a “Life Interest” clause clearly. This helps avoid future eviction of the donor.

Using Technology for Document Accuracy

In 2026, many states moved to digital land records. They now use Unique Land Parcel Identification Numbers (ULPIN). Therefore, manually managing versions of a Gift Deed of immovable property in India is risky. You should use a centralized system to track recitals. This ensures consistency and prevents title disputes during the e-registration process.

Conclusion: Streamlining Property Transfers with Technology

Drafting a valid Gift Deed of immovable property in India requires care. First, confirm the donor’s intent and capacity. Second, ensure the property exists and the transfer is gratuitous. Finally, complete the mandatory registration with two witnesses. This makes the transfer legally binding.

As India moves toward full digitization, the role of a lawyer is evolving. You must now manage complex documentation with high precision. Specifically, manual errors in valuation can lead to heavy penalties. Consequently, modern tools are becoming essential for legal success.

Streamline your drafting process and manage property case files effortlessly. Use LawSathi’s AI-powered document management to save time. Book a demo today to see how we empower modern Indian law firms.