The landscape of international taxation in India changed forever on January 15, 2026. Specifically, the India-Mauritius DTAA Supreme Court ruling has sent ripples through the financial world. This occurred in the case of Authority for Advance Rulings v. Tiger Global International II Holdings.

For decades, the “Mauritius Route” offered a predictable path for foreign investment. However, this new judgment signals a move toward substance-based scrutiny. As a result, investors must now prioritize real business operations over simple paperwork.

Understanding the Historical Shift

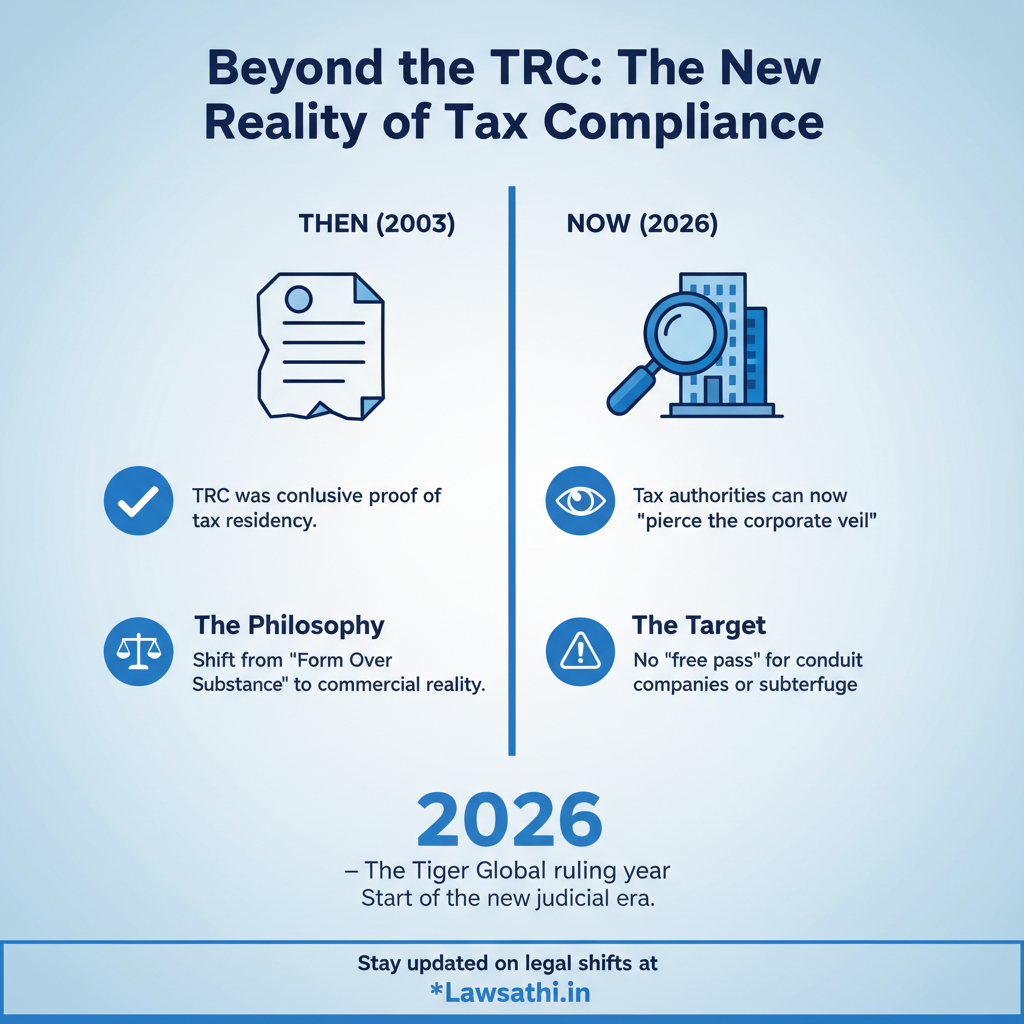

Historically, the Azadi Bachao Andolan* (2003) case provided great comfort to investors. It established that a Tax Residency Certificate (TRC) was sufficient to claim treaty benefits. This “form-over-substance” approach meant the tax department could not easily “pierce the corporate veil.”

Consequently, many investors used Mauritius-based entities to manage their Indian portfolios. They did this to ensure minimal tax liability. In contrast, the current legal climate demands much more transparency from these entities.

The Tiger Global Controversy

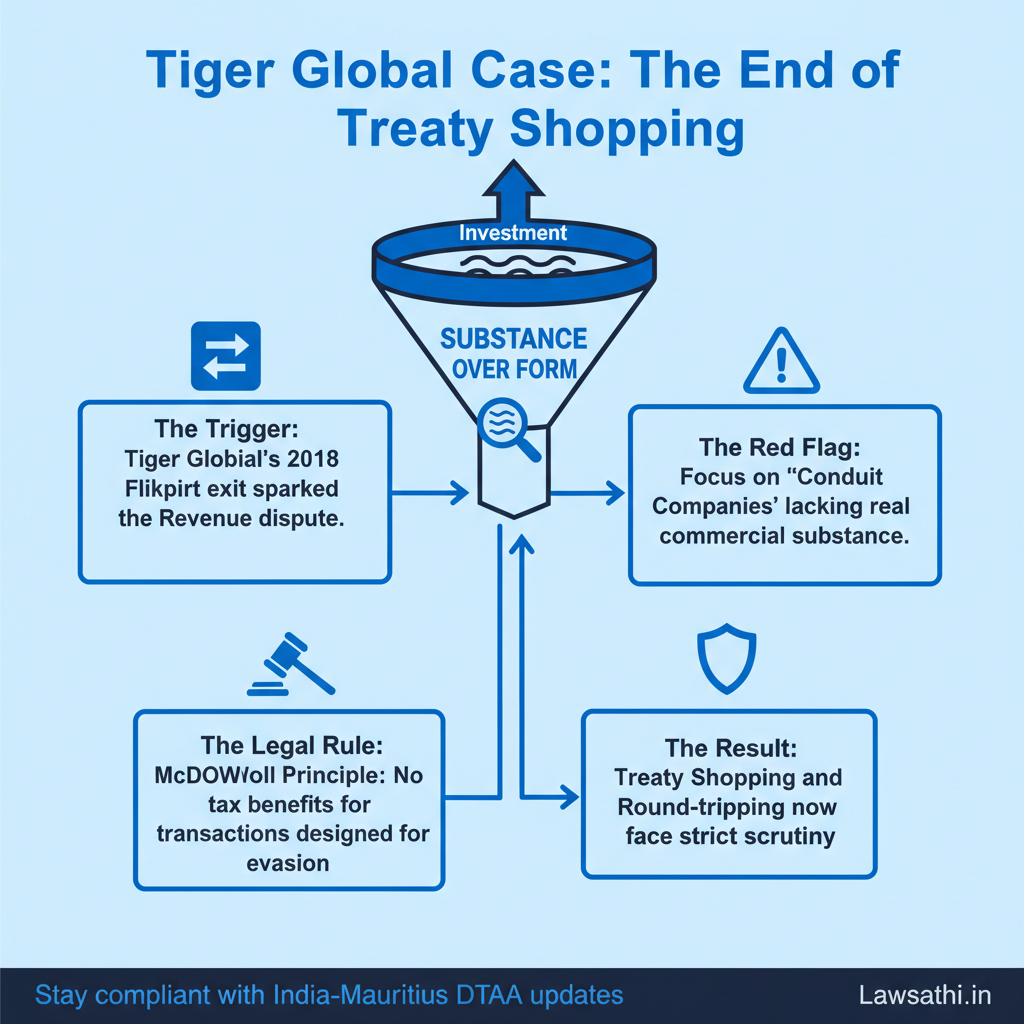

The latest dispute arose from Tiger Global’s 2018 exit from Flipkart. In this case, the Revenue argued that the Mauritian entities were mere “conduit” companies. These entities reportedly lacked commercial substance.

Furthermore, the tax authorities claimed the entities were controlled by US-based management. According to reports by SCC Online, the Court held the transaction was designed with the sole intent of evading tax.

Key Legal Issues: Substance Over Form and Treaty Shopping

The most significant takeaway from this India-Mauritius DTAA Supreme Court ruling is the devaluation of the TRC. While a TRC remains a valid document, it is no longer “conclusive evidence.” Therefore, tax authorities can now look behind the certificate if they suspect a “sham” arrangement.

Moving Beyond Circular 789

For years, CBDT Circular 789 of 2000 protected investors by affirming the TRC’s validity. However, the Supreme Court has clarified this circular’s limitations. In fact, LiveLaw notes that the Revenue is entitled to probe “colorable devices.”

Consequently, if a structure exists only to bypass Capital Gains Tax India Mauritius, the treaty benefits can be denied. Most importantly, the court emphasized that tax treaties should not be used as tools for tax evasion.

Addressing Treaty Shopping

“Treaty shopping” refers to when residents of a third state use a treaty for tax advantages. This practice often involves “round-tripping” of funds. To combat this, the Court reiterated the McDowell principle.

This principle states that while tax planning is legal, subterfuge is not. Consequently, lawyers must now ensure their clients’ corporate structures reflect genuine commercial reality. Specifically, these structures must demonstrate more than just tax savings.

The Impact of the 2024 Protocol and MLI Integration

The integration of the Multilateral Instrument (MLI) has fundamentally altered Section 90 of the Income Tax Act. Most importantly, the 2024 Protocol introduced the Principal Purpose Test (PPT) into the India-Mauritius DTAA.

This test allows authorities to deny benefits if a “principal purpose” of the transaction was to obtain tax relief. Therefore, the old methods of tax shielding are no longer reliable.

The Role of the Principal Purpose Test

The PPT represents a global shift toward tax transparency. Under this test, the intent behind an investment is scrutinized. For example, if a Mauritius entity has no real office or employees, it fails the PPT.

Moreover, Justice J.B. Pardiwala emphasized that treaties must not erode India’s tax sovereignty. For this reason, investors must demonstrate a valid commercial reason for being in Mauritius.

Retroactive Application of GAAR

Furthermore, the Court addressed the General Anti-Avoidance Rules (GAAR). Even for investments made before 2017, GAAR can apply if the “exit” or sale happens after GAAR’s implementation.

This interpretation limits the “grandfathering” protection previously expected by many PE funds. As a result, legal practitioners must reassess old portfolios that are currently pending exit. This change significantly increases the risk for long-term holders.

Capital Gains Taxation: What Changes for FPIs and Investors?

In the past, shares acquired before April 1, 2017, were considered tax-exempt. However, the India-Mauritius DTAA Supreme Court ruling puts a caveat on this rule. Specifically, the exemption is only safe if the entity is not a “conduit.”

If the structure is an “impermissible avoidance arrangement,” the tax department can now levy Capital Gains Tax India Mauritius. Consequently, the age of the investment does not automatically guarantee immunity.

The Conflict Between Section 90 and GAAR

Under Section 90 of the Income Tax Act, a taxpayer usually chooses the more beneficial provision. In contrast, the Supreme Court ruled that this choice is restricted by Section 90(2A).

This section mandates that GAAR prevails over treaty benefits. Therefore, FPI taxation India has become significantly more complex for funds operating out of Mauritius. As a result, compliance costs are expected to rise.

Implications for Startups and PE Exits

Many tech startups and Private Equity firms use Mauritius-based vehicles to enter India. For these investors, the “commercial substance” requirement is now a priority. For instance, an exit involving billions of dollars, like the Flipkart-Walmart deal, will face intense scrutiny.

Consequently, firms must prove that their Mauritian directors are actually making the key investment decisions. In other words, passive shells will no longer be tolerated.

Implications for Legal Practitioners and Tax Consultants

This ruling significantly raises the compliance bar for legal professionals. For example, a TRC alone will not suffice during an audit. Instead, practitioners must prepare a robust “substance file” for every client.

Specifically, this file should contain evidence of local board meetings and local expenditures. Additionally, the file should include employee payroll in Mauritius to prove active operations.

Advising on Restructuring

Clients might need to restructure their existing holdings. To illustrate, a company might need to hire local managers in Mauritius to satisfy the PPT. Additionally, documented evidence of “effective management” within Mauritius is now non-negotiable.

According to judicial observations in the Tiger Global case, “form” will no longer save a transaction lacking “substance.” Therefore, proactive changes are necessary.

Predicted Increase in Litigation

Expect a surge in Section 147 notices for reassessment. The Income Tax Department feels empowered by this judgment to reopen high-value cases. Specifically, any major exit since 2018 through the Mauritius route could be under the lens.

Therefore, tax consultants should perform “health checks” on their clients’ structures immediately. For example, verifying the trail of decision-making is now a vital task.

Conclusion: Navigating the New Era of International Tax Law

The India-Mauritius DTAA Supreme Court ruling marks the end of an era. While India remains an attractive destination for foreign capital, the “free pass” for Mauritius-based entities has ended. The Supreme Court has balanced the need for foreign investment with the necessity of tax integrity.

In conclusion, the focus has shifted from “Tax Planning” to “Tax Substance.” This trend will likely extend to other treaties, such as those with Singapore, Cyprus, and the Netherlands. For the Indian legal community, the takeaway is clear. We must advise clients based on the intent of their structures, not just the incorporation documents.

Stay ahead of complex tax litigation. Manage your case laws and research effortlessly with LawSathi’s AI-powered legal document management. Book a demo today to streamline your practice.