# Supreme Court Upholds AAR Rejection in Tiger Global Case: A New Era for GAAR and Tax Treaty Benefits

On January 15, 2026, the Indian tax landscape experienced a seismic shift. The Supreme Court delivered a monumental verdict. This decision redefines international tax planning in India.

The Tiger Global Supreme Court GAAR ruling effectively ends years of legal ambiguity. Specifically, it targets Mauritius-based holding structures. This ruling will have lasting effects on how foreign capital enters the country.

Why the 2026 Verdict Matters

This decision marks the end of blanket reliance on Tax Residency Certificates (TRC). Consequently, foreign investors must now prove genuine commercial substance. They must do this to claim treaty benefits.

For Indian lawyers, this case represents a critical turning point. It changes how we interpret tax treaties and anti-avoidance laws. Therefore, practitioners must adapt to a more rigorous compliance environment.

The dispute stemmed from Tiger Global’s 2018 exit from Flipkart. This occurred during the Walmart acquisition. As a result, tax authorities sought to tax capital gains exceeding $2 billion.

However, Tiger Global claimed an exemption. They relied on the India-Mauritius Double Taxation Avoidance Agreement (DTAA). This set the stage for a massive legal battle regarding tax sovereignty.

Case Background: From AAR Rejection to the Apex Court

The saga began when the Authority for Advance Rulings (AAR) rejected Tiger Global’s application. The AAR cited the jurisdictional bar under Section 245R(2) of the Income Tax Act.

Furthermore, it stated the transaction was prima facie designed for tax avoidance. This initial rejection signaled a shift in the government’s approach.

The Flipkart Share Sale Dispute

Tiger Global argued that its investments were “grandfathered.” Specifically, they referred to the 2016 Tax Protocol. They made these investments between 2011 and 2015.

Under Section 90 of the Income Tax Act, they believed the TRC provided a guarantee. In their view, it was an absolute proof of residency. However, the court eventually disagreed with this narrow interpretation.

Arguments on Limitation of Benefits (LOB)

Moreover, the company contended that the Delhi High Court had supported its position in 2024. They argued that the Mauritius entities possessed valid legal existence.

In contrast, the Revenue Department claimed these were mere “conduit companies.” They argued the entities had no independent management. Consequently, the court had to decide if these structures had real economic purpose.

The Rise of GAAR: Understanding the Connectivity

In its final decision, the Supreme Court integrated GAAR into its judicial reasoning. This integration is vital for tax professionals to understand.

Judicial Reasoning on Tax Sovereignty

The Court held that tax sovereignty must not be compromised by aggressive planning. For instance, treaties should not facilitate tax evasion. Therefore, the bench focused on the underlying intent of the corporate structure.

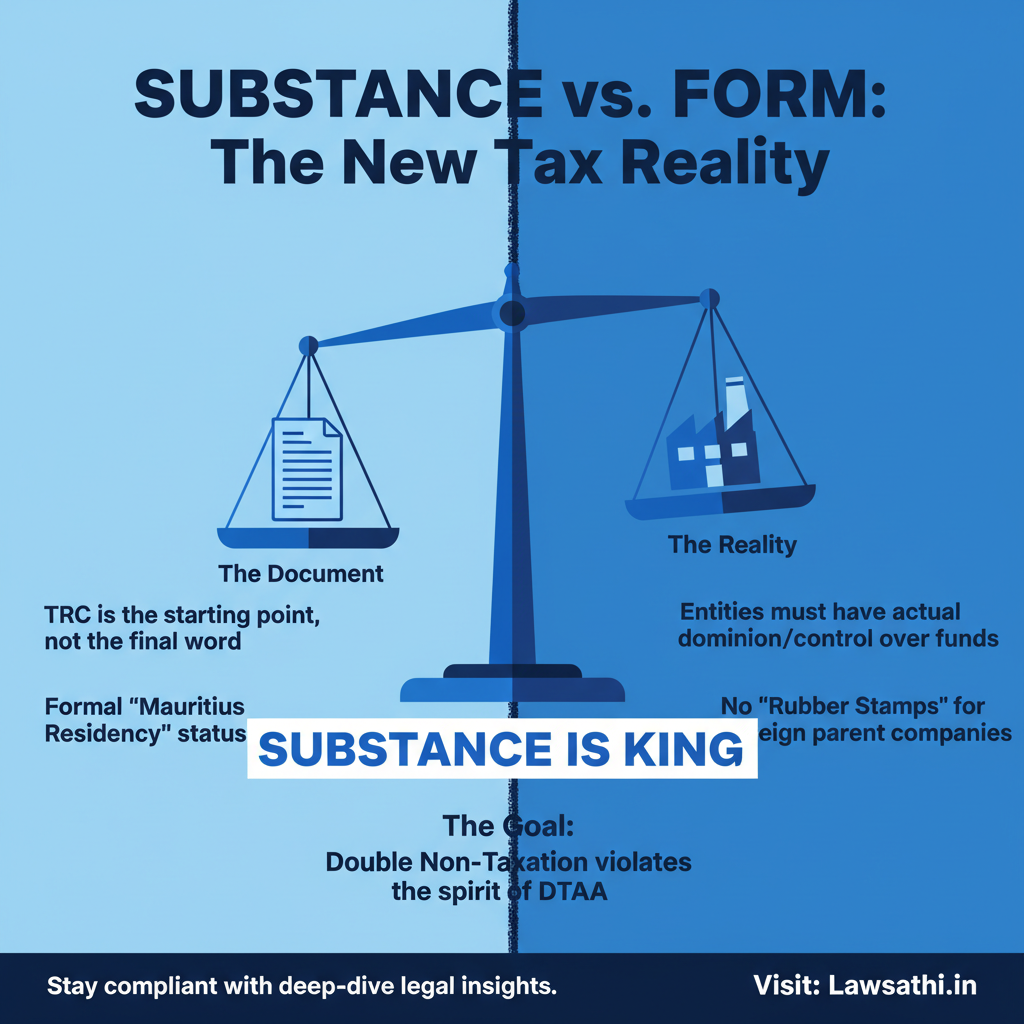

Substance Over Form in 2026

The Court applied the “substance over form” doctrine with new vigor. Specifically, it looked behind the corporate veil of the Mauritian holding companies.

It found that the US-based parent company made all critical investment decisions. Therefore, the Mauritius entities acted merely as “rubber stamps.” As a result, the court refused to acknowledge them as independent tax residents.

Why the TRC Is No Longer Enough

Furthermore, the Tiger Global Supreme Court GAAR ruling clarifies the TRC’s role. A TRC is only a starting point. While a TRC is necessary, it is no longer sufficient.

This is true if the structure lacks economic reality. In fact, the Court ruled that authorities can look through structures. They may do this to find “impermissible tax avoidance.”

Key Legal Principles Upheld by the Supreme Court

The ruling provides a deep dive into Article 13 of the India-Mauritius Tax Treaty. Most importantly, it addresses the concept of “Beneficial Ownership.”

The Court noted that the distinction between tax planning and tax evasion is found in the intent. If the intent is purely to save tax, the structure may fail.

Revisiting Article 13 Interpretations

The Court emphasized that treaty protection is for entities “liable to tax” in their home country. However, Tiger Global sought a situation of “double non-taxation.”

This meant the income was not taxed in India or Mauritius. Consequently, the Bench labeled this as contrary to the spirit of the DTAA. For this reason, the claim for exemption was denied.

The Beneficial Ownership Test

Additionally, the Court revisited the “beneficial ownership” test for capital gains. It determined that the Mauritian entities did not have dominion over the funds.

Because the income was destined for the US parent, the route was deemed a colorable device. In other words, the entity was a mere conduit for the parent company.

Impact on FPIs and Future Cross-Border Investments

Foreign Portfolio Investors (FPIs) must now rethink their entry and exit strategies in India. Specifically, those using the “Mauritius Route” face increased scrutiny.

New Powers for Tax Authorities

The Tiger Global Supreme Court GAAR ruling empowers the Income Tax Department. They can now launch deep “look-through” investigations. As a result, investors must ensure their structures are robust and defensible.

Implications for Private Equity Structures

Similarly, Private Equity (PE) firms must evaluate their existing holding companies. The ruling suggests that grandfathering clauses do not provide total protection.

For example, a 2015 investment might still face scrutiny. This happens if the 2026 exit lacks commercial substance. Therefore, historical investments are no longer immune to current anti-avoidance standards.

Increased Scrutiny on Offshore Transfers

As a result, we expect a surge in litigation regarding indirect transfers. Tax authorities will likely focus on the Place of Effective Management (POEM).

Above all, investors must realize that treaty benefits are no longer automatic. Specifically, the India-Mauritius Tax Treaty 2026 benefits require proof of local substance.

Key Takeaways for Tax Practitioners and Law Firms

For lawyers, the priority is now on building “substance files” for clients. Documentation must go beyond simple audits and bank statements.

Furthermore, you must demonstrate that boards in treaty jurisdictions are autonomous. They must actually make the decisions themselves. This documentation will be the first line of defense during an audit.

Essential Documentation for GAAR Scrutiny

First, ensure that board meetings are held locally. Resident directors must participate actively in these meetings. Second, maintain records showing the commercial reasons for the specific jurisdiction.

To illustrate, tax savings should be secondary to business goals. These goals might include asset protection or market access. Specifically, every transaction must have a non-tax business purpose.

Advising Multinational Clients

Finally, advise your clients on the threshold of “impermissible tax avoidance.” The Court has made it clear that “treaty shopping” is over.

Practitioners should use this Supreme Court reportable judgment as a guide. It serves as a blueprint for future compliance audits. Consequently, lawyers must review all existing structures immediately.

Navigating the New Tax Landscape

The 2026 ruling represents a shift toward “systemic compliance.” While India remains an attractive destination for FDI, the rules have changed. The Supreme Court has balanced ease of business with tax integrity.

In conclusion, the Tiger Global Supreme Court GAAR ruling marks the end of “shell companies.” Tax planning is still legal, but it must be rooted in reality. Lawyers must now be more vigilant in structuring deals.

Stay ahead of landmark tax rulings and manage your research effortlessly. LawSathi’s AI-powered platform helps you find relevant precedents mid-trial. Book a free demo today!