The Indian tax landscape changed forever on January 15, 2026. On this day, the Supreme Court delivered a monumental verdict. The Tiger Global Mauritius Supreme Court ruling has sent shockwaves through the investment community.

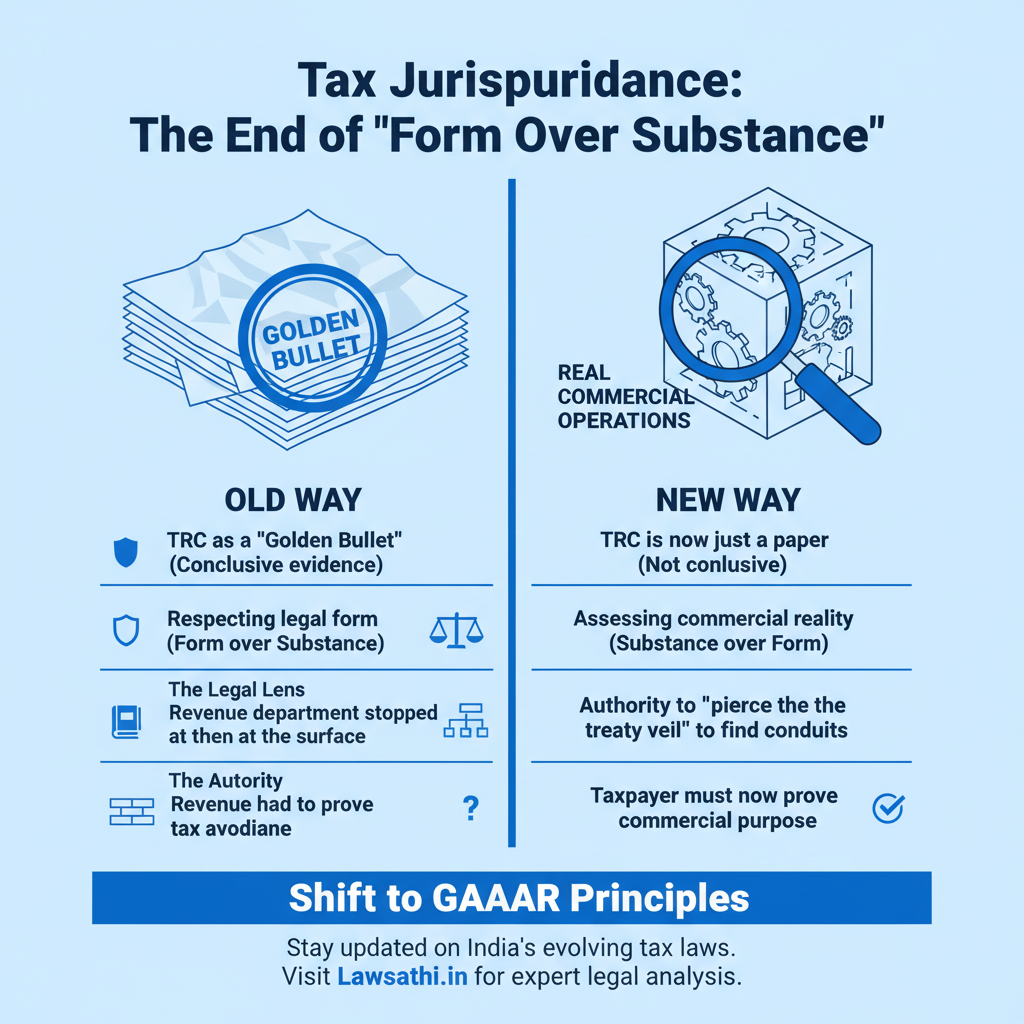

This decision marks a fundamental shift in how India treats offshore structures. Specifically, the court moved from a “Form over Substance” approach to “Substance over Form.” Consequently, foreign investors must now prove their commercial purpose beyond just paperwork.

A New Era of Tax Jurisprudence

Historically, India respected the legal form of overseas holding companies. However, this ruling changes that long-standing tradition. The Supreme Court decisively revived an earlier order from the Authority for Advance Rulings (AAR).

Earlier, the Delhi High Court had granted relief to Tiger Global. But the apex court set that aside in Civil Appeal Nos. 262-264 of 2026. Furthermore, for Indian law firms, this signifies a pivot toward aggressive tax enforcement. Therefore, legal professionals must reconsider how they structure cross-border deals.

The Core Dispute: Tax Residency Certificates vs. Commercial Substance

The primary conflict involved Tiger Global’s exit from Flipkart. Specifically, the Mauritian entities claimed capital gains tax exemption under Article 13 of the India-Mauritius DTAA. They presented their Tax Residency Certificates (TRC) as definitive proof of their eligibility.

Why the TRC Is No Longer a “Golden Bullet”

For years, a TRC served as a “clearance certificate” for treaty benefits. Nevertheless, the Supreme Court ruled that a TRC is not conclusive evidence if the entity is a conduit.

The Revenue department argued that these entities lacked real commercial substance. In fact, the court noted that the real “head and brain” lived elsewhere. Specifically, control lay with Tiger Global Management LLC in the USA.

As a result, the court viewed the Mauritian structure as a “see-through” arrangement. This creates a high hurdle for future litigants. Moreover, it places the burden of proof squarely on the taxpayer.

Identifying Conduit Entities in Practice

How does one identify a conduit company today? First, the court looked at who actually made the investment and divestment decisions. For example, if a company has no local employees or offices, it faces risks.

Moreover, if it merely passes funds from a parent to a subsidiary, it looks like a conduit. Lawyers must now look past the TRC to the actual decision-making trail. In addition, they must document all local functional activities thoroughly.

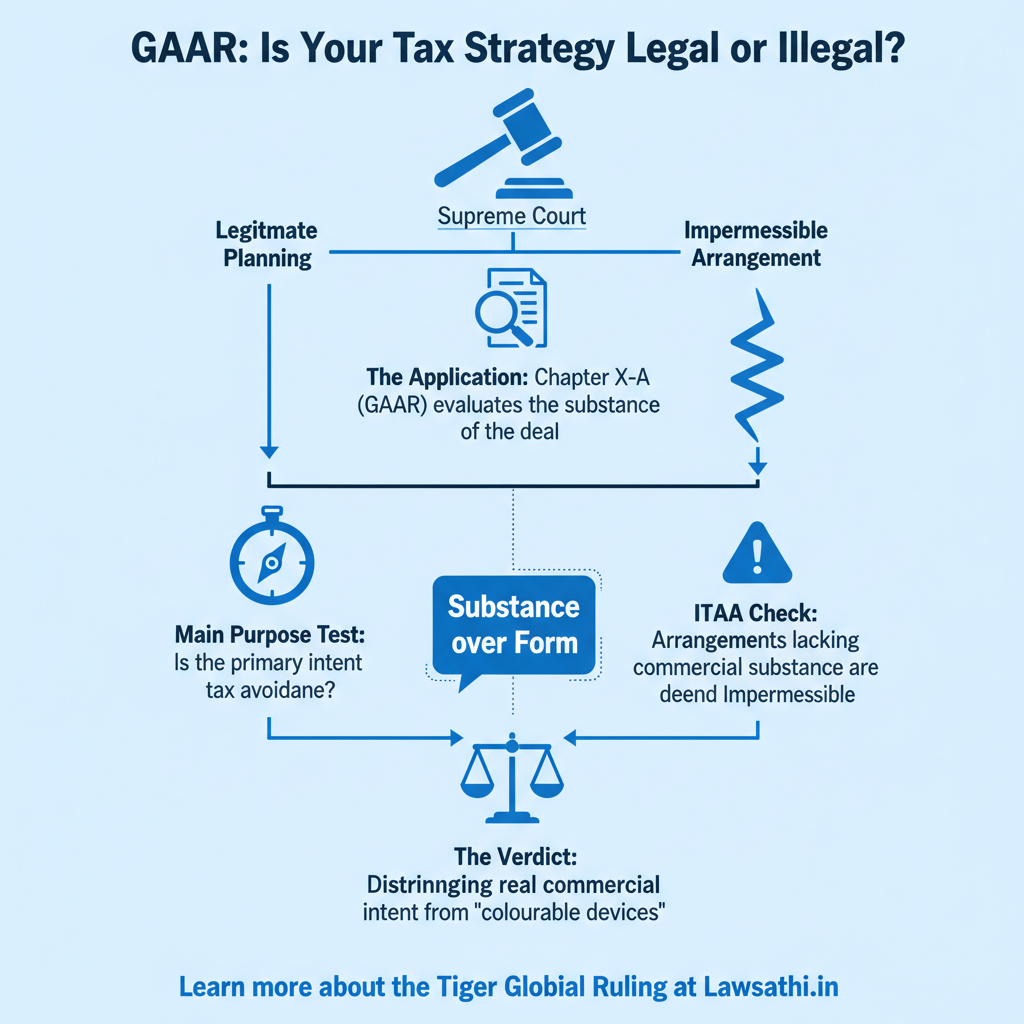

Decoding GAAR in the Context of the Ruling

The most significant part of the Tiger Global Mauritius Supreme Court ruling involves Chapter X-A of the Income Tax Act. This chapter deals with the General Anti-Avoidance Rule (GAAR). The court applied these rules to determine if the arrangement was “impermissible.”

The Main Purpose Test and ITAA

Under Section 96(2), the onus often lies on the taxpayer to prove their intent. Specifically, the court found that this transaction satisfied the “main purpose test” for tax avoidance. It classified the structure as an Impermissible Tax Avoidance Arrangement (ITAA).

In other words, the arrangement lacked any genuine commercial rationale. It was a “pre-ordained transaction” designed to avoid tax in both India and Mauritius. Consequently, the court allowed the Revenue to ignore the treaty benefits and tax the gains in India.

Tax Planning vs. Tax Evasion

Crucially, the court distinguished between legitimate tax planning and illegal evasion. This distinction is vital for tax practitioners. For instance, choosing a tax-efficient route is permissible if it has a real business purpose.

However, creating “colourable devices” to bypass law is evasion. The SC reaffirmed that artificial structures will be dismantled by judicial scrutiny. Thus, the intention behind the structure is now more important than ever.

Implications for Foreign Portfolio Investors (FPIs) and PEs

This ruling creates significant ripples for Private Equity (PE) firms. They can no longer rely on simple offshore setups to save tax. Instead, they must build “substance” into every level of their investment vehicle.

Heightened Documentation Requirements

Investors now face a much higher burden of proof. For example, they must maintain detailed records of local Board meetings. Furthermore, these meetings should show independent deliberation by local directors.

Simply signing papers drafted in New York or London will no longer suffice. Additionally, firms should employ local staff in the treaty jurisdiction. They must also incur operational expenses that match their business size. Without these, the Indian Revenue may “pierce the treaty veil.”

The Risk of Retrospective Scrutiny

Many investors assumed that pre-2017 investments were safe due to “grandfathering” clauses. However, the SC clarified that GAAR might still apply. If the “tax benefit” or the exit occurs after the GAAR effective date, scrutiny is possible.

As a result, this could lead to a wave of new assessments for old PE funds. Therefore, funds must review their historic structures immediately. They must also prepare for potential audits by the tax authorities.

The Future of Treaty Shopping: India’s Stance on DTAAs

India is aligning itself with global standards like the BEPS framework. This framework aims to stop “Base Erosion and Profit Shifting.” Therefore, the power of tax havens is rapidly eroding. The Tiger Global Mauritius Supreme Court ruling highlights India’s preference for source-based taxation.

Impact on Other Treaties

This ruling does not just affect Mauritius. It sets a precedent for treaties with Singapore, the Netherlands, and Cyprus. For instance, the India-Singapore DTAA often mirrors the Mauritius treaty. Consequently, structures in Singapore will likely face similar “substance” tests.

Furthermore, the Multilateral Instrument (MLI) introduces a “Principal Purpose Test” (PPT). This test works alongside GAAR to filter out treaty shopping. As a result, the era of the “paper company” is effectively over.

Legislative Reinstatement of TRC?

Some experts argue for a legislative fix to protect the TRC’s value. They fear that the ruling creates too much uncertainty for genuine investors.

However, until the government intervenes, the court’s view remains the law. Tax lawyers must prepare for a more litigious environment in the coming years. In fact, many firms are already updating their compliance protocols.

Summary: Key Takeaways for Legal Practitioners

To navigate this new world, lawyers must adopt a “veil-lifting” mindset. You should not take corporate structures at face value. Instead, perform deep due diligence on the commercial rationale of every client structure.

– Check for Local Management: Ensure the offshore entity has actual decision-making power. – Review GAAR Risks: Assess if the primary motive of the structure is a tax benefit. – Update Documentation: Maintain real-time records of board minutes, local audits, and employees. – Monitor Judicial Trends: Stay updated on how the AAR and the High Courts apply this ruling.

The Tiger Global Mauritius Supreme Court ruling is a wake-up call. It reminds us that substance is the only true defense against aggressive tax scrutiny in 2026.

Complex tax litigation requires instant access to case laws and precedent. Manage your research and stay ahead of GAAR developments with LawSathi’s AI-powered legal suite. Book a demo today.