Land acquisition compensation tax exemption remains one of the most contentious issues in Indian revenue law. This persists despite over a decade of litigation and multiple judicial pronouncements. For legal professionals advising landowners across India, the uncertainty creates significant challenges in tax planning and dispute resolution. However, the much-anticipated Union Budget 2026 has come and gone without addressing this critical ambiguity. Consequently, the legal community must continue navigating conflicting precedents.

The Decade-Long Ambiguity: RFCTLARR 2013 vs. The Income Tax Act

Understanding Section 96 and Its Non-Obstante Clause

The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (RFCTLARR Act) introduced Section 96. This section came with an explicit tax exemption provision. According to Section 96 of the RFCTLARR Act, “No income tax or stamp duty shall be levied on any award or agreement made under this Act, except under Section 46.”

This non-obstante clause was designed to override conflicting provisions in other statutes. Specifically, it includes the Income Tax Act, 1961. However, the interplay between this exemption and existing tax provisions has sparked extensive litigation. Therefore, a fundamental question remains. Does Section 96 provide blanket exemption for all components of compensation? Or do certain elements remain taxable under specific Income Tax Act provisions?

The CBDT Circular That Failed to Settle the Debate

In October 2016, the Central Board of Direct Taxes issued Circular No. 36/2016. This circular attempted to clarify the position. It stated unequivocally that compensation received under the RFCTLARR Act is exempt from income tax. Furthermore, it noted that the exemption under Section 96 is “wider in scope than the tax-exemption provided under the existing provisions of Income-tax Act, 1961.”

However, this clarification came with a critical limitation. Specifically, the circular applies only to acquisitions conducted under the RFCTLARR Act itself. It does not extend to the 13 enactments listed in the Fourth Schedule. These include the National Highways Act, 1956, the Railways Act, 1989, and the Electricity Act, 2003. As a result, this limitation has created a two-tier system of tax treatment. This continues to confuse practitioners and litigants alike.

Conflicting Judicial Precedents: A Fractured Landscape

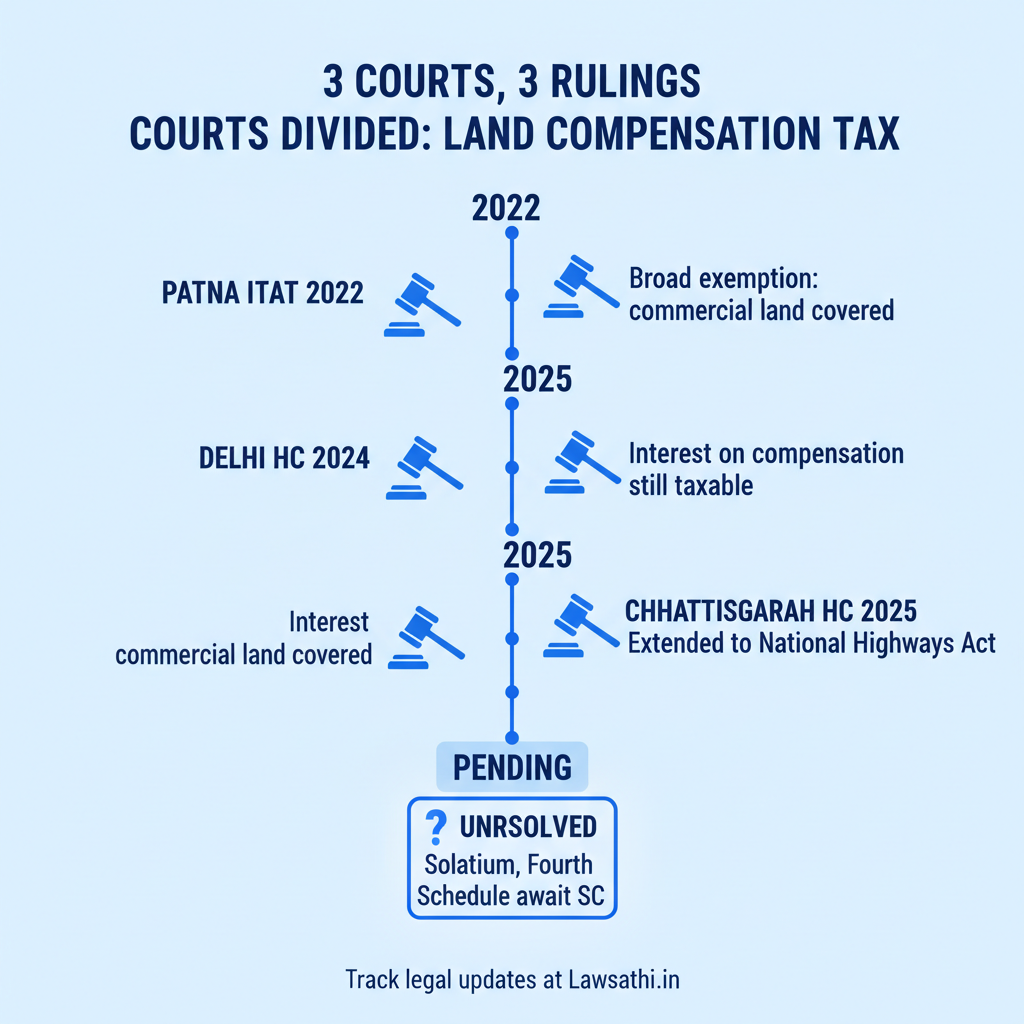

The Patna ITAT Ruling: Broad Interpretation

The Income Tax Appellate Tribunal (ITAT) Patna delivered a significant ruling in August 2022. The case was ITO Ward-4(5), Patna v. Suresh Prasad. The tribunal held that compensation for compulsory acquisition of commercial and non-agricultural land qualifies for exemption under Section 96 of the RFCTLARR Act.

This ruling expanded the scope of exemption significantly. It went beyond the traditional agricultural land protection under Section 10(37) of the Income Tax Act. For lawyers advising clients with non-agricultural property acquisitions, this precedent offers a strong foundation for claiming exemption. However, the ruling’s persuasive value varies across jurisdictions. Moreover, revenue authorities continue to challenge this interpretation.

Delhi High Court on Interest Taxability

The Delhi High Court delivered a crucial clarification in April 2024. The case was Principal CIT v. Inderjit Singh Sodhi. The court distinguished between compensation and interest. It ruled that interest on compensation or enhanced compensation remains taxable under Section 56(2)(viii) of the Income Tax Act.

This position stems from the Finance (No.2) Act, 2009. This Act specifically amended the Income Tax Act to make interest on compensation taxable as “income from other sources.” For legal practitioners, this creates a clear bifurcation in advisory. The principal compensation amount may qualify for exemption. However, the interest component is definitively taxable.

Chhattisgarh High Court: Extending Exemption to Fourth Schedule

Perhaps the most significant recent development came from the Chhattisgarh High Court in September 2025. The case was Sanjay Kumar Baid v. ITO_5.pdf). The court ruled that Section 96 exemption applies even to land acquired under the National Highways Act, 1956. This is a Fourth Schedule enactment.

The court’s reasoning was grounded in constitutional principles. It held that denying exemption for acquisitions under Fourth Schedule enactments would violate Article 14 of the Constitution. This article guarantees equality before law. Therefore, this ruling, if upheld by the Supreme Court, could fundamentally reshape the land acquisition compensation tax exemption landscape.

The Unresolved Issues: Where Ambiguity Persists

Fourth Schedule Enactments and Section 105

The core conflict centers on Section 105 of the RFCTLARR Act. This provision exempts 13 specific enactments from the Act’s application through the Fourth Schedule. However, Section 105(3) changes this picture significantly. As amended by the Removal of Difficulties Order 2015, it makes the compensation determination provisions (Sections 26-28) applicable to these enactments.

The legal debate centers on whether Section 96 falls within “compensation determination” provisions. Revenue authorities argue that Section 96 is a tax provision, not a compensation provision. In contrast, taxpayers counter that the net compensation received after tax directly affects the adequacy of compensation. Therefore, tax exemption is integral to the compensation framework.

Solatium: Exempt or Taxable?

Solatium represents a significant component of acquisition payouts. It is calculated at 100% of the compensation amount under Section 30 of the RFCTLARR Act. However, the tax treatment of solatium remains technically unsettled. This is despite favorable ITAT trends.

Most tribunal rulings have treated solatium as part of “compensation” entitled to exemption. For example, the Patna ITAT decision,-patna-v.-suresh-prasad/view) took this position. However, the absence of a definitive Supreme Court ruling leaves room for revenue challenges. Consequently, lawyers advising clients must prepare for potential litigation while claiming exemption.

The Section 46 Agreement Exception

Section 46 of the RFCTLARR Act allows direct agreements between acquirers and landowners. This effectively bypasses the formal award process. Crucially, Section 96 explicitly excludes Section 46 agreements from the tax exemption.

This creates a practical dilemma for landowners. Agreements reached through negotiation may carry full tax liability. On the other hand, court-awarded compensation enjoys exemption. For legal advisors, the challenge lies in determining whether a particular “agreement” represents genuine voluntary settlement. Alternatively, it may be effectively coerced acceptance under threat of compulsory acquisition.

Current Tax Treatment: A Component-by-Component Analysis

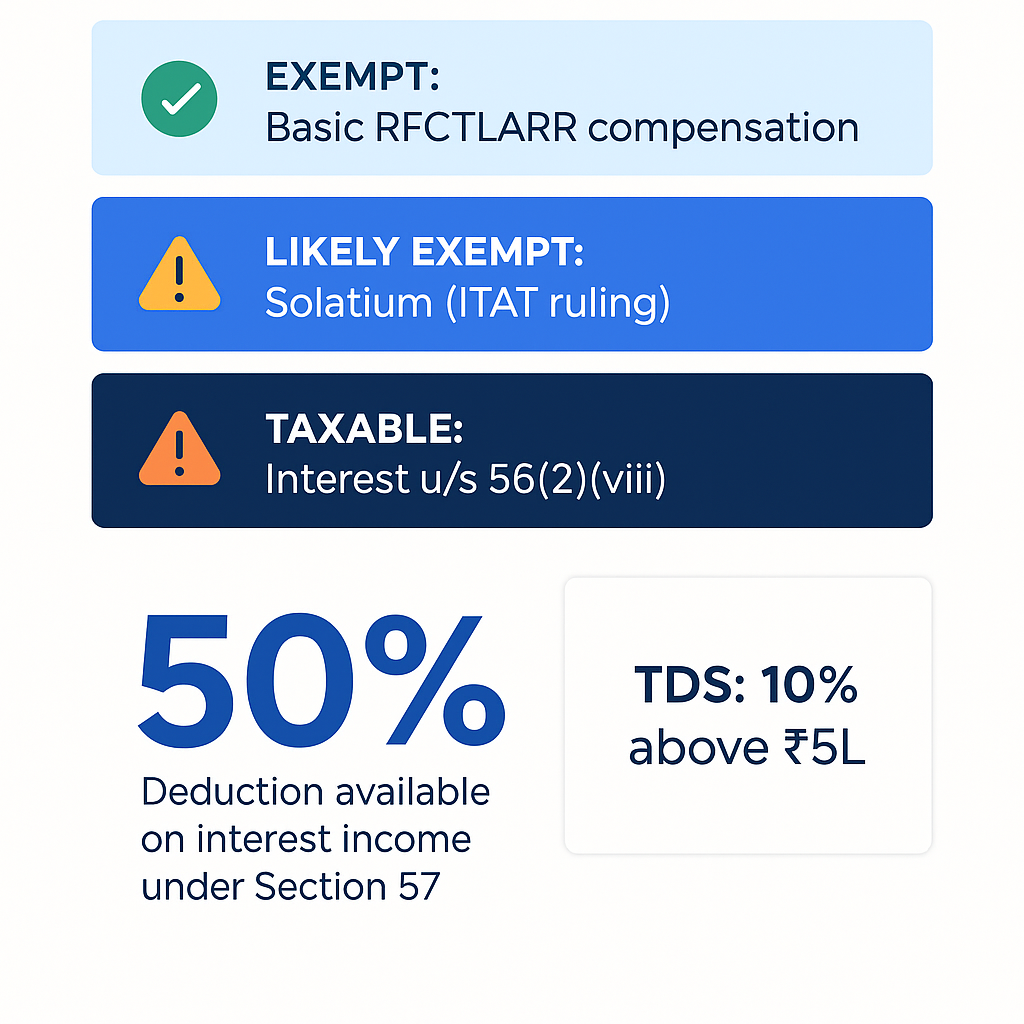

Understanding What’s Exempt and What’s Taxable

According to the Income Tax Department’s official guidance, the tax treatment varies significantly by component. Basic compensation awarded under the RFCTLARR Act qualifies for exemption. This is under Section 96 read with CBDT Circular 36/2016.

Solatium is likely exempt under prevailing ITAT interpretations. However, it lacks explicit statutory clarification. Interest on compensation, in contrast, is definitively taxable under Section 56(2)(viii). Importantly, a 50% deduction is available under Section 57 for such interest income. This effectively reduces the tax burden.

Enhanced compensation awarded by courts follows the same principles as original compensation. The principal amount qualifies for exemption. However, interest on enhanced compensation remains taxable. As a result, this framework creates a consistent but complex advisory landscape for legal professionals.

TDS Implications Under Section 194LA

Tax deducted at source under Section 194LA creates practical complications. The provision mandates 10% TDS on compensation exceeding ₹5,00,000 for non-agricultural land acquisitions. However, when the underlying compensation qualifies for exemption under Section 96, landowners must claim refunds through their income tax returns.

For NRIs, the situation is more complex. While no special exemption provisions exist, the same Section 96 principles apply. However, higher TDS rates may apply if PAN is not furnished. This creates cash flow complications that require proactive advisory intervention.

Legal Implications for Pending and Future Litigation

Strategic Considerations for Ongoing Disputes

Legal professionals handling pending land acquisition compensation tax exemption disputes must adopt jurisdiction-specific strategies. For cases involving acquisitions under the RFCTLARR Act itself, the position is relatively settled. Therefore, claims for exemption should cite CBDT Circular 36/2016 and favorable ITAT precedents.

For Fourth Schedule acquisitions, practitioners should leverage the Chhattisgarh High Court ruling. However, they must acknowledge the risk of appeal. The constitutional argument based on Article 14 provides strong foundation for claiming parity in tax treatment.

Procedural Requirements for Refund Claims

For clients seeking refunds of TDS deducted on exempt compensation, proper documentation is essential. Required documents include the acquisition award copy, acquisition notification, and detailed compensation breakdown. Additionally, the Income Tax Return must explicitly claim exemption. This often requires additional disclosures to explain the discrepancy between TDS certificates and declared income.

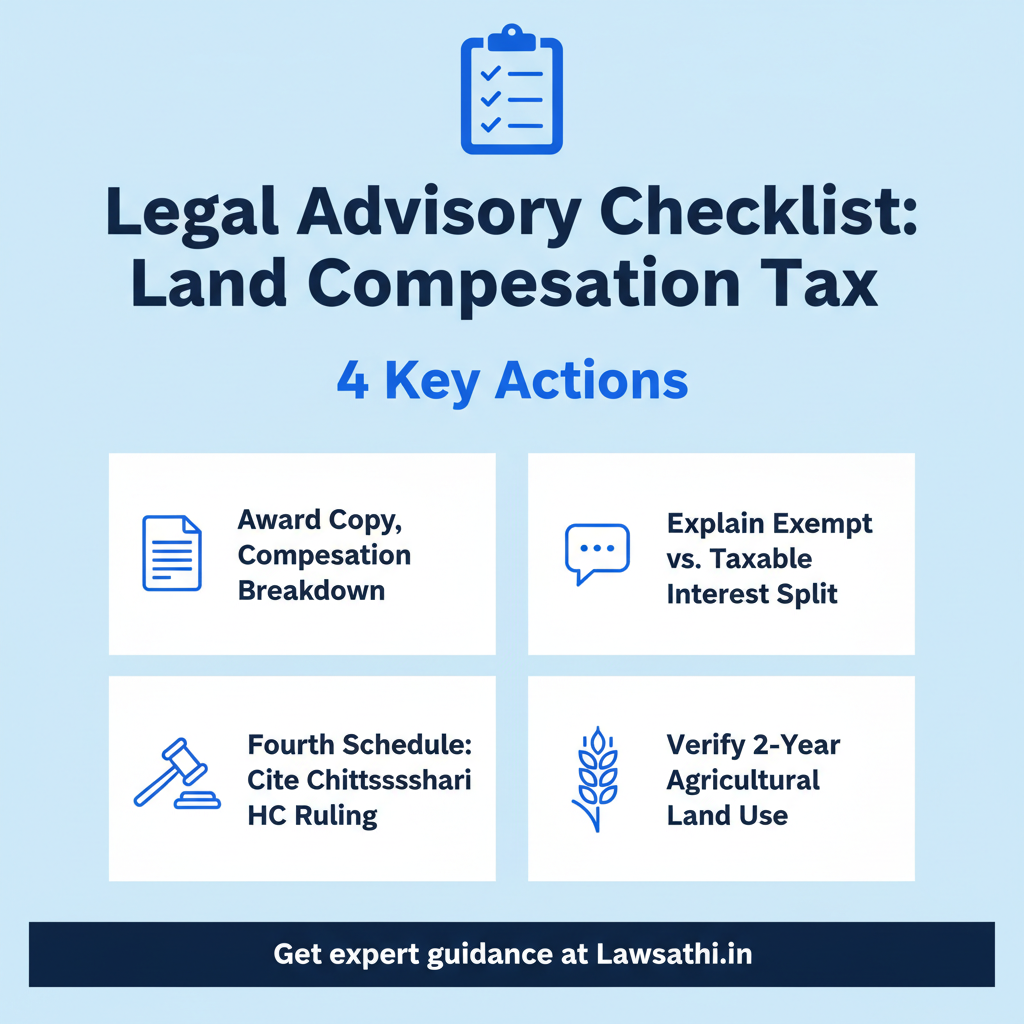

Advisory Checklist for Legal Professionals

Client Communication and Documentation

Effective advisory on land acquisition compensation tax exemption requires systematic client communication. Lawyers should clearly explain the bifurcation between exempt compensation and taxable interest. Furthermore, engagement letters should specifically address the contingency of adverse revenue action. This is particularly important for solatium claims.

For clients with pending appeals, consider the cost-benefit analysis of continuing litigation versus accepting the current position. Where interest taxation is concerned, the legal position is settled. Therefore, contesting interest taxability will likely result in wasted costs and adverse orders.

Compliance Checks for Different Categories

Agricultural land acquisitions receive additional protection under Section 10(37) of the Income Tax Act. However, this exemption requires that the land was used for agricultural purposes for two years immediately preceding the transfer. Therefore, verification of agricultural land status through revenue records is essential for claiming this dual protection.

For NRIs and HUFs holding agricultural land, the analysis becomes more nuanced. Residential status affects the taxation framework. Meanwhile, the nature of land determines applicable exemptions. Consequently, comprehensive advisory requires examining both the acquisition framework and the taxpayer’s specific circumstances.

The Road Ahead: Awaiting Legislative Clarity

Why Budget 2026 Missed the Opportunity

The Union Budget 2026 introduced significant direct tax reforms. These include litigation management initiatives as noted by legal analysts. However, the Finance Bill 2026 contains no amendments addressing the land acquisition compensation tax exemption ambiguity.

The Memorandum to Finance Bill 2026 outlines various tax changes. Yet it remains silent on Section 96 harmonization. This legislative inaction perpetuates the uncertainty that has plagued landowners and practitioners since the RFCTLARR Act’s implementation in 2014.

Anticipating Future Developments

The legal community should monitor the Supreme Court’s potential consideration of the Chhattisgarh High Court ruling. A definitive apex court judgment on Fourth Schedule applicability would resolve the most significant remaining ambiguity. Until then, practitioners must navigate conflicting precedents and advise clients accordingly.

Additionally, future Budget sessions may finally address this issue. The growing volume of litigation and the fundamental policy question of taxing involuntary land transfers may eventually compel legislative intervention.

Conclusion: Certainty Remains Elusive

The land acquisition compensation tax exemption framework illustrates the challenges of interpreting overlapping statutes without clear legislative harmonization. Despite a decade of litigation, CBDT circulars, and multiple High Court rulings, fundamental questions remain unresolved.

For legal professionals, the current environment demands careful case-by-case analysis. While compensation under RFCTLARR awards enjoys relatively settled exemption status, Fourth Schedule acquisitions and solatium treatment continue to generate disputes. The interest component remains definitively taxable, offering at least one area of clarity.

As legislative silence persists, practitioners must stay updated on judicial developments and evolving tribunal interpretations. The stakes for landowners—often farmers and rural families facing involuntary displacement—are significant. Therefore, accurate advisory is not just a professional obligation but a matter of significant economic consequence.

Simplify your Revenue Law practice. Use LawSathi to track regulatory amendments and automate client updates instantly.