The landscape of commercial dispute resolution in India is changing rapidly. Recently, the Delhi High Court delivered a landmark ruling regarding arbitration award interest Delhi High Court standards. This judgment clarifies a long-standing dispute between decree holders and judgment debtors. Specifically, it addresses when the “interest clock” actually stops ticking during execution proceedings.

Understanding the Interest Cessation Conflict

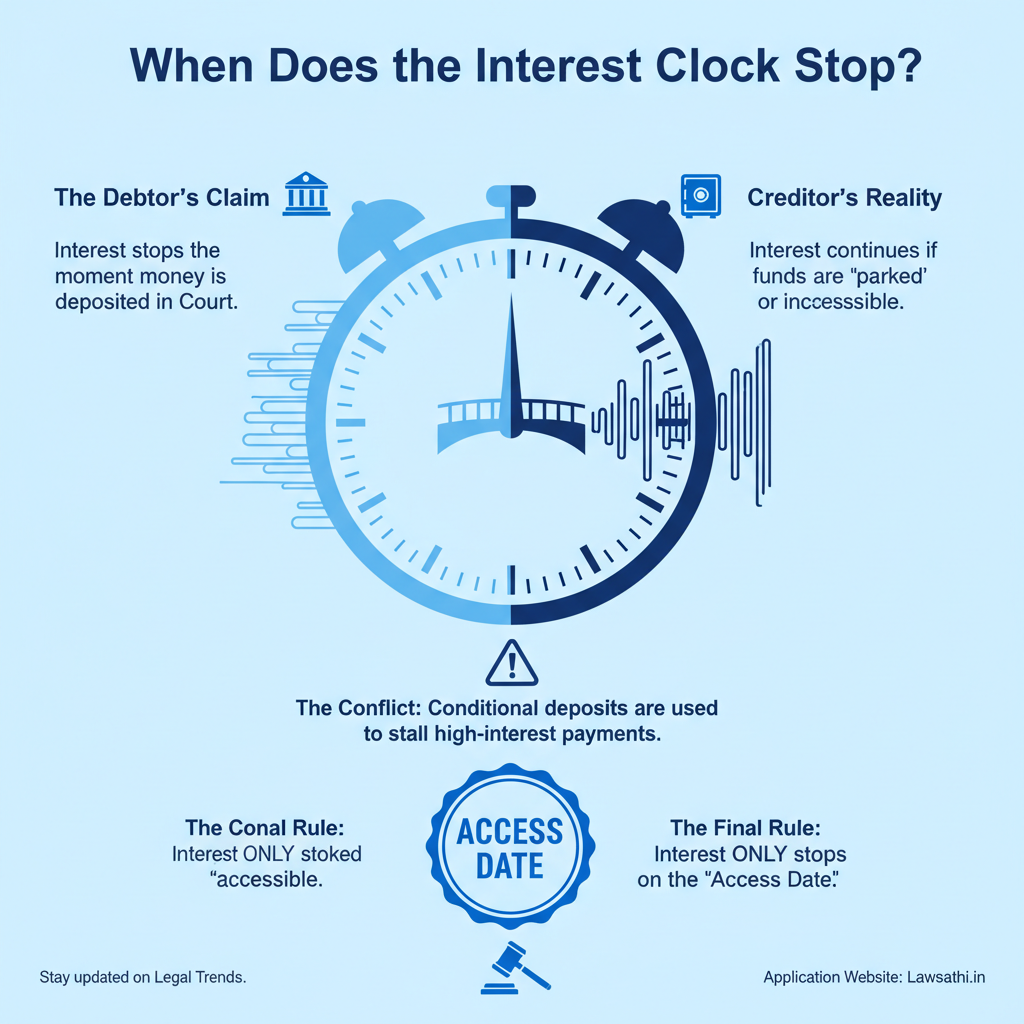

Many lawyers struggle with the conflict between the “date of deposit” and the “date of access.” Debtors often claim that depositing money in court should stop interest immediately. However, creditors argue that interest should run until they can actually use the funds.

Why This Ruling Matters for 2026

This decision is critical for anyone involved in commercial dispute resolution India. Therefore, legal practitioners must understand how “access” is now defined by the judiciary. This guide will analyze the ruling and offer actionable advice for your practice.

The Core Legal Question: When Does Interest Stop Multiplying?

At the heart of this issue is Section 31(7) Arbitration and Conciliation Act. This section gives arbitrators the power to grant interest. However, it does not explicitly state when that interest must cease during the execution phase.

Interpreting Section 31(7) and the CPC

The Court looked closely at Order XXI, Rule 1 of the Code of Civil Procedure (CPC). Traditionally, judgment debtors thought that “payment into court” was sufficient to stop interest. In contrast, the Court has now emphasized the importance of the decree holder’s ability to reach those funds.

The Shift to “Availability”

As a result, the focus has shifted from mere deposit to the “availability” of the money. For example, a deposit is not a valid tender if it comes with strings attached. If the debtor places conditions on the release of funds, the interest continues to accrue. Most importantly, the decree holder must be able to withdraw the money without legal hurdles.

Case Summary: Analysis of the Disputed Ruling

In the pivotal case of PCL STICCO (JV) v. National Highways Authority of India (NHAI), the Court clarified the timeline of liability. In this instance, NHAI deposited over ₹123 Crore into the court registry. However, they did so while the award was still being contested.

Defining Fair Metrics for Interest

The Court reasoned that the “access date” is the only fair metric. Interest ceases only when the award holder has knowledge of the deposit. Additionally, they must have the freedom to withdraw it. To illustrate, if a debtor deposits money but tells the court not to release it, they haven’t really “paid” the debt.

The Problem of Conditional Deposits

Consequently, the Court ruled that interest stops only when the money is truly accessible. Furthermore, this ruling targets the tactic of “parking” funds. Some debtors deposit money just to stop high interest rates while they continue litigating.

Ending the Strategy of Stalling

The Delhi High Court has now made it clear that this strategy will no longer work. Furthermore, the money must be ready for pickup. Unless the money is truly available, the interest meter keeps running. This ensures debtors do not benefit from procedural delays.

Impact on Judgment Debtors and Decree Holders

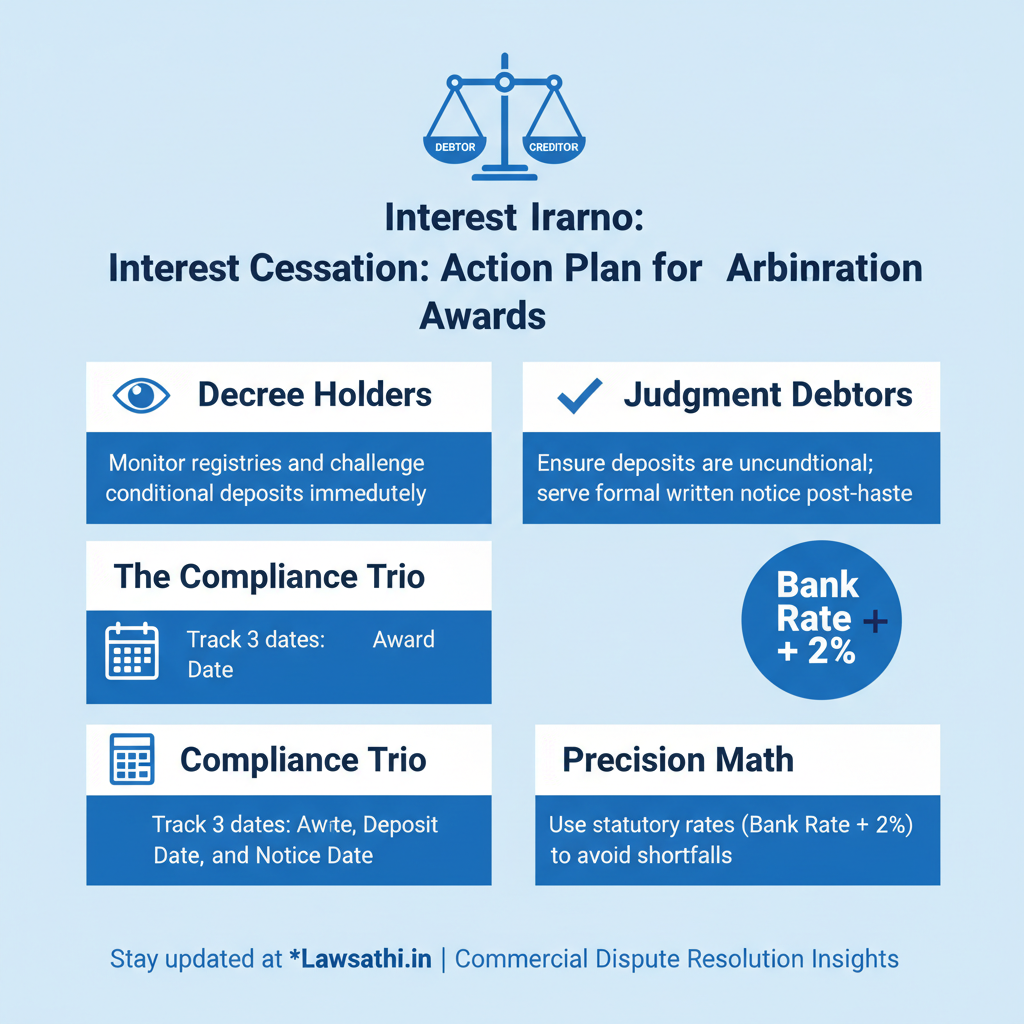

This ruling creates significant Delhi HC legal updates 2026 context for corporations. First, judgment debtors can no longer enjoy the “float” of funds locked in a registry. If they want to stop interest, they must ensure the decree holder receives a formal notice.

Strategies for Decree Holders

For lawyers representing decree holders, this is a major victory. Therefore, you should now proactively monitor court registries. Additionally, you must immediately move for the release of any deposited funds.

Challenging Debtor Conditions

If the debtor imposes conditions, you must argue that the interest period remains active. Specifically, show that the funds are not yet “accessible” in a legal sense. This approach protects the financial value of the award for your client.

Advice for Judgment Debtors

On the other hand, debtors must be more precise. If you represent a corporation, ensure that every deposit is unconditional. Furthermore, you must serve a clear, written notice to the other side immediately. Any delay in notification could cost millions in post-award interest India payments.

Comparison with Previous Precedents (HPPC vs. GMR)

The Court’s decision aligns with the Supreme Court’s stance in BHEL v. R.S. Avtar Singh. This case established the “rule of appropriation” for debt recovery. Under this rule, any payment is first applied to interest. Second, it covers costs. Finally, the payment applies to the principal.

Following the Rule of Appropriation

Therefore, interest continues to run on any remaining principal amount after the deposit. This principle of restitutio in integrum ensures the creditor is fully indemnified. Because money loses value over time, the Delhi High Court protects creditors from inflationary loss.

Consistency with CPC Order XXI

Similarly, the judgment upholds the integrity of Order XXI of the CPC. A decree is not satisfied by a unilateral act of the debtor. Instead, it requires the actual transfer of economic benefit. This consistency provides a predictable framework for execution of arbitral awards in India.

Practical Implications for Law Firms

Managing arbitration award interest Delhi High Court calculations requires high precision. Lawyers must now track three distinct dates. These include the award date, the deposit date, and the notice date. Even a difference of a few days can involve substantial sums.

The Need for Precise Interest Calculation

In fact, calculating interest manually is becoming too risky for modern firms. You must account for statutory rates under Section 31(7)(b). This rate is usually 2% higher than the prevailing bank rate. Consequently, failing to track the “notice date” correctly can lead to significant financial discrepancies.

Using Technology for Litigation Management

Lawyers should use automated tools to monitor these timelines. For instance, tracking when a notice was served is vital for your execution petition. Moreover, automated alerts can remind your team to file for fund withdrawal. These notifications help you act the moment a deposit is detected.

Conclusion: A Step Toward Efficient Dispute Resolution

The Delhi High Court’s ruling is a massive leap for the “Ease of Doing Business” in India. By linking interest cessation to the “access date,” the judiciary has signaled a pro-enforcement stance. This prevents judgment debtors from using the legal system to delay fiscal responsibility.

Ultimately, this clarity benefits the entire legal ecosystem. For example, it encourages faster settlements. In addition, it reduces the burden on execution courts. As we move through 2026, the focus remains on making arbitration a truly effective remedy.

Most importantly, understanding these nuances ensures your clients receive every rupee. Streamline your arbitration practice and never miss a calculation. Try LawSathi’s AI-powered litigation management suite today to track your awards and interest effortlessly.