The landscape of intellectual property in India is changing rapidly. Recently, there has been a massive surge in MSME trademark registration in India. This growth follows the seamless integration of the Udyam Registration portal with the IP India filing system. Today, small businesses are more aware of their brand value than ever before.

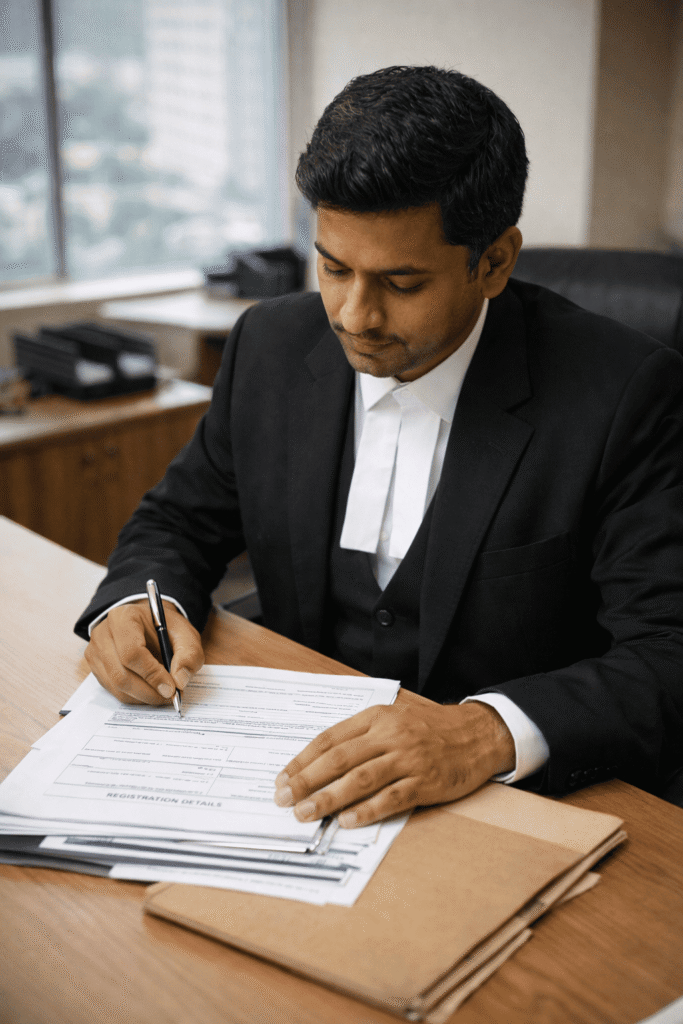

The Role of IP Lawyers in the MSME Sector

As a legal professional, you must specialize in MSME-specific filing strategies. These businesses often lack the capital for long legal battles. Consequently, they rely on you for airtight protection. You must navigate the Trade Marks Act, 1999, and the Trade Marks Rules, 2017, with precision.

Legal Framework and Recent Amendments

The Indian government has introduced several amendments to the Trade Marks Rules. These changes prioritize faster processing for small entities. Furthermore, the 2024-2025 filing statistics show that MSMEs now account for a significant portion of all new applications. Therefore, understanding the nuances of MSME trademark registration in India is essential for any modern IP practice.

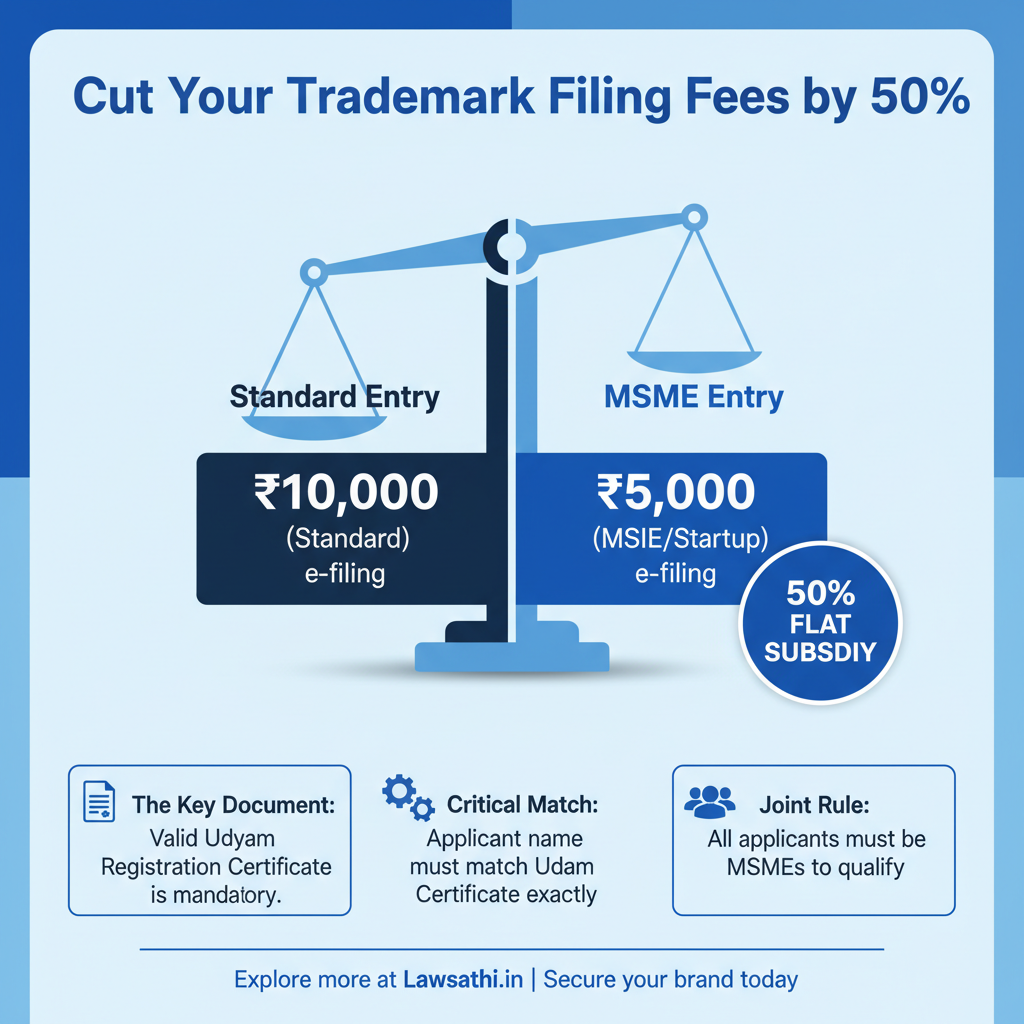

Leveraging MSME Benefits: Fee Concessions and Udyam Integration

One of the most attractive features of MSME trademark registration in India is the fee concession. The government offers a 50% flat fee subsidy to MSMEs and Startups. This reduces the official filing fee from ₹10,000 to ₹5,000 for e-filing.

Necessary Documentation for Fee Benefits

To claim this benefit, you must provide a valid Udyam Registration Certificate. In the past, lawyers used various MSME certificates. However, the Registrar now strictly requires the Udyam certificate. Specifically, the name on the certificate must match the applicant name in Form TM-A.

Avoiding Common Filing Pitfalls

Many lawyers face problems when claiming fee concessions during filing. For example, if the application is in joint names, all parties must qualify as MSMEs. If even one applicant is a large entity, you must pay the full fee. Additionally, ensure the Udyam certificate is active and not expired at the time of filing.

Strategic Trademark Class Selection for MSMEs

Proper trademark class selection for MSMEs is the foundation of a strong registration. India follows the Nice Classification system, which includes 45 different classes. Classes 1 to 34 cover goods, while classes 35 to 45 cover services.

Cross-Class Search Strategies

You should never perform a search in just one class. For instance, a tech MSME might need protection in Class 9 for software. However, they might also need Class 42 for IT services. Therefore, cross-class searching is vital to prevent future infringement suits.

Defensive Filings for Expanding Entities

Moreover, you must consider the growth trajectory of the MSME. Many startups expand into related industries within two years. As a result, you might suggest “Intent to Use” filings in supplementary classes. This strategy protects the brand before the client actually launches new products.

Global Considerations and the Madrid Protocol

If your MSME client plans to export, discuss the Madrid Protocol early on. Selecting the right classes in the home application is crucial for international filings. In contrast, an error in the Indian “base” application will affect all international registrations. This makes precision in trademark class selection for MSMEs a top priority.

Handling Trademark Rectification under Section 57

Sometimes, a registered trademark can become a hurdle. This is where the trademark rectification procedure India becomes relevant. Under Section 57 Trade Marks Act 1999, any “person aggrieved” can seek to cancel or vary a registration.

Grounds for Rectification in India

Common grounds for rectification include non-use of the mark for five years. Furthermore, if a mark was registered without “sufficient cause,” it may be removed. Bad faith registrations by competitors often target MSMEs. Consequently, you must be ready to file Form TM-O to rectify the register.

Registrar vs. High Court Jurisdiction

Following the Abolition of the IPAB, rectification petitions now go to the High Courts or the Registrar. This shift has changed the timeline for many cases. For example, the trademark rectification procedure India often moves faster in High Courts for complex disputes.

Defending MSME Clients from Attacks

On the other hand, your MSME client might face a rectification petition. Larger corporations sometimes use these to bully smaller competitors. In such cases, you must prove the “bona fide” use of the mark. Specifically, collect invoices, marketing spend, and social media presence as evidence of usage.

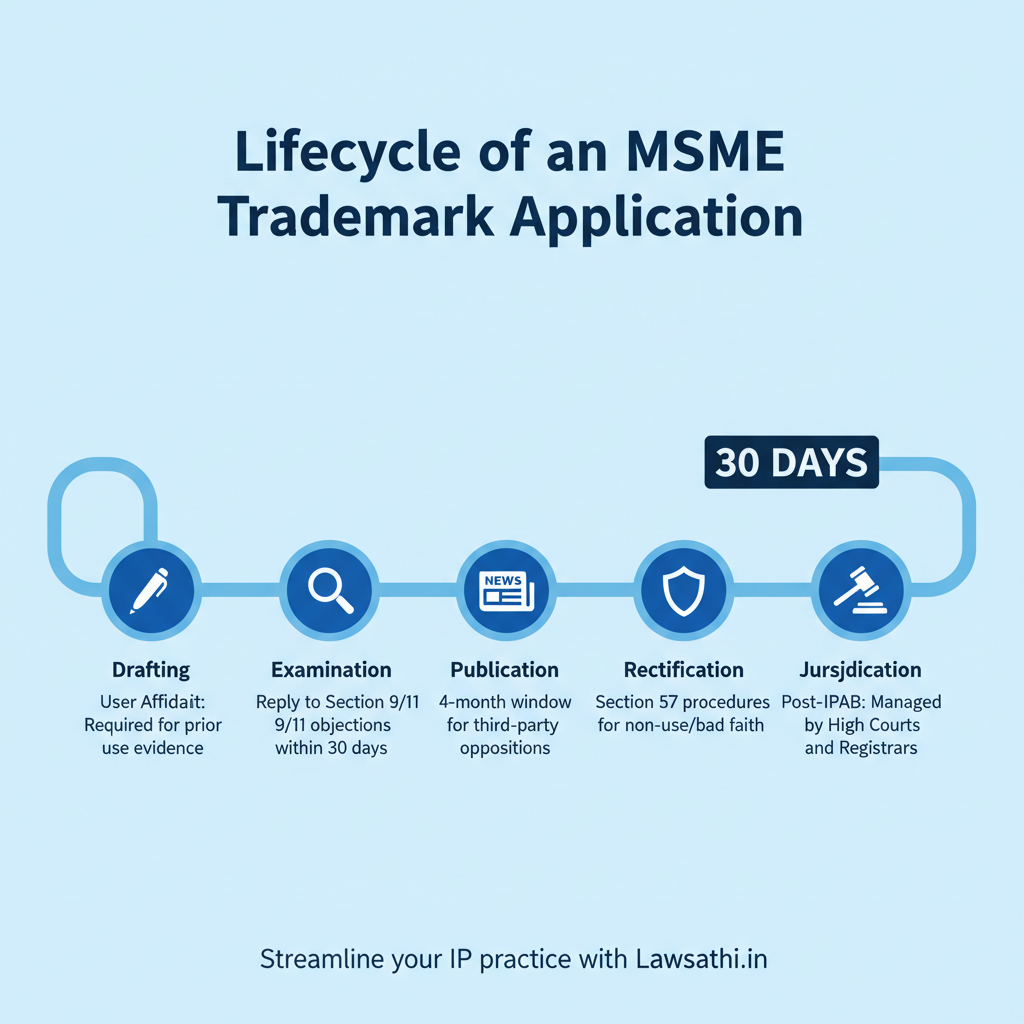

Step-by-Step Legal Procedure: From Examination to Grant

The process of MSME trademark registration in India begins with a well-drafted application. If your client has used the mark before filing, you must draft a robust ‘User Affidavit’. In fact, this document must contain clear evidence of the date of first use.

Responding to Examination Reports

Most applications face an Examination Report within 30 days. You will likely encounter objections under Section 9 (absolute grounds) or Section 11 (relative grounds). Therefore, you must provide a detailed response to succeed. For example, use the “honest concurrent user” defense if a similar mark exists.

The Role of Publication and Opposition

Once accepted, the mark is published in the Trademark Journal. This starts a four-month window for third-party oppositions. If no one opposes, the Department issues the Registration Certificate. Consequently, monitoring the Journal is a critical task for any IP practice management for Indian lawyers.

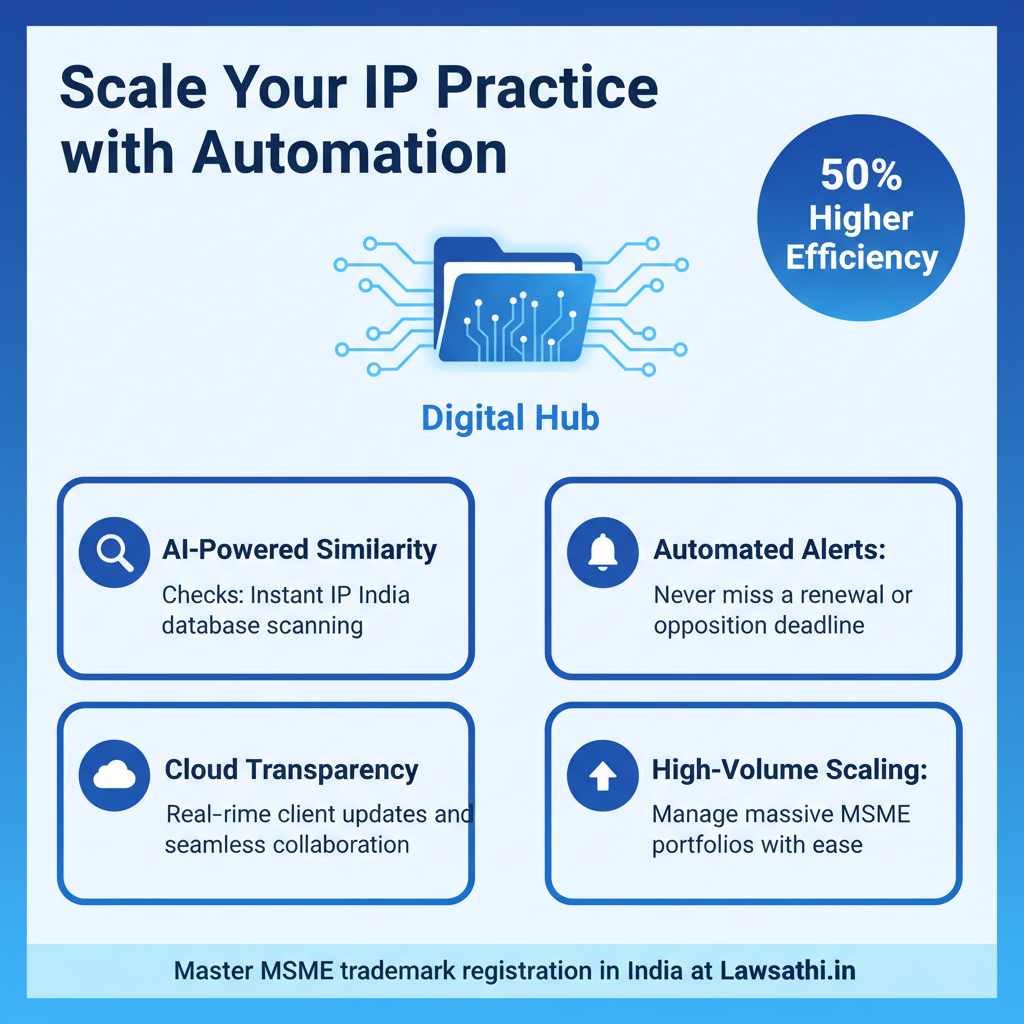

Automation in IP Practice: Managing MSME Portfolios

Managing a large volume of MSME trademark registration in India is challenging. MSMEs often have limited staff to track their own legal deadlines. As a result, the burden falls on the law firm. You must ensure no renewal or opposition deadline is missed.

The Power of AI in Trademark Management

Modern IP practice management for Indian lawyers relies heavily on automation. AI tools can now perform similarity checks across the entire database in seconds. Furthermore, these tools can automatically track the status of applications from the IP India website.

Building a Collaborative Workspace

Therefore, lawyers can now spend more time on strategy and less on data entry. Specifically, cloud-based platforms allow you to share real-time updates with your MSME clients. This transparency builds immense trust and strengthens the lawyer-client relationship.

Efficient Portfolio Scaling

In fact, automation allows small firms to manage hundreds of trademarks easily. You can set alerts for hearing dates and expiration periods. Moreover, this ensures that your client’s most valuable asset—their brand—remains protected without constant manual oversight.

Conclusion: Protecting the Future of Indian Business

Registering a trademark for an MSME is not just a filing task. It is a strategic move to protect a business’s identity and future growth. By mastering class selection and understanding rectification laws, you provide invaluable service.

Stay ahead of the curve by using the latest legal technologies available in the Indian market. Specifically, streamline your IP practice and never miss a trademark deadline again. Experience how LawSathi’s AI-driven practice management helps Indian lawyers manage MSME portfolios with ease. Finally, book a free demo today!