The Supreme Court recently clarified a critical boundary for taxpayers seeking tax certainty. In a significant judgment, the Court addressed the mandatory bar under Section 245R(2)(iii) Income Tax Act. Therefore, this ruling marks a pivotal shift for the real estate sector and legal practitioners across India.

Specifically, the decision examines when the Board for Advance Rulings (BAR) must reject an application at the threshold. Most importantly, it settles the debate over what constitutes a “pending proceeding” in property-related tax conflicts.

Understanding the Threshold Rejection

The core question revolved around whether an application can be rejected if a tax notice is already issued. In fact, many taxpayers previously used advance rulings to delay active scrutiny. However, the Supreme Court has now reinforced a vital point. Specifically, the Authority for Advance Rulings cannot be used as a parallel forum.

Why This Matters for Property Law

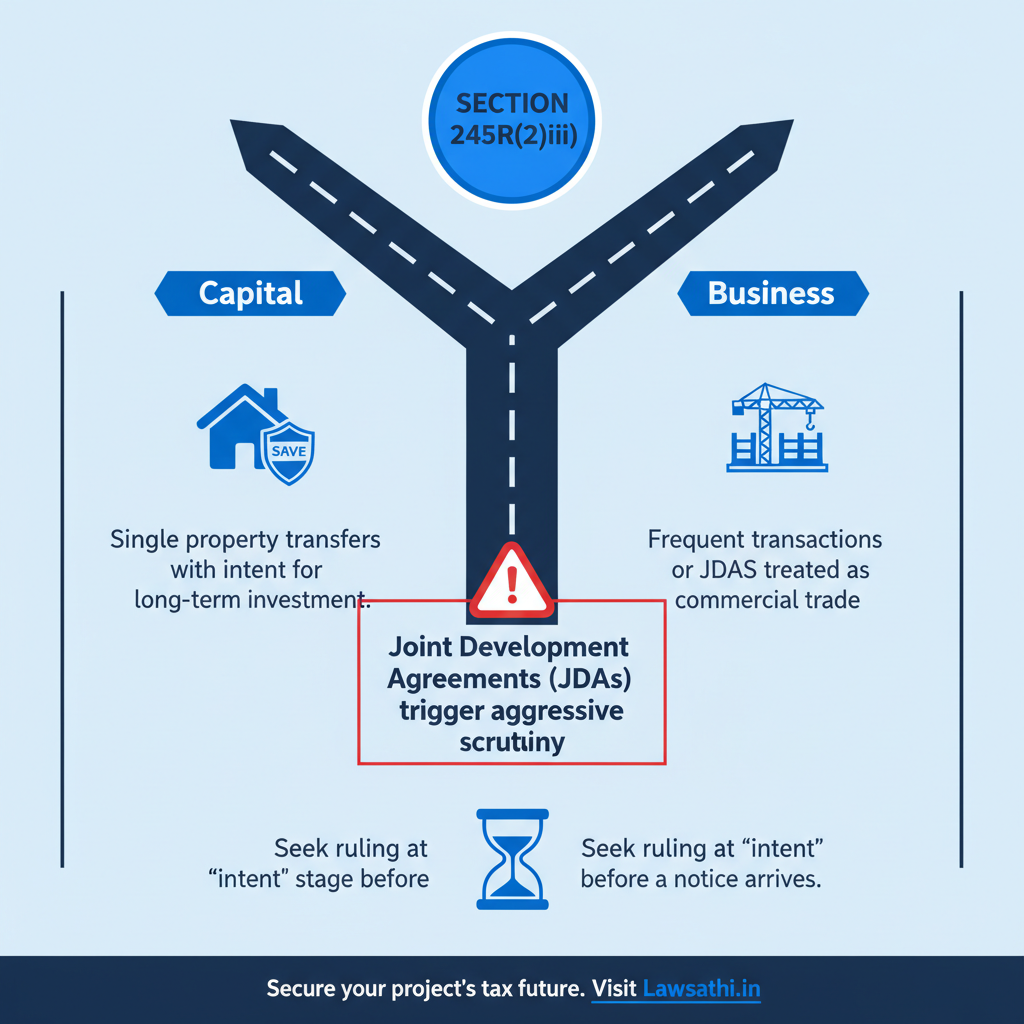

The case has high stakes for Indian property law and taxation. Specifically, property transfers often involve complex questions about capital gains versus business income. As a result, developers frequently look for pre-emptive legal clarity. This helps them avoid significant future liabilities.

The Statutory Framework: Understanding Section 245R of the Income Tax Act

The Authority for Advance Rulings (AAR) was created to provide tax certainty for non-residents and specified residents. Historically, its primary goal was to avoid long-drawn litigation. However, this power is not absolute.

Section 245R(2) of the Act outlines several mandatory bars. According to the Income Tax Act, 1961 – Section 245R, the Authority “shall not” allow an application in three specific cases.

The Missing Piece: Section 245R(2)(iii)

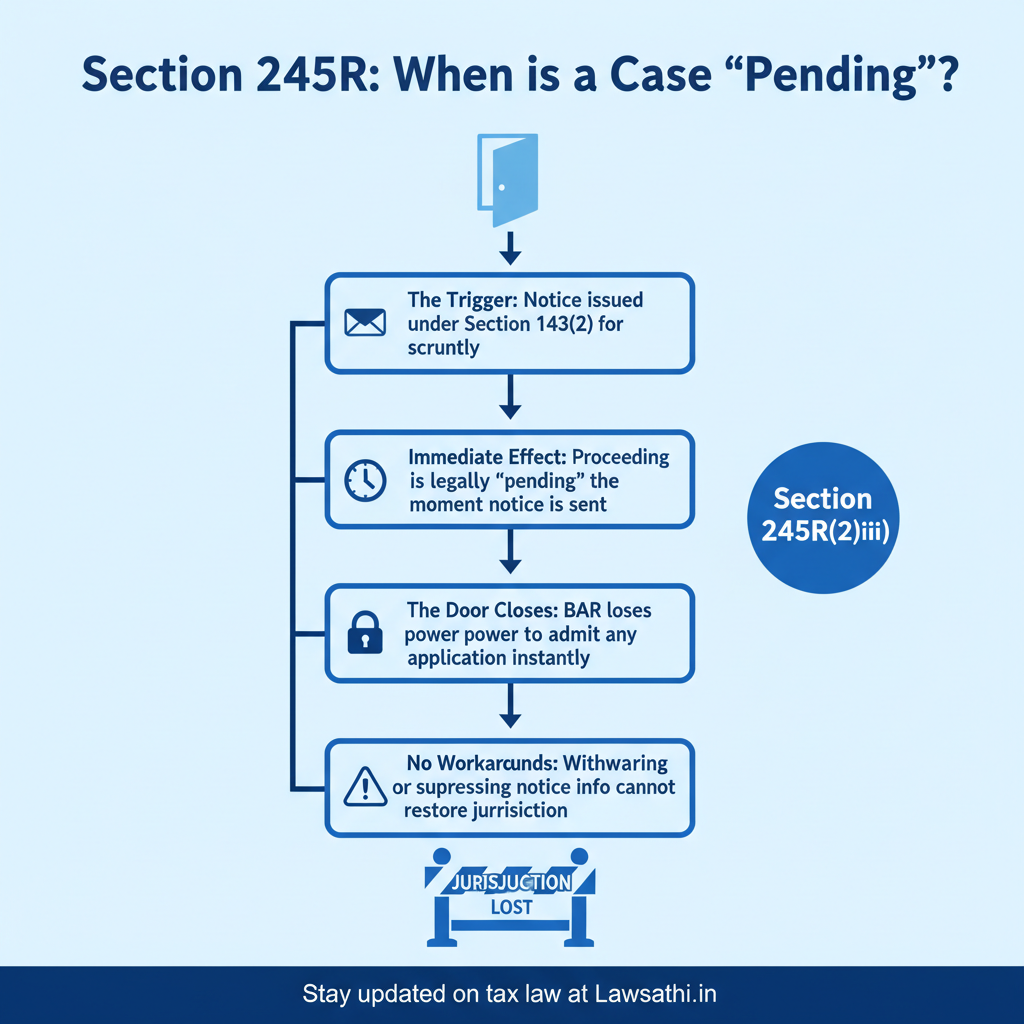

The third clause, Section 245R(2)(iii) Income Tax Act, is particularly strict. It prevents any ruling if the issue is “already pending” before any income-tax authority, Tribunal, or Court. In other words, the door to an advance ruling closes if the Department has already started looking into the matter.

Transition from AAR to BAR

Furthermore, the government has transitioned from the AAR to the Board for Advance Rulings (BAR). This change occurred through the Finance (No. 2) Bill. While the structure changed, the mandatory bars under Section 245R(2) remain firmly in place.

Factual Background: The Property Law Nexus

Real estate transactions in India are often prone to intensive tax scrutiny. For example, joint development agreements (JDAs) often trigger disputes regarding the point of tax liability. Consequently, the nature of a transaction often dictates the type of tax. Specifically, it determines if a developer pays capital gains tax or business tax.

The Conflict in the Transaction

In this specific case, the taxpayer sought a ruling on a large land transfer. At the same time, the Revenue Department had already initiated proceedings. The Department argued that the transaction was already under scrutiny. Therefore, they claimed the AAR had no jurisdiction to hear the case.

Intervention by the Income Tax Department

The Department intervened because they believed the transaction was designed for tax avoidance. As a result, they cited the Supreme Court’s historical stance in B.N. Bhattacharjee. This precedent suggests that mandatory statutory bars cannot be bypassed by equitable arguments.

The Supreme Court’s Interpretation of ‘Pending Proceedings’

The Supreme Court recently refined the definition of “pending” in the case of Vijay Krishnaswami v. DDIT. For instance, the Court held that a proceeding becomes pending the moment a notice is issued. Specifically, it cited notices under Section 143(2) as a clear trigger for “pendency.”

The Notice as a Jurisdictional Bar

Moreover, the Court emphasized that a full trial is not necessary for a matter to be considered “pending.” If a return of income is filed and a scrutiny notice is issued, the bar applies immediately. Consequently, the AAR is divested of its power to admit the application after this point.

Judicial Precedents and Threshold Rejection

In fact, the Court has consistently upheld this strict interpretation. In the case of PCIT v. Sanjeev Kumar Vudugula, the importance of departmental constraints was highlighted. Therefore, taxpayers cannot simply withdraw an appeal to “create” jurisdiction for an advance ruling.

Impact on Developers and Real Estate Entities

This ruling significantly limits the “safe harbor” strategy for real estate firms. Previously, many developers used advance rulings to stall ongoing assessments. However, the Supreme Court property law judgment 2026 makes this strategy nearly impossible.

Risk Assessment for Taxpayers

Real estate entities must now perform risk assessments much earlier. For example, they should evaluate the need for a ruling at the “intent” stage. If you wait too long and receive a scrutiny notice, you lose the chance for an advance ruling. Therefore, timing is the most critical element in modern tax planning.

Redefining Legal Strategy

Furthermore, many real estate disputes involve high tax values. As a result, developers frequently face searches under Section 132. In light of Vikram Bakshi v. R.P. Khosla, practitioners must be cautious about procedural integrity. Any suppression of pending notices could lead to a total recall of the ruling.

Key Takeaways for Legal Practitioners

For lawyers, the Section 245R rejection is a lesson in proactive filing. First, you must ensure that your client files the application before the return of income is due. Alternatively, ensure it is filed before any notice under Section 143(2) arrives.

Disclosure and Transparency

Additionally, full disclosure of all existing notices is now mandatory. If you fail to disclose a pending notice, the BAR may later quash the ruling for fraud. In fact, transparency is the best defense against a threshold rejection. Similarly, you must distinguish your current questions from those covered under active scrutiny.

Handling Future vs. Past Disputes

Practitioners should also note that advance rulings are meant for proposed transactions. Therefore, if a transaction is already a subject of active investigation, it is better to take the traditional appeal route. This includes proceeding through the Commissioner of Income Tax (Appeals).

Conclusion: The Future of Tax Certainty in India

The transition to the Board for Advance Rulings aims for faster resolution. However, the Supreme Court’s stance on Section 245R(2)(iii) Income Tax Act means we will see more threshold rejections. Consequently, taxpayers may find themselves pushed back into traditional direct tax litigation India.

Ultimately, this ruling restores the balance of power to the Assessing Officers. It ensures that advance rulings remain a tool for genuine, pre-emptive certainty. As a result, legal practitioners must adapt by focusing on early-stage tax advisory rather than late-stage defense.

Moreover, you should stay ahead of landmark judgments to streamline your tax litigation work. Our AI-driven tools help you manage case files and stay updated with real-time legal alerts. Book your LawSathi demo today!