# Supreme Court on Section 245R(2)(iii): Rejection of Advance Ruling Applications Explained

The Indian tax landscape changed significantly on January 15, 2026. On that day, the Supreme Court delivered a landmark judgment. This ruling focused on Section 245R(2)(iii) Income Tax Act. Specifically, it clarifies when the Authority for Advance Rulings (AAR) can reject an application.

Furthermore, the Court addressed the fine line between tax planning and tax avoidance. For Indian lawyers, this decision serves as a critical guide. Most importantly, it helps define international tax structures. Consequently, understanding these jurisdictional limits is now essential for every tax practitioner.

Introduction to the Supreme Court’s Mandate on Section 245R(2)(iii)

The Supreme Court recently redefined the powers of the AAR. This mandate also applies to its successor, the Board for Advance Rulings (BAR). In the case of Authority for Advance Rulings v. Tiger Global International II Holdings, the Court explored its core duties. Specifically, it looked at whether the AAR can reject applications at the “threshold stage.”

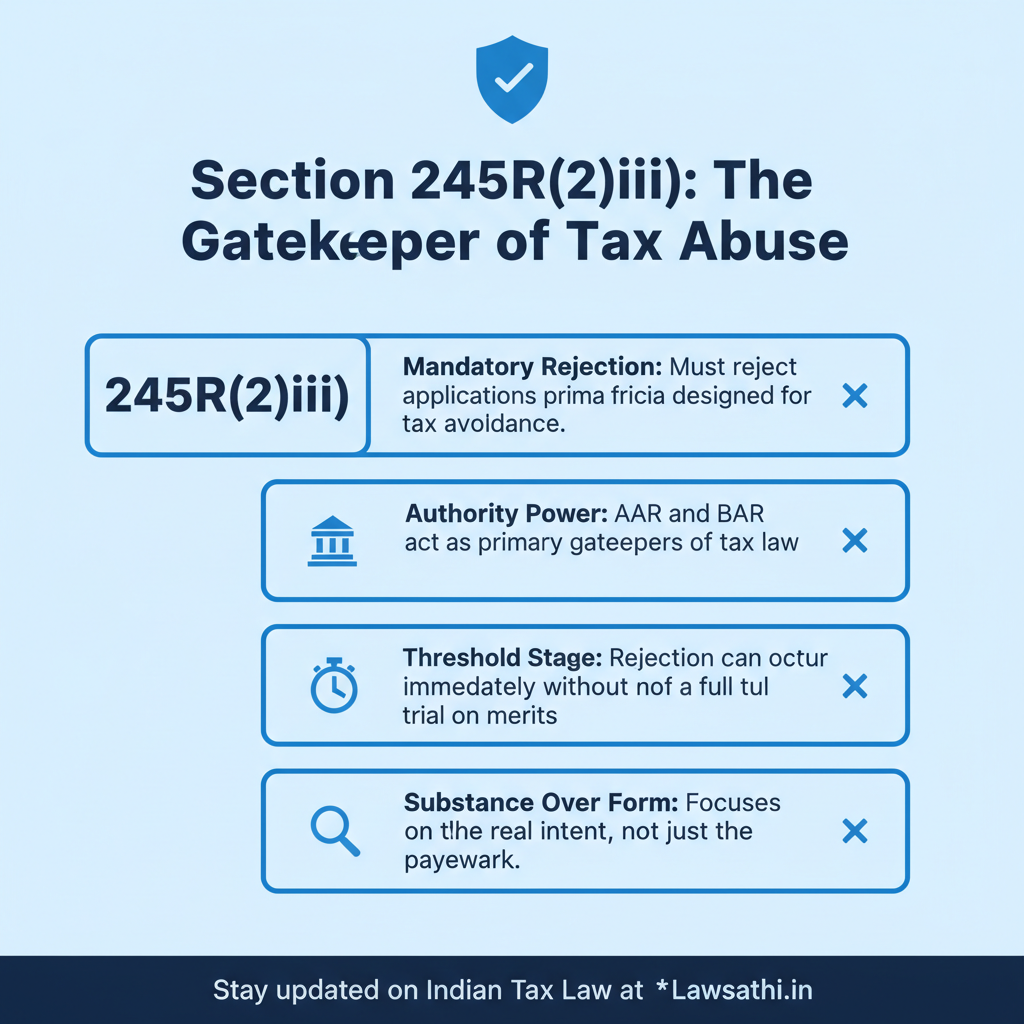

The Power to Reject at the Threshold

Many taxpayers seek advance rulings to gain certainty on future liabilities. However, the Court held that the AAR must act as a gatekeeper. For example, if a transaction appears designed for tax avoidance, the AAR must act. Specifically, the AAR is legally obligated to reject it immediately. Therefore, the tribunal does not need to proceed to a full hearing on merits.

Shifts in Tax Jurisprudence

Furthermore, this ruling signals a shift toward “substance over form.” The Court noted that multinational corporations often use complex structures. Specifically, they use these to avoid Indian taxes. By strengthening Section 245R(2)(iii) Income Tax Act, the judiciary aims to curtail such practices. As a result, this decision impacts both existing applications and future tax litigation.

Understanding Section 245R(2)(iii) of the Income Tax Act

The Income Tax Act, 1961 provides a clear statutory framework for advance rulings. Under Section 245R(2), the AAR faces mandatory limits on its jurisdiction. Specifically, Clause (iii) is particularly powerful. This is because it focuses on the intent of the transaction.

The Tax Avoidance Clause

Specifically, this clause bars any application where the transaction is “prima facie designed for tax avoidance.” This means the AAR looks at the “why” behind an investment. If the primary motive is avoiding tax, the application fails. In other words, the AAR lacks the authority to bless a tax avoidance scheme.

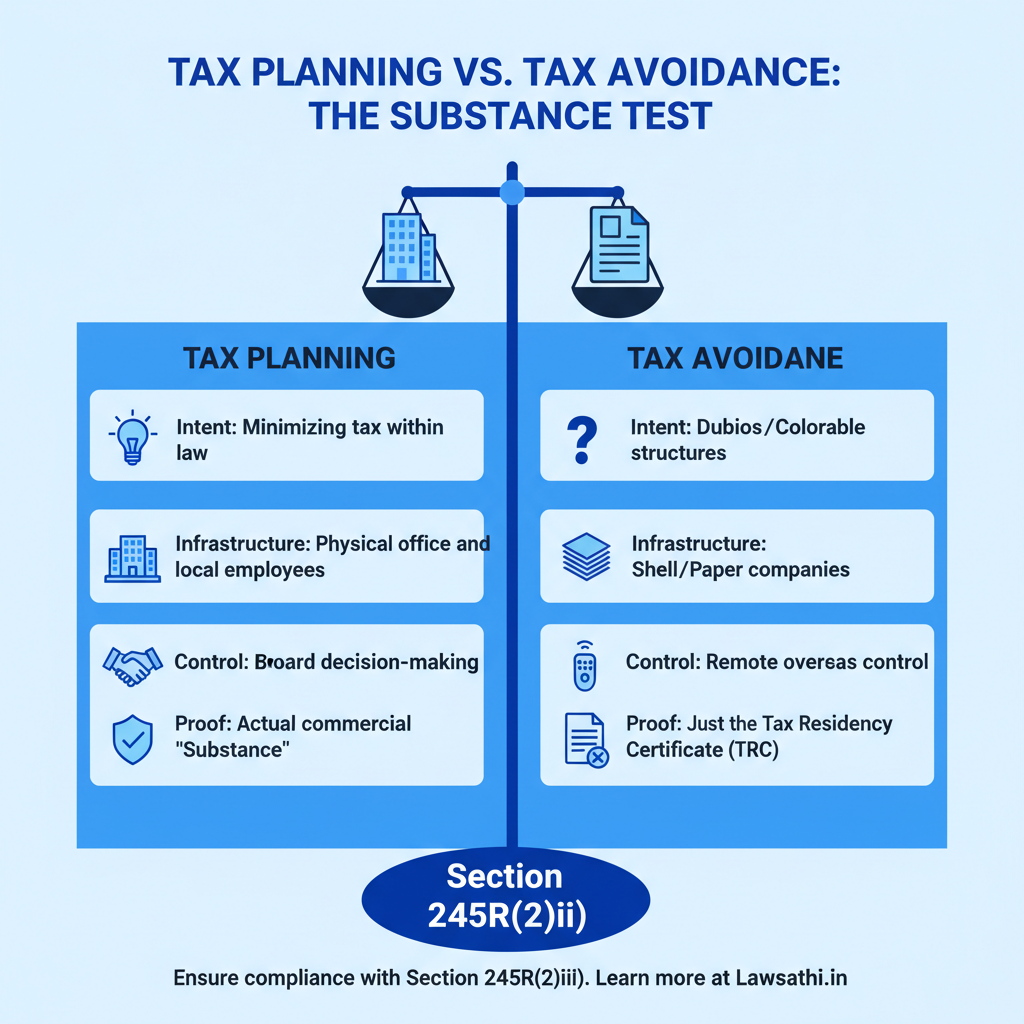

Legitimate Planning vs. Prohibited Evasion

Moreover, the Court clarified the boundary between planning and evasion. Taxpayers can certainly plan their affairs to minimize tax within the law. However, once a structure becomes “colorable” or “dubious,” it crosses a line. For example, using a conduit entity without real operations is a major red flag. This applies directly under Section 245R(2)(iii) Income Tax Act.

Case Facts: The Journey from AAR to the Supreme Court

The Tiger Global case involved the 2018 sale of Flipkart Singapore shares. The buyer was a Luxembourg entity called Fit Holdings S.A.R.L. This entity was part of the Walmart group. Tiger Global is based in Mauritius. Consequently, they claimed capital gains exemption under the India-Mauritius Double Taxation Avoidance Agreement (DTAA).

The AAR’s Initial Rejection

Initially, the AAR rejected the application in 2020. The authority noted that the Mauritian entities had no commercial substance. For instance, the real control was exercised from the USA. As a result, the AAR deemed the entities as mere “conduits.” These were created to circumvent Indian taxes.

Comparing Control and Management

In addition, the Court looked at the physical location of decision-making. Specifically, it found that the Mauritian office lacked authority. Moreover, only a few directors resided in Mauritius. Therefore, the structure failed the substance test needed for treaty benefits.

The Reversal and Final Verdict

Subsequently, the Delhi High Court quashed this rejection in 2024. The High Court favored the taxpayer by focusing on treaty benefits. However, the Supreme Court in 2026 set aside the High Court’s order. The apex court upheld the AAR’s decision. Specifically, it cited the clear mandate of Section 245R(2)(iii) Income Tax Act.

Key Findings: Why the Supreme Court Upheld the Rejection

The Supreme Court provided a deep interpretation of “prima facie” evidence. It ruled that “prima facie” is not just a superficial glance. Instead, it means that evidence points conclusively to avoidance. For example, the absence of employees in Mauritius proved the lack of substance.

Discretionary Powers and Corporate Veils

In addition, the Court affirmed the AAR’s power to “pierce the corporate veil.” The authority can look behind the paperwork at the threshold stage. If an entity is a mere shell, the AAR must use its power. Therefore, it must reject the plea. This ensures that paper companies do not misuse the advance ruling mechanism.

No Requirement for an Exhaustive Trial

Furthermore, the Court clarified that no full trial is needed. If the Revenue Department provides evidence of a lack of substance, that is enough. Therefore, the BAR can dismiss applications based on initial records. This reportable judgment creates a much higher bar for taxpayers to cross.

Impact on Pending Advance Ruling Applications

This judgment has a direct impact on the newly formed Board for Advance Rulings (BAR). Existing applications will now face much stricter scrutiny. This is especially true regarding commercial rationale. Specifically, tax lawyers must now prove a bona fide business purpose. Saving tax alone is no longer sufficient.

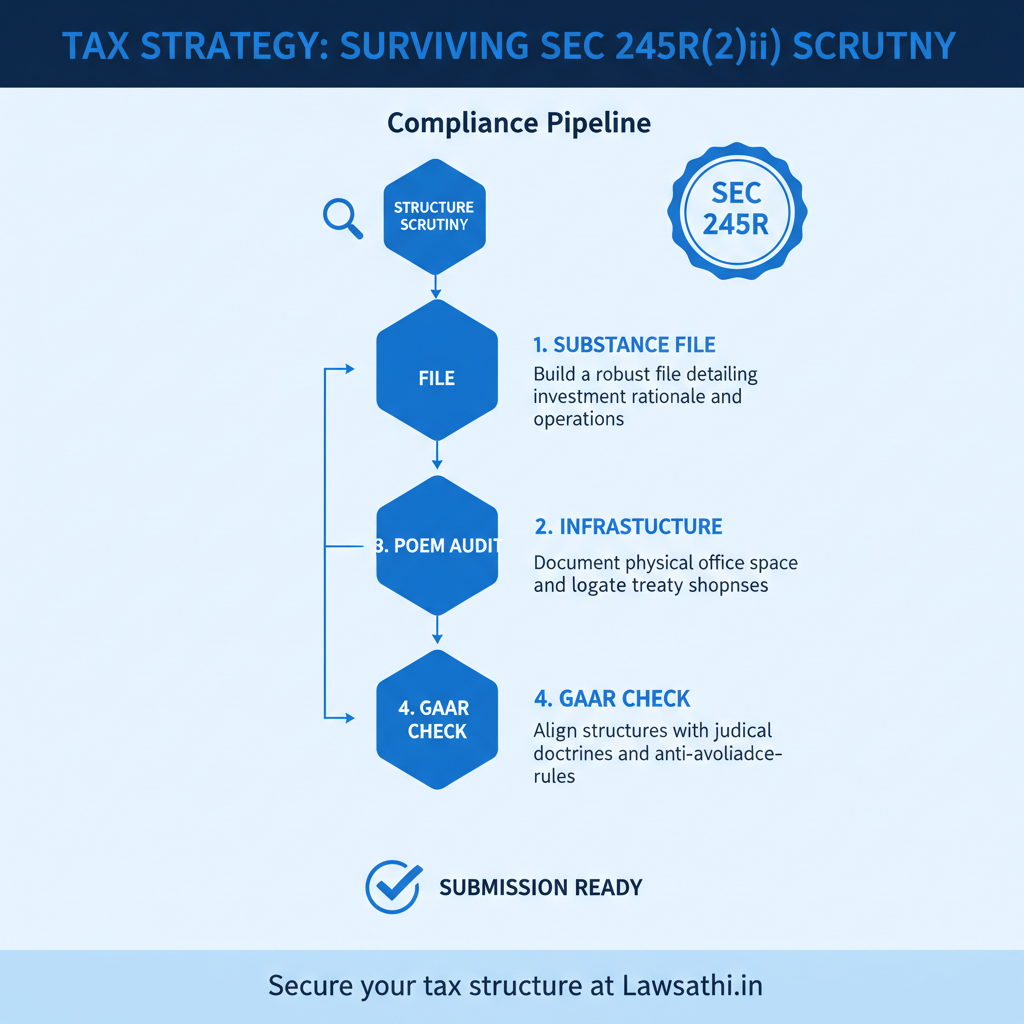

The Role of GAAR

Additionally, the Court highlighted the interaction with General Anti-Avoidance Rules (GAAR). Judicial anti-avoidance doctrines can now be applied alongside GAAR provisions. Consequently, some transactions may meet the literal words of the law but still fail. In fact, they will fail if they lack a “substance test.”

The Limitation of TRCs

Most importantly, a Tax Residency Certificate (TRC) is no longer a “golden ticket.” Previously, a TRC from Mauritius often guaranteed treaty benefits. Now, the Revenue and the BAR can look behind the TRC. Specifically, they will verify the “Place of Effective Management” (POEM). This helps prevent treaty shopping.

Practical Compliance Tips for Tax Practitioners

For practitioners dealing with Section 245R(2)(iii) Income Tax Act, documentation is key. You must build a robust “substance file” for every transaction. This file should include the investment rationale. Furthermore, it should contain evidence of local management.

Essential Documentation

First, ensure that the entity has physical office space and local employees. Second, document that board meetings happen in the resident country. Third, maintain records of local operational expenses. Without these, the AAR may view your client as a conduit. As a result, they may reject the application.

Alternatives to Advance Rulings

If an application is rejected, remember that other remedies exist. As noted in recent Supreme Court precedents, rejection is not final. Specifically, it does not prevent you from contesting the assessment. However, the findings of the AAR will still carry significant weight.

Conclusion: The Evolving Landscape of Tax Litigation in India

The Supreme Court’s stance on Section 245R(2)(iii) Income Tax Act reflects a global trend. Tax authorities worldwide are moving toward transparency. In India, this ruling balances two factors. First, it provides taxpayer certainty. Second, it protects national revenue.

Therefore, lawyers must adapt to this “substance-first” approach. Merely following the letter of the law is no longer enough. You must understand the commercial intent of every arrangement. This ensures staying compliant in an era of aggressive tax scrutiny.

Stay ahead of complex tax litigation and manage your case research efficiently with LawSathi’s AI-powered insights. Start your free trial today!