The legal landscape of Hindu Undivided Families (HUF) is shifting rapidly. For decades, practitioners have debated the ownership status of assets held by the family head. On February 5, 2026, the Supreme Court provided much-needed clarity on the presumption of properties acquired by Karta.

Consequently, this ruling impacts how lawyers approach partition suits and property disputes across India. Specifically, it addresses whether a property is “self-acquired” or belongs to the entire family. Therefore, understanding these nuances is essential for modern legal practice.

Introduction: The Evolving Jurisprudence of Joint Hindu Family Property

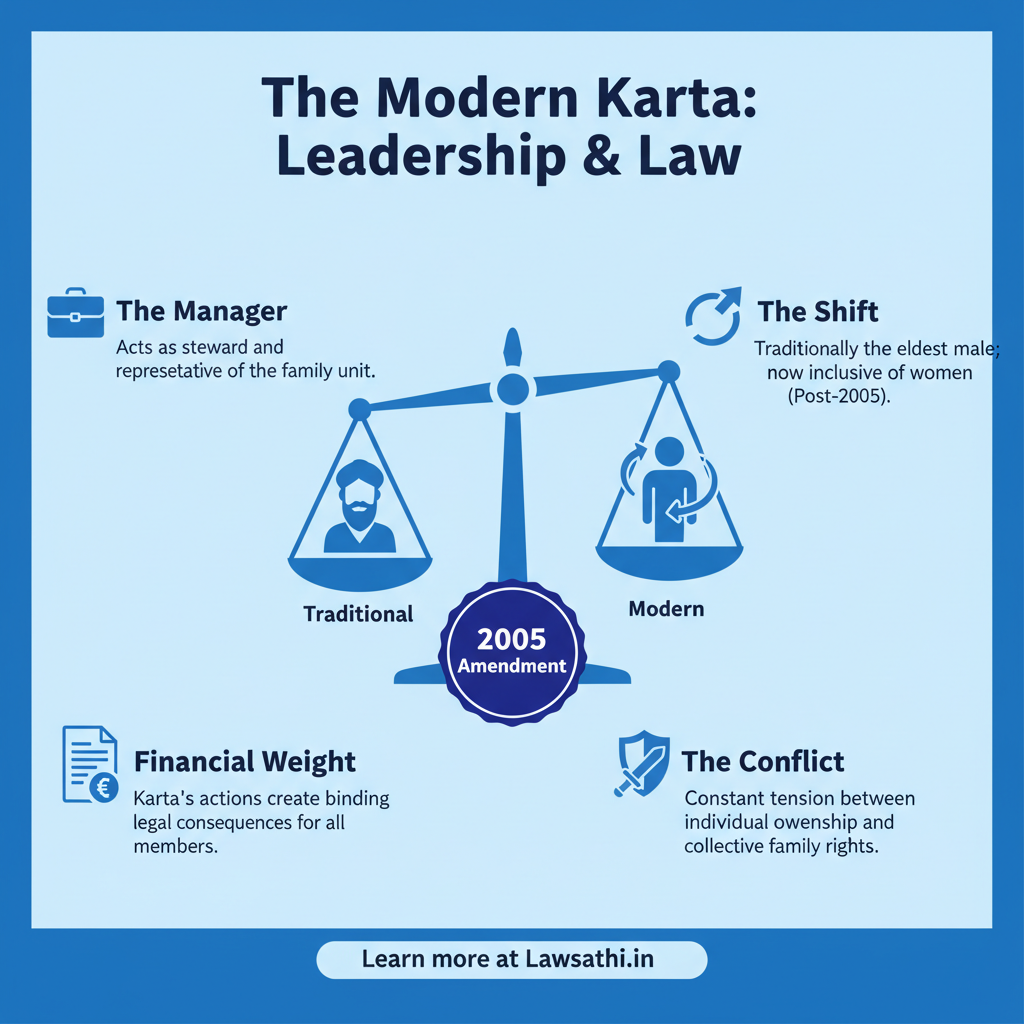

A Karta holds a unique position in a Joint Hindu Family. He acts as a manager, steward, and representative of the family unit. Therefore, his financial actions always carry a heavy legal weight. Historically, the Mitakshara law governed how family wealth was handled. However, modern litigation often creates a fundamental conflict between individual and collective rights.

The Conflict of Ownership

The primary question is whether every property held by the Karta is presumed joint. This issue arises frequently when a Karta buys land in his own name. Is it his private asset, or does it belong to the HUF? Furthermore, recent Supreme Court interventions have significantly clarified how we characterize these properties in a court of law.

Legal Definition of Karta

In traditional Hindu law, the Karta is usually the eldest male member. Nevertheless, the 2005 amendment to the Hindu Succession Act changed this dynamic. Now, women can also lead the family as managers. As a result, the legal duties and powers of the Karta remain a focal point of property litigation in 2026.

The Core Legal Principle: Is There a Presumption of Jointness?

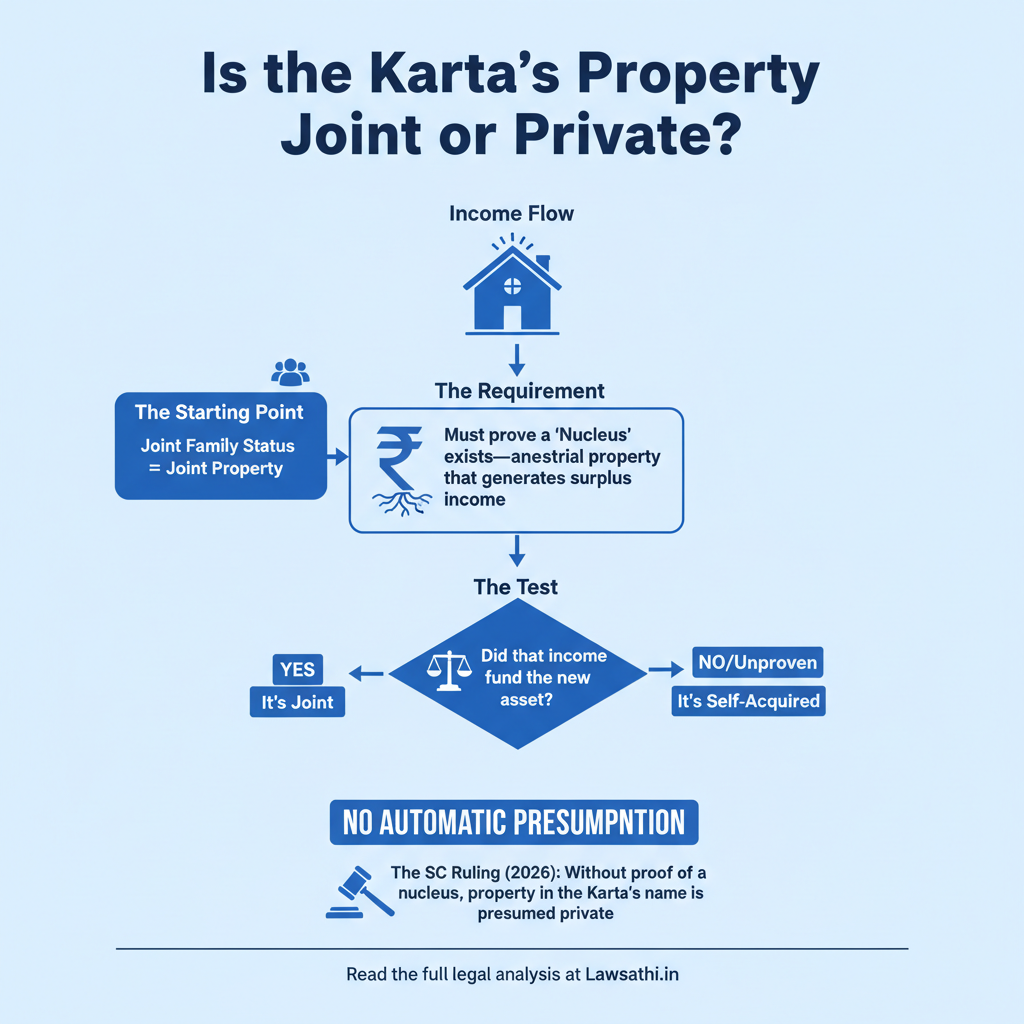

Many people believe that all property in a joint family is shared. However, the law does not actually support this automatic assumption. The Supreme Court recently reaffirmed this in Angadi Chandranna v. Shankar (2025). Specifically, the court stated that a family being joint does not mean the property is joint.

Analysis of the Nucleus Theory

To claim a property is joint, you must prove the existence of a “nucleus.” This refers to ancestral property that yields enough income to buy more assets. For example, if the family owns a fertile farm, that income could fund new land. In contrast, if the ancestral land is barren, no such presumption arises.

Distinguishing Family from Property

Practitioners must distinguish between a “joint family” and “joint family property.” A family can live together without sharing all financial assets. Therefore, the presumption of properties acquired by Karta only begins once you prove a sufficient income-generating core. Most importantly, the court will not assume a nucleus exists based on mere probability.

Burden of Proof: Who Must Prove the Character of the Property?

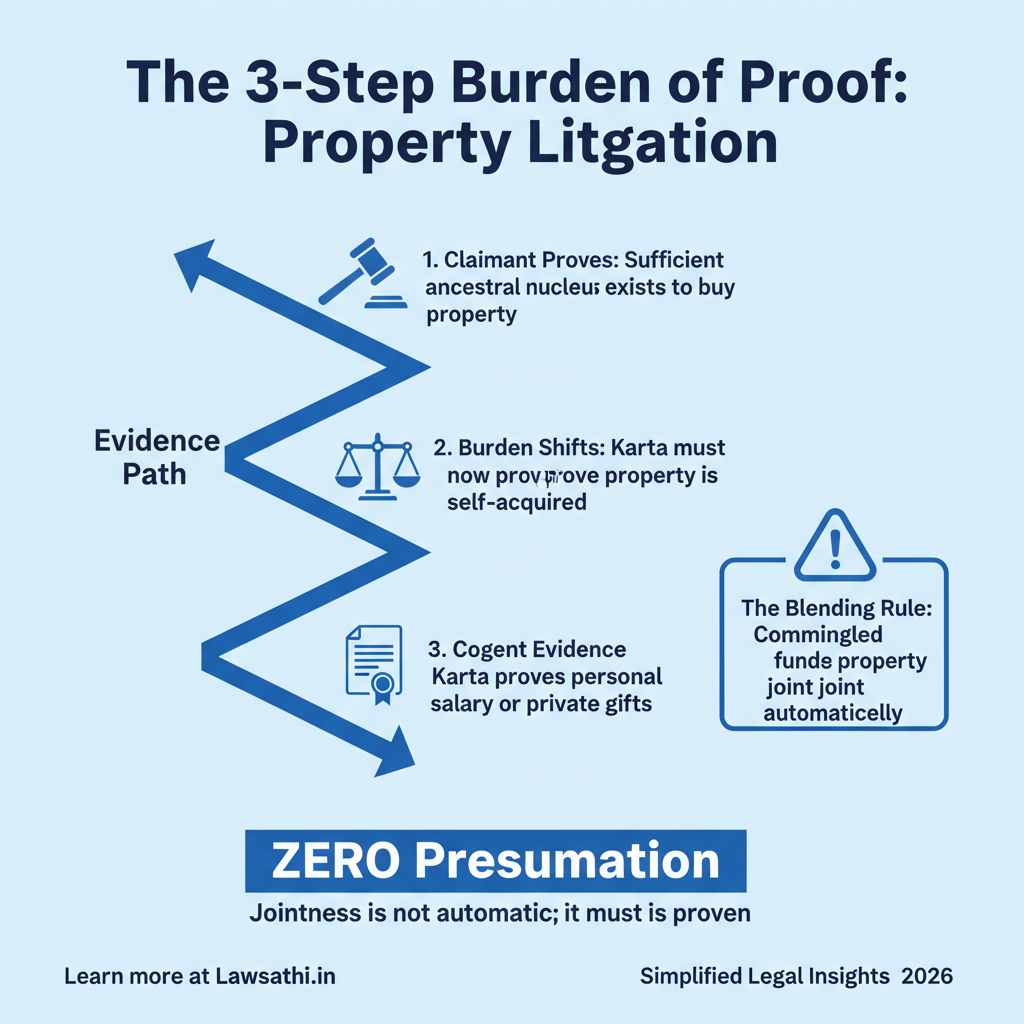

Applying the right burden of proof is crucial in property law. Initially, the burden rests on the person claiming the property is joint. This party must show the family had an ancestral fund. Furthermore, they must demonstrate that this fund was sufficient to make the acquisition.

Shifting of the Burden

Once the claimant proves a sufficient nucleus, the burden of proof shifts. At this stage, the Karta must prove he used separate funds. For instance, he might show his personal salary or a private gift as the source. Recent rulings from February 2026 emphasize that property stays with the HUF without “cogent evidence” of self-acquisition.

The Concept of Blending

Sometimes, a Karta might mix his personal money with family funds. This is known as “blending” or commingling. If a Karta voluntarily throws his assets into the common stock, they become joint. However, the court requires clear proof of his intention to abandon separate ownership. This distinction is vital for protecting individual wealth within an HUF.

Key Supreme Court Judgments Determining Karta’s Acquisitions

Landmark cases continue to shape the presumption of properties acquired by Karta. The case of Srinivas Krishnarao Kango v. Narayan Devji Kango remains a foundational precedent. It established the “sufficiency of nucleus” test that courts still use today. Moreover, the court has integrated these old rules with the modern Hindu Succession Act.

Recent Updates (2023-2026)

In the N.S. Balaji v. DRT (2023) decision, the court discussed alienation. It confirmed that a Karta can mortgage HUF property for “legal necessity.” This can be done even without the consent of minor members. Additionally, the court remains strict about how funds are used.

Managing Risk and Liability

Courts also look at the nature of the Karta’s business. For example, a Karta cannot start a risky business and charge those debts to the family property. Consequently, if a Karta uses joint funds for personal speculation, he alone is responsible for the losses. Above all, this protects the collective assets of other family members.

Factors Influencing the Court’s Decision

When deciding these cases, Indian courts look at specific factual indicators. First, they examine the nature of the initial ancestral nucleus. Was the income enough to create a surplus? If the family lived in poverty, it is unlikely they bought new land using joint funds.

The Importance of Documentary Evidence

Modern litigation relies heavily on a paper trail. Specifically, the court prioritizes sale deeds, mutation records, and tax filings over oral testimony. For instance, if the Karta filed separate income tax returns, it supports his claim of self-acquisition. On the other hand, mutation in the name of the HUF strongly suggests joint ownership.

Conduct of Family Members

The behavior of the family over decades also matters. For example, do other members live on the property? Have they been sharing the rent or profits? If a Karta allows his siblings to enjoy the property for thirty years, the court might view it as joint. Thus, consistent conduct serves as powerful evidence in partition suits.

Implications for Legal Practitioners and Litigants

For lawyers, the presumption of properties acquired by Karta requires a strategic approach. You cannot simply file a generic partition suit. Instead, you must carefully trace the trail of funds. Moreover, this often involves forensic accounting to identify the source of every major purchase.

Strategic Advice for Drafting Plaints

When drafting a plaint, specify the income-generating capacity of the ancestral property. If you fail to plead the existence of a nucleus, the court may dismiss your claim. Furthermore, ensure that you challenge any “self-acquisition” claims with documented financial gaps. For example, show that the Karta’s official salary was too low to afford the disputed asset.

Avoiding Common Technical Pitfalls

Litigants often rely too much on oral history. However, in the 2026 legal climate, documentary evidence is the “gold standard.” Similarly, remember that shares become self-acquired properties once a partition is finalized. Understanding this timeline is essential for determining future inheritance rights.

Conclusion: Balancing Ancient Traditions with Modern Individualism

The current legal stance on the presumption of properties acquired by Karta favors “proof over presumption.” While the court protects the family unit, it also respects individual labor. The February 2026 rulings show that the Karta is accountable. However, he is not a slave to the joint family structure.

Ultimately, the burden of proof is the deciding factor in most HUF disputes. By proving a sufficient nucleus, family members can protect their collective heritage. Conversely, by providing cogent evidence of independent income, a Karta can safeguard his personal legacy. In conclusion, this balance ensures that the Joint Hindu Family remains relevant in a modern economy.

Managing complex property litigation requires meticulous documentation. Let LawSathi’s AI-powered research and case management tools help you build an airtight argument for your next HUF partition suit. Get a free demo today!