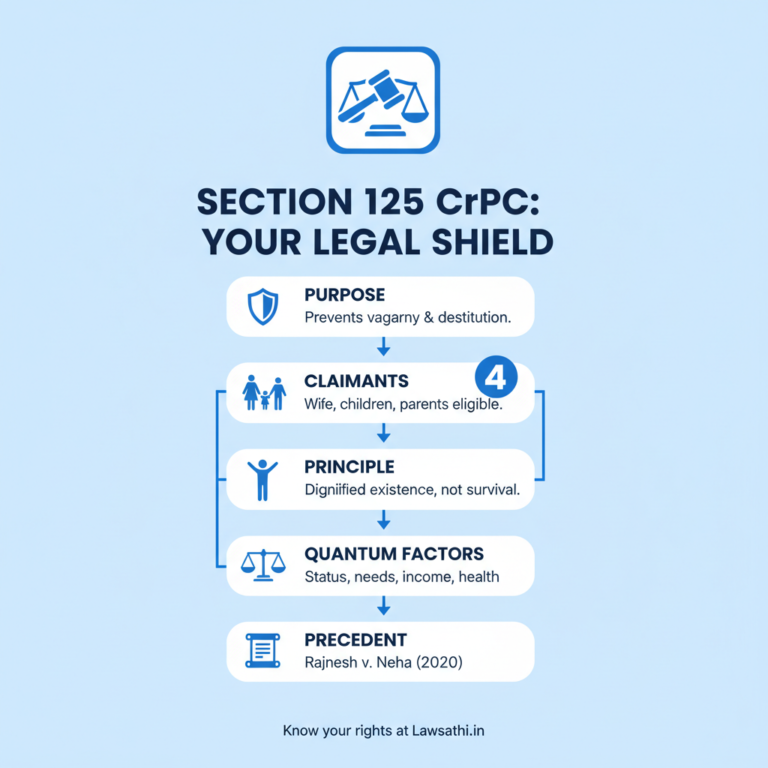

Analysis of Jharkhand HC’s ruling upholding ₹24,000 monthly maintenance under Section 125 CrPC. Key…

Will AI replace lawyers in India? Analyze 2026 automation trends, job security risks for legal…

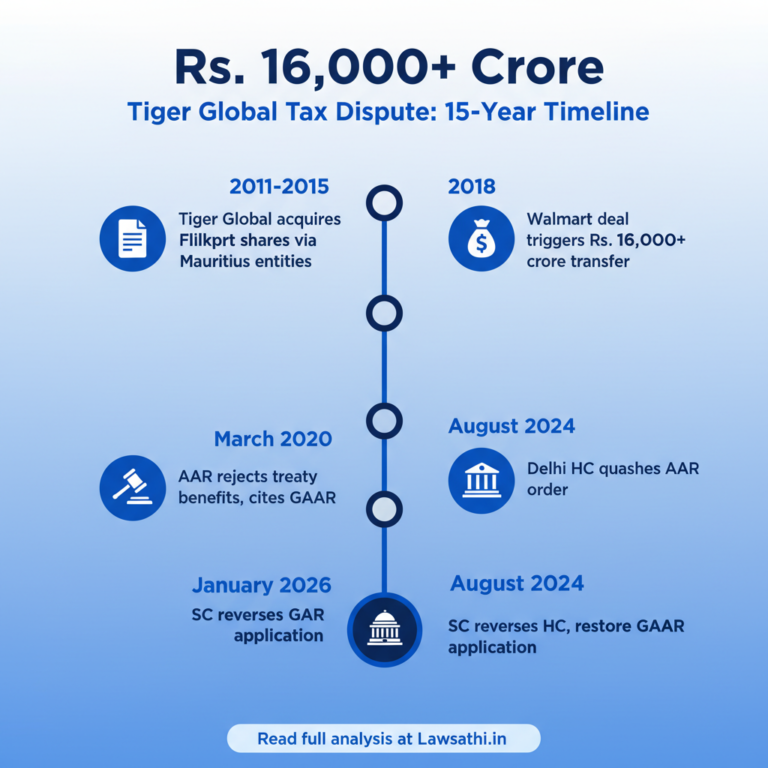

An in-depth analysis of the Supreme Court’s ruling on Tiger Global’s Mauritius entities and GAAR…

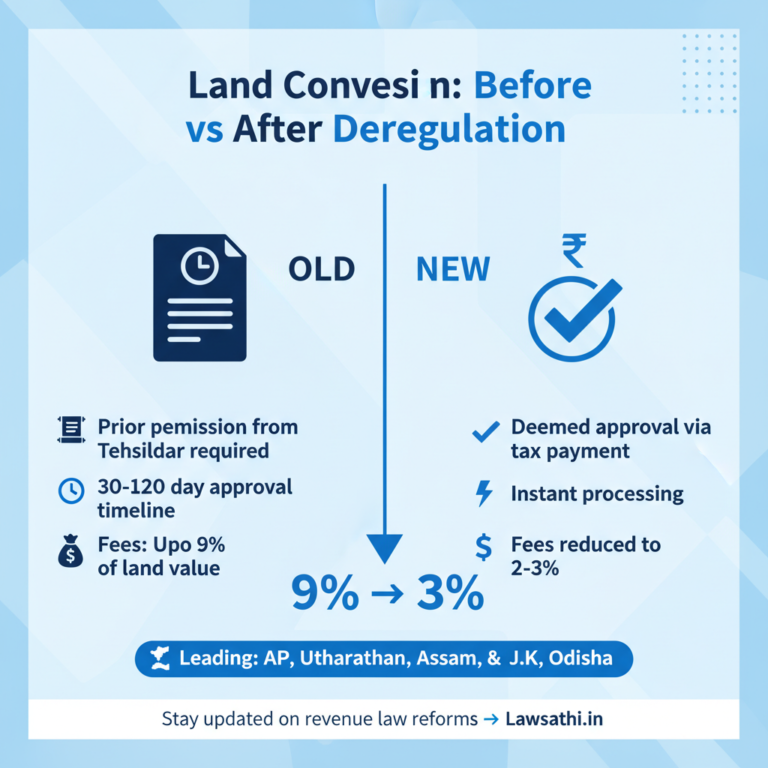

Analyze the government’s 28 major deregulation moves, including the scrapping of land conversion…

Budget 2026 clarifies no income tax on government land acquisition payouts. Analyze the end of the…

Analyze the Supreme Court’s landmark ruling on cricket association composition and application of…

Analysis of Jharkhand HC’s ruling upholding ₹24,000 monthly maintenance under Section 125 CrPC. Key takeaways for lawyers on maintenance…

Will AI replace lawyers in India? Analyze 2026 automation trends, job security risks for legal professionals, and how lawyers can adapt to legal tech…

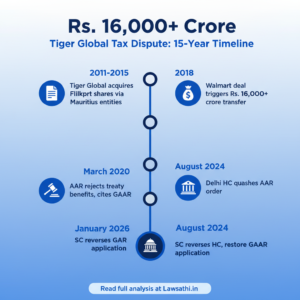

An in-depth analysis of the Supreme Court’s ruling on Tiger Global’s Mauritius entities and GAAR. Understand the implications for capital gains tax…

Analyze the government’s 28 major deregulation moves, including the scrapping of land conversion permits. Understand the impact on revenue law…

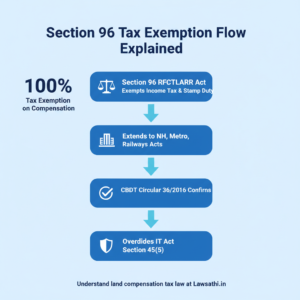

Budget 2026 clarifies no income tax on government land acquisition payouts. Analyze the end of the Section 96 ambiguity and its impact on legal…

Analyze the Supreme Court’s landmark ruling on cricket association composition and application of constitutional principles to sports bodies. Key…

Analyze the Supreme Court’s clarification that the Payment of Gratuity Act, 1972 does not apply to Central Government civil employees. Key takeaways…

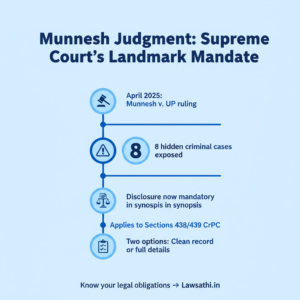

Understand the Supreme Court’s mandate on disclosing criminal history in bail applications. Learn implications of non-disclosure and compliance…

Understand full tax exemption on land compensation for highway & metro projects. Key legal provisions, case laws, and compliance tips for Indian legal…