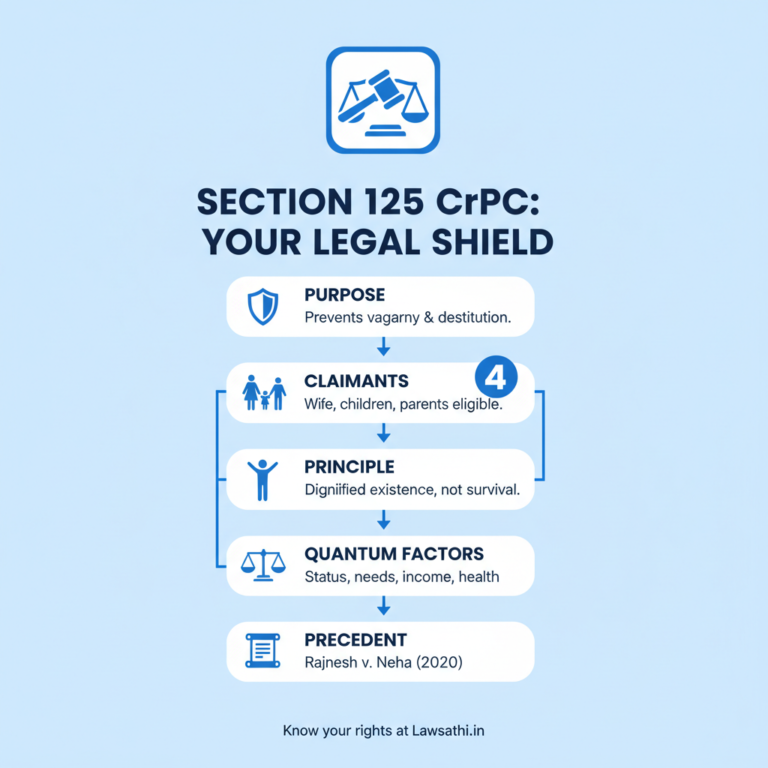

Analysis of Jharkhand HC’s ruling upholding ₹24,000 monthly maintenance under Section 125 CrPC. Key…

Will AI replace lawyers in India? Analyze 2026 automation trends, job security risks for legal…

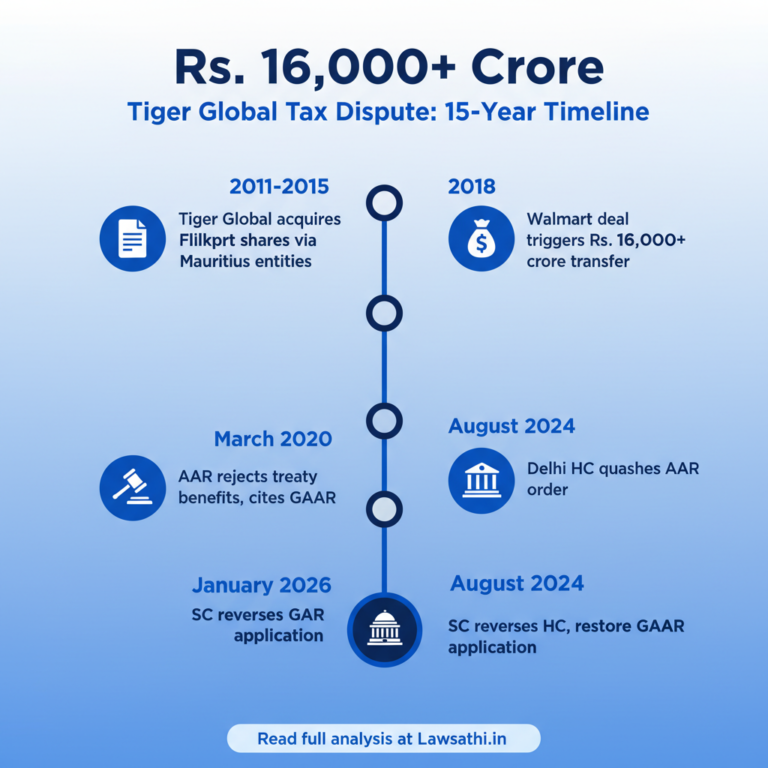

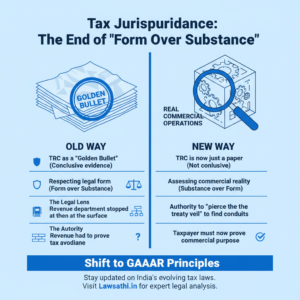

An in-depth analysis of the Supreme Court’s ruling on Tiger Global’s Mauritius entities and GAAR…

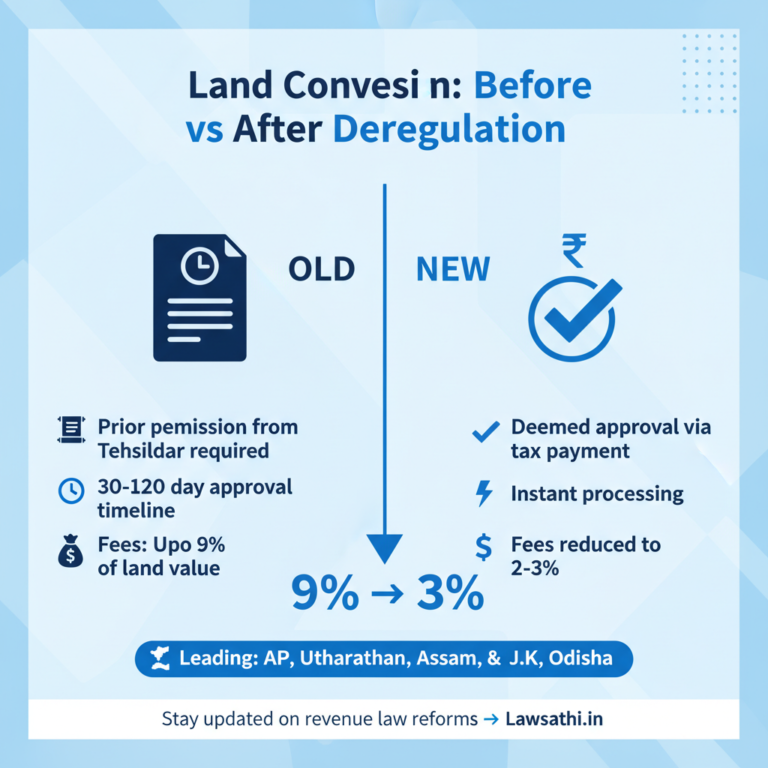

Analyze the government’s 28 major deregulation moves, including the scrapping of land conversion…

Budget 2026 clarifies no income tax on government land acquisition payouts. Analyze the end of the…

Analyze the Supreme Court’s landmark ruling on cricket association composition and application of…

Supreme Court denies Tiger Global Mauritius capital gains tax exemption. Explore GAAR implications for Indian law firms and tax legal professionals in…

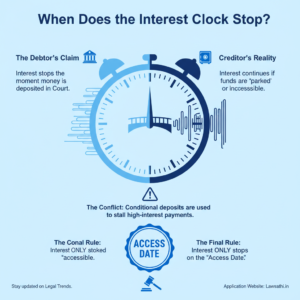

Analyze the Delhi High Court ruling stating interest on arbitration awards ceases when the decree holder gains access to funds. Key insights for…

Master the art of responding to GST Show Cause Notices (SCN). Explore legal strategies, Section 73/74 nuances, and documentation tips for Indian tax…

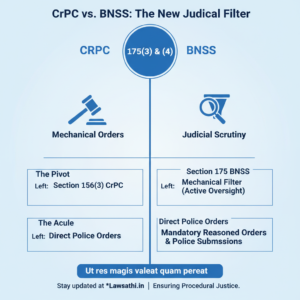

Explore the Supreme Court’s harmonious interpretation of BNSS Sections 175(3) and 175(4) regarding investigative powers and procedural compliance for…

Analysis of the Supreme Court hearing on Feb 4, 2026, in Adani Enterprises vs. journalists. Explore legal implications for media law and corporate…

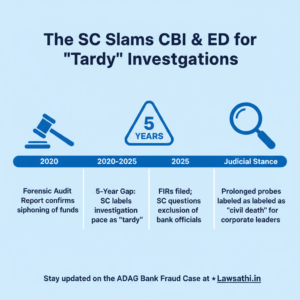

Supreme Court questions ED and CBI over delays in the ADAG Bank Fraud Case. Read the legal analysis of Anil Ambani’s undertaking not to leave India…

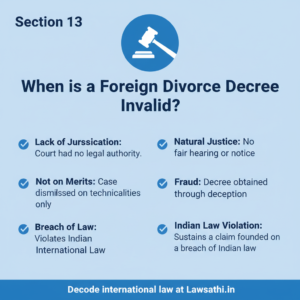

Master the legal procedure for executing foreign divorce decrees in India. Explore Section 13 CPC requirements, jurisdictional rules, and…

Master the MSME Samadhaan recovery process. A step-by-step guide for Indian commercial litigators on filing claims, MSEFC arbitration, and enforcing…

Explore the SC ruling declaring menstrual hygiene a fundamental right under Article 21. Legal analysis for Indian lawyers on impact and implementation…