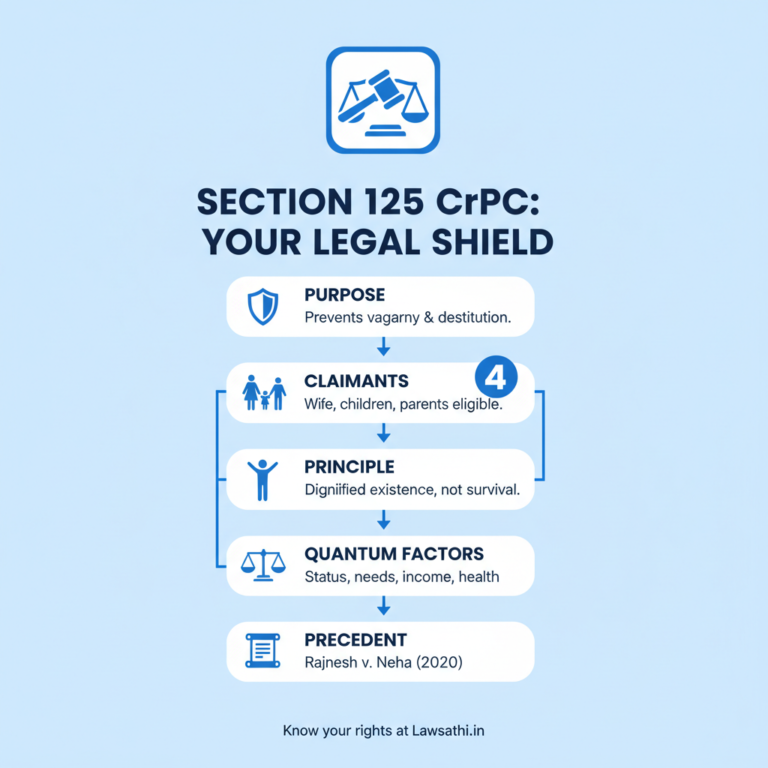

Analysis of Jharkhand HC’s ruling upholding ₹24,000 monthly maintenance under Section 125 CrPC. Key…

Will AI replace lawyers in India? Analyze 2026 automation trends, job security risks for legal…

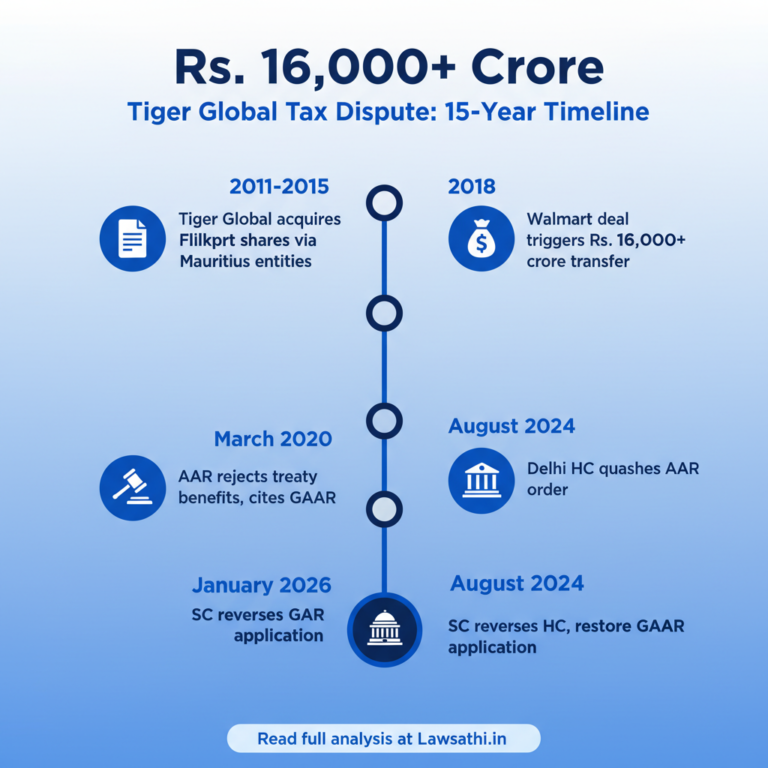

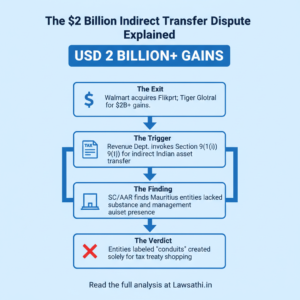

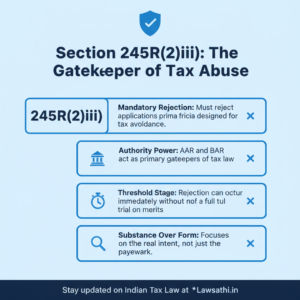

An in-depth analysis of the Supreme Court’s ruling on Tiger Global’s Mauritius entities and GAAR…

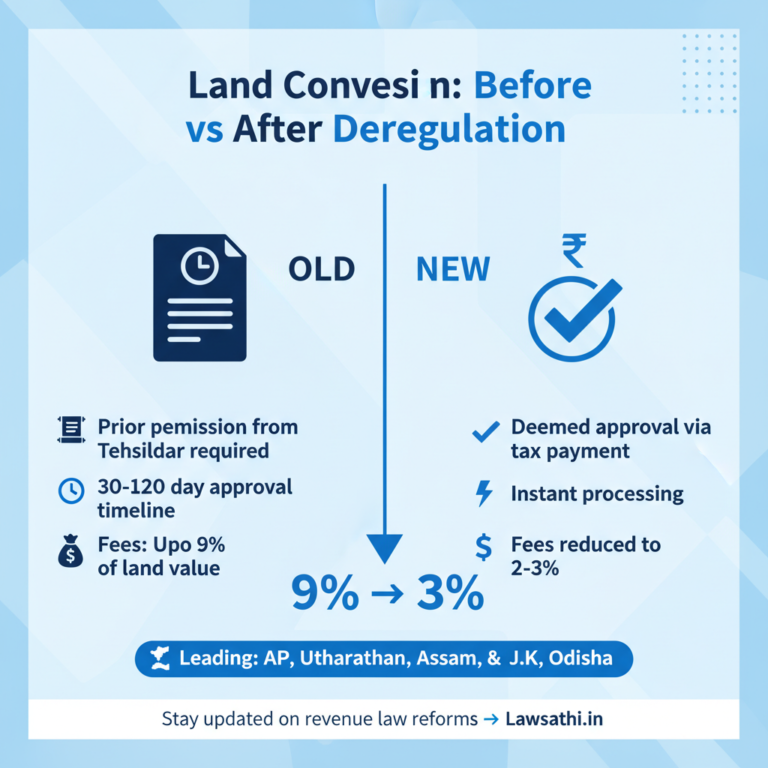

Analyze the government’s 28 major deregulation moves, including the scrapping of land conversion…

Budget 2026 clarifies no income tax on government land acquisition payouts. Analyze the end of the…

Analyze the Supreme Court’s landmark ruling on cricket association composition and application of…

Explore Gujarat’s historic land law merger. 16 Acts are now one Unified Land Code. Learn how this impacts property litigation and revenue practice for…

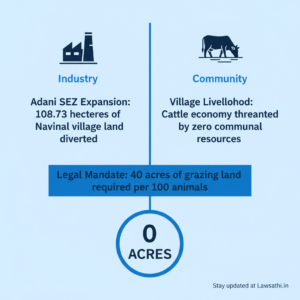

Analysis of the Supreme Court’s stay on the Gujarat HC order regarding Adani’s 108-hectare Gauchar land acquisition. Critical updates for revenue law…

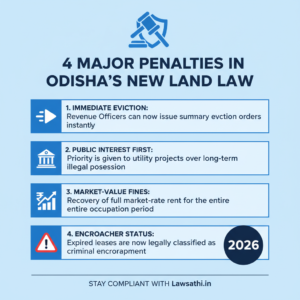

Explore Odisha’s new law to end land encroachment. A deep dive for legal professionals into the summary eviction process and regularisation of land…

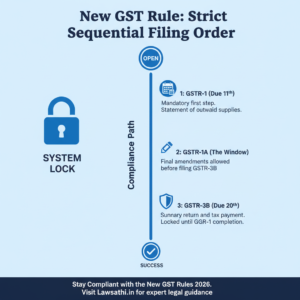

Stay updated on the new GST rules effective January 1, 2026. Learn about mandatory compliance, ITC blocking mechanisms, and revised return deadlines…

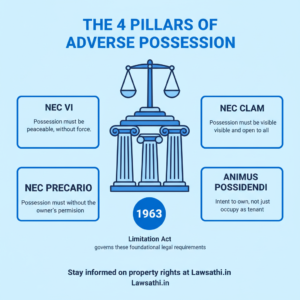

Supreme Court clarifies that tenants cannot claim ownership through adverse possession. Detailed analysis of Jyoti Sharma vs Vishnu Goyal for Indian…

Analyze the Supreme Court’s landmark ruling on GAAR vs DTAA in the Tiger Global case. Essential insights for Indian tax lawyers on treaty abuse and…

Supreme Court Upholds AAR Rejection in Tiger Global Case: A New Era for GAAR and Tax Treaty Benefits

Supreme Court’s Jan 15, 2026 ruling on Tiger Global & GAAR: Analysis of tax treaty benefit rejections for Indian lawyers and tax professionals…

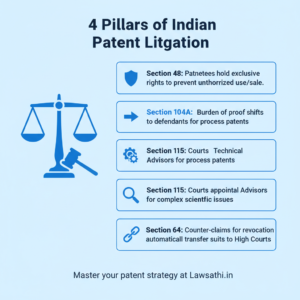

Protecting intellectual property has become vital for R&D-driven industries. In today’s competitive market, innovation is the primary driver of…

Explore the Supreme Court’s ruling on Section 245R(2)(iii) regarding the Authority for Advance Rulings (AAR) and its power to reject applications…