The Payment of Gratuity Act Central Government employees question has finally been settled by the Supreme Court. In a landmark judgment delivered on February 11, 2026, the Court clarified a crucial point. Central Government civil servants cannot claim gratuity under the Payment of Gratuity Act, 1972. Instead, they remain governed exclusively by the Central Civil Services (Pension) Rules. This ruling brings much-needed clarity to a jurisdictional debate. Previously, this debate had divided courts and tribunals across India.

The case, N. Manoharan vs. The Administrative Officer & Anr., involved retired employees of the Heavy Water Plant, Tuticorin. This plant functions under the Department of Atomic Energy. They had sought gratuity benefits under the PGA rather than the CCS Rules. However, the Supreme Court’s definitive answer has significant implications. It affects labor law practitioners and government counsels alike.

Background of the Dispute: Statutory Overlap

Understanding the Legislative Framework

The Payment of Gratuity Act, 1972, was enacted as a social welfare legislation. According to the Chief Labour Commissioner’s official document, the Act’s preamble establishes its purpose clearly. Specifically, it provides for gratuity payments to employees in factories, mines, oilfields, plantations, ports, railway companies, and shops.

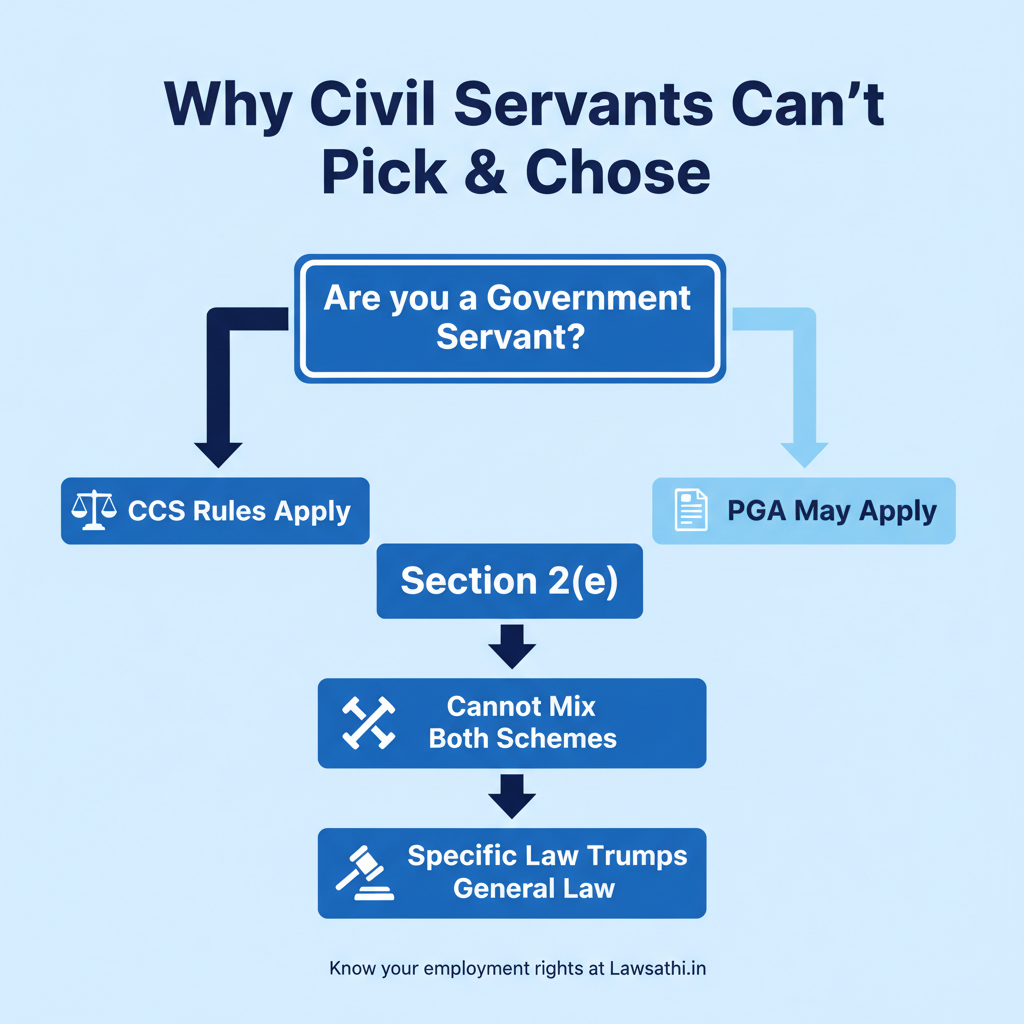

However, the Act contains a crucial exclusionary provision. Section 2(e) defines “employee.” But it specifically excludes persons holding posts under the Central or State Government. This exclusion applies when other Acts or rules provide gratuity payments for such persons.

The Competing Regulatory Schemes

Central Government civil servants have always been governed by the CCS (Pension) Rules. These rules, consolidated as the CCS (Pension) Rules, 2021, provide a comprehensive framework. Furthermore, they cover all retirement benefits. For instance, they include provisions for death-cum-retirement gratuity. This is calculated differently from the PGA formula.

This created a fundamental conflict. Could government employees choose the more beneficial scheme? Or did their status as civil servants automatically exclude them from the PGA? The Central Administrative Tribunal had previously ruled that the PGA’s overriding effect applied even to government servants. However, this position has now been definitively overturned.

History of Conflicting Interpretations

Different High Courts had taken varying positions on this issue. For example, the Bombay High Court had held that the PGA overrides state pension rules. However, that case involved a Zilla Parishad employee. It did not involve a Central Government civil servant.

The Supreme Court had also previously dealt with similar questions in Municipal Corporation of Delhi v. Dharam Prakash Sharma (1998) 7 SCC 22. In that case, employees of a statutory corporation were extended PGA benefits. But crucially, they were not Central Government servants.

Supreme Court’s Analysis: The Logic of Exclusion

The Definitive Interpretation of Section 2(e)

Justice Bhatti authored the judgment for the Bench, comprising Justices Pankaj Mithal and S.V.N. Bhatti. He examined the legislative intent carefully. The Court held that the exclusionary clause under Section 2(e) is unambiguous. Consequently, Central Government employees fall outside the PGA’s ambit.

The Court observed that the appellants were not “employees” entitled to claim gratuity under the PGA. Their status as Central Government servants placed them squarely within the exclusion. Therefore, this interpretation aligns with the principle that specific laws prevail over general ones.

Why Civil Servants Cannot Choose Between Schemes

The Supreme Court endorsed a crucial argument made by the respondents. Employees cannot claim government servant status for service benefits. Yet, they cannot simultaneously seek PGA benefits for gratuity. This principle prevents forum shopping. Moreover, it ensures regulatory consistency.

As the Court noted, the Heavy Water Plant functions as an adjunct of the Department of Atomic Energy. Therefore, its employees are Central Government servants. They cannot selectively choose which regulatory framework suits them better.

Distinguishing Previous Precedents

The Court carefully distinguished the Municipal Corporation of Delhi case from the present matter. MCD employees worked for a statutory corporation, not the Central Government directly. Therefore, they could legitimately claim PGA benefits.

However, Heavy Water Plant staff are directly part of the governmental framework. This distinction is critical for practitioners advising clients on similar matters. Ultimately, the character of the employing organization determines the applicable law.

Impact on Central Government Civil Employees

Retirement Benefits Under CCS Rules

Central Government employees receive gratuity under the CCS (Pension) Rules framework. According to the Pensioners’ Portal of the Government of India, three types of gratuity are available.

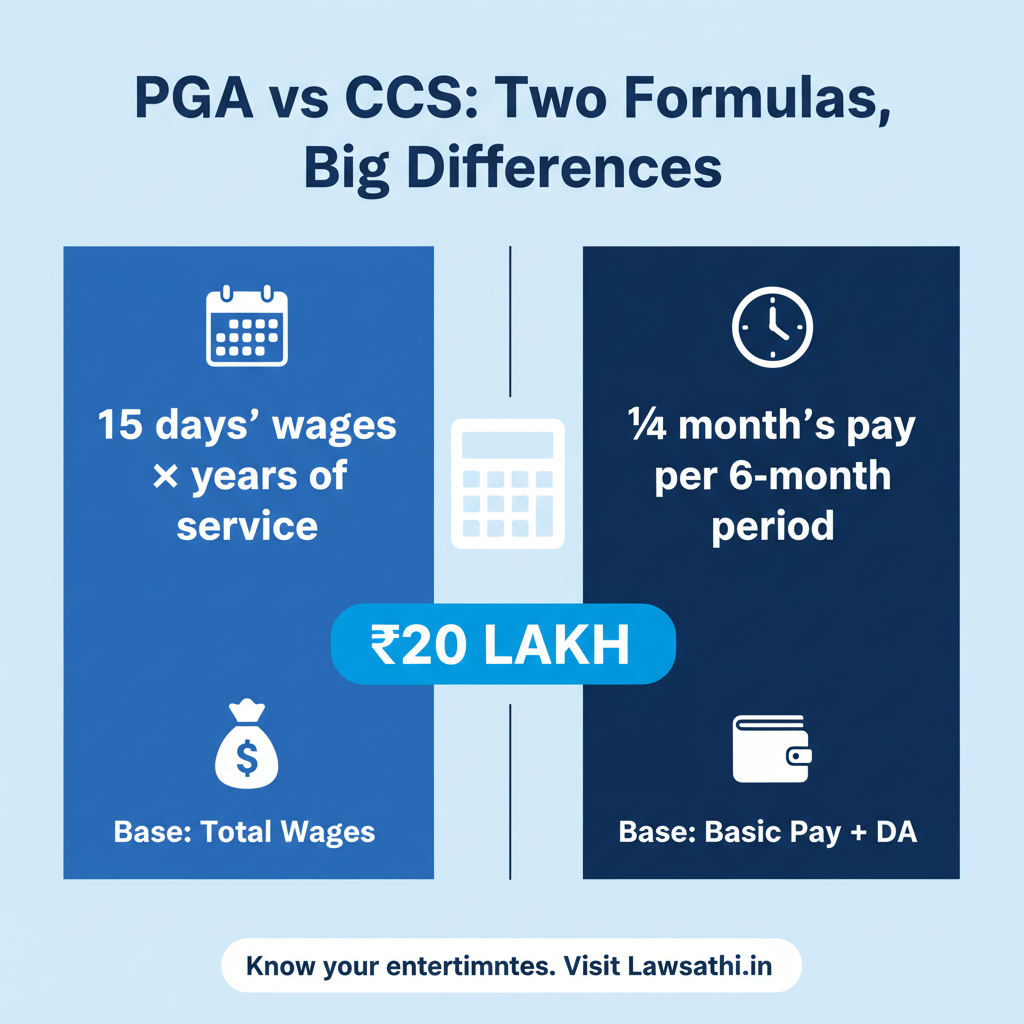

Retirement gratuity requires a minimum of five years of qualifying service. Specifically, it is calculated at one-fourth of a month’s Basic Pay plus Dearness Allowance. This applies for each completed six-monthly period. The maximum benefit is capped at 16½ times the Basic Pay plus DA. However, this is subject to an overall ceiling of ₹20 lakhs.

Comparing PGA and CCS Gratuity Calculations

The Supreme Court gratuity judgement makes it essential to understand the difference in calculations. Under the PGA, gratuity is calculated at 15 days’ wages for each completed year of service. Specifically, this uses a formula of 15/26 multiplied by last drawn wages and years of service.

Under CCS Rules, the calculation differs significantly. It uses Basic Pay plus DA as the base, not total wages. Additionally, the formula accounts for each six-monthly period of service completed. Both schemes have the same ₹20 lakh ceiling after the 2018 PGA amendment.

Practical Consequences for Employees

For Central Government civil employees, this ruling means several things. First, they must pursue gratuity disputes only through the Central Administrative Tribunal. The Labour Court or Controlling Authority under the PGA has no jurisdiction.

Second, the calculation methodology under CCS Rules will apply invariably. Therefore, employees cannot argue for PGA’s potentially more beneficial formula. Third, the time limits for CAT proceedings differ from those under the PGA.

Practical Implications for Legal Practitioners

Determining the Correct Forum

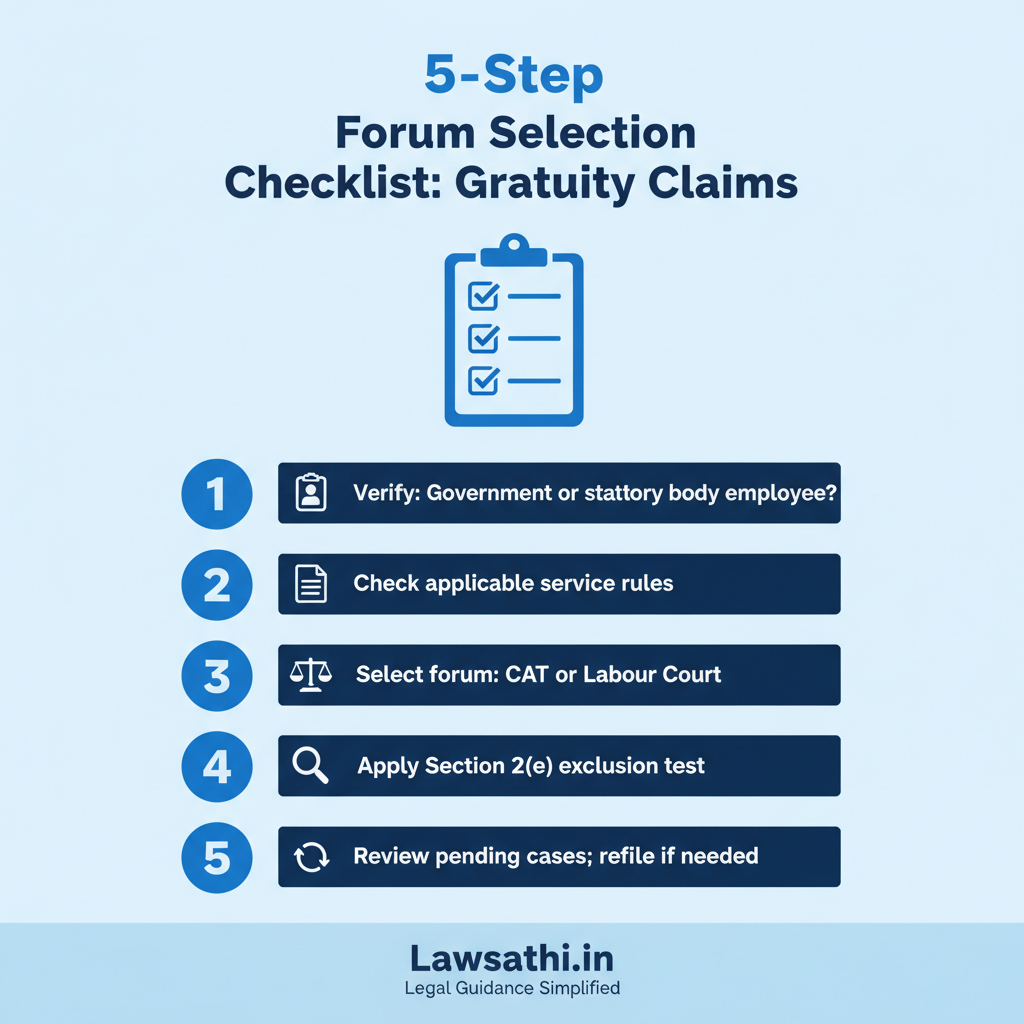

This judgment has profound implications for case management. Therefore, lawyers must carefully determine their client’s employment status before filing. The CCS Pension Rules vs Gratuity Act question must be answered at the outset.

For Central Government civil servants, the CAT remains the exclusive forum. In contrast, the position may differ for employees of statutory corporations or PSUs. Each case requires careful analysis of the employer’s character.

Reviewing Pending Litigation

Practitioners must review all pending cases involving Central Government civil employees gratuity claims. Cases pending before Controlling Authorities under the PGA may need to be withdrawn. Furthermore, fresh applications before CAT may be necessary if limitation permits.

This applies particularly to matters where government servants sought PGA benefits. The Supreme Court has now definitively ruled that such claims are not maintainable.

Strategic Considerations for Service Matters

When drafting service matters involving retirement benefits, lawyers must follow certain steps. First, verify whether the client is truly a government servant. Second, examine the applicable service rules carefully.

Third, calculate benefits under the correct regulatory scheme. Fourth, file before the appropriate forum. These steps prevent dismissals on jurisdictional grounds.

A Practitioner’s Checklist

Before filing any gratuity-related case, ask these questions:

– Is the client a Central Government servant or statutory body employee? – Which service rules apply to their employment? – What forum has jurisdiction – CAT or Labour Court? – Does Section 2(e)’s exclusion clause apply?

The answers determine your entire litigation strategy.

Understanding Section 14’s Limited Scope

The Overriding Effect Provision

Section 14 Payment of Gratuity Act provides that the Act has overriding effect. Specifically, it states that PGA provisions prevail over inconsistent provisions in other enactments. This was the primary argument advanced by employees seeking PGA benefits.

However, the Supreme Court clarified that Section 14 has limited application. It only applies when the person falls within the PGA’s definition of “employee.” If Section 2(e) excludes someone from that definition, Section 14’s overriding effect becomes irrelevant.

The Primacy of Definition Over Application

This interpretation follows established principles of statutory construction. First, the Court determines whether a person is covered by the legislation. Only then does it examine the legislation’s application and effect.

The exclusion in Section 2(e) operates at the threshold stage. Therefore, it determines coverage before any question of override arises. Consequently, Section 14 cannot expand the Act’s scope to cover excluded persons.

Implications for Future Cases

This reasoning will likely apply to similar disputes. Whenever an enactment excludes certain categories, those exclusions must be respected. Therefore, general overriding clauses cannot defeat specific exclusions.

Conclusion: Clarifying the Legal Landscape

Summary of the Supreme Court’s Position

The Supreme Court has delivered a definitive ruling. It settles the Payment of Gratuity Act Central Government employees question. Central Government civil servants are excluded from the PGA by Section 2(e). Consequently, they must seek gratuity benefits only under the CCS (Pension) Rules.

This ruling prevents forum shopping by government servants. It establishes that employment status determines applicable law. Therefore, employees cannot selectively choose beneficial provisions from different regulatory schemes.

The Broader Separation of Service and Labor Law

This judgment reinforces the distinction between service law and labor law in India. Service law governs government servants through specific rules. In contrast, labor law governs other employees through general statutes like the PGA.

The jurisdictional boundaries are now clearer. CAT handles service matters for government servants. On the other hand, Labour Courts and Controlling Authorities handle labor matters for other employees.

Future Questions Remain

Some questions still require clarification. For instance, contractual government employees may present different considerations. Similarly, employees of autonomous bodies need case-by-case analysis. The position of New Pension Scheme subscribers regarding gratuity also deserves examination.

However, the fundamental principle is now settled. Government servants cannot claim PGA benefits. This brings certainty to an area that had seen conflicting rulings for years.

Confused by conflicting service law precedents? Use LawSathi’s AI-powered legal research tools to find relevant case law in seconds. Streamline your practice management today—sign up for a free trial.