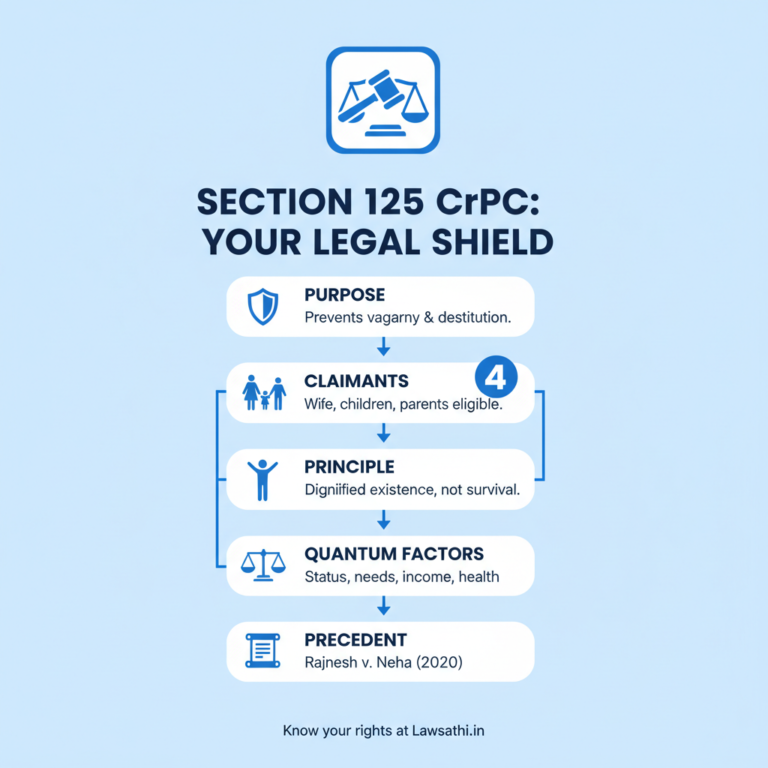

Analysis of Jharkhand HC’s ruling upholding ₹24,000 monthly maintenance under Section 125 CrPC. Key…

Will AI replace lawyers in India? Analyze 2026 automation trends, job security risks for legal…

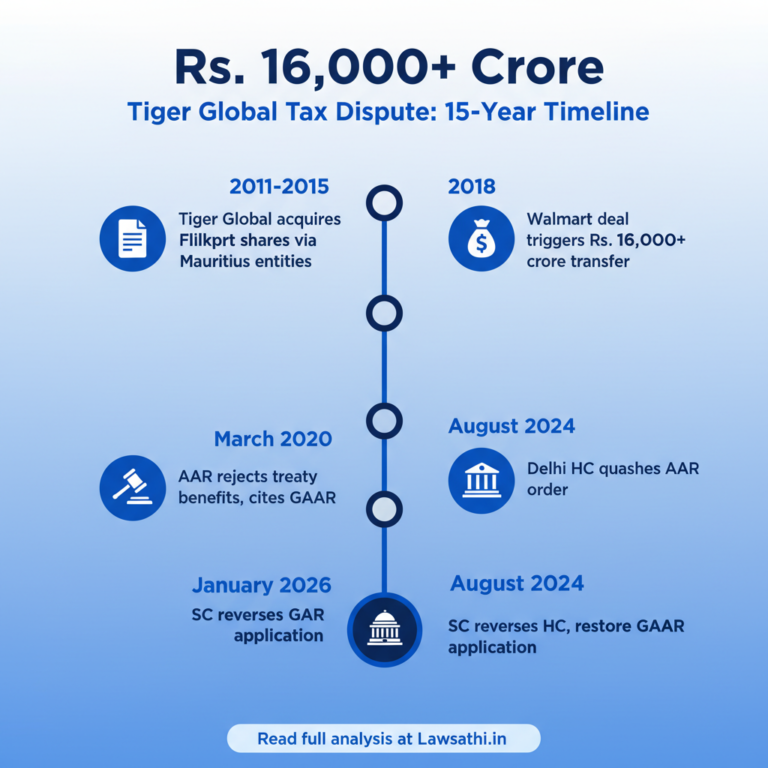

An in-depth analysis of the Supreme Court’s ruling on Tiger Global’s Mauritius entities and GAAR…

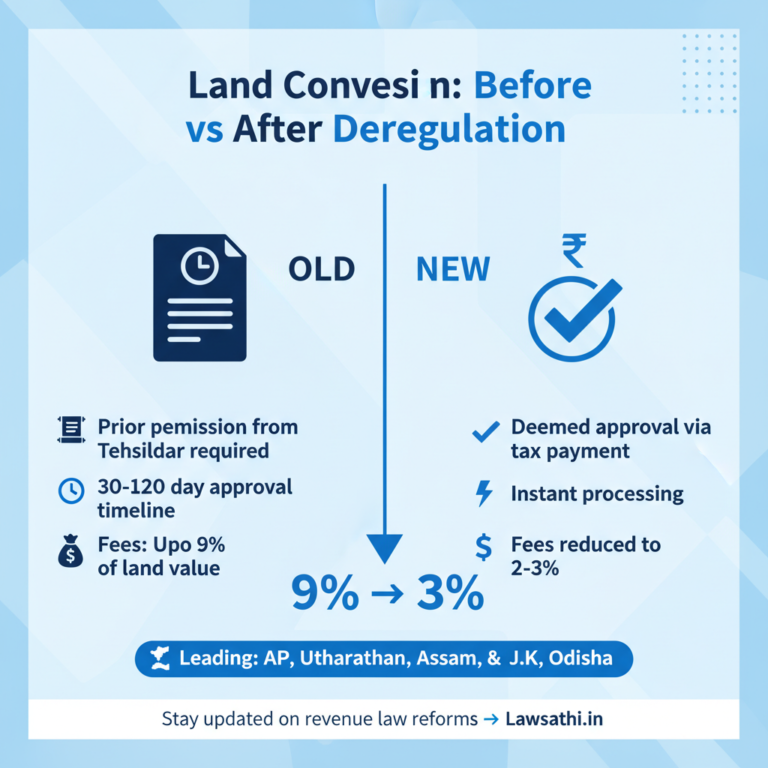

Analyze the government’s 28 major deregulation moves, including the scrapping of land conversion…

Budget 2026 clarifies no income tax on government land acquisition payouts. Analyze the end of the…

Analyze the Supreme Court’s landmark ruling on cricket association composition and application of…

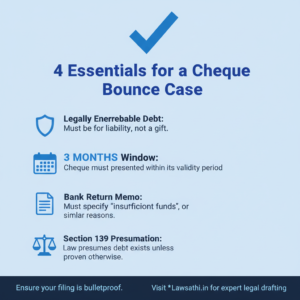

Filing a cheque bounce case under Section 138 is now a specialized task for Indian litigators. In 2026, the judiciary has shifted…

The Indian tax landscape changed forever on January 15, 2026. On that day, the Supreme Court delivered a monumental verdict…

The landscape of international taxation in India changed forever on January 15, 2026. Specifically, the India-Mauritius DTAA Supreme Court…

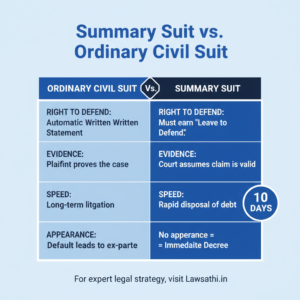

In the fast-paced world of Indian litigation, a Summary Suit is a formidable weapon for recovery. Unlike ordinary civil proceedings…

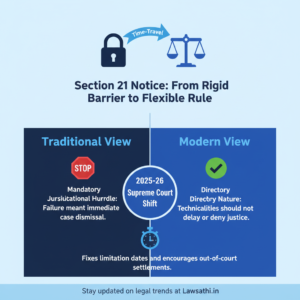

Is a missing notice truly a death knell for your arbitration case? For many years, Indian lawyers viewed the Section 21…

The Supreme Court recently clarified a critical boundary for taxpayers seeking tax certainty. In a significant judgment, the Court addressed…

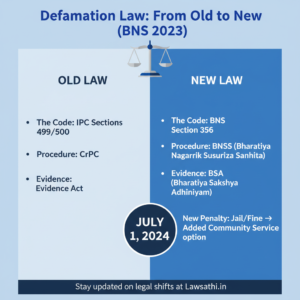

The legal landscape in India changed significantly on July 1, 2024. The traditional Indian Penal Code (IPC) has now been…

Drafting a Gift Deed of immovable property in India requires more than just templates. Specifically, it demands a deep understanding of the…

The legal landscape in India has changed significantly with the arrival of the Bharatiya Nagarik Suraksha Sanhita (BNSS). For defense…